| An updated version of this post is now available. Read the 2020 version of the $120K credit card showdown here |

The credit card landscape in Singapore can be roughly segmented into three tiers.

At the lower end you have the entry-level segment, where the required incomes range between $30-50K per annum. This is where you find your DBS Altitudes, your Citibank Premiermiles and assorted other rewards cards. These may have some basic privileges like a limited number of lounge visits, but otherwise the best frill you can hope for is a solid miles earning proposition.

In the middle, you have the cards for those earning between $120-150K, which usually combine favorable miles earning rates with enhanced benefits like unlimited lounge access and complimentary airport transfer, as well as concierge access. Think OCBC Voyage, Citibank Prestige and HSBC Visa Infinite.

Then, you have the elite segment where required incomes are $500K and up or by invitation only. This would include cards like the Citibank Ultima, the DBS Insignia and the UOB Privilege Reserve. These cards are for the creamy de lah creamy of society- think special invites to luxury car launches, watch shows, and black tie regattas where monocled men sip champagne and say things like “I have nothing against ethnic people, I just wouldn’t want my daughter marrying one, is all”.

(There are of course some cards that straddle these segments (the UOB PRVI would be a good example of this, at least until it cut its income requirement from $80K to $50K), but they’re the exception rather than the rule)

The Entry Level Prestige Segment

Today I want to talk about the cards in the middle, which for want of a better term I’ll call “entry level prestige”. These cards require incomes of $120-150K., and I’d put the following six cards in this bracket

- OCBC Voyage ($120k p.a)

- HSBC Visa Infinite ($120K p.a)

- Citibank Prestige ($120K p.a)

- SCB Visa Infinite ($150K p.a)

- AMEX Platinum Reserve ($150K p.a)

- Maybank Visa Infinite ($150K p.a)

*Why have I left out the CIMB Visa Infinite? It has an income requirement of $120K but other than that I don’t think it’s meant to compete for the same audience as the cards above. It has no annual fee, but also limited benefits and it doesn’t earn miles.

On the one hand, these cards don’t have the uberluxe features of the top end tier (don’t expect fancy launch parties like this one). But on the other, they aren’t for just anyone- if you as an individual earn $120K per annum you’d already be earning more than ~51% of all households in Singapore. If you’re in this bracket you no doubt live pretty comfortably, and banks throw in some enhanced benefits because well, you’re worth it.

That said, these cards also come with substantial annual fees which generally cannot be waived. These annual fees aren’t in the crazy $3.2K neighbourhood of the DBS Insignia, but at $500-600 a year they’re high enough that you shouldn’t be rushing off to sign up for every single one.

Here’s a summary of how the six cards stack up (you’ll need to use the scroller to see all 6 because of page width)

| OCBC VOYAGE | Citi Prestige | HSBC Visa Infinite | SCB VI | Maybank VI | AMEX Platinum Res | |

|---|---|---|---|---|---|---|

| Income Req | 120,000 | 120,000 | 120000 | 150,000 | 150,000 | 150,000 |

| Annual Fee | 488 | 535 | 650 (1) | 588.5 | 600 (first year free) | 535 |

| Welcome Miles | 15,000 | 25,000 | 35,000 | 35,000 | None | None (2) |

| Miles with Renewal | 15,000 | 25,000 | None (20,000 unofficially) | None | None | None (3) |

| Local MPD | 1 | 1.3 (4) | 1.25 (5) | 1.4 (6) | 1.2 | 0.69 |

| Overseas MPD | 2.3 | 2 (4) | 2.25 (5) | 3 (6) | 2 | 0.69 |

| Special MPD | 2.3 (dining) | 10 (Kaligo) | N/A | N/A | N/A | 3.47 (selected partners) |

| Lounge Access | Yes | Yes | Yes | Yes | Yes | Yes |

| Concierge | Yes | Yes | Yes | Yes | Yes | Yes |

| Airport Limo | Yes | Yes | Yes | No (7) | Yes | No |

| Private Club Access | No | No | No | No | No | Yes |

| Complimentary Travel Insurance | Yes | Yes | Yes | Yes | Yes | Yes |

| Other perks | 4th night free, Jetquay access | Jetquay access | FAR Card, Platinum Golf, Boingo Wifi, LoveDining |

(1) $488 for HSBC Premier members

(2) Complimentary set lunch for 2 at Labyrinth upon approval till 9 Aug 2017 + 1 free night at choice of 5 Frasers Hospitality properties. Spend $5,000 within 6 months of approval to get 27.8K miles (50K MR points)

