[this is a sponsored post by DBS, which has just relaunched its Multiplier account with a revised bonus structure. All opinions and analysis are those of The Milelion]

It’s safe to say that if you asked me about credit cards and savings accounts, I’d say a hundred words about the former for every word about the latter.

After all, credit cards mean miles and points. And miles and points mean first class spas, luxurious seats, vintage champagne, gourmet meals, overwater villas. Savings accounts, on the other hand, seem less glamorous by comparison. If credit cards are sexy, savings accounts are their plain Jane cousins: day-to-day ATM withdrawals, GIRO arrangements, fixed deposits, and a place for your friend to PayNow after you’ve generously offered to pay for dinner with your card first.

That said, savings accounts are ultimately what fund your miles adventures, and travel hackers have to park their money somewhere. Moreover, if we claim to be all about maximizing value when we travel, then we can’t have a blind spot where something as important as savings accounts are concerned.

The fact is, savings accounts in Singapore have pitifully low interest rates. Although I have fond memories of earning 4-5% interest on my POSB Savings Book as a kid (here’s an interesting retrospective about the time when savings accounts earned 9.5% interest), those days are long gone and 0.1-0.2% is now par the course. At least until the ABBAs started appearing.

The rise of ABBAs

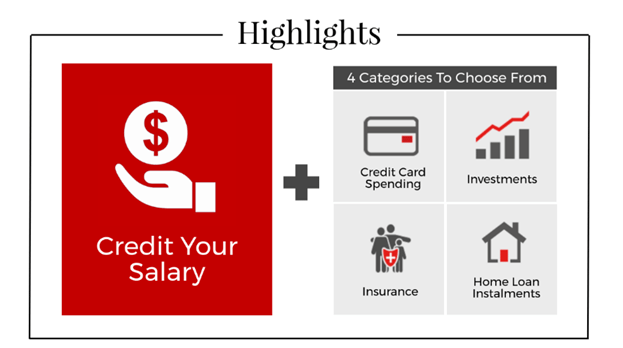

Consumer gripes about perpetually low interest rates have led banks to create what I call “activity-based bank accounts” (ABBAs), which award bonus interest contingent upon completing a series of financial activities.

For example, you might earn bonus interest on your savings account when you credit your salary, make a certain number of bill payments, spend a certain amount with the bank’s credit cards, and buy investment products. All these activities earn revenue for the bank, a portion of which they return to you in the form of higher interest.

