What is a financial comparison site?

Financial comparison sites featuring everything from credit cards to loans to bank accounts to insurance have sprung up in Singapore. The idea behind these sites is to bring together different products from different providers, allowing consumers to do an unbiased (at least, in theory) side-to-side comparison of the pros and cons of various offerings.

How do they earn money?

These platforms earn money from affiliate marketing. What that means is that every time a customer signs up for, say, a credit card, the bank gives the platform a commission*. Given the sheer variety of credit card offerings we have in Singapore, there are attractive commissions to be earned from customer acquisition. It’s no wonder these some of these sites have major VC backing.

*technically it’s slightly more complicated- some platforms may also offer credit cards from banks with which they don’t have partnership agreements just for comprehensiveness sake

A quick Google search found nine different players in this space, some of which are home-grown and some of which started elsewhere before opening up in Singapore.

Full disclosure: The Milelion has a commercial relationship with GoBear, which provides some of the affiliate links for credit card applications on this site. It’s a relationship that literally started last week though and I’d been putting this article together for a month prior.

I think the fundamental tension that exists for any financial comparison site is that you earn money when people sign up for products through you. Therefore, like any commission-based business, there’s always going to be pressure to recommend not the products that best fit the customer the best, but those which earn the highest commission.

Of course, the presence of a conflict of interest doesn’t necessarily translate into an actual one. Similar conflicts exist in any principal-agent situation, be it health insurance or financial planning, and when’s the last time that led to any problems?

Oh.

So how reliable are financial comparison sites? What value do they give you? How robust are their recommendations? I spent some time going through the nine sites and here are some thoughts I have.

The problem with rating systems

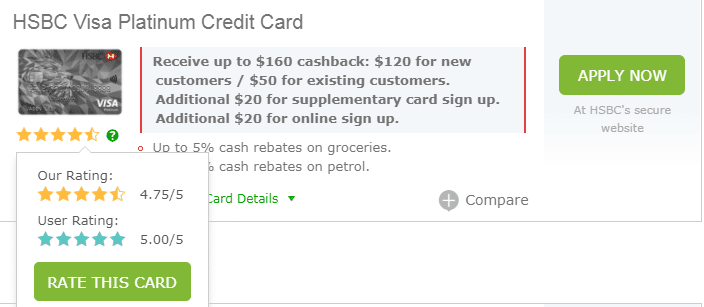

Of the nine financial comparison sites I looked at, three of them (Moneysmart, Get.com and EnjoyCompare) provide ratings for credit cards.

I’m not a fan of the idea.

I hope everyone sees the fundamental problem with this, similar to the age-old debate about the “issuer-pays” model of credit ratings. It is inherently difficult to provide objective ratings of a product when your main revenue stream comes from the provider of said product.

This issue isn’t helped by the opacity of the rating systems. I could not find any explanation on Moneysmart’s site as to how their ratings are derived. Nor for EnjoyCompare, beyond this very illuminating line

To help you find the best credit card deal on the market, we have attributed a star rating to each of the credit cards on our website.

Get.com is the exception, with the most detailed explanation of the three

At GET.com, we compare credit cards and rate them objetively based on the credit card’s features, interest rates and fees. Cards are rated by our team based primarily on the basis of value for money to the cardholder. The GET.com team rates each card based on its annual fee, rewards, benefits, bonus, interest per annum, privileges and flexibility (in how benefits can be used and how rewards are earned and redeemed), and other card features

Interestingly enough, Get.com also offers the most detailed ratings of the three. Moneysmart uses a 1-5 scale with intervals of 1, EnjoyCompare uses a 1-5 scale with intervals of 0.5, but Get.com shows ratings to two decimal points. That provides the opportunity for some analysis, and in doing so hopefully explain why rating credit cards may not be in a site’s interest.

I went through the entire Get.com site to put together this spreadsheet of the ~100+ credit card offerings they have in Singapore, together with the scores given. Let it never be said that The Milelion doesn’t have great weekends.

