I think it’s no secret that I’m not the biggest fan of the OCBC Voyage card. I’ve written several articles on the topic and have invariably come to the same conclusion- that its proposition simply doesn’t make sense for aspiring travel hackers.

An introduction to the OCBC Voyage Card

In-depth analysis of the OCBC Voyage card

Revisiting the OCBC Voyage card

But just because it doesn’t work for me, does that make the card a complete write off? As much as the egomaniac in me would like to say “yes”, this wouldn’t be much of an article if we stopped here. Besides, based on its thread in HWZ and random observations at the payment counter, the card seems to be gaining traction just fine despite my misgivings.

My interest in the card was re-piqued (neologism ftw) recently when OCBC’s Corporate Communications team reached out to me. I suppose that’s understandable given if you google “OCBC Voyage Card” the second link is my rather unflattering take on the product.

They asked if I’d be interested to meet them for lunch and a chat. I thought this would be a great opportunity to speak to someone on the other side and we got it set up. I ended up meeting one person from the communications department and one from the Voyage product team. I’ll admit to feeling a bit paiseh meeting the latter, given that I’ve been pretty much saying his baby was ugly the whole time, but that didn’t get in the way of a great discussion. And although I still don’t think the Voyage card is right for me, at least the discussion helped me to see what type of consumer OCBC is targeting with this and how it might fit into the travel patterns of some people.

This article assumes you already understand the Voyage card. If not, do have a read of the above articles because that will help you contextualize this much better.

The OCBC Voyage versus traditional miles cards

OCBC’s stance is that the Voyage card can hold its own against traditional miles cards because it offers customers something above and beyond a traditional miles card- the flexibility and convenience of being able to redeem Voyage Miles for any airline and any seat.

I agree that’s a great feature. My question is whether or not that feature in and of itself is sufficient to compensate for what I see to be the two main drawbacks of the Voyage card

- A higher number of miles required to redeem premium cabin tickets when compared to SQ saver rates

- A miles earning rate below that of competitor cards

With regards to the first point, yes, saver availability on certain SQ routes can be like a rare pokemon, so from one point of view it’s unfairly penalizing to the Voyage to compare it against saver rates. That said, however, if you’ve got the flexibility in travel dates and the patience to bug SQ repeatedly, you can come up on top by sticking to a traditional miles card and Krisflyer redemptions.

With regards to the second, the Voyage card earns 1 VM per $1 on general spending, 2.3 VMs per $1 on dining and overseas spending. While the bonus on dining and overseas spend are good to have, there are other cards out there which do as well if not better.

The UOB Visa Signature gives you 4 miles per overseas $1 with a minimum of $1,000 overseas spend in a statement period, the UOB PRVI Miles gives 2.4 miles per overseas $1 without restriction.

Dining wise, both the UOB PPA and the HSBC Advance Visa give you 4 miles per $1 on dining with no cap. In terms of general spending, the Citibank Premiermiles, UOB PRVI, DBS Altitude, ANZ Travel, heck, even the relaunched Krisflyer cobranded portfolio will all outearn the Voyage card.

But to say “outearn” is to say that a Krisflyer mile is the same as a Voyage mile. And that’s not strictly speaking true.

Doing a like to like comparison

The fundamental difficulty in comparing the Voyage card to a traditional miles earning card is that they earn different currencies.