(3) 1 free night at choice of 5 Frasers Hospitality properties with renewal

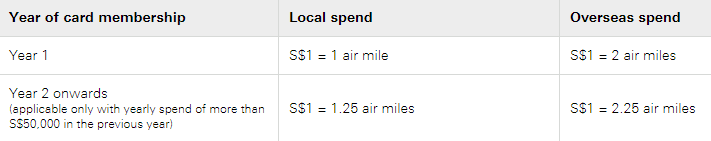

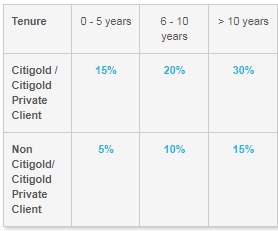

(4) Additional relationship bonus of 5-30% applied to annual retail card purchases at end of membership year

(5) With min $50K spend in previous year, otherwise 1/2 mpd for local and overseas

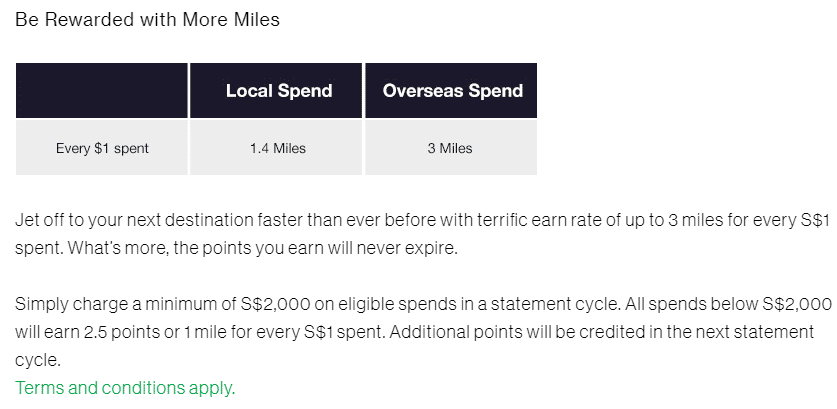

(6) With minimum spend of $2,000 a month, otherwise 1 mpd for local and overseas

(7) Offers $100 of Uber credits + 25K miles with payment of annual fee, with 10% Uber rebate capped at $100 per quarter

That’s a lot to take in at once, so let’s go category by category

Miles Earning Rate

| Local MPD | Overseas MPD | Special | Remarks | |

|---|---|---|---|---|

| AMEX Platinum Reserve | 0.7 | 0.7 | 3.47 (selected partners) | |

| OCBC VOYAGE | 1.2 | 2.4 | 1.6 (dining) | 2.4 mpd rate until 31 Dec 19 |

| Maybank VI | 1.2 | 2 | N/A | |

| HSBC VI | 1.25 | 2.25 | N/A | First year mpd is 1/2 mpd for local/overseas spending. Unlock 1.25/2.25 by spending >$50K in 1 year |

| Citi Prestige | 1.3 | 2 | 10 (Kaligo) | Year-end relationship bonus can increase this up to 1.42/2.12 mpd |

| SCB VI | 1.4 | 3 | N/A | Spend >$2K per month to unlock 1.4/3.0 mpd, otherwise 1 mpd for everything |

Same caveats as above apply re: miles earning rates for HSBC VI and SCB VI

Who immediately loses out?

Despite what its publicity materials would have you believe, the AMEX Platinum Reserve (PR) is clearly inferior from a miles earning perspective. 0.7 mpd for local and overseas spend means that there’s no way you could use this as a general spending card. There is the possibility of earning 3.47 mpd at selected Platinum EXTRA partners, but these are mainly high end fashion boutiques and a handful of restaurants. I understand that some people may keep this card on hand for the dining benefits (see last section) and that’s fair enough, but I’d be very hard pressed to justify putting any other sort of general spending on it.

The OCBC Voyage is, for reasons I’ve covered extensively elsewhere, not strictly in the same category as the rest of these cards insofar as it’s basically a cashback card with a call option for miles. The VMs it earns have a value that fluctuates between 1.5-3 cents depending on cabin and route (the value of a VM is calculated by some black box algorithm).

I’d say the HSBC VI loses out because earning the 1.25/2.25 mpd rates requires you to spend $50K in the preceding year. This means that if you’re just starting out, you earn a pitiful 1 mpd on local spend which simply isn’t good enough. Ditto the Maybank VI, which has a mpd profile similar to that of the DBS Altitude- good, but not something to pay a premium for.

