I’ve often lamented over the fact that OCBC is missing a convincing miles earning card. And no, I don’t consider the Voyage card to be in that category (read a few thousands words about that here, here and here). Well, perhaps not any longer.

[credit_card_shortcode cc_id=”21775″]

OCBC has just relaunched its Titanium card. The previous version of the Titanium card was underwhelming to say the least, as I mentioned in the OCBC Omnibus entry.

Ahhhh, Titanium. The one card that summed up OCBC’s desperate miles gambit once upon a time. The card proudly trumpeted the ability to earn 1 mile per $1 of local spend and 2 miles per $1 of overseas spend. Then they put in small brackets, subject to minimum spend of $1,500 per month.

This was sad for 2 reasons. First, it was already possible to earn 40% more miles on local spend with other, better cards like the ANZ Travel Card and the PRVI Miles. Second, those cards didn’t have any minimum spend. You’d get 1.4 miles per $1 whether you spent $1 or $10,000. Till this day I can’t figure out why OCBC is so unwilling to bite the bullet and introduce a card that at least matches those offerings (off tangent: I remember once upon a long time ago when American Express proudly said that it was going to award 1 mile per $1 spent so that it was easier for consumers to remember. That despite the fact that rivals were offering 20-30% more. But hey! Easier to remember! That’s something!)

There really is no compelling reason to get this card. JetQuay access is an interesting pitch, but it’s limited to 70 redemptions per month until the end of September 2015 and only for 1 companion, so if you’re travelling as a family this is not an option. In any case the JetQuay “luxury” lounge is extremely underwhelming based on reports online (the only meal options are instant noodles)

The new and improved Titanium Rewards Card

The Titanium card has been rebranded as the Titanium Rewards card effective immediately.

There’s a lot of hue and cry on the website about this but the only thing you need to remember is $1=4 miles whenever you shop (offline or online).

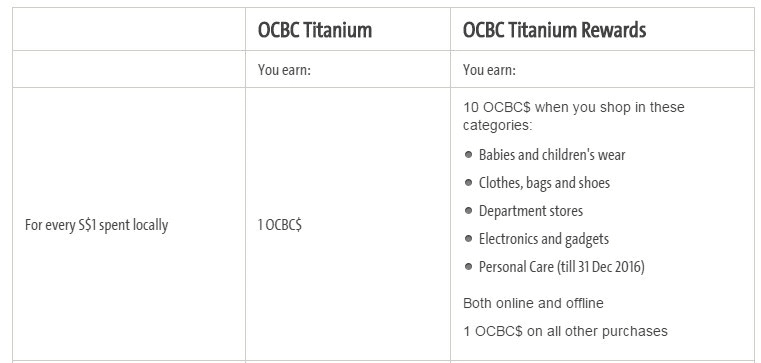

The relevant categories are shown below-

EDIT: Adam on the comments has pointed out a big point of differentiation between the Citi Rewards card and the Titanium Rewards- Citi Rewards doesn’t give 10X on electronics shopping but Titanium does. Which means if you’re going to buy a big ticket electronics item like a desktop PC or a flatscreen TV, you would do a lot better by having a Titanium card (no other card offers bonus points for brick and motar electronics shopping to my knowledge).

I suppose now it remains to be seen how strict the definition of “online shopping” is. The Citibank Rewards card, for example, has been a bit more liberal than you might expect in its interpretation of “online shopping”. Case in point: buying Starwood points from SPG.com qualifies as online shopping.

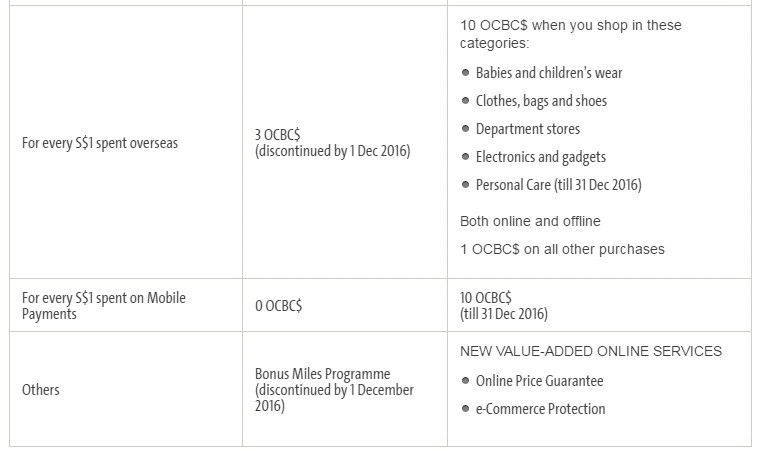

The other good thing is that you can get 4 miles per $1 whenever you pay using mobile payments like Android Pay, Apple Pay and Samsung Pay.

