For quite some time, one of the most Fight Clubby things about the miles and points game was the ability to earn 10X points (4 miles per $1) on bill payments through the Citibank Rewards card and AXS machines.

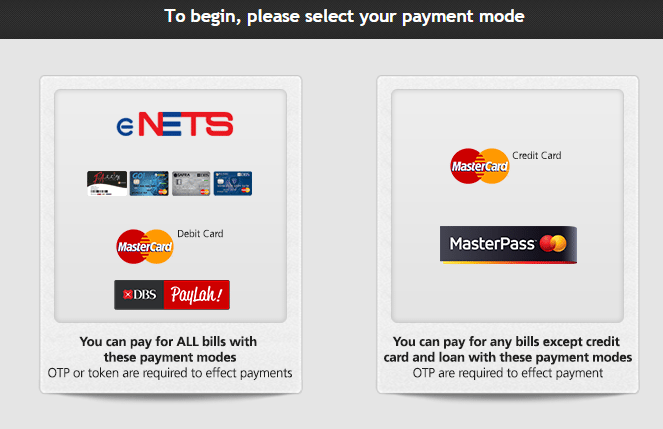

You needed the Mastercard version of the card for this to work. What you’d do is select the Mastercard/MasterPass option on the AXS e-station, then add your bills (insurance, season parking, town councils, storage, telephone, condo fees, club memberships) to your basket.

When the time came to pay, you would receive an OTP and the transaction would register as online. And although this wasn’t anything like the “shoes, bags and clothes” that the Citibank Rewards card promised 10X points for, people were still receiving the bonus points whether by accident or design. Although the Citibank Rewards only gave 10X points for a maximum of $12,000 spending per year, this was still an easy way for people to earn 48,000 miles on spending they would have to incur anyway.

This trick was guarded zealously by many in the community. Woe betide anyone who posted something like “guys I don’t see my bonus points so I called up the CSO to check what’s going on.” Man, the vitriol they received…

![]()

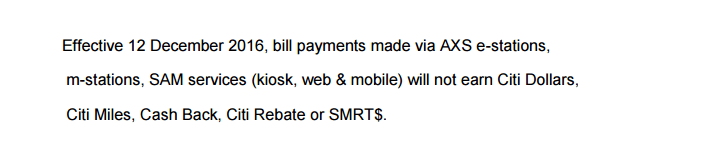

Well so much for that because Citibank has posted a very curt message on its website which brings the party to an end.

As upsetting as it is that this is going away, I’d rather stay philosophical about this. Opportunities come and go all the time. We had a similar mourning period when DBS changed their T&C with the Woman’s card (but even then it’s still unclear as to whether the new T&C exclusions are being enforced), and it wasn’t the end of the world.

November is the last month you have to make your bill payments and enjoy your 10X bonus, so no time like the present.

noooooooooooo….this was the only useful thing about this card. will probably have to pay in advance.

what will i do without this site.

sigh ): this was truly the most useful card for that. Any suggestions as to what card to use from now on?

Damn, I was hoping this was going to be good for another tax season.

so here’s the thing- if you don’t mind tying up your funds in a 0 interest account you can prepay your tax bill to max out whatever balance there is left on your 12k annual points cap

Do you mean i can pay the tax in advance for next year?

i mean that so long as you’re ok parking your money in a place where it earns 0 interest you could conceivably prepay any bill account so you have a credit balance. you could prepay your singtel bills, your town council bills, your tax bill, whatever you know for sure will be recurring. worse come to worse they’ll simply mail you a cheque back with your money.

in fact could that be a way for MS? hmmmmmmmm…..

got it, thanks.

When I once paid my tax via AXS in April, two month before the statement was generated, they mailed it back and I got a phone call from IRAS – they wanted to know why I did it. I told them that I did it because I would not be in the country during the NOA sending time and wanted to deal with it early. Was told not to do it again because it screws up their system.

Refunded to you in the form of a cheque? Or to your card?

It was check.

ok so i’ve got this straight

1. you overpaid your balance via card

2. they returned you via cheque

which means you found a ms opportunity!

U get a warning for over funding IRAS. IRAS may even banned cc payment using axs for the troubles that they are getting. Don’t do it

ok, could you then do the same thing with your singtel bill? or any other bill apart from iras?

No issues overpaying other billing agencies. I used to do it to trigger 5% cashback on Manhattan card under their older rebate structure. I believe most companies (e.g. Telcos) welcome the extra interest-free cashflow.