| Rank | Bank | Card Name | Score | Tag | Can be applied through site? |

| 1 | American Express | Krisflyer card | 4.8 | miles | yes |

| 2 | OCBC | 365 | 4.8 | yes | |

| 3 | American Express | True Cashback | 4.79 | yes | |

| 4 | Citibank | rewards visa | 4.78 | miles | yes |

| 5 | Citibank | cash back | 4.77 | yes | |

| 6 | UOB | one card | 4.76 | yes | |

| 7 | HSBC | visa platinum | 4.75 | yes | |

| 8 | HSBC | advance | 4.75 | yes | |

| 9 | CIMB | visa signature | 4.74 | no | |

| 10 | ANZ | optimum | 4.73 | yes | |

| 11 | SCB | unlimited cashback | 4.7 | yes | |

| 12 | American Express | Platinum credit card | 4.7 | miles | yes |

| 13 | UOB | delight | 4.65 | yes | |

| 14 | ANZ | travel visa signature | 4.6 | miles | yes |

| 15 | DBS | altitude visa | 4.6 | miles | no |

| 16 | ICBC | visa dual currency | 4.6 | no | |

| 17 | UOB | yolo | 4.6 | yes | |

| 18 | BOC | family card | 4.6 | no | |

| 19 | Maybank | world mastercard | 4.6 | no | |

| 20 | Citibank | premiermiles | 4.5 | miles | yes |

| 21 | OCBC | titanium rewards | 4.5 | miles | yes |

| 22 | UOB | PRVI miles mc/visa | 4.5 | miles | yes |

| 23 | DBS | altitude amex | 4.5 | miles | no |

| 24 | HSBC | visa infinite | 4.5 | miles | no |

| 25 | OCBC | frank | 4.5 | yes | |

| 26 | SCB | singpost platinum | 4.5 | yes | |

| 27 | POSB | everyday | 4.5 | no | |

| 28 | DBS | live fresh | 4.5 | miles | no |

| 29 | Maybank | duo platinum | 4.5 | no | |

| 30 | American Express | krisflyer ascend | 4.4 | miles | no |

| 31 | Maybank | platinum visa | 4.4 | yes | |

| 32 | BOC | shop! Card | 4.4 | no | |

| 33 | CIMB | visa infinite | 4.4 | no | |

| 34 | HSBC | premier mastercard | 4.4 | no | |

| 35 | SCB | manhattan | 4.4 | no | |

| 36 | UOB | lady’s card | 4.4 | yes | |

| 37 | DBS | black visa | 4.4 | no | |

| 38 | UOB | lady’s solitaire card | 4.4 | no | |

| 39 | Citibank | clear platinum | 4.4 | miles | no |

| 40 | HSBC | revolution | 4.4 | miles | yes |

| 41 | Maybank | horizon visa signature | 4.3 | miles | yes |

| 42 | UOB | priv miles amex | 4.3 | miles | yes |

| 43 | OCBC | voyage | 4.3 | miles | no |

| 44 | SCB | tigerair platinum | 4.3 | no | |

| 45 | ANZ | switch platinum | 4.3 | yes | |

| 46 | Citibank | smrt platinum | 4.3 | yes | |

| 47 | OCBC | plus! Visa | 4.3 | yes | |

| 48 | DBS | treasures black elite amex | 4.3 | no | |

| 49 | Diners Club | v card | 4.3 | no | |

| 50 | ANZ | platinum visa | 4.3 | yes | |

| 51 | UOB | metro-UOB | 4.3 | no | |

| 52 | American Express | rewards card | 4.3 | miles | no |

| 53 | American Express | platinum reserve | 4.3 | miles | no |

| 54 | Maybank | family and friends | 4.2 | yes | |

| 55 | UOB | visa infinite | 4.2 | miles | no |

| 56 | CIMB | world mastercard | 4.2 | no | |

| 57 | Citibank | m1 platinum | 4.2 | no | |

| 58 | Diners Club | sheng siong | 4.2 | no | |

| 59 | DBS | woman’s card | 4.2 | no | |

| 60 | OCBC | platinum credit card | 4.2 | no | |

| 61 | American Express | gold card | 4.2 | miles | no |

| 62 | American Express | centurion | 4.2 | miles | no |

| 63 | SCB | platinum mastercard | 4.2 | yes | |

| 64 | ANZ | platinum mastercard | 4.2 | yes | |

| 65 | OCBC | cashflo | 4.2 | yes | |

| 66 | DBS | insignia | 4.1 | miles | no |

| 67 | SCB | priority banking visa infinite | 4.1 | no | |

| 68 | OCBC | robinsons group | 4.1 | yes | |

| 69 | UOB | preferred platinum visa | 4.1 | no | |

| 70 | OCBC | arts credit card | 4.1 | no | |

| 71 | American Express | capitacard | 4.1 | yes | |

| 72 | Citibank | prestige | 4 | miles | no |

| 73 | American Express | PPS card | 4 | miles | no |

| 74 | American Express | solitaire pps | 4 | miles | no |

| 75 | UOB | jcb platinum | 4 | no | |

| 76 | Diners Club | international credit card | 4 | no | |

| 77 | OCBC | elite world | 4 | miles | no |

| 78 | CIMB | platinum mastercard | 4 | no | |

| 79 | DBS | esso card | 4 | no | |

| 80 | OCBC | best denki | 4 | no | |

| 81 | American Express | platinum card | 4 | no | |

| 82 | ANZ | signature priority banking VI | 4 | no | |

| 83 | OCBC | NTUC plus! Visa | 4 | yes | |

| 84 | Diners Club | international charge card | 3.9 | no | |

| 85 | DBS | takashimaya | 3.9 | no | |

| 86 | UOB | singtel card | 3.9 | no | |

| 87 | DBS | takashimaya amex | 3.9 | no | |

| 88 | ICBC | unionpay dual currency | 3.9 | no | |

| 89 | SCB | prudential | 3.9 | no | |

| 90 | BOC | travel card | 3.8 | no | |

| 91 | UOB | visa signature | 3.8 | miles | no |

| 92 | Diners Club | secret recipe | 3.8 | no | |

| 93 | OCBC | great eastern cashflo | 3.8 | no | |