It’s a close fight between the Prestige and the SCB VI. The Prestige has an interesting tiered bonus system that awards you bonus points at the end of your membership year. My understanding is that if you spend $100,000 in a year and have a 5% relationship bonus, you get 5,000 Citi Dollars ($100K spending * 5% bonus). That’s only 2,000 miles, though.

Even if you totally maxed this out with the 30% bonus, you’d be looking at 12,000 bonus miles with $100K of annual spend (which, by the way, is a heck of a lot of money). The incremental mpd, at its highest, is 0.12. Therefore this relationship bonus isn’t a big draw for me.

The SCB VI requires you to spend at least $2K a month before you get 1.4/3 mpd on local/overseas. Let’s be honest, such sums are definitely achievable if you’re earning $150K a year. What’s more, 3 mpd is an excellent overseas spending rate. If you’re the sort who can use your personal card for business expenses, you could really rake in the points when you travel overseas.

Winner: SCB VI. If you’re making $150K a year, putting $2K a month on a single card shouldn’t be too much of an ask

Welcome Gifts/Renewal Gifts

| Annual Fee | Joining Gift | Renewal Gift | First year cpm | |

|---|---|---|---|---|

| OCBC VOYAGE | $488/$3,210 | 15000 VMs / 150,000 miles | Same as joining | 3.25/2.14 |

| UOB Visa Infinite Metal Card | $650 | 25,000 miles | 25,000 miles | 2.6 |

| Citi Prestige | $535 | 25,000 miles | 25,000 miles | 2.14 |

| HSBC VI | $488 (Premier)/$650 | 35,000 miles | None | 1.39/1.86 |

| SCB VI | $588.50 | 35,000 miles | 20,000 miles (unofficial) | 1.68 |

| Maybank VI | $600 (first year free) | None | None | N/A |

| AMEX Platinum Reserve | $535 | 2N Frasers Hotel Voucher | 2N Frasers Hotel Voucher | N/A |

(1) $488 for HSBC Premier members

(2) Reports say that cardholders are offered 20,00 miles for paying the renewal fee, however this is not an official benefit

As I mentioned, the majority of these cards do not offer waivers of their hefty annual fees. Therefore, they need to provide some sort of incentive for people to hop on.

This usually takes the form of welcome miles, which the Voyage, Prestige, HSBC VI and SCB VI all offer. In terms of cents per mile, here’s how they order (cheapest to most expensive)

| Card | Annual Fee | Miles | Cents Per Mile |

|---|---|---|---|

| HSBC VI- Premier Customer | 488 | 35,000 | 1.39 |

| SCB VI | 588 | 35,000 | 1.68 |

| HSBC VI- Regular Customer | 650 | 35,000 | 1.86 |

| OCBC Voyage- Option 3 | 10,000 | 500,000 | 2 |

| OCBC Voyage- Option 2 | 3,210 | 150,000 | 2.14 |

| Citibank Prestige | 535 | 25,000 | 2.14 |

| OCBC Voyage- Option 1 | 488 | 15,000 (VM) | 3.25 |

Of course, it’s not fair to look at it purely from a CPM view because of the additional benefits each card has. But it’s a good place to start. All things equal, the Citibank Prestige needs to make up for its higher CPM through other benefits. And even if I believed the SCB VI had no real benefits, I could still justify paying the annual fee (at least for the first year) by viewing it as a pure miles purchasing exercise.

I don’t really value the AMEX PR’s welcome/renewal gift of a free night’s stay at a Frasers property. There are only five participating properties worldwide, and none of them are in what I’d call particularly expensive hotel cities.

I know there’s a limited time complimentary set lunch for 2 at Labyrinth for approved cardmembers, and perhaps some people like that, but it’s not a convincing welcome gift for me either. I’m also vaguely aware that the AMEX PR gives you some discounted staycation vouchers upon approval, but again this isn’t something I’d value enough for the annual fee. If there are other AMEX PR welcome/renewal gifts that aren’t publicly listed, please let me know.

Despite its hefty annual fee, the Maybank VI does not have any welcome miles nor renewal gift. However, it is the only card in this set that waives the first year annual fee. I’m thinking of applying for it just before a trip and plonking down the minimum spend just so I can review the (by all accounts very underwhelming) Jetquay private terminal in Singapore, enjoy the unlimited Priority Pass and then cancel it for the next year. An unlimited Priority Pass would normally cost US$399, so that might actually be the best welcome gift…

In terms of renewal gifts, it was surprisingly slim pickings. The Prestige and Voyage have the same renewal offer as the joining one, but these still represent buying miles at a slight premium to what they’re worth. The others do not have an (at least official) retention gift. This makes me wonder if acquisition is a more important metric than retention when product managers are evaluated.