IRAS seems to actively refund, so this probably adds to unwelcome hassle and cost to them.

https://www.iras.gov.sg/irashome/Quick-Links/Tax-Refunds/

When Automatic Refunds Will Not Be Given

Taxpayers will not be given automatic refunds under these circumstances:

3. Instruction to Leave the Credit Balance

When the taxpayer has informed IRAS to leave the credit in their tax account to offset future taxes.

I called them and did this and they have noted my request.

Is calling the only option ?

yes appears so

Hi Aaron,

I have paid my tax in advance and received the rewards point before it ended. Then i received the call from IRAS officer, they ask for reason, and i told them i have forgotten and paid twice. Then they send me back the cheque..

SO i got both points and money back.. Thanks for your advise.

i think we have just discovered a form of ms….

If you pay in advance when there is no due, it will be refunded to you – in 2 weeks 🙂 I used this trick to jack up some points on my card

Don’t be stupid. If everyone starts doing it. IRAS may consider asking axs to take out the option of paying tax using credit card. U will get nothing in the future

They will not because IRAS is more interested in people paying their taxes than what the problems that the banks may have.

Unless they are under a legal requirement to process refund immediately. I cannot think of another reason why they would be dumb enough to return interest free funds.

If you overfund your tax account it becomes a problem for them, that’s why they refund you the excess. Trust me, u get a warning letter and potentially kill this game.

Hi Aaron,

If I use the cit rewards master card to top up FEVO, can I to earn 10X points (4 miles per $1)?

No

🙁

You can all in pay to IRAS-Personal tax : )

no, you don’t get for fevo.

Is there a monthly limit?

All good things come to end eventually.

I’m sure that is another alternative but it is closely guarded.

Any hint on the alternative?

Not I am aware of, but I did not dig seriously in it. However once a year ago I got a PM from someone at HWZ showing a screenshot of 100K miles cashed every month.

I can’t imagine life without mileslion

at the moment, aside from HSBC Advance (which is extremely unreachable for me), any suggestions for bill payments?

while we are on the topic.. any suggestion how to earn miles for ezlink top-up..?

Extremely unreliable is understatement. I’ve applied to it in April and got no response since that.

I don’t think HSBC advance let’s you earn miles on bill payments? They do?

Answer is no.

And above mentioned schema of overpaying to IRAS tax does not work – they don’t like it and you will get warning.

Go down to their branch.

Got it in a week.

I WAS THERE four times – at Raffles Place branch. Last time – on Thursday.

If you have contact information of upper management of HSBC, please share. Because I am ready to write to their HQ that Singapore branch is engaging into discrimination practice. Otherwise I can’t explain their behaviour.

Erh no go there and apply

What about bill payments to telcos (eg. Starhub) made directly through their website, do this still earn 10x?

Sad to learn about this. I just only enjoyed the perk of paying my income tax bill via Masterpass and received the 10x.

Since the cessation of 10X points for AXS bill payments, I have been paying directly to Singtel & Starhub using their website/app with Citibank Rewards card and have been awarded the 10X points for the past few months. However today I noticed my latest payment to Singtel has only 1X reward point, not sure if anyone else notice the change.

My last payment on 13 Feb still clocked 10x. When was yours?

(That said, since it’s not advertised as an eligible 10x type, I don’t think there’s any way to get it if you weren’t awarded, unfortunately!)

Mine was made end Feb to SingTel.

Called IRAS yesterday to check on the feasibility of paying my income taxes early – and they mentioned that Dec was too early to pay taxes.

When I asked on the possibility of advance payment to offset next year’s NOA, they said usually tax payments are expected in Aug / Sept of a year and that I shouldn’t try and pay this early.

But starting from January/February it is OK?

Honestly, I did not push them beyond that. Given that Citi is killing this option in 4 more days, does it even matter if we are able to pay in Jan / Feb?

Do they give the points base on transaction date or posting date?

Anyone have confirmation if HSBC Advance awards 10x points for E-AXS and E-SAM payments?

The only restriction for HSBC Advance is transaction bonus for EZ-Link will count a maximum of 200.

You cant use visa on E-AXS.

if I use the citi rewards card to pay my tax bill via cardup, will it give me the 10X points?

Also, assuming citi is having a promotion for existing card members for their premiermiles visa and premiermiles mastercard, 15,000 welcome miles in addition to 1.2miles per $1 if I swipe $10k. If I were to apply for both, does that mean they will give me 30K miles and 1.2*20K if I swipe 10K on each card?