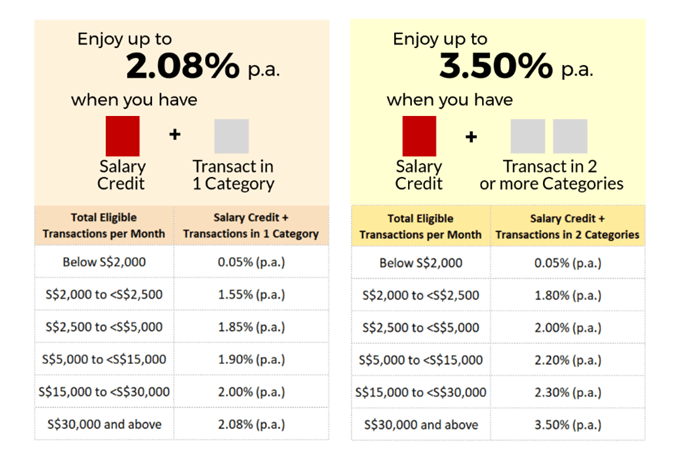

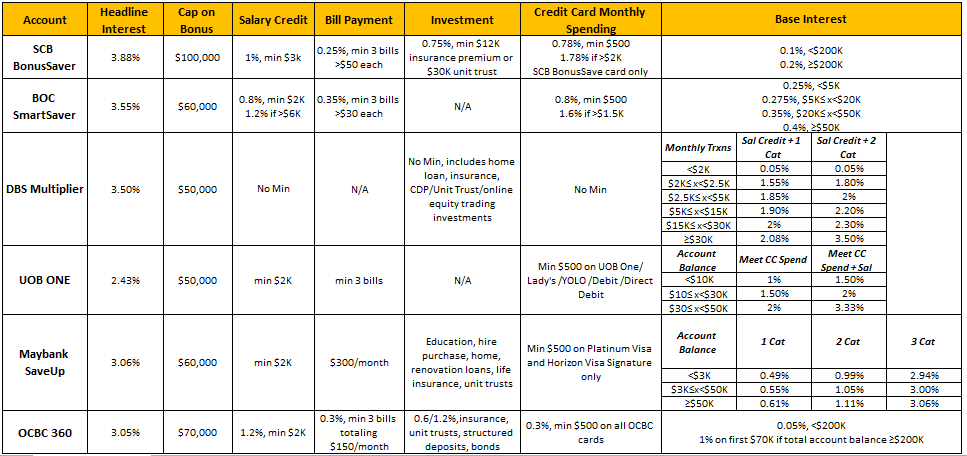

ABBAs advertise interest rates of up to ~3-4% depending on how many activities you complete. Bonus interest is typically capped on a maximum account balance of $50-70K (SCB is a notable exception, offering bonus interest up to a $100K balance cap).

There’s no shortage of ABBAs in Singapore, each with different mechanisms, bonus structures, kickers, and terms and conditions. I spent the better part of an afternoon trawling through websites to put together the complicated summary table below (that in itself should tell you that ABBAs favor the detail-oriented)

The question I had on my mind was this: which ABBA is most compatible with a miles maximizing strategy?

The problem for miles chasers

If you, like me, are trying to optimize the number of miles earned for every dollar of credit card spend, you’re going to run into the following problem:

A miles chaser cannot max out the interest on most ABBAs because satisfying the credit card threshold requires putting spend on a sub-optimal card

Or to be more specific: the cards that most ABBAs require you to use in order to hit the minimum credit card spending either don’t earn miles (UOB One/YOLO, all Bank of China cards, SCB BonusSaver) or do a crappy job of doing so (UOB Lady’s Card- 0.4 mpd anyone?).

To summarize the issue:

- UOB One: Only spending on the non-miles earning ONE/Lady’s Card/YOLO cards counts towards monthly spend

- BOC SmartSaver: BOC has no miles cards

- SCB BonusSaver: Requires you to use the BonusSaver credit card that does not earn miles

Only the following ABBAs allow you to incorporate a decent miles earning card into your spending:

- DBS Multiplier: Altitude, Woman’s Card (World + Regular)

- OCBC 360: Titanium Rewards

- Maybank SaveUp: Horizon Visa Signature

My problem is further compounded by the fact that I don’t buy unit trusts or investment products from banks because I don’t like the implicit fees involved.

My investments are predominantly equities, traded through SCB because of their low commissions (although that might change now that I’ve learned about lower brokerage fees from cash upfront services). However, SCB doesn’t recognise equity trades as part of the “investment” component of their BonusSaver account. I also don’t currently have a home loan with any of the banks (and in any case, only DBS and Maybank would consider home loan repayments as a bonus-able category). Long story short, I can’t enjoy the interest bonuses arising from investments either.

So where does that leave the would-be miles chaser?

Given that the interest rates offered by ABBAs are inherently linked to your behavior, it’s impossible to do comparisons without laying out scenarios. So I’m going to consider a miles chaser at three stages in his/her life- starting work, mid-career and advanced.