| 94 | UOB | professionals platinum | 3.8 | no | |

| 95 | DBS | nus alumni | 3.8 | no | |

| 96 | Diners Club | mustafa | 3.8 | no | |

| 97 | DBS | nus alumni platinum | 3.8 | no | |

| 98 | SCB | platinum visa | 3.8 | yes | |

| 99 | SCB | nus alumni | 3.8 | no | |

| 100 | BOC | sccci great wall affinity | 3.7 | no | |

| 101 | Diners Club | home team ns | 3.7 | no | |

| 102 | Diners Club | long beach | 3.7 | no | |

| 103 | DBS | passion card | 3.7 | no | |

| 104 | SCB | pruprestige visa signature | 3.7 | no | |

| 105 | DBS | nuss | 3.7 | no | |

| 106 | Maybank | manchester united platinum | 3.7 | yes | |

| 107 | BOC | chinese scholars and students | 3.6 | no | |

| 108 | UOB | unionpay platinum | 3.6 | no | |

| 109 | Diners Club | nature’s farm | 3.6 | no | |

| 110 | Diners Club | raffles marina | 3.6 | no | |

| 111 | HSBC | secured platinum visa | 3.6 | no | |

| 112 | Maybank | catholic high | 3.5 | no | |

| 113 | Diners Club | international ace | 3.5 | no | |

| 114 | Citibank | ultima | 3.4 | miles | no |

I further tagged each card by whether it is a “miles relevant” card (i.e. whether it earns rewards points versus cashback) and whether it can be applied for through the Get.com website. This will become relevant later.

The thing that jumped out at me most was that scores were generally high. The top rated card (AMEX Krisflyer Card) had a score of 4.8, and the bottom rated card (Citibank Ultima) had a score of 3.4. The average and median scores were about 4.20 out of 5. Once I removed the smaller, outlier card issuers (like Diners Club, BOC and ICBC), the average increased to 4.28 out of 5.

In an absolute sense, 4.28 out of 5 is a very good score. If you take the point of view of the average Joe scrolling through the site and looking at scores, a 4.28 out of 5 isn’t going to raise any red flags.

Of course, the whole purpose of a comparison site is to compare scores, not consider them in isolation, so how do cards measure up to each other?

And that brings me to the other tag I made: whether or not you can apply for a particular card via Get.com. When you look at that cut, cards which could be applied through Get.com scored an average of 4.44, versus 4.07 for those which could not.

There are two extremes of interpreting this. The first, and most charitable way, is that Get.com curates its selection, making sure that it only offers cards which give genuine value to people. The second, more conspiracy theorist way, is that there is a need to make certain cards look better because they’re more valuable to the site in terms of commissions.

Now I’m not so cynical as to suggest that’s the case. The real answer is probably somewhere in between, and there are valid reasons why the cards which can’t be applied through Get.com have a lower average rating. Inside this basket are a whole load of super dumpy Diners Club co-branded cards and random offerings like the BOC Chinese Scholars and Students card/ Maybank Catholic High card hovering in the 3.5-3.7 range, which no financial comparison site in its right mind would be pushing. I have no doubt that these cards are crap, and therefore the average score of “cards not offered through Get.com” is dragged down.

That said, the optics are still bad because it can come off on first impression that the site demonstrates an upwards biased towards cards it promotes. Which is why I think a rating system can do more harm than good.

And that brings me to my second problem with rating systems. Let’s look only at cards that earn rewards points/miles because that’s what I feel most qualified to talk about. This removes a lot of junky cards from our sample set and reduces the noise.

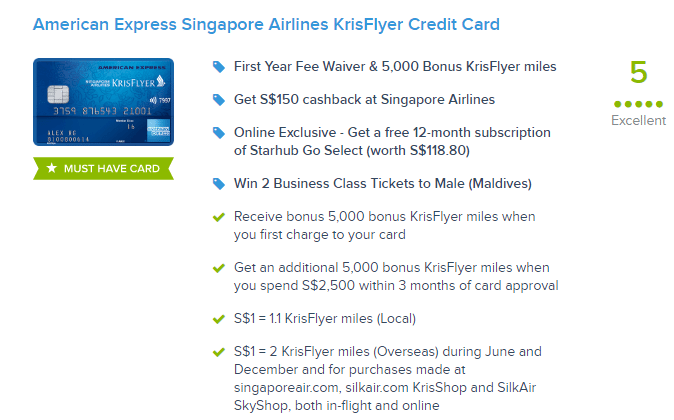

When I look at individual card scores, it makes absolutely no sense to me that the American Express Krisflyer Card should be top of the pile. I mean, here is a card that offers 1.1 mpd on general spending, and 2.0 mpd on overseas spending only in the months of June and December. Yes, it has no conversion fees, a 5,000 mile bonus with your first spend and an opportunity to earn a further 5,000 miles with your first $2,500 of spending, but there are better offers out there. The DBS Altitude, for example, was giving new customers 10,000/15,000 miles with $2,000 of spend in the first 2 months earlier this year. Plus, you’ll earn a superior general spending (1.2 mpd) and overseas spending (2.0 mpd year round) rate. The only reason I’d get the AMEX Krisflyer is to spend a few bucks, get my 5,000 mile first user bonus and then sock drawer the thing.