Winner: SCB VI would win in the first year, but after that it could be difficult to justify renewing any of these 6 cards unless you really valued the benefits. Honorable mention to the Maybank VI for no first year fee.

Travel Perks

All the cards have travel insurance, although working out the difference in coverage limits is an exercise I’ll leave for those of you with more time. They do differ on airport transfer, lounge access and other travel perks, as I’ll elaborate below.

Airport transfer

If you’re uber rich, you could get unlimited airport transfers with DBS Asia Treasures or Citigold Private Client (min AUM: $1.5M)

For the rest of us, there’s this-

| Card | Min Spend Requirement | Max Uses | Airport Drop/Pickup |

|---|---|---|---|

| Citi Prestige | $20K spend per quarter unlocks 2 rides | 2 per quarter, 8 per year | Drop or pickup |

| HSBC Visa Infinite | $2K spend in a month unlocks 1 ride (first two per year are free) | 24 per year (includes the two free trips) | Drop only |

| Maybank Visa Infinite | $3K spend in a month unlocks 2 rides (no min spend if >$60K spending in prev. year) | 2 per S$3K spend, 8 per year | Drop or pickup |

| OCBC VOYAGE | S$3K spend or S$1.5K FCY spend in a month unlocks 1 ride | 2 per month | Drop or pickup |

| UOB Visa Infinite Metal Card | N/A | N/A | N/A |

| AMEX Platinum Reserve | N/A | N/A | N/A |

| SCB Visa Infinite | N/A | N/A | N/A |

The easiest limo service to qualify for is without a doubt the Prestige’s. You get one entire quarter to spend $1.5K (vs having to spend $2-3K in a month with the rest) in foreign currency. Once that’s been met, you can use the benefit up to four times in a quarter (i.e. no need to spend $3K to get 2, $4.5K to get 3 etc). Note that the spending need not be physically overseas- so long as it’s foreign currency it’s good.

I also value the ability to use the limo service for both drop offs and pickups. As I explained in my article on credit card limo service, pickups are more expensive for service providers because there is an unknown amount of waiting time.

Winner: Citibank Prestige. Lowest spend requirement, plus the ability to unlock up to 4 trips with just $1,500 of spend

Lounge Access

| Card | Lounge Network | No of Free Visits |

|---|---|---|

| Citi Prestige | Priority Pass | Unlimited (+1 guest) |

| HSBC Visa Infinite | Priority Pass | Unlimited |

| Maybank Visa Infinite | Priority Pass | Unlimited |

| OCBC VOYAGE | Plaza Premium | Unlimited (+1 guest) |

| SCB Visa Infinite | Priority Pass | 6 |

| UOB Visa Infinite Metal Card | Dragon Pass | 4 |

| AMEX Plat Reserve | N/A | N/A |

Citibank is the clear king of this category, with unlimited visits for both yourself and a guest. HSBC doesn’t give you a priority pass with unlimited guesting, but your supplementary cardholder can get an unlimited use Priority Pass of their own.

SCB’s offering is a letdown, because six visits is just stingy compared to what the Prestige , HSBC VI and Maybank VI are offering (have I mentioned that the Maybank VI has the first year free?)

I am, however, unsure whether I’d rather have 6 visits to over 1,000 lounges or unlimited visits to 70 (OCBC Voyage). OCBC, you see, doesn’t give a Priority Pass. Instead it has a tie up with Plaza Premium lounges. The Plaza Premium network is reasonably large, with many major cities covered (no US presence though), but it’s definitely not in the same league as a Priority Pass.

I was very surprised at the paucity of the AMEX PR options, given the otherwise excellent lounge coverage that the AMEX Platinum Charge Card has. I know that AMEX Platinum cardholders can access the pretty swanky Centurion Lounges, but these are currently limited to selected locations in the USA only.

EDIT: It has since been clarified to me that complimentary access to Centurion Lounges is only for Platinum Cardholders, i.e the invite only tier in Singapore. If you hold an AMEX PR card you can access but must pay a US$50 fee

There’s an upcoming Centurion Lounge in HKG, but even so the coverage isn’t anywhere near that of Priority Pass (although the quality would be much better)

Winner: Citibank Prestige. All the lounge visits you could possibly want. Plus, you can do this.