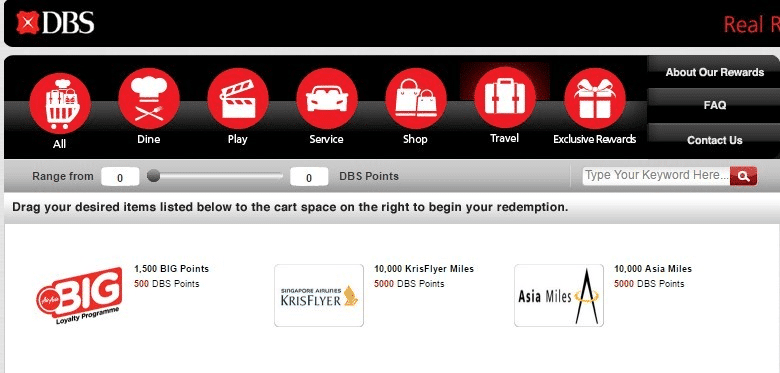

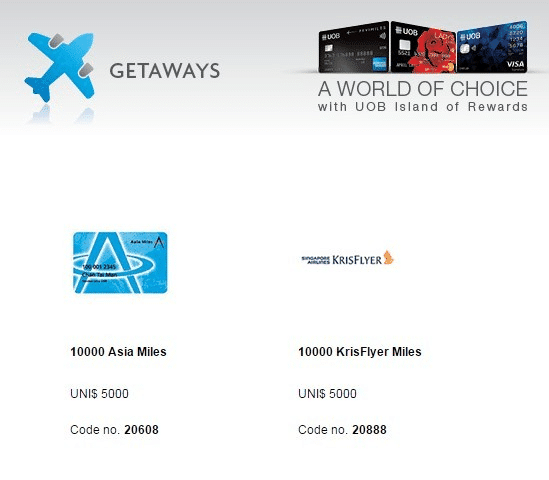

Traditional miles earning cards earn points with a bank, which can be converted to Krisflyer miles. For example, the DBS Altitude earns DBS Points, the UOB PRVI Miles earns UOB UNI$, the Citibank Premiermiles earns Premiermiles, all of which are convertible to Krisflyer/Asia miles. These miles are then used to redeem for award seats on a specific airline based on when seats are available.

The Voyage card earns Voyage Miles (VMs), which can be redeemed against the cost of a revenue ticket on any airline, any seat and any date (assuming you have sufficient VMs)

This is how the two currencies compare

[wpsm_comparison_table id=”14″ class=””]

Two important observations arise from this:

Conversion

It should be clear that although VMs can be converted to Krisflyer miles at a 1:1 ratio, to do so would be silly. It does not make sense to use the OCBC Voyage card to earn Krisflyer miles, because if you want to earn Krisflyer miles, there are traditional miles cards that can earn better rates, as mentioned previously.

Valuation

When I first wrote about the Voyage card my conclusion was that VMs were valued internally at about 3 cents each. That was based on this chart released by Voyage as part of their marketing materials when the card launched.

After getting several different quotes from the Voyage Concierge, I’m not sure that’s the case anymore.

Based on the routings I was provided with and my subsequent back-checking of the respective commercial prices, I can only conclude that the value of a VM can range between 1-3 cents, but I cannot explain how it is determined exactly.

Presumably the valuation fluctuates every day based on some internal algorithm. At a high level, I can say that I noticed as I moved up cabin classes the value per mile increased, but I never saw it go above 4 cents per VM.

[wpsm_comparison_table id=”21″ class=””]

On the other hand, the value of a Krisflyer mile can be anywhere from 2 cents to 7 cents, depending on whether you redeem it for economy, business or first and whether you get saver or standard availability.

And here’s where it gets even more complicated.

The above analysis doesn’t take into account the whole picture. You need to somehow place a value on the fact that

- VMs can be redeemed for revenue ticket space rather than restricted award space

- VMs can be redeemed on any airline

That means that to do an apples to apples comparison, if you want to give a Krisflyer mile a potential value of 7 cents per mile, you also need to boost the value of a VM to take into account these features.

And therein lies the rub-do you value the flexibility and certainty of being able to redeem your miles for any airline, seat and date? Your miles can certainly go further on SQ, but very often on certain routes you’ll be stuck with a waitlist, and given SQ’s erratic behavior in clearing waitlists, you may not be able to confirm the rest of your travel plans in advance. But on the other hand, if the premium cabin experience is what you’re after (and it should be), are you willing to have to incur much higher spending thresholds to redeem through Voyage?

The above factors make it very difficult to do a straight out comparison of the Voyage and traditional miles cards.