Likewise, I don’t think the UOB Visa Signature should be ranked so low. It’s offering the best overseas spending rate of 4 mpd, albeit with certain conditions. It’s a great miles earning card if you know how to use it right. The gutted ANZ Travel Visa Signature (which in any case isn’t available for application anymore) is definitely not ahead of cards like the PRVI, and I think the Citibank Prestige is a much better offering than the HSBC Visa Infinite due to the 4th night free hotel benefit plus superior miles earning rate.

Of course, the inherent flaw in my analysis is that I’ve done this from the POV of someone who values miles above all else. That’s not how everyone thinks. Some people just want a card with no/low annual fees. Others want a card with the best dining discounts. Still others want a card that gives special access to clubs, airport lounges, etc. How exactly do you take all this into consideration when assigning scores?

The short answer is you can’t. And that’s the problem with a ratings system, because it can’t hope to capture all this complexity. So that’s why I think any site with a credit card rating system is asking for trouble. It may lead to the impression of bias, even when none exists, and it is difficult to capture different people’s selection criteria in a single number.

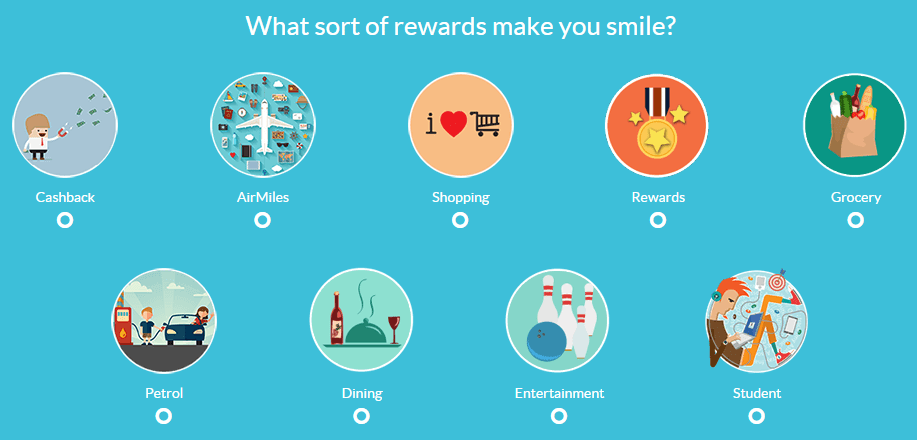

Lack of a robust credit card recommendation tool

With all the different credit cards out there, it’s easy for a first timer to be overwhelmed. That’s why some comparison sites offer tools that recommend specific credit cards based on your financial circumstances and spending habits.