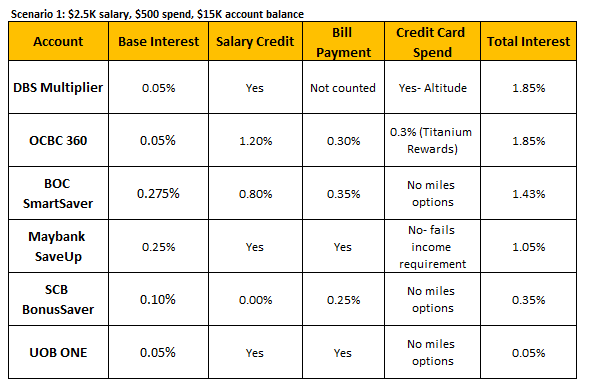

Scenario 1: Fresh Grad, $2.5K net salary, $500 credit card spend, $15K account balance

This individual is fresh out of university and eager to start building his or her miles balance. Here’s the options:

A few points to note about the above analysis

- I’m probably being overgenerous to the OCBC 360 account. To enjoy the bonus 0.3% interest on credit card spend, you need to put $500 per month on OCBC cards. Since we have assumed a miles chaser, his best option is the Titanium Rewards card. But this is a specialized spend card, earning 10X (4 mpd) on online and offline shopping plus mobile payments and 1X (0.4 mpd) everywhere else. Obviously this individual will have credit card expenses that do not fall into the 10X category, and unless he’s willing to earn 0.4 mpd on those, he won’t be able to hit the $500 a month spend requirement

- SCB has no interest for salary crediting in this scenario as it requires a minimum salary credit of $3K per month. But look, if you think I’m cherry picking, you can assume he earns $3K and the main difference in the table above is that SCB goes up to 1.35%, still not the best option

- This individual will not be able to meet the Maybank SaveUp three product threshold because his income of $30K means he’s only eligible for the Maybank Platinum Visa (a cashback card) as opposed to the Horizon Visa Signature

- This will be a recurring point throughout the three scenarios so best to address it here: if you want to play the miles game, you can ignore the UOB One completely. because the UOB One requires you to spend $500 with the One/Lady’s/YOLO card for you to earn any bonus interest; you can’t circumvent that requirement by doing another activity

We see that the DBS Multiplier account is clearly the best option for someone with this profile. Simply by using an Altitude card (good for general spending plus online hotels and flights) and crediting salary, this person can earn 1.85% interest with the Multiplier account.

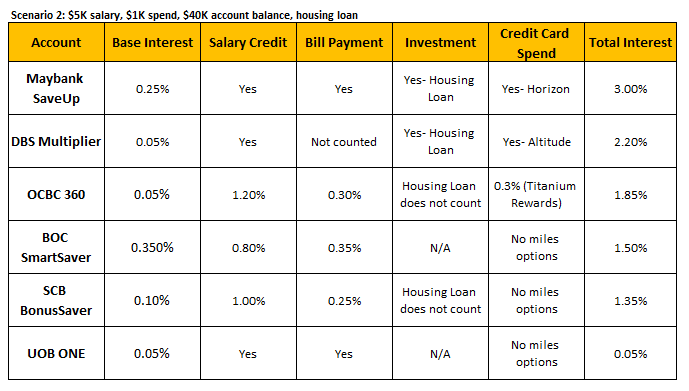

Scenario 2: Mid-career, $5K net salary, $1K credit card spend, $40K account balance and housing loan

Now we consider the profile of someone who has been in the workforce for a few years, a mid-career professional. This person is likely to have a housing loan as well.

Here are the observations

- The Maybank SaveUp is a solid offering for someone with this profile, if he is able to put $500 worth of dining/petrol/taxi spending on the Horizon Visa Signature card. Remember that the Horizon Visa Signature earns 3.2 mpd on such spending so it’s a good deal as far as miles earning is concerned

- The OCBC 360 becomes less attractive in this scenario because the bank does not recognise housing loan repayments as part of the investment category

- For DBS I have assumed the individual takes a housing loan from the bank; if he does not then the interest rate goes down to 1.9%

It’d be hard to argue against the Maybank SaveUp in this case. The interest rate of 3% is well ahead of any other account, plus it doesn’t require him or her to forego miles earning thanks to the very excellent Horizon Visa Signature card that can cover dining/taxis/petrol.