Other Travel Perks

There are two other perks I want to touch on briefly. The first is JetQuay. Remember JetQuay? For a long while it seemed to be the must-have amenity on credit cards. I remember even the OCBC Titanium was offering it as a perk. And then the hype slowly died down, probably in no small part due to the fact that Changi Airport is so good and JetQuay so underwhelming (at least they have updated the F&B offerings, but once upon a time the only F&B they had was instant noodles. In a private terminal)

Both the Prestige and the Maybank VI provide JetQuay access. The Maybank VI requires a minimum spend of $3K. The Prestige has no minimum spend, but it’s worth noting that this access is a benefit provided by Mastercard World and World Elite rather than Citibank itself.

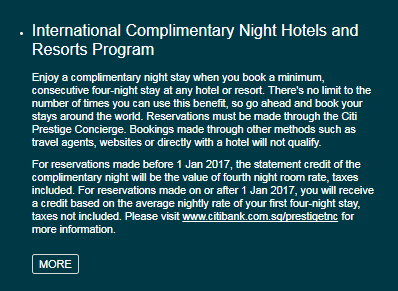

The Citibank Prestige has another great benefit called fourth night free. Basically, if you book three nights through the Citibank concierge, you get your fourth night free via a refund. The concierge will be able to book for you any publicly available rate (so don’t worry about getting ripped off), and your bookings will be eligible for elite credit and points. What’s better is that this refund is credited on the back end. If, for example, you stay for 4 nights at $100 each, you’re first billed $400 then get a $100 refund later on your statement. However, you earn hotel points and elite credit based on 5 nights and $500 of spend.

If you’re travelling on business, it also means that you could pocket the difference based on what you’re reimbursed versus what you’re charged (is that theft? another discussion for another day…). This system is apparently going to change soon with online bookings being introduced, but you can still opt for the old method…for now.

Winner: Citibank Prestige

Club Access, Dining and Other Perks

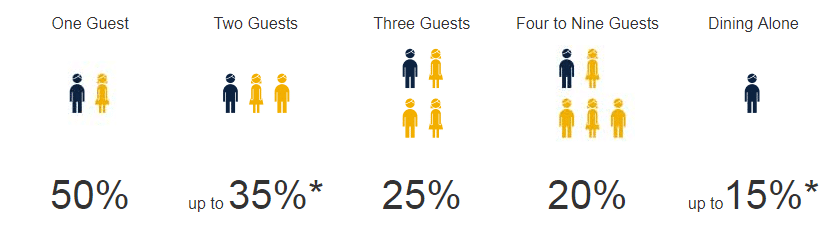

This is where the AMEX PR really shines. It’s got a solid suite of dining privileges with the FAR Card and its LoveDining privileges. This gives you anywhere between 15-50% off dining at hotels like the Fairmont, Swissotel and Conrad, as well as a wide selection of restaurants. If you dine out a lot at hotels, you could conceivably earn back your annual fee just on these discounts. Of course, if you’re the sort who can afford to eat that much at hotels, you might not really care about the annual fee.

The AMEX PR is also the only card in this set that has private club access via its partnership with the Tower Club. However, the T&C states that this is limited to the first 5 AMEX PR members daily. Can’t let just anyone in, y’know.

Although the club has fitness facilities, they’re off limits to you as an AMEX PR cardholder. You’ll have access to the F&B options, but do note that you’ll be charged a surcharge of 10% on all F&B incurred at the Tower Club because you’re one of the unwashed masses.

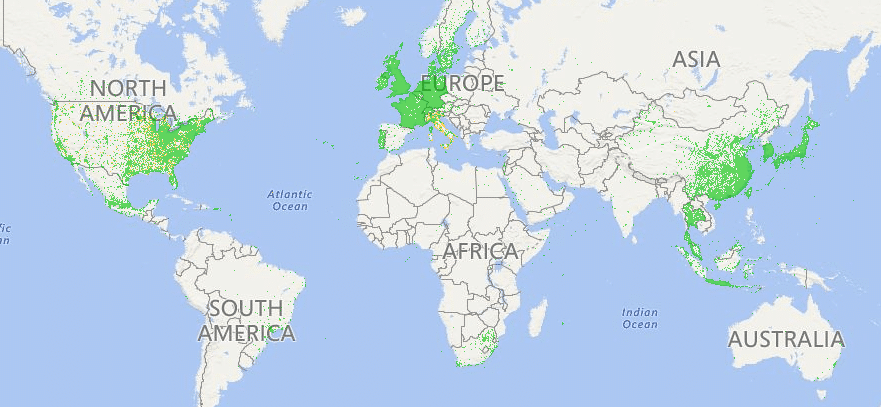

There’s a whole Platinum Golf program if you’re into that sort of thing, but the other feature I find more useful as a business traveler is the partnership with Boingo. This gets you

- Access to 1 million hotspots worldwide

- Unlimited Wi-Fi access at global hotspots

- Access on up to four devices

- No Wi-Fi roaming fees

A glance at the coverage map shows you that this benefit is more useful in some countries than others, but it’s a nice perk to have nonetheless.