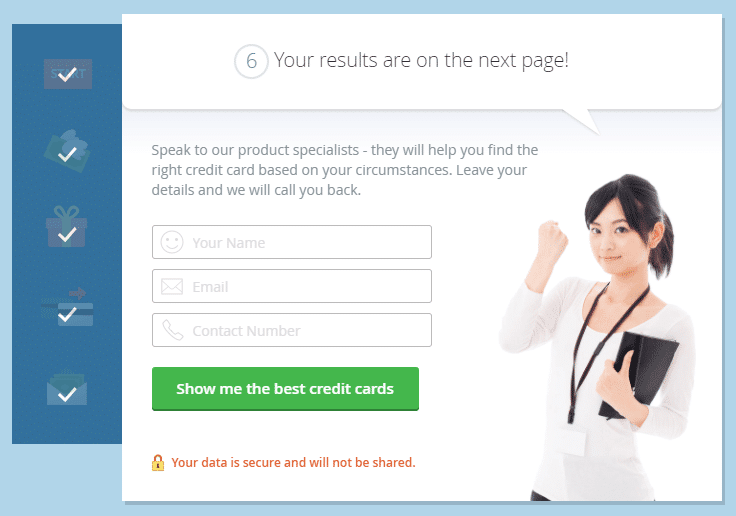

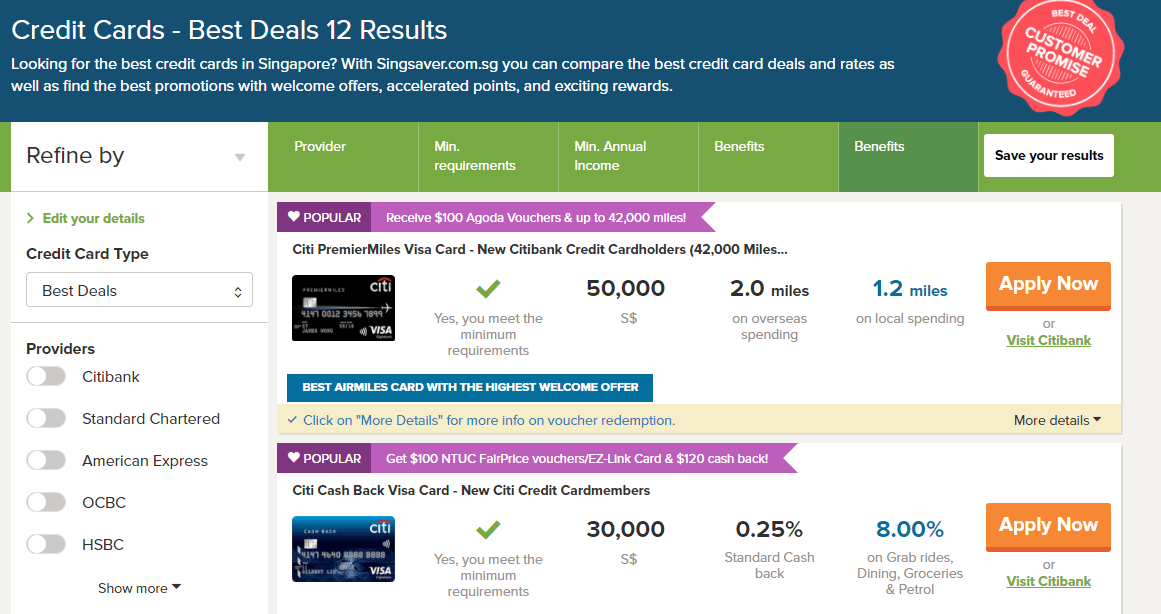

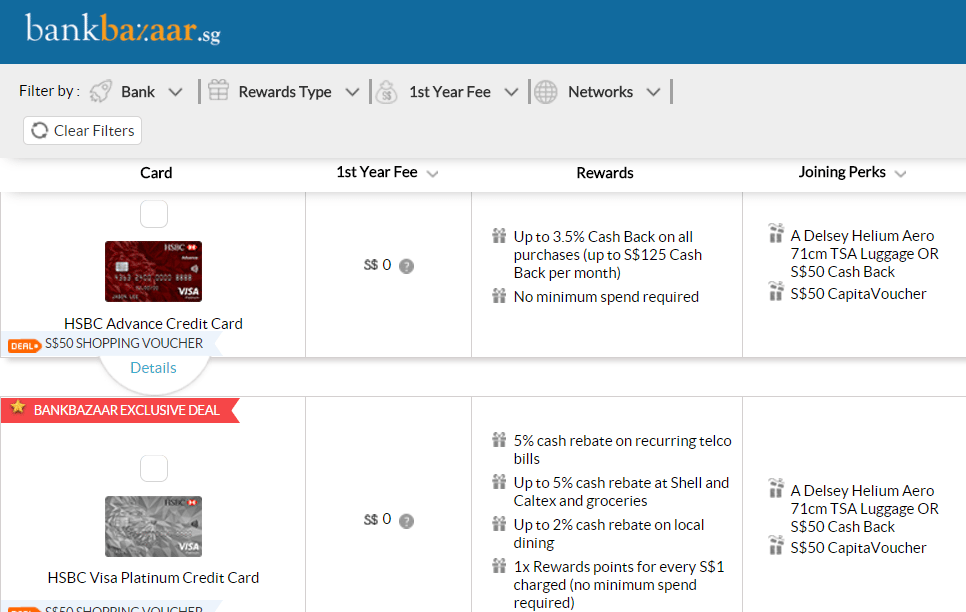

Of the nine providers, four of them (GoBear, iMoney, Bank Bazaar and Singsaver) offer some sort of credit card recommendation tool. These typically ask you questions like your nationality, what categories you spend on the most, what type of rewards you like, and your salary in order to come up with a list of recommended cards.

It’s a form of lead generation in a way, and both Bank Bazaar and iMoney request for your personal contact details before showing you the results. Bank Bazaar lets you skip this, but iMoney does not.

I didn’t find the recommendation tools particularly robust. Singsaver seemed to prioritize the results by whichever bank was offering a sign up bonus (presumably leads which generate more income for them) and never actually asked me if I wanted miles, rewards points or cashback.