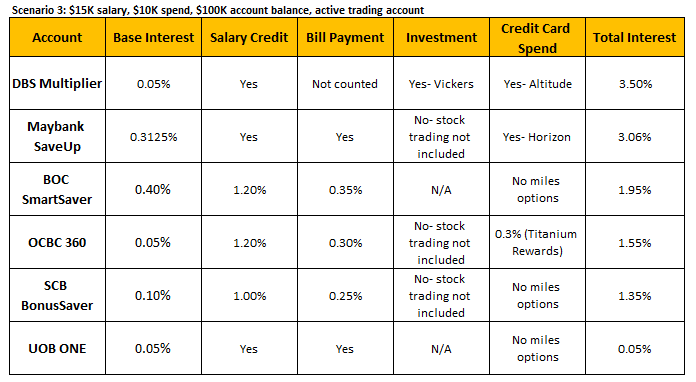

Scenario 3: Experienced Professional, $15K net salary, $10K credit card spend, $100K account balance, active trading account

This individual commands a high paying job that requires frequent business travel and hence has the opportunity to put reimbursable business expenses on his personal cards. In addition to this, he has an active equities trading account through which >$5,000 of trades are done each month.

Observations

- The Maybank SaveUp value proposition is largely unchanged from Scenario 2, because the individual has already maxed out the 3 category bonus. The small difference between scenarios is due to a higher base interest on the account balance

- The DBS Multiplier favors an individual with this profile because it maxes out at 3.5% for a $30K transaction volume each month (sum of salary credit, credit card spending plus investments). Also note that the Multiplier is the only ABBA which counts online equities trading as part of the investment category

So if you’re a high earner who is also able to put big spending on personal cards, the Multiplier account provides the best platform for savings while still allowing you to enjoy bonus interest from spending on miles earning cards.

Summing it up

Both the Maybank SaveUp and the DBS Multiplier are good bank accounts for miles chasers.

The Multiplier is good if you fall at either extreme- someone who is just starting out in their career, or someone who is well-established and earning/spending in a high income bracket.

The SaveUp is a good choice for mid-career professionals who cannot tap into the highest brackets of the Multiplier, yet would be able to meet the three product category for the SaveUp through salary crediting, bill payments and use of the Horizon Visa Signature card.

One of the common objections I’ve heard from people about the miles game is that using the right card in each situation will mean giving up bonus interest on their ABBA. I hope this shows that there are ABBAs which are compatible with a miles chasing strategy, and you don’t have to settle for one or the other.

“also don’t currently have a home loan with any of the banks (and in any case, only DBS and Maybank would consider home loan repayments as fulfilling the investments component).” I am not sure if i reading this correctly. Home loan with dbs counts under the investment category? Then the ‘home loan instalments’ category in the dbs image is…? POSB has this thing called ‘Invest Saver’ where you park a certain amount with them to buy ETFs or Bonds Fund provided by them. I think this is the part where you fulfill the ‘investment’ category. Home loan repayment fulfills the… Read more »

nope, good spot. home loan is indeed under the home loan category. have updated that. workings remain unchanged though, and remember it isn’t so much about what category things fall into as much as it is total cashflow through the account.

Ah okay. Cool. Hahaha. Now to just considering to jump back or not. Haha

Note that though Standard Chartered has Visa Infinite as a mile-earning credit card, SCB BonusSaver only recognises spending on the tied BonusSaver credit or debit card for card spend requirement, so SCB Visa Infinite card spend is a non-starter.

right again! I have fixed this. Doesn’t change the conclusion, but how embarrassing.

Aaron I think you’re being unfair to UOB. It only requires a $500 spend/month (on a somewhat sucky card, yes). But it’s actually very easily attainable, especially if you’re already used to splitting your expenses on a couple of different cards. Just chalk 500 on purchases like food/groceries which wouldn’t give you much miles anyway (excl the uob pp amex since it’s dead) & you’re done for the month. & it leaves you complete flexibility to pursue your other miles strategy. Haven’t done the math, but off the top of my head I think that will skew your calculations and… Read more »

well, the thing about that is that you could still earn very good miles on food/groceries with other cards. maybank horizon- 3.2 mpd, hsbc revolution- 2 mpd. groceries- at ntuc where there’s a paywave machine you can use your UOB Visa signature or UOB PPV for 4 mpd as well. so I personally wouldn’t be willing to trade off $500 of miles earning each month given that the incremental interest of UOB one over saveup/multiplier would not in my mind offset the lost miles remember, in the examples above we have made the assumption that this is someone who values… Read more »

