Most DBS cardholders will know that the bank charges a S$27 fee (set to increase to S$27.25 in 2024 once GST increases to 9%) for each conversion of DBS Points to airline miles.

However, there is an alternative option for those who prefer to convert their points more frequently (or in smaller quantities): the KrisFlyer Miles Auto Conversion Programme.

In this post, we’ll look at how it works, and who it makes the most sense for.

Overview: DBS KrisFlyer Miles Auto Conversion Programme

|

| FAQs |

| T&Cs |

| Read Point 10.1-10.2 |

The DBS KrisFlyer Miles Auto Conversion Programme is available for the following cards:

- DBS Altitude AMEX

- DBS Altitude Visa

- DBS Insignia Card

- DBS Treasures Black Elite Card

It is not available for the DBS Vantage, DBS Woman’s World Card, or any other DBS cards for that matter.

However, remember that DBS Points pool. So long as you have one of the participating cards, you can still use it as a conduit to cash out DBS Points earned on the Vantage, Woman’s World Card etc.

| ✈️ KrisFlyer miles only |

| As the name suggests, this programme is only available for conversions of DBS Points to KrisFlyer miles. No such equivalent exists for any of DBS’s other transfer partners (Air Asia, Asia Miles, Qantas). |

The programme costs S$43.20 per year (S$43.60 from 2024), defined as the 12-month period from enrolment.