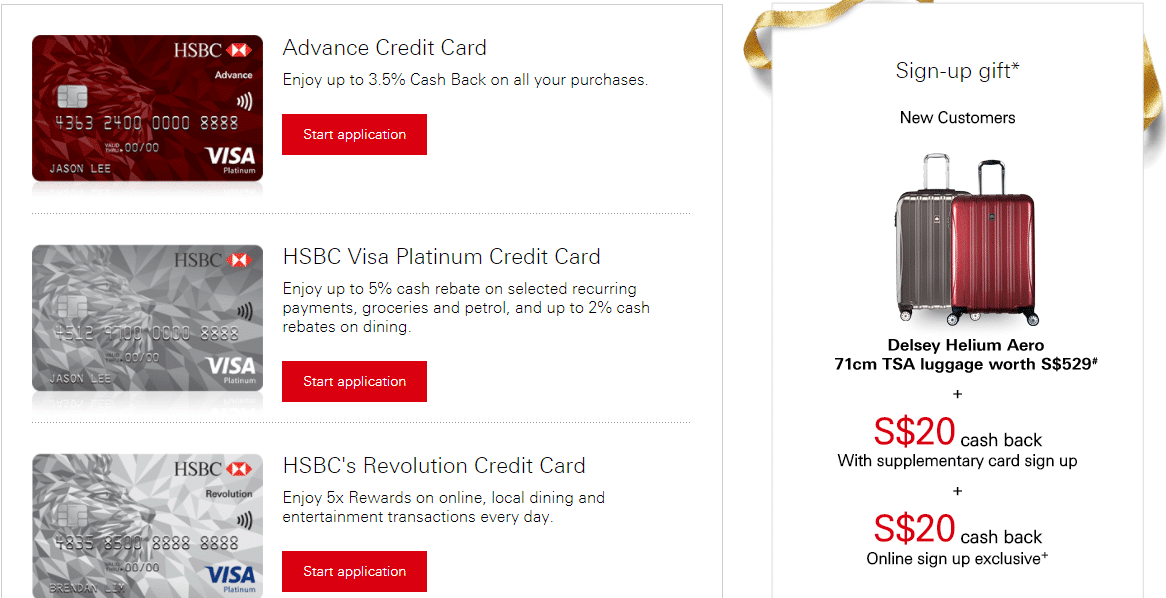

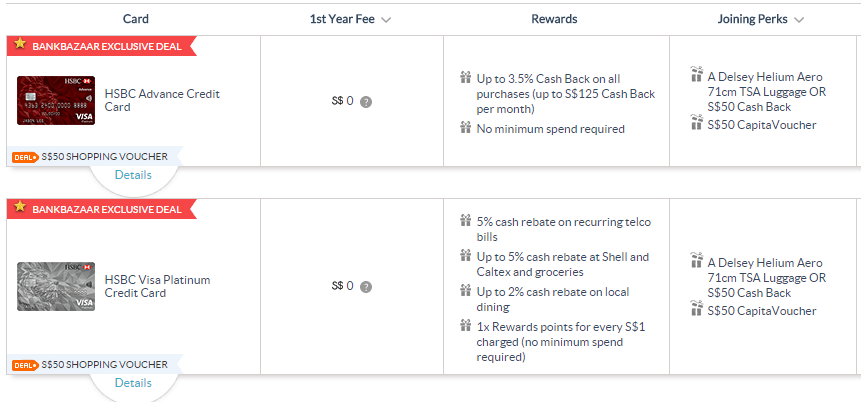

Bank Bazaar did ask me what type of rewards I wanted to earn, but despite me indicating “air miles”, the recommendation tool still showed me two cashback cards (HSBC Advance +HSBC Visa Platinum) among their top three results. Again, I suspect it’s because their algorithm is designed to push cards which earn the site bigger bonuses.

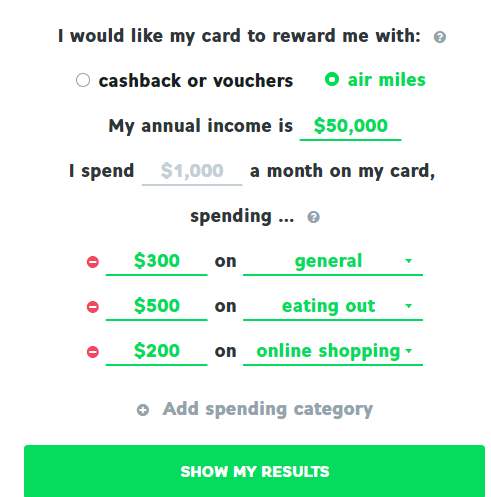

GoBear’s tool allows you to enter specific amounts for spending in each category and outputs the exact number of miles you would earn with that spending profile and various cards. That makes the calculation a bit more intuitive for the user insofar as it provides the “so what”.

What was disappointing, however, was that the Gobear tool still reverted to a one-card solution when making the recommendations. So if, for example, I indicated I spent $1K a month of which $500 was dining, $200 was online and $300 general purpose, they’d show me the following options-

The site says with an annual spend of $12K split into those categories, I could get 21.6K miles by using the Maybank Horizon Visa Signature. This is based on 3.2 mpd on dining (3.2*500*12) + 0.4 mpd on everything else (0.4*500*12). I appreciate that the math is right, but that’s far from an optimal solution. If the engine could tell me to put my dining on the Maybank Horizon, my online spending on the DBS Woman’s card and everything else on the DBS Altitude, that’d be a lot more valuable than a one card strategy.

Indeed, this shortcoming is common across all the recommendation tools on these comparison sites. None of them offer a portfolio strategy, and we know that if it’s miles you want, you can’t just rely on a single card to get there. I’m no coding genius, but I’m sure it wouldn’t be technically impossible to create a tool that could recommend how to maximise the miles you earn using a portfolio of cards based on your spending patterns, taking into account sign up bonuses etc. And since these sites make more money the more cards you sign up for, wouldn’t a tool like this be in their interest?

If only there were a rugged, slightly balding man who specialised in this area and could be engaged for a reasonable fee…

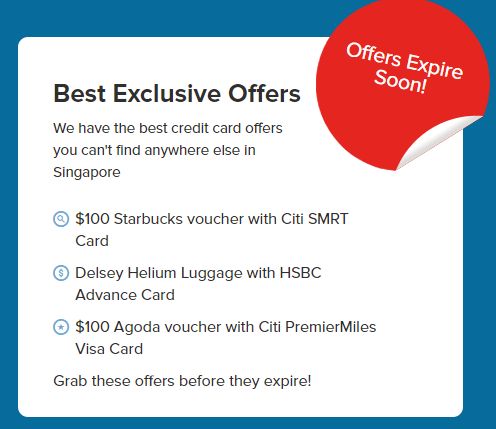

Exclusive sign up gifts that aren’t

Financial comparison sites earn money when you apply through them, so they’d better well start sharing some of that wealth around. Unfortunately, while most sites advertise great sign up bonuses, they don’t tell you that it’s what the bank would give you anyway, regardless of how you signed up. I find that bordering on disingenuous.