Hi Aaron, I recently conducted a similar exercise myself, with the principal goal of maximizing interest. I say this was the principal goal because (at least for me), the ultimate solution allowed me to carry on with an optimal miles strategy as well. For your Scenario 2 and 3, those individuals may likely have sizeable deposit amounts, far exceeding the deposit caps under each banks’ ABBA. A key issue then because what interest rates you are getting beyond the cap. This was key in my decision to go with BOC SmartSaver in the end. By crediting salary, and paying my… Read more »

no doubt boc has good base interest rates compared to other local banks. however, i think the question is whether if you had this much liquidity you’d be ok leaving it in a bank account earning <1% or whether you'd want to put it to work in the stock market. profile of a guy in scenario 3 would probably lean towards the latter.

any additional cash above the 60k cap can be put into cimb fastsaver for 1.0% no strings attached

CIMB FastSaver earns 1.0% p.a. only fo 1st 50k, aobve 50k only 0.6% p.a.

For people with low bank balances, DBS Bank & Earn might be a better deal. It pays cashback as a % of activity instead of interest. In my case, Bank & Earn pays more when my bank balances are below $20k, but Multiplier will pay more if I’m above $20k.

https://www.dbs.com.sg/personal/deposits/bank-earn/cashback-bonus

Note: the current t&c expires 31 Dec 2017, shall see if they extend it. if not i’ll probably switch over to multiplier as well

just want to point out the maximum effective interest rate for UOB One account is 2.43% instead of 3.33% (tiered interest rate).

yeah, that’s right. That is very sneaky because I think they’re the only bank which discloses their interest in such a manner (although that in itself isn’t surprising- check this out: http://www.sgbudgetbabe.com/2017/10/better-alternatives-to-uob-stash.html). I was debating whether to show 3.33 vs 2.43 because everyone is familiar with the 3.33% figure and I thought it would cause confusion, but I don’t think we should encourage such untransparent practices. will change it.

1) For maybank saveup, the maximum interest is 3%, as the bonus interest only apply for up to $50k deposit.

2) what does bill payment in the 3 scenarios under DBS multiplier refers to? There is no bill payment category for DBS multiplier.

3) DBS WWMC can also be used to contribute to card spend on DBS multiplier.

btw 1) Maybank SaveUp bonus interest has been upped to $60k since a few months ago

thank you, have edited that.

bill payments do not count towards multiplier. have updated the table. have mentioned the WWMC in the article already.

edit: I remember why I included that- it was part of a point I was making that if you make bill payments via your credit card through say a ipaymy/cardup type portal it would count towards your overall cashflow

there was used to be other way to boost saveup interest to 5% by paying income tax, however, this promotion is gone

Hello,

The DBS Multiplier account is pretty bad for a new graduate. You need to hit 7.5k worth of activity in order to gain the 1.85%. That alot per month for a fresh grad. I am not sure if this had change but ya pretty misleading. Haha. Cheers.

they just launched the new account today which lets you hit 1.85% with 2.5k.

Oh wow! that an excellent deal! Thanks!

do grown men/women really hold 100K cash account balance?

you’re not making your money work if you’re holding that much cash…

You’d be surprised! Check out the hwz forum on priority banking – can see how many poor souls maintain 100k or 200k just to earn some marginal benefits or sign up bonuses.

I am a grown woman (27 years) with 150k in cash account balances. I have been advised not to invest them as I am looking to buy property in 3 years. Please let me know if you know where to park these funds.

Index funds. Let it be Singapore/Asia/US/Global. The wider range you buy, the more you’re diversifying your risk

If you have a pension or life insurance policy, they’re doing they’re also buying index funds on your behalf and charging you for it.

Buy it, don’t look at it.