(EDIT: Thanks to Milefan on the comments I’ve learned that the Citibank Prestige has Boingo access too)

It was surprising that despite their premium positioning, none of the other cards had any other perks worth writing about. I’m sure there may be some unpublished ones, maybe the occasional invite to a snazzy society event or two, but otherwise there was nothing.

Winner: AMEX PR, hands down

Conclusion

When I think consider all the categories, it’s a very close fight between the SCB VI and Citibank Prestige, but for me the Prestige wins.

It’s true that the SCB has a better miles earning rate (assuming you hit the $2K minimum) and if you’re able to put a lot of overseas spending on the card you can really rake in the miles. However, the Prestige has a more generous lounge access and limo policy, plus Jetquay access and the 4th night free benefit. The SCB VI has a superior first year gift but loses out on the lack of a compelling renewal gift. Citibank’s renewal gift, while not the cheapest way of buying miles, is at least equal to what they give you in the first year.

It is a shame that the Prestige does not come with any club access or unique dining program ala what AMEX has, but there’s no way I’d take a 0.7 mpd earning rate in exchange for that.

Hopefully this article has been useful for those of you blessed enough to be in such a conundrum. I’m personally do not own any of these cards (have been leaning towards getting a Prestige though) because I’m quite happy with my current card strategy. You definitely don’t need any of these to “win” the miles game, but if it works for you, why not?

Thanks for this article. Was considering the prestige for its unlimited lounge 🙂

$150k p.a ah? Still trying to get there…

Hey Aaron,

Citi Prestige does offer Boingo access (as a generic feature to some MC members):

http://www.citibank.com.sg/global_docs/0517/edm/Prestige_Global_wifi_Edm_mar17/edm.htm

thanks for letting me know! will update

Any idea how does Boingo works?

Had the offer to get it for free but was afraid of unknown underlying costs.

Just sign up for the account via card page and get unlimited usage at their wifi hotspots. Somewhat spotty coverage, but I’ve found it useful in the states (especially at airports, where free wifi is sometimes unavailable).

Have never been charged for it.

Have both Prestige and SCB VI and my thoughts: 1. SCB VI has a ton of freebies if you spend enough. Over the past year, I’ve gotten the following free: 1 night at W hotel and 2 nights at JW Marriott (stacks with Starwood/Marriott member status points earn rate), 4 hour yacht charter at Sentosa (this is crazy fun and totally awesome. Google any yacht charter, min 4 digits). That and the 6 priority passes, 3 miles per $ overseas earn rate (which isn’t hard to hit) make it far worth it’s annual fee. 2. Prestige doesn’t give me nearly… Read more »

(1) how did you get the free nights at w/marriott? minimum spend? or just because?

(2) how are you getting the 1.5 mpd figure? suppose you spend $100 in a year. 15%= 15 citidollars= 6 miles. that’s incremental of 0.06 mpd. unless i don’t have the calculations right…

Best earn rate for Prestige including 30% bonus is 1.42 mpd. Still about the highest in the market for everyday spend – not counting the ultra-prestige cards.

I think 1.5mpd was derived by multiplying 1.3 by 1.15 arriving at 1.495.

Thank you!

I was torn between which card to get next.

I will go for the Citi Prestige.

Yes, am also considering prestige for its 1 for 1 musicals and dining at $100Gourmet.

I regularly use Jetquay on my prestige however its value is limited to avoiding airport queues and crowds, and getting driven to your gate. F&B is still abysmal compared to terminal/lounge options. Rather dull place unless you want quiet and to get work done. Also, capped to X (80 I think?) users per month.

I have had very good concierge experiences but also some poor ones, so based on how lucky you are.

tell me more about jetquay? if you want to check in there, makan a bit then go to the airline lounge instead of the gate will they oblige?

i’ve used jetquay before via my OCBC titanium rewards card. you are eligible for 1x use per month, and you get to bring 1 guest along. u can only reserve/make a request 1 month in advance. u can choose either the arrival or departure service (or both, if you happen to depart and return on different months) the departure service basically works like this: you travel to the CIP terminal, and they take care of the rest. they will take your baggage and passport and settle all the admin stuff while you relax in their lounge and eat their mediocre… Read more »

Thanks for sharing your experience! Doesn’t really sound like something worth paying for. Which makes me wonder- how do these guys stay in business? I guess the credit card companies must be paying them a certain discounted fee, and the occasional vvip who really values privacy might use the terminal, but otherwise the value prop for businessmen/ high value Leisure travellers just isn’t there for an airport as efficient as singapore

Interesting question, but when my GF was using it out of singapore on the 21st of july, he saw, ronaldo’s van and people waiting for him there.

maybe its all the private jet.