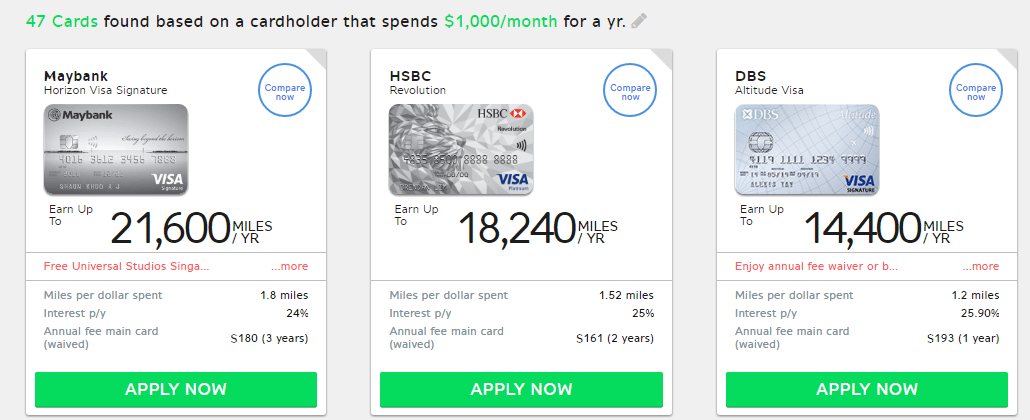

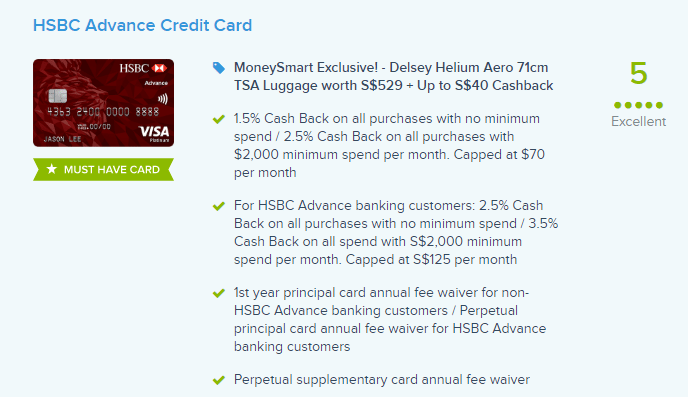

For example, Moneysmart’s website advertises a Moneysmart Exclusive– get a a free luggage bag when you sign up for the HSBC Advance card.

But that’s not true. It’s not a Moneysmart exclusive, it’s something available to all new HSBC Advance cardholders, as you can see on HSBC’s website.

Bank Bazaar has the same deal, Singsaver has the same deal, EnjoyCompare has the same deal. So it’s dishonest to paint that as some exclusive benefit people get when applying through your site. (Moneysmart does have an exclusive deal with Citibank though where it’s offering a Qoo10 voucher for first-time applicants of certain Citibank cards)

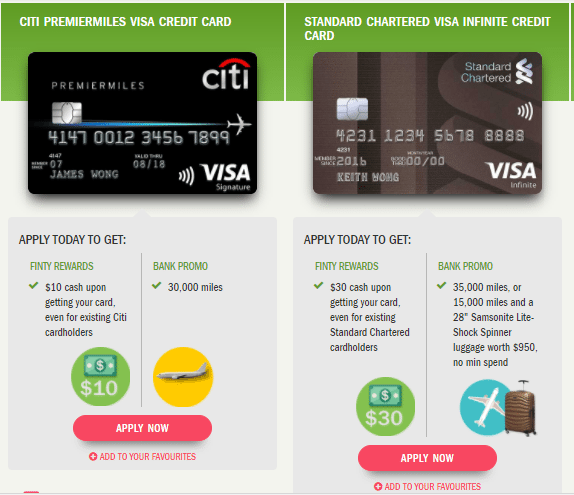

The four other sites which offer exclusive deals are GoBear, Singsaver, Bank Bazaar and Finty.

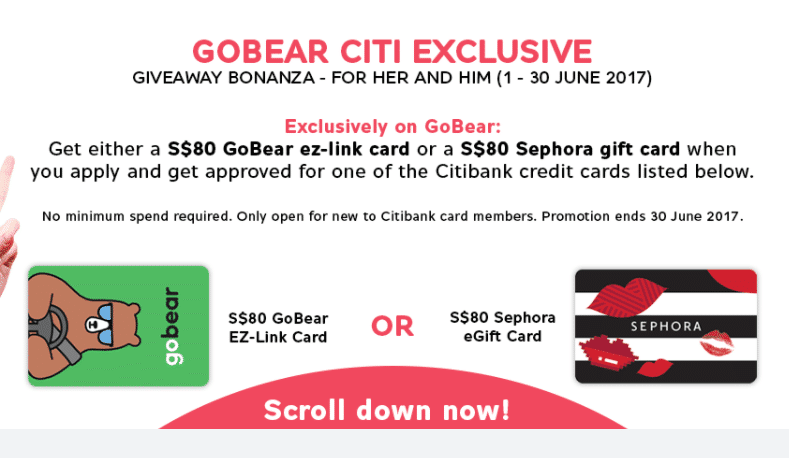

GoBear is running an exclusive promotion with Citibank that gets you an $80 ez-link or Sephora gift card when you apply and are approved for certain Citibank cards. There’s also an ongoing promotion for the HSBC Advance card where every 5th approval wins a PS4 or Nintendo Switch

Singsaver is running their own exclusive promotion with Citibank and HSBC Advance too that offers gifts like a $150 Fairprice voucher or a $100 Agoda voucher.