But I need the money to buy property in the next 3 years… I don’t have any pension or life insurance policies.

3 years is a long time. Look at any of the index’s performance mentioned earlier over the past 1 year, 2 year and 3 year.

Historic performance isn’t an indication of future performance, but I would take the risk.

ETFs are very easy to buy and sell. When you sell, you get the money back in your account in 2~3 days. So this wont slow down your property transaction.

This is not related to airmiles so Aaron might not like this and my advice may not be correct too.

Ha. I’m hardly the specialist on investing, so I appreciate any and all advice. That said, my tech stocks have all been performing very well over the past couple of years…

Exactly, Tech stocks have done tremendously over the past 5 years. If you don’t know what stocks to buy, ETF investing is a good passive way of investing. Personally i think picking stocks is not wise putting risk on a single name. The less you know, the wider the coverage the fund should be in my opinion. E.g Kate if you dont know anything get a global etf, i’d think it do better than your savings rate and you’d also get a dividend of some sort which would beat your savings rate as well. if the world goes to shit… Read more »

Isn’t it a good time to buy a property if stocks and property prices come crashing down in the next crisis ? I have bought some ETFs yes.

Me and my wife. We are both on EP, higher than average salary. No loans. I would not consider buying investment products from banks, period. DBS’s RM wanted us to buy PIMCO as an example and when I saw fee structure of 3% of the purchased amount I asked – ‘you are joking, right’? No, they don’t At the same time I do not want to buy invest in anything substantial because of uncertainty of our current status – we got denied PR once already and I applied second time. If we lose our jobs (no idea when next recessions… Read more »

Pimco stuff are funds – they charge more on the basis they expect to outperform their bench mark through adjusting their holdings, which would be a an index of some sort. I also would never buy shit from a bank because they market it up extortionately on a percentage basis This is why you should consider ETFs. They are very low cost funds, they replicate indexes at very low costs, like 0.05%. Often the brokerage fees could be close to zero too. Again, to liquidate is simple as clicking sell. You could even not sell and transfer it to your… Read more »

I already have ETF holding in an account with other country. Question is – which platform here in Singapore allow buying Russel/S&P 500/NASDAQ ETFs or Vanguard for example with SGD, instead of requiring you to convert SGD to USD and then buy the ETF. To be honest, I did not do much research on this matter due to reasons outlined above. Regarding PR – I have double Masters and and my wife has Masters and MBA – all diplomas and transcripts were in papers, as well as recommendations from work and charities. Still we got denied but rumors are that… Read more »

if you want to buy a US etf in SGD, you’re just giving the bank/etf manger the opportunity to charge you more. If they’re currency hedge, they charge more. you know…you can buy a vanguard fund in USD and not get ripped off too much on fx if you use company like world first to change your sgd to usd, they’re only about 0.4% off market spot rates, which the consumer never gets, then you can buy the low cost vanguard fund in usd. are you chinese, white or brown or filipino? your probably slides lower near the end of… Read more »

Just to confirm, which is kind obvious, if I want to buy USD denominated fund (Vanguard, Russel, etc) you have to have USD in the account. Either by depositing USD directly, or depositing SGD and then buy/covert USD for it. In addition to Word First what other companies allow you to buy US based ETFs? As I said – did not research this topic in depth. Are here, in Singapore SGD denominated ETFs with high ratings? As far PR: I am caucasian – and I _mean_ it – was born next to caucasus mountains. I (and wife) have two citizenships… Read more »

Yes, you’ll need USD. Look at USD ETFs listed in London (for best tax treatment). Standard Chartered online trading is the best of the local banks.

Avoid anything in SGD unless its the local STI ES3 or bonds.

Thanks Phil. Anything else I should know? Where is the best (platform/service) is to buy bonds/STI you’ve mentioned.

As far as USD denominated ETFs – should one treat SC with the same suspicion as other banks pushing you towards their investment platform? Just asking.

Standard Chartered is the easy choice for bond ETF, domestic ETF and global ETFs, though there are other options depending on how much you have to invest.

I hope Aaron doesn’t mind me posting but there is a guy on HWZ who has worked this all out and even published a SG specific ebook.

http://forums.hardwarezone.com.sg/money-mind-210/%2Aofficial%2A-shiny-things-club-4866757.html

I personally know Josh. Seems need to dig his email…

Aaron,

One point to note about the latest DBS rules: Salary crediting is a mandatory component. If i work for myself, that will be a huge challenge.

Have you tried to use your business bank account to do a salary GIRO to your private bank account?

Currently using the Bonussaver/SCB VI.

I have confirmed with the branch that in order to get 1.88% via 2k spending, you have to use the BonusSaver card to transact. Any spending using other SCB cards will not be taken into account for. Or do you have varying mileage with this condition?

the T&C states that spend must be done via the bonus saver card only.

Hi Aaron, I agree that it’s a tough task to do a comparison of all the ‘ABBA’s. But it’s through the exercise that one will truly understand the differences. I went through the comparison exercise recently and it indeed took quite some time . I would like to add that for the Maybank SaveUp account’s bill payment condition, the payment must not be for payment of Maybank credit cards nor for Etiqa products. Therefore, for miles chaser, he /she should continue to use non-Maybank merchant specific credit card’s and pay for the credit card bills via Maybank GIRO. Make sure… Read more »

Hi, great write-up. Am currently juggling OCBC, CIMB, UOB, BOC and SC for my savings. Have hit the cap for each account but am hesitant about putting more money into stocks at this point in time, as some others have recommended above. Wanted to point out that the cap for SC bonussaver is 100k and not 70k.

Cheers

thanks! this was fixed quite early yesterday so it’s possible your browser is displaying a cached version of the site. try pressing control f5 and you should see the new post

There’s another scenario where DBS multiplier is useful — for married couples. DBS multiplier tracks transactions across all accounts so you don’t have to credit your salary to the multiplier account per se. A couple can set up a joint account and both credit their salary there. Then each sets up their own individual multiplier account. DBS takes the combined salary as total transaction amount for both individuals. It’s much easier to hit the >5000 bracket this way. DBS home loans taken under both names will entitle both parties to the same amount of transactions as well.

To be fair to UOB One, $500 spend on UOB One gets approx 3.33% cashback provided you maintain that for the 3 months in your quarter. Obviously it’s UOB so you need to read the T&Cs, but the One card has a more relaxed exclusions list (does not exclude silly things like SMART$ merchants) compared to the other UOB cards that UOB is infamous for. Why I say that is that if you are hitting the DBS requirements using your Altitude card, and you can put through $500 of local spend per month on the Altitude at 1.2mpd, why not… Read more »

Some slight edits, the bonus cap for ocbc 360 is $70k; for scb bonussaver it is $100k

weird- that’s what it’s showing on my side. it’s possible your browser is caching an older version of the post, press control f5 and it will do a hard refresh

Just want to point out that DBS has a minimum balance requirement or a $5 fee applies:

“Fall-below fee of S$5 if average daily balance falls below S$3,000 (based on total SGD equivalent of SGD & foreign currency balances”

Also, realistically, 0.3% interest on $3000 is $9 per year. I am confident that putting my money elsewhere will give me better returns than $9 a year.

I will stick with OCBC 360 without the credit card.

Probably there is category #4 – people who have higher than average salary as income, some, not much credit card spend (don’t know anyone who spends $10k/mo on credit card even with business expenses – most MLCs issue company business card mandating spend on business trips with that card) and no investments with the banks. Most middle manager expats I think would fall into above category. I personally have no investment products with banks and have no intention to buy one due to high fees. At the same time I do not have any housing loans to do my EP.… Read more »

[…] programme on 1st Nov 2017. As there are already very well written reviews of the new programme by Milelion and 15HWW, I will not be writing a long […]

[…] Spending on the BOC Elite Miles World Mastercard will count towards the monthly spending requirement for earning 0.8/1.6% bonus interest. This, intriguingly, would make the BOC SmartSaver the new best savings account for miles chasers. […]