I heard MBS is a big user too

I believe their high end offering is what justifies the economics. Their Jetquay top tier service costs a bomb but includes literal jetside limo service, private suite with bathroom and canapes etc. Used it previously and was told by the staff, ex SQ crew, that my bum was resting on the spot previously occupied by Lady Gaga the day before. So really more for VIPs avoiding the unwashed masses but due to low utilisation they strike deals with CC companies and hospitality services. It’s a differentiator from the tons of competitors. My guess.

You can get a buggy ride with the JQ service. This can either be to your gate or to an airline lounge. If the latter, they won’t wait for you to then send you to your gate.

For arriving passengers, one “benefit” is that they will send you to the JQ terminal and deliver your luggage to the terminal. So, no need to stand by the carousel.

Very good detailed analysis. Thanks Aaron!

Very Interesting article. Your employer must be very lucky to have you working for them. Such comprehensive details and this is not even your job. About JetQuay. I once used it on arrival into Singapore, earlier this year. The fun part was being met at the aerobridge with your name and being driven in a buggy. (Cheap Thrill for me.)But had to share buggy with others. Then the silly part began. They retrieved luggage for all users of JetQuay on the same flight at the SAME time! So, that took an exceedingly long time to get the luggage to the… Read more »

I agreed. Aaron is amazing and can you then imagine his quality of his real work (the one that pays his salary).

Just to check, if I’m on SQ suites, do I get to use the SQ private terminal at Changi on both departure and arrival or just on departure? Only read reviews regarding departure so far. if only on departure I’ll go with jetquay on arrival…

you mean TPR, not private terminal. departure only.

Thanks Aaron! I’ll try Jetquay for arrival then.

For the SCB VI, important to note that the 1.4 mpd and 3 mpd for local and overseas spend are technically promotional rates until 31 December 2017. It’s possible that SCB will extend the promotion but one cannot take it for granted.

Although not advertised, I received a 20,000 miles thank-you when I renewed the card after the first year.

Anyone knows how strict Citibank is with the Prestige 120k income requirement? I am 20k short 🙁

I’m curious about this as well! (or for that matter, the income req for the other cards in this tier as well). Anyone has experience with how flexible the income req is, given that it’s usually just to give a sense of exclusivity?

Citi was strict. My application with 3 payslips which did not include bonus and was slightly lower than income req was rejected. I had to wait for the NoA that included the bonus to apply.

CITI is pretty strict with their income requirement (unfortuantely).

SCB was pretty lenient at one point. Got it when i was at 80k p.a. only. Not too sure about now…

If JetQuay access is a Mastercard World & World Elite benefit then DBS WWMC can be used?

Was just about to suggest that. No need to wait for Maybank VI. Go ahead and make plans to review the underwhelming JetQuay experience now!

(The buggy ride can be quite fun. Cheap thrill.)

Regarding AMEX benefits… 1) Don’t think the PR gets free Centurion lounge access. When they refer to “Platinum Card”, it’s specifically to the charge card (which would probably lie somewhere between entry prestige and actual elite, on your spectrum). 2) If you don’t really value any of those extra staycation/wine vouchers or Tower Club (and some other) benefits that PR grants, the lower-end “Platinum Credit Card” offers pretty much the same dining benefits (and Boingo access), but it’s easier to get the fee waived for that one. I find it worthwhile having access to those benefits without having to pay… Read more »

(1) this is what confuses me about the platinum card. i get that the entry level platinum credit card (min income $50K) will probably not be considered a platinum card for the purpose of free centurion lounge access. but I thought the PR might given its higher tier (that said, I doubt any lounge agent in the states will be aware of that, much less care). maybe a quick call to the amex customer service line will sort this out (2) didn’t know amex was willing to waive annual fees. I actually have an unactivated amex platinum credit card in… Read more »

“The Platinum Card” in all amex lingo in all countries refers exclusively to the amex platinum charge card.

thanks for letting me know, I will update the article

Care to share what is ur current card strategy?

I’m currently on Altidue + WWMC.

Ageee that the prestige is the best of the lot! The citi prestige also has 1-for-1 dining offers for the $100 citi gourmet programme, as well 1-for-1 offers on major musicals at MBS or the esplande.

