Cardup is a service that allows you to use your credit card to make payments for things like rental, income tax, condo management fees, insurance premiums and tuition fees, earning credit card rewards points in exchange for a 2.6% fee.

Cardup does not qualify for 10X with any credit cards (UOB PPV and DBS WWMC recently updated their T&Cs to exclude it), so under regular circumstances the best deal you can do is buy miles at 1.81 cents each (UOB PRVI @ 1.4 mpd, 2.6% fee).

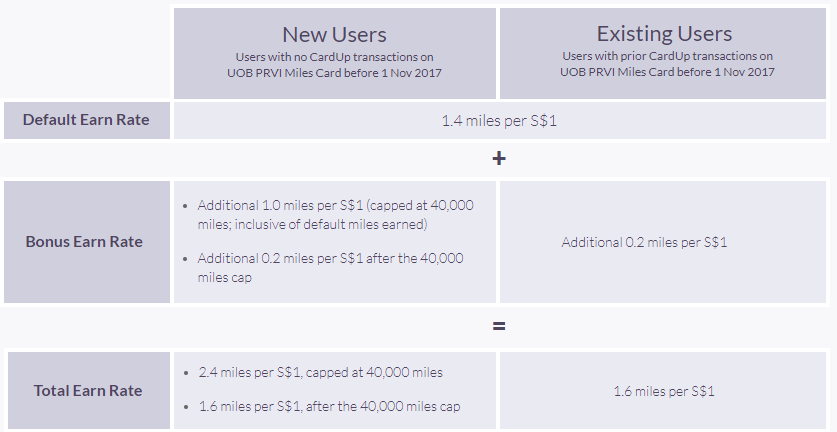

However, Cardup is now partnering with UOB from now till 31 Dec to offer the following promotion in conjunction with the UOB PRVI Miles Visa and UOB PRVI Miles Mastercard (AMEX is not included).

If you’ve not used your UOB PRVI miles card with Cardup prior to 1 November you can earn 2.4 mpd capped at 40,000 miles (~$16,667 of spending). If you have, you earn 1.6 mpd without any cap. Full T&C here.

This promotion does not discriminate between new and existing Cardup users; rather, all that matters is whether you have used your UOB PRVI miles card with Cardup before. If you own a UOB PRVI Miles Visa and have used it with Cardup before, you can apply for a UOB PRVI Miles Mastercard to enjoy the 2.4 mpd rate. Remember that UOB pools your UNI$ anyway plus your first year annual fee is waived, so there’s no cost to you for doing this. Alternatively, you can apply for a supplementary UOB PRVI Miles Visa and use that for the payment, and you’d earn 2.4 mpd still. There are enough ways to get around the “never used the card for Cardup” restriction before, so no one should be earning at the 1.6 mpd level.

Both your Cardup payment and the Cardup fee (2.6%) earn points, so under this promotion you’re paying:

- @ 2.4 mpd- 1.06 cents per mile

- @ 1.6 mpd- 1.58 cents per mile

1.06 cents per mile is a fantastic deal, and I’d buy miles at that price in a heartbeat. At this price, it’s possible to buy a round trip economy award ticket to Bali for $159, for example. I guess the catch, if you want to call it that, is that the maximum miles you can buy at 1.06 cents is 40,000.

As a reminder, here’s how much it costs to buy miles in Singapore through other methods-

| Method | Type | Implied Income Req | Cents Per Mile | Annual Limit |

|---|---|---|---|---|

| SCB VI Tax Payment- >$2K p.m | Payment Facility | 150000 | 1.14 | Tax bill |

| HSBC VI IRAS Payment- >$50K p.a (1) | Payment Facility | 120000 | 1.2 | Tax bill |

| HSBC Premier MC IRAS Payment (2) | Payment Facility | 30000 | 1.25 | Tax bill |

| HSBC VI- Premier Customer | Welcome Gift | 120000 | 1.39 | 35000 |

| HSBC VI IRAS Payment- <$50K p.a | Payment Facility | 120000 | 1.5 | Tax bill |

| SCB VI Tax Payment- <$2K p.m | Payment Facility | 150000 | 1.6 | Tax bill |

| SCB VI | Welcome Gift | 150000 | 1.68 | 35000 |

| HSBC Visa Plat/Revo Tax Payment | Payment Facility | 30000 | 1.75 | Tax bill |

| Citibank PM AMEX | Annual Fee | 80000 | 1.78 | 15000 |

| iPayMy/Cardup with UOB PRVI | Payment Facility | 50000 | 1.81 | Unlimited |

| HSBC VI- Regular Customer | Welcome Gift | 120000 | 1.86 | 35000 |

| UOB Reserve VI "Pay Anything" | Payment Facility | Invitation | 1.9 | Unlimited |

| Citibank PM Visa | Annual Fee | 50000 | 1.93 | 10000 |

| DBS Altitude | Annual Fee | 30000 | 1.93 | 10000 |

| OCBC Voyage- Option 3 | Annual Fee | 120000 | 2 | 500000 |

| UOB PRVI Pay | Payment Facility | 50000 | 2 | Unlimited |

| iPayMy/Cardup with DBS Altitude | Payment Facility | 30000 | 2.11 | Unlimited |

| OCBC Voyage- Option 2 | Annual Fee | 120000 | 2.14 | 150000 |

| Citibank Prestige | Annual Fee | 120000 | 2.14 | 25000 |

| DBS Altitude- Tax Payment | Payment Facility | 30000 | 2.5 | Tax bill |

| OCBC Voyage- Option 1 (3) | Annual Fee | 120000 | 3.25 | 15000 |

| Buy from Singapore Airlines (4) | Stupid | 0 | 5.51 | Unlimited |

(1) The HSBC website says that $1=0.4 miles for tax payment facility, but I have received reports that VI holders have received 1/1.25 mpd as per their relationship bonus

(2) The income requirement to get a HSBC Premier MC is $30,000, but you need $200K in deposits to open a HSBC Premier account

(3) OCBC Voyage Option 1 involves paying $488 to get 15,000 Voyage miles. These can be converted to Krisflyer miles at a 1:1 ratio but are technically more valuable than Krisflyer miles as they can also be used to pay for revenue fares at a fixed value per mile.

(4) SQ charges US$40 per 1,000 miles purchased. Price shown here is reflective of current exchange rates. The only way I could justify paying this is if I needed the miles right this minute, as SQ will credit them instantly

These rates are certainly much lower than the UOB PRVI Pay feature that lets you buy miles at 2 cents each. The key difference is that UOB PRVI Pay allows you to buy unlimited miles, whereas Cardup requires that you have a bona fide bill payment to make (well, in theory at least. I’m vaguely aware that it is possible to overpay certain account balances provided the recipient isn’t in the practice of refunding credit balances, and not all payments via Cardup need invoice documentation)

Moreover, if you have Cardup referral credit, your cost per mile is further reduced. If this is your first Cardup payment, you can use my code AARONW54 to get $20 off the fees. Otherwise, feel free to use any of the codes in the comments section here as well (but please don’t post referral links in the comments section of this particular article, so we can have all the codes in one place).

1.06 cpm is an amazing price, and even though the general rule is not to buy miles speculatively, I think I may make an exception for this.

Wow great new deal on this.

Milelion Edit: Pls keep all referral codes to this thread, thanks

“Otherwise, feel free to use any of the codes in the comments section here as well (but please don’t post referral links in the comments section of this particular article, so we can have all the codes in one place).” 🙁

so that’s $424 for 40,000 miles? hmm

Ikr. And if you have referral credit the cost comes down further

2.6% of $424 is about $11, so $424+$11-$20, so $415. interesting, but only own the amex version

Assuming you can still get 4mpd using DBS WW for Cardup payments, would it make more sense to use the WW or UOB PRVI?

You can’t because DBS cards are explicitly excluded to earn points from ipaymy/cardup. It is in T/C.

Hi

Just to check, can we just buy miles outright with the UOB Prvi cards ? Thanks.

Hello. I’m new to this. How do I buy miles with this deal?

That’s quite the incentive. I’m now reconsidering my dormant CardUp account. Anyone care to remind me what kind of payment details we should enter about the landlord payee?

so if I want to make payment for 6 months of rent, will that give me 2.4 mpd or will it be 2.4 for nov and dec and 1.6 for the remaining 4 months of rent????

Only payments credited Dec 31st get the bonus. So if you want to pay for 6 months and get the whole bonus worth you have to pay all 6 months by Dec 31st.

Wrong! It only has to be charged by Dec 31st. If rent is paid on January 1, can still get the bonus…

Is there a Milelion telegram chat group for like-minded enthusiasts?

any one has a suggestion on what bill i can pay 16k of?

I cant seem to find any bill to pay:(

Hi, any idea if applying a supplementary card can chalk up additional 40K i.e. 40K + 40K for both main and supplementary card?

negative. cap is per card. when i talked about supplementary cards, I meant that if you as the principle prvi miles cardholder had used your card with cardup prior to the promo date, you could still earn 2.4 mpd by getting a supp card and using that instead (because promo tracks by card number)

Hi, do you know if the 40k is limited to only one transaction or can I spread over a few?

My code is (removed)

Do not post codes in this thread.

I posted my question via ‘CONTACT US’ but haven’t got a reply, so I’m dumping it here I guess. First of all, any idea if Citi Premiermiles earns miles on Cardup? I’ve always been a cashback guy because I’m not into travelling (gasp), but Cardup has piqued my interest as a means to get some value back from my insurance and tax payments. Since I pay my premiums annually, that big lump sum exceeds the cashback cap of any >3% cashback card out there, so I have no choice but to dip my toes into the miles game. Citi Premiermiles… Read more »