Let’s look at an example of how the Voyage card can work for someone (and how it might not)

Who should use the Voyage card?

Consider John. John’s main goal is to pay as little as possible for air tickets. He wants to stretch his miles as much as he can and is ok with flying economy on any airline, so long as the price is right.

John wants to go to Hong Kong, in economy. He calls up the Voyage concierge. The concierge gives him the following options

- Via TigerAir for 13,300 VMs + $96

- Via United for 24,600 VMs + $70.80

- Via Cathay for 22,900 VMs + $79.70

If John were were to redeem with SQ he would have to pay 25,500 Krisflyer miles (after the online 15% discount) and S$62.90 in taxes.

John doesn’t like the “hassle” of using multiple cards (you might be able to tell that I don’t really like John already). He hears from a reliable source that the UOB PRVI has the best general earning rates in Singapore (1.4 miles per $1 local, 2.4 miles per $1 overseas). So if he were to use an alternative, he’d use this and only this card.

Assuming a mix of 40% dining spend, 20% online spend, 10% overseas spend and 30% general spend, he would earn an average of 1.65 VMs per S$1* with the Voyage versus an average of 1.5 miles per S$1* with the UOB PRVI.

*2.3 VMs per $1 for overseas and dining spending with Voyage, 1 VM per $1 for general spending. 2.4 miles per $1 for overseas spending with PRVI, 1.4 miles per $1 for general spending

In this one-card only situation, John comes out on top in two ways- he earns more miles per $1, and he requires fewer miles to redeem his tickets. To redeem this flight to Hong Kong, John would need

- S$8,060 spending on the OCBC Voyage (assuming the Tiger Air option is chosen. Remember, John just wants to get there)

- S$17,000 spending with traditional miles cards

John thinks: Wow! I not only need fewer miles to redeem my tickets and less spending, I also have more choices of flight timings and airlines. Plus I don’t pay any conversion fees and I can get instant confirmation.

John is very happy.

Now consider Cindy. Cindy’s dream is to try First Class, something she will never be able to afford out of pocket.

Cindy wants to go to San Francisco. She calls up the Voyage concierge. The concierge gives her the following options

- Via Etihad for 252,700 VMs + S$725

- Via ANA for 350,900 VMs + S$755

- Via Singapore Airlines for 402,500 VMs + S$826

- Via United Airlines for 451,100 + S$161

- Via Cathay for 488,200 VMs + S$178

But, had Cindy gone with a traditional miles card she would have the following options

- 182,750 Krisflyer miles and S$800 to get a round-trip SQ First Class ticket to San Francisco (assumes saver availability, otherwise 357,000 miles are needed)

- 225,000 Krisflyer miles and S$104 to fly the same route in ANA first class through a Krisflyer partner award redemption

- Or she can turn her DBS Points/UOB UNI$ etc into Asiamiles at the same rate as Krisflyer, and spend 205,000 Asiamiles and S$150 to fly the same route in Cathay first class.

Now, imagine Cindy is not averse to using multiple cards and plans to maximise the number of miles she can earn by using the optimal card in each situation (I like Cindy). So with her 40% dining, 20% online, 10% overseas and 30% general spending, she could generate 3.22 miles per $1* on average.

*4 miles per $1 on dining, online and overseas respectively with HSBC Advance/UOB PPA, DBS Woman’s/HSBC Advance, UOB Visa Signature, 1.4 miles on general spending with UOB PRVI

In order to fly First Class, Cindy would have to spend

- ~S$153,150 with the OCBC Voyage (assuming she goes with the Etihad option, keeping in mind the 1.65 VMs per $1 we calculated with John)

- ~S$56,750 by using a mixture of traditional miles cards

Cindy thinks: So if I use the Voyage card, I’ll have to spend more than 2.5X the amount I’d have to spend with traditional miles cards to get my First Class ticket.

Cindy is sian.