A word about the much-maligned HSBC VI.

Agree the benefits have greatly shrunk over time compared to when it was first released.

I did however renew recently at $488 (Premier) after I was offered 20k miles on renewal. Supposed to be hush-hush but this is not the first year they have done this.

There are still a couple of nice perks that swung me to renew too:

– unlimited PP for supplementary cardholders

– generous limo drop off policy

– fast track at some airports

– occasional cashback promos on top of earn rate (received $380 so far in 2017)

” $488 (Premier)” – the key word is Premier.

Unless you are a Premier customer, this card makes no sense. Paying 650 annual fee and then having to negotiate with them for miles in return is not worth the hassle.

By bringing “Premier relationship” into the equation, the HSBC VI card essentially belongs to the “Elite” card category. You cannot compare it then with Citi Prestige or SCB VI.

Hmmm

I think the elite tier is for like North of 1.5m AUM in the bank or 500PA

HSBC VI 488 AF is similar to Citi prestige 30k PA with citigold or OCBC voyage with premier.

Bong

I think on of the most underrated fact of the HSBC VI is the travel insurance.

At least for me, the car rental excess of 2k is very generous, not much travel insurance have such a generous excess coverage, let alone those with credit card.

So I’m not sure why either of them don’t talk about it but I’ve had two totally surprising experiences. I currently have Citi Prestige, Amex Plat Reserve and SCB VI. Usually, I go big on the Citi Prestige for all the great offers and discounts. BUT… 1. I got 80,000 (yes, that’s not a typo – eighty thousand) bonus miles linked to spend on my new Amex Plat Reserve. They advertise the 50,000 MRs on their site, but I received an additional 90,000 MRs for hitting the spend target in one month. And this it totally NOT advertised! This is… Read more »

The problem with these is they are not guaranteed. You have no right to ask for them, leave alone an enforceable right.

But have to agree that it’s poor marketing from both Amex and SCB.

Hey Aaron

Would just like to share that I got credited voyage miles for paying singtel bill manually, might worth some digging into as T&C states that recurring telco bills does not get miles, but what about manual payment for other cards?

[…] SCB Visa Infinite is part of the so-called “$120K” group of entry level prestige cards (although its income requirement technically is $150K). You earn 1.4 and 3.0 mpd on local and […]

Thank you for the very informative article. I’ve been digesting info from your website and from various other sources online. I was always opting for 0 annual fee credit cards with the simplest benefits (as much cashback as possible). I have since changed strategy and going with the miles cards instead as I tend to travel more often. Based on your detailed write up of these cards and after having analyzed my spend for the past 12 months, I decided to go for the SCB VI vs the Citibank Prestige. I assumed no annual miles refresh from SCB (although people… Read more »

glad it helped! do note you can get some free money when you sign up for the scb VI (plus get a hefty chunk off the annual fee). check it out here.

Thanks, I checked it out and used the code! Any way to support this awesome site. The more I dig through it the more I learn!

Thanks again man

[…] I’d be surprised if BOC went with a high requirement like $80,000 or $120,000. A card with a $120,000 income requirement would generally require some additional features like unlimited lounge access and airport transfers […]

[…] SCB Visa Infinite is part of the so-called “$120K” group of entry level prestige cards (although its income requirement technically is $150K). You earn 1.4 and 3.0 mpd on local and […]

Hey, great review. It’s 2018 so you might want to add some new contenders to your list. The UOB VI metal card also offers welcome and renewal miles, plus club access.

I agree too, that it’s a great review.. and agree that it may be time for an update.. but also,, life, and banks have changed and evolved over the years (months) and it’s now more than just what’s the local-spend-mpd and overseas-spend-mpd.. there are now ‘land mines’ all over the place, with exclusions of certain merchants and/or categories like school fees, Insurance premiums, utilities companies etc.. and I, for one, have had too many lessons learnt about these land mines, losing thousands of miles because I didn’t read properly into the individual bank’s Ts & Cs, which I now do… Read more »

[…] my opinion, the Citi Prestige is one of the best cards in the $120K credit card segment, thanks to the fourth night free hotel benefit, unlimited Priority Pass visits for the principal […]

[…] Club access or the Citi Prestige’s fourth night free benefit. Consequently, I think that other cards in the $120K-150K income segment offer a much more compelling value preposition in terms of […]

[…] my opinion, the Citi Prestige is one of the best cards in the $120K credit card segment, thanks to the fourth night free hotel benefit, unlimited Priority Pass visits for the principal […]

Great review. do you know if the card is metal or plastic?