Finity offers rewards to both new and existing cardholders, and I like its way of presentation because they clearly show what gift is from them and what the bank would have given anyway

Bank Bazaar only offers bonuses on HSBC cards for now in the form of a $50 Capitamalls voucher.

Who has the best rewards? It depends. Finty offered smaller sign up rewards than GoBear or SingSaver, but offered them on 30 different cards. Their bonuses tended to be available even if you held other cards with the same bank. GoBear and SingSaver had bigger rewards, but only on Citibank and HSBC cards, and these tended to require you to be a first time applicant.

I imagine the rest of the financial comparison sites will also be hard at work to secure exclusive deals like this, but until they do, you owe it to yourself to shop around and make sure you’re not leaving value on the table.

Other odds and ends

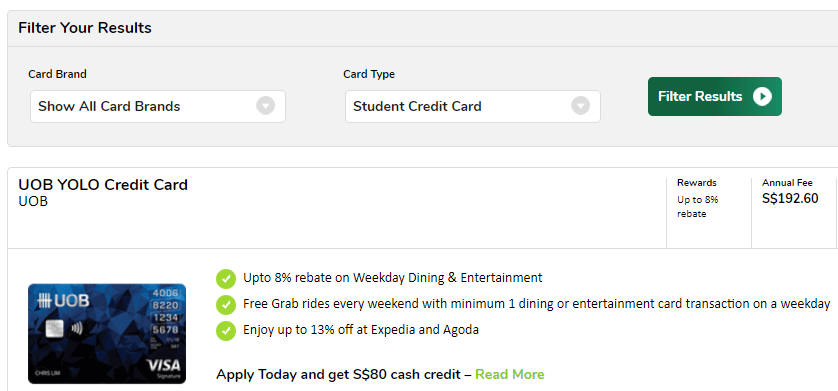

The sites weren’t completely without error. EnjoyCompare listed the UOB YOLO as a student card, when it requires you to earn a minimum of $30K per annum. You could be charitable and chalk this up as a classification error due to a finger slip when tagging. And maybe that’s all it is.

But seeing this error makes me wonder about how robust the rest of their classification process has been. Because it makes you think all they did was glance at the marketing materials, conclude the YOLO was aimed at students (which is easy to understand given the way the card is branded and the benefits it comes with) and classify it as such. In other words, that they bought into the marketing instead of doing robust, detailed reads of the T&C.

My take

Financial comparison sites can be useful in demystifying credit cards and other financial products by providing a platform where consumers can do card-to-card comparisons among different banks. To the extent they offer (genuine) exclusive sign up offers and (objective) reviews, they have the potential to offer significant value.

So long as you’re aware of the issues I pointed out (is this gift really exclusive to the site? Are these ratings relevant to me as a miles chaser? Is this recommendation tool showing me all relevant cards or just selected ones?) I think you’ll be well equipped to make them work to your advantage.

EDIT: Here’s a summary table that compares all the different sites on a few selected dimensions

| Site | No. of Cards | No. of Banks | Rates cards? | Recommendation tool? | Sign up Exclusives |

| EnjoyCompare | 20 | 8 | Yes | No | No |

| GoBear | 95 | 13 | No | Yes | Yes |

| iMoney | 86 | 13 | No | Yes | No |

| Singsaver | 100+ | 13 | No | Yes | Yes |

| Moneysmart | 41 | 10 | Yes | No | Yes |

| Get.com | 100+ | 14 | Yes | No | No |

| Bank Bazaar | 82 | 8 | No | Yes | Yes |

| Value Penguin | 100+ | 11 | No | No | No |

| Finty | 37 | 8 | Yes | No | Yes |

What a siong weekend/s you must had. Only a website like The Milelion will recommend a plethora of cards.

With the trending of comparison sites of late, this informative post comes at a good time. Takes a lot to understand and word them out.

I have trouble keeping up with the numbers of sites popping up, and this easily sums them all up. No need to crack my brains to recall the sites any further. Thanks for the round-up.

Do you ever consider that it is precisely because so many people get their cards wrong (thanks to great sites like these) that banks are willing to take the punt that allows us to do what we do?

My sentiments exactly. Banks exists to make money. They may offer certain schemes as carrots and take a loss on those (or at least lesser profit) in the hope that customers use their cards on other areas that makes money.

If everyone game their scheme to milk maximum benefit in every category, then all the benefits will be watered down for all.

Aaron, maybe you should just SEO your site to keywords like “credit card comparison miles cashback”… or ask aforementioned slightly balding man to do it for you?

… You realize I was just kidding, I hope?

Winners don’t use SEO.

but instead of ratings being affected by partnerships I may just be that they seek partnerships with cards of inherently higher ratings/value