Some caveats to the above analysis. First, there is a cash outflow involved with using a traditional miles card (reasonable for Cathay and SQ partner awards, ridiculous for SQ), but the huge difference in the number of miles required (and the earn rate of Voyage versus traditional miles cards) is the counterbalance to that.

Second, you can argue that instant confirmation may not be available when you go with traditional airline awards programs. That’s certainly not ideal, but in my mind that’s not worth paying double the miles.

Third, you can talk about how the ticket purchased through VMs will earn some miles because they’re revenue tickets. That will bring the calculations a little bit closer, but certainly not enough to tip the balance.

You can see here how John may value the Voyage, but Cindy will not. John and Cindy are two fundamentally different types of consumers and that brings me to my next point

Value vs Access

Conceptually speaking, there are two main benefits that travel hacking gives:

The first is value. When people build up miles and points, they get to save money by not spending as much as they would have to on airline tickets and hotels. That’s what John is going for in the example above.

The second is access. When people build up miles and points, they get access to experiences they normally would not have been able to/willing to pay for. I would never pay to fly SQ Suites, but I am able to fly SQ Suites because I have miles. I would never shell out $1K+ per night at the Conrad Koh Samui, but I am able to experience the Conrad Koh Samui because I have points. That’s what Cindy is going for.

For me, access always trumps value. Which is why I generally advocate not redeeming miles for economy class travel, because economy class is something most of us could normally afford anyway.

Cindy is making an access play; John is going for value.

The Upshot

So here’s my stance.

The ideal person for a Voyage card is someone who travels mainly to regional destinations that are served both by budget and full service carriers (the presence of budget competition nudges full service to keep their fares down), like Taiwan, Hong Kong, Bangkok, Western Australia, China, Japan, Indonesia etc. This person doesn’t care about premium cabin travel but does care about paying as little out of pocket as possible. This person also prefers just using one card for all spending for the sake of convenience.

But if you’re someone who wants to fly premium cabins, who doesn’t mind using multiple cards and is willing to plan a vacation around award space availability, then you’d be much happier off using a combination of traditional miles cards. And that’s as fair a conclusion as I can come to.

I don’t for a minute doubt that OCBC genuinely believes that its product has a serious value proposition. I agree it does. But their target audience is not people who do what we do. The Voyage card is for the convenience seeking individual, who likes having a bespoke concierge service who can prep itineraries for them, who wants to be able to jet off as and when without worrying about the vagaries of award space.

I realise there are other aspects we haven’t touched at all in our analysis, namely qualitative ones. OCBC Voyage has a full featured concierge that helps you secure hard to book reservations/concert tickets/walk your dog/buy flowers for your spouse or mistress/whack people you don’t like and make it look like an industrial accident etc. I’ve not tried this service so I can’t speak to whether or not it is better than the many similar services out there. And I suppose different people will value this benefit differently, depending on how much time they have.

So TL;DR, look at your own travel patterns, preferences and where you stand on the access vs value question and decide whether you want a Voyage card based on that.

[Thanks again to OCBC for the help provided in writing this article. This is not a sponsored piece and The Milelion did not receive any compensation for writing it. An advance copy was sent to OCBC before publishing as a courtesy to check for the accuracy of calculations and Voyage quotations. However all opinions remain those of The Milelion]

cover photo by baileycheng

Hi Aaron, Just would like to ask…do Citithankyou points work the same way as VMs?

come again? in what way?

I could be wrong, but you can use citithankyou points for booking revenue flights, and earn miles? Sorry if I am wrong, but I am very confused by the terminologies of citithankyou points, citimiles and citi$. Thanks for replying by the way!

woah seriously? i always thought they were just for transferring to airline miles programs. This is news to me (citi$ has been replaced by thankyou points in SG btw). let me go and read up on it. i didn’t see that option listed on the TY site though…

You can go to https://www.citirewards.com and poke around – think you’ll need to log in to citi banking to really see the rates, though.

wow i never knew about this. each citi point is valued at 0.42 cents. 1 citipoint= 0.4 miles. so if you use their flight booking service you’re basically taking 1 cent per mile value. poor, very poor.

Still not convinced. I think I’ll stick to my current mix: Citibank Reward for paying bills online + shopping, DBS Women + Fevo (hate the 1% fee though!), ANZ for transactions in Aussie dollars and anything after exceeding $2,000 from DBS Women.

To include one more card into my rotation will need to prove that it has an attractive rewards. 4m/$.

Also remeber no yearly fee waiver, ocbc cs rep is notorious for being horrific. I dont know why you even wrote this article tbh. Almost feels like you were threatrn to do so or lawyers would grt involved. The ocbc voayage is a crap card paying 500sgd a yesr for nothing. This article tbh is quite redundant. The cobclusion you made is the same with your previoud ocbc review, card for redeeming economy class only plus paying the 500sgd annual fee with no perks

but dude now you can read the same conclusion in 2,600 words. that’s way more awesome in my book.

Plus it is more balanced view in my opinion, as there could be people who fall into the John category out there. In fact, most if not all of my friends fall into that category, or at best, somewhere between John and Cindy. So arguably, there MAY be some people out there who could find value in this. People like Stephen and Aaron and me are “Cindys” so obviously we won’t find this card of much utility.

I got the card and paid $3,210 for the 150k miles. Used to use it for dining, and now I’ve moved to FEVO. Don’t think I’ll renew it though, unless they sell me a bunch of miles again.

Also a person who makes 120-150k a year which is the requirement for this card is hardly collecting miles to fly economy class. This card is just absurd, i dont even know what kind of person ocbc is targetting to use this card.

People with families, and need to bring spouse + kids to get there.

Well, nice going trying to find someone who might possibly, hopefully, on a good day, find value in this.

If I was John’s friend, however, I would suggest he sign up for a rebates card (OCBC’s own 365 card is not a bad place to start!) that suits his spending habit. In all likelihood, the rebates on the same $8k spending would probably pay for that TigerAir ticket to Hong Kong, both the fare & the tax.

I find it hilarious that when you google ocbc voyage card the 2nd link is aarons review hahhaha that must have really pissed off ocbc. Personaly i think the original review was fare and in less words.

No one with a 120k-150k or grester income is a “john” type.. which is required for this ridiculous card.

Earlier this year they offered 500k miles for a $10k renewal fee. This is the only known fuss free way to procure this amount of miles. So this is priceless and the rest of the benefits are thus free.

$10k for 500k miles is certainly a good deal, although it is possible to buy miles under 2 cents each through other cc annual fees (eg scb VI). that said, you wouldn’t be able to buy in such a high volume at one go.

OCBC CUSTOMER SERVICE IS LIKE ROOM SERVICE AT AUSCHWITZ.

non existent.

I really like the whacking people part. I will sign up today if they can do it. :)) But honestly, I think most concierge from other cards can do the run of mill stuff.

Leaving aside the UOB Visa Signature, which one can exceed quickly if going on a couple of weeks holiday, I have decided to switch to OCBC voyage for my foreign spend because of forex fees. Uob PRVI is at 3.25. OCBC at 2.8. But the percentage drop in miles, when u calculate, is far lesser than the percentage increase in the forex fee. I paid for 150k miles too.

Other than the UOB Visa Signature for overseas general spending, you could also consider the UOB PP Amex (foreign dining), DBS WWMC (foreign Uber transportation), Citi Rewards (foreign shopping) and pre-pay your hotel expenses, you might just manage to get by without PRIVI or OCBC Voyage.