OCBC has actually provided a table to explain how the new Titanium Rewards card differs from the old one. I’ll show it here but basically all you need to know is: old card useless, new one kind of useful

The full T&C can be found here. The main points to note are

- The maximum bonus you can earn per card anniversary year (not calendar year) is based on $12,000 of spending (or 48,000 miles)

- You earn 10X points at the following merchants

- MCC 5611: Men’s and Boys’ Clothing and Accessories Stores

- MCC 5621: Women’s Ready to Wear Stores

- MCC 5631: Women’s Accessory and Speciality Stores

- MCC 5641: Children’s and Infants’ Wear Stores

- MCC 5651: Family Clothing Stores

- MCC 5661: Shoe Stores

- MCC 5691: Men’s and Women’s Clothing Stores

- MCC 5732: Electronics Stores

- MCC 5699: Miscellaneous Apparel and Accessory Shops

- MCC 5311: Department Stores

- The bonus 9X points will be posted to your card account by the end of the next calendar month following the transaction

- OCBC points last for 2 years before expiring (although once you transfer to Krisflyer you get another 3 years validity)

Conclusion

This is definitely a welcome move from OCBC and finally provides them with something of a competitive miles offerings. There are obvious overlaps with the Citibank Rewards card, but if you’re trying to hit the minimum spending requirements to earn bonus interest on your 360 account for example, it might be worth giving this card a look. Just remember that the more you spread out your points, the more you’ll need to pay in conversion fees. So unless you’re planning to do a whole lot of spending on shopping, this might not be the right option for you.

Another interesting thing that crossed my mind was whether this would be a Citibank type situation where you can’t pool your points and end up having to pay multiple conversion fees within one bank. For example, Citibank Rewards earns ThankYou points but the Citibank Premiermiles earns Premiermiles. The two cannot be converted together (by right- I know you can call in and ask for both to be done at once and the CSO might grant it to you as a “one time exception”) and therefore you end up paying 2 conversion fees which is really dumb. My suspicion is that it will be the same for Voyage + Titanium Rewards holders because the Titanium Rewards card earns OCBC$ but the Voyage earns Voyage miles (Assuming you wanted to convert your Voyage miles to Krisflyer miles which is a really dumb choice)

Credit card reboots can sometimes be gamechanging, and other times completely underwhelming. While I wouldn’t call offering 4 miles per $1 gamechanging (because it’s been done before), this is definitely a step in the right direction for OCBC.

Hey Aaron,

Don’t you think this card is more superior to the citi Rewards card because it also accepts electronics and personal care spends?

Though $12k spend limit is a little low. ?

electronics is definitely a useful category to have, but i do most of my electronics shopping on amazon anyway which would qualify for 10x with citi rewards. i can’t remember the last time I bought something from harvey norman/best denki. That said, if I were furnishing my house and needed to buy a big ticket item like a flat screen TV I would probably use harvey norman/best denki…and that would earn me a lot of miles if I used the titanium rewards card… so yes, I see your point. $12K cap is indeed low, but if you and your spouse… Read more »

Is there any way to check in advance if Harvey Norman is correct categorised under that mcc code?

no, but i would be very, very surprised if it were not.

If bank identify spending type solely through the MCC, how do they know if I am buying a tv (an electronic item, hence 10x rewards) or a coffee table from Harvey Norman?

Hi Aaron,

what kind of electronics do you buy on Amazon ? Thinking of maximizing my Citi Rewards before the end of the month.

oh small items like headphones, battery chargers, drone accessories.

if you want to maximise- just buy a gift card from amazon and use it later

Hi Aaron, isn’t shopping on Amazon for electronics more expensive than in brick and mortar store considering exchange rates and shipping fees?

Well,not if you have amazon prime and someone to mule it back for you!

Just wondering. If buying SPG points using CITI rewards card has the 10x points does it mean booking SPG hotels online also gets you the bonus points? Can anybody confirm this…

And on the OCBC Rewards. Looking forward to buying a new Mac and the iPhone 7 (yes, I’m slow that way…) soon. Any ideas if the Apple Store (online and authorised resellers) and telcos would fall under the 10x category?

re: first point. I would very much doubt so given that points.com processes spg point transactions whereas online prepaid reservations are processed by another party.

my reading of the t&c says that apple store would be 10x.

One small point – 2 year expiry + cap of 48,000 miles per year, means you’d get a maximum of 96,000 miles before you’d have to transfer at a cost of $25. Transfers are in blocks of 10,000 miles, and as you pointed out, you might not be able to pool the rewards points (can’t think of any other card I’d use from the OCBC lineup anyway). So you’ll either be transferring 90,000 miles, or else you’ll have to find some way to earn 4,000 miles at a crappy earn rate. Not really sure if that’s worth it. Citi Rewards… Read more »

that’s a good point too P, thanks for pointing it out. in that respect citibank gives you a bit more time to build up a balance (albeit with the same problem as ocbc- i.e. thankyou points vs premiermiles)

Downside is that OCBC only allows conversion to Krisflyer miles. There is no option for Asiamiles. 🙁

You won’t be able to pool voyage miles and OCBC $. They are a separate entity. Based on my current accounts. Aaron, would your kindly share the contact the OCBC Voyage team that contacted u for your article? Can pm you my story.

will send you a mail

How about luxury watches?

Anyone knows the mcc?

Or tried buying using any card before and knows the mcc?

Hi Aaron,

Just realize that Titanium Rewards is World Mastercard. Would that mean that currently this is the World Mastercard with lowest income requirement?

well, the citibank rewards mastercard version is also world and has 30k income requirement.

Does OCBC bank do any sign up bonuses typically? I am interested to sign up for this but still hesitating in case they launch some sign up promos!

unlikely to offer it for a card like this

There’s a $50 sign up bonus now. Paltry, but that’s OCBC’s standards.

OCBC Titanium 10x on mobile payments extended to 31 Mar 17

Have anyone tried to load FEVO card with this OCBC Titanium Rewards?

Does anyone know if watches fall under mcc5699? So far HSBC advance & Citi rewards doesn’t award for that. We are planning on buying a few high end watches soon overseas. Any help is greatly appreciated….

Use OCBC Titanium Apple Pay to top up your NETS Flash Pay card at the EZ link top up machine. Then use this Nets Flash Pay card to pay your bills at 7-11. Have to convince the cashier that Flash Pay will be accepted as their first response will be, only cash and nets for bill payment.

There, you have a new way to earn 4mpd to pay bills though it might be painful to top up multiple times as each top up transaction is only $40 and I think there is a limit of $100 top up per day.

I believe there is a monthly limit to ezlink top up and the like (e.g. FEVO card) of SGD$200. Capping the bonus points to 2000 points. Happy to be corrected though heh.

Wasnt aware of that! Can anyone confirm?

Can anyone confirm if this Tiitanium card provides 10x for points.com miles purchases (like SPG or Alaskan, for example)?

quite certain it will not but cannot confirm

what makes u think its quite certain ?

because if your transaction is processed by the airline (eg avianca), it’ll code as an airline transaction and not be eligible. if it’s by points.com, it will likely code as some misc e commerce (not sure exactly what) and won’t be in one of the ocbc rewards categories. i think points.com earned 10x with citibank rewards though

10x for mobile payments and personal care extended to 30 September

Hi

So with this card use via mobile payment, any purchases including medical bills will get 10X rewards?

Thanks

I didn’t get 10x for spending at mega discount store 🙁

Did anyone get?

The 9x is posted in the next month towards the end (eg. 28th/29th). So if you spend today, you will only see the 9x sometime end August.

Having said that, your spending at the mega discount store may be classified as a different MCC? Best check with the CSOs.

Yup MCCs is what they go by. I used this card for the last 6 months and my rewards points garnered is disappointing to say the least… Below is a list of some of the stuff they won’t award the bonus points that I encounter… 1. SportsDirect in Malacca. Bought jerseys from this world of sports type shop. Not awarded. 2. Toys R Us in Msia and Spore. Not awarded. 3. Jewellery shop. Spend quite a bit here for presents. Not awarded. They make a distinction between jewellery store MCC and apparel assasories departmental store MCC 4. Amazon. Not awarded… Read more »

With so many unclear exclusion due to MCC tagging, it’s really not worth using this card. Adding on to the fussle of remembering or referring to charts collated and comet invited by the community, there are still unknowns and uncertainty on which merchant award the bonus.

I just got a reply from OCBC CSO. Megadiscount Store is coded MCC 5722 (Household Appliance Store), and is NOT ELIGIBLE for 10x OCBC$.

I got wind that the mobile payment promotion will be extended till Sep 2018. If so, this has the potential to be one of the best cards of 2018 IMO.

yup, its updated on their website already

that is awesome. this card should then become part of your regular rotation. will update the what cards… section accordingly and get a post up. thanks!

Till dec 2018

I just got the card, so I spent some time scouring the relevant HWZ thread. There’s an active OCBC rep who’s been replying and confirming eligible/non-eligible spend there.

I spent a few minutes updating the HWZ crowdsourced CC spreadsheet – think it now offers a quick snapshot of what type of merchants are eligible.

Hopefully, other card users will join in to help update! =D

I know I said I’d write something about the card extending the 10x points on mobile payments, but I want to hold off for just a few weeks cause i’m taking a meeting with the bank to see if I can secure some special sign up bonus for milelion readers…

Sign on bonus? Hope they extend it to existing customers too ?

haha we can hope but don’t get your hopes up. nothing drives card product managers like new sign up figures