But you see… John is actually a bit of an idiot. No one who thinks “…doesn’t like the “hassle” of using multiple cards (you might be able to tell that I don’t really like John already). He hears from a reliable source that the UOB PRVI has the best general earning rates in Singapore (1.4 miles per $1 local, 2.4 miles per $1 overseas). So if he were to use an alternative, he’d use this and only this card.’ Would read this blog or have any interest in any of the advice you’re even giving. Which comes down again to… Read more »

Also,

‘Thanks again to OCBC for the help provided in writing this article. This is not a sponsored piece and The Milelion did not receive any compensation for writing it. An advance copy was sent to OCBC before publishing as a courtesy to check for the accuracy of calculations and Voyage quotations. ‘

Almost sounds like they threatened to sue? No arm twisting at lunch?

life, in reality, is often a lot less dramatic. although one might be tempted to think this was some sort of “isd invite you lim kopi” type dealie, it was nothing of the sort. Things don’t work that way anymore- the amount of negative publicity generated from trying to strongarm bloggers would surely outweigh any benefits (and, if the idea is to hush things up, would only be counterproductive). In any event, the folks at OCBC couldn’t have been nicer and I genuinely enjoyed our chat. There is a bit of a tendency among people who do what we do… Read more »

aaron, although you do make a practical point, this site is not dedicated to the average reader. It is to inform readers like us, who like to play “the game” to yield maximum returns which I am sure 99% of the readers are very appreciative of your hardwork. However publishing another article on this poor product again, only cause OCBC decided “to meet with you” is a poor excuse to justify the tone of your article, ie. dont be so harsh, there is a reason to use this card. I will repeat this 999x NO ONE who reads this site… Read more »

so my take is this: i’m all for presenting both sides of an argument. I’d like to imagine that whoever reads these articles is smart enough to weigh the pros and cons to come to a conclusion that makes sense for him or her. For me, the conclusion is unchanged. I would not use this card. But I’d prefer people see how I came to that conclusion rather than me just telling them what to think. so i take your point about how you would never use this, and that’s just fine. don’t. maybe then this article, if nothing else,… Read more »

value aside, does this card do allow you to book Etihad’s first class apartment seats?

you can book any seat, any flight, any time so long as you have the miles. i imagine first class apartment would need a fair amount of them. not to mention the residence…

The fact that such products not only exist, but also continue to be introduced in the market (capita card?!) makes me think that there are many more Johns than i initially imagined! We Cindys are a minority!

Thanks for this.

Actually, I am the “john” that MileLion describes. – Most of my trips are within the SEA region. (check) – One credit card user man (check) It replaced my Citi Prestige card as Primary. I was attracted to other bank features like online system and bank services so i switched my portfolio from Citi to OCBC The Voyage concierge services are quite good in my personal experience. (maybe my expectations are low) Also, I’ve never had to wait long to speak with Customer Service. Now on annual fees, if we use apple to apple comparison with Visa Infinite or MasterCard… Read more »

Milelion https://milelion.com/2016/09/24/a-chat-with-the-ocbc-voyage-team/ – Thanks Aaron for this article. I’m an OCBC customer but credit card is with Citibank Premiermiles. I am a John in this regard. I like simplicity of an experience and am definitely not a travel hacker. I used to favour cash back cards these days the value it brings isn’t as good as it used to be. I’ve been reading your blog for quite awhile now but admittedly, it never truly relate to me till this particular article, where it caters for towards my simple person’s approach to credit cards. Which is not the travel hackers but… Read more »

Agree that the card itself does not seem interesting to the average mileshacker but I have always considered it to be a fallback option in case I need SQ miles quickly for premium cabin travel. I know that value is not great (SGD3,210 annual fee for 150k miles) but it is still nearly a BC return trip to Europe on SQ for about half of the amount you pay for a revenue ticket (was more than a return BC ticket before the KF devaluation). I have never exercised the option but will keep it in mind in case I am… Read more »

Hey aaron! Is there an update to this article given all the changes to the SIA award charts? no 15%/ devalue of Partner awards “Now consider Cindy. Cindy’s dream is to try First Class, something she will never be able to afford out of pocket. Cindy wants to go to San Francisco. She calls up the Voyage concierge. The concierge gives her the following options Via Etihad for 252,700 VMs + S$725” Cause i just realize this is pretty decent…. 253k voyage miles round trip first class? Sia will cost 236k miles but the availability is shit. and standard redemption… Read more »

that’s an interesting point you’ve raised. the equation definitely changes given the devaluation, but i’ve not studied just how much yet. would also need to get some quotes from the voyage concierge on the latest rates (we’re assuming that they kept the valuation of a VM the same since we last wrote about this).

would be quite a bit of legwork, but i’m curious to know too. let me add it to the to do list.

Also i realise maybe the voyage card works for those who are affluent but dont want to do the legwork for waiting for miles and stuff. I was in a discussion with a friend and when i told him to get sin to jfk suites, you have have to book a year in advance, he flipped. But then he realize he could pay standard fares and still gotten it. And even at standard fares, sin jfk 450k miles, even if you buy at 2 cents each its 9k sgd. its still cheaper than buying a suites ticket for 17k sgd… Read more »

thanks man. let me give this some thought

Not sure if any help but… I got some quotes for Residence recently SG-UK (my aspirational target). Pretty hefty 1.4m points for 2 people.

If assuming approx – $55k ticket cost vs $30k (assuming you pay 3x the 10k for 500k miles) not great but re: your point on access I’m not sure many other ways in SG to get similar?

Clarification: residence is on etihad’s a380, but ey470 from Singapore is a dreamliner with j as the highest cabin class. So I assume you got a mixed cabin ticket?

I have to admit I hadn’t twigged to that, they didn’t make that transparent in the quote – they gave me an optionality of – 1) Return Residence Sin-Lon 1pax 2) Return Residence Sin-Lon 2pax 3) Sin to Lon Residence, Lon to Sin First Class 1 pax They didn’t note that it would be a mixed cabin however looking at it you must logically be correct that it’s a mix of Residence and First Class Suite, what I don’t know is if you have 2 pax in suite like the residence and therefore that’s why only $7k differential in ticketed… Read more »

Hi Aaron, according to the t&c (if i’m reading this correctly), voyage miles bought from annual fee payment of S$3,210 and S$10,000 will be converted to krisflyer miles.

https://www.ocbc.com/assets/pdf/cards/voyage%20150k%20signup%20promo-terms-conditions.pdf

Am i reading this correctly?

So if that is the case, one cant bought outright 150k VM or 500k VM (and hoping these miles stay as VM) to redeem any flight + elite miles.

this was being discussed on the other ocbc voyage thread posted by louis. by right it’s supposed to be auto conversion but anecdotal evidence says that some people have avoided the conversion because it didn’t trigger automatically. will ask louis to weigh in on this too

ah… i may have missed that thread…

thanks.

Those people may have avoided it by not filling their Krisflyer details in the sign-up form. Louis has accounts of the Voyage team calling ppl up and asking them for the missing details. To transfer the VM. The application form is quite clear that the latter 2 options would be converted to KF miles.

As an additional, overall I like the card and the “extras” however I’m definitely frustrated by their inability to –

1) Show the transparency of miles awarded

2) On challenge said I will need to calculate myself and query

3) When I have done so there is about a 30k differential for this statement, the obvious transactions (foreign spend) add up to more than the total awarded miles in statement period so definitely something wrong with system.

Have put in a complaint… will update on the outcome!

If you have internet banking with OCBC, you can check the VM awarded for each transaction.

1. go to “Rewards”

2. then to “Transaction History”

3. click the transaction “reference number”

You also have to make sure that your overseas spending are not converted to SGD by the merchants (DCC)!

This could be the reason that you were awarded lower VM.

This article is indepth to the point where it touched on local spending and on normal voyage card.

It will be good to look at the whole spectrum of the voyage cards: Premier/Private Client/BOS cards.

I can only comment on Premier/Private Clients voyage cards wherein all local retail spent is S$1:1.6 miles / foreign spent is S$1:2.3miles.

Also conversion fee (of S$25) to Krisflyer miles is waived.

I do find this segment of voyage card quite attractive through recently I have switched to Citi ULTIMA for all my local SG spent..

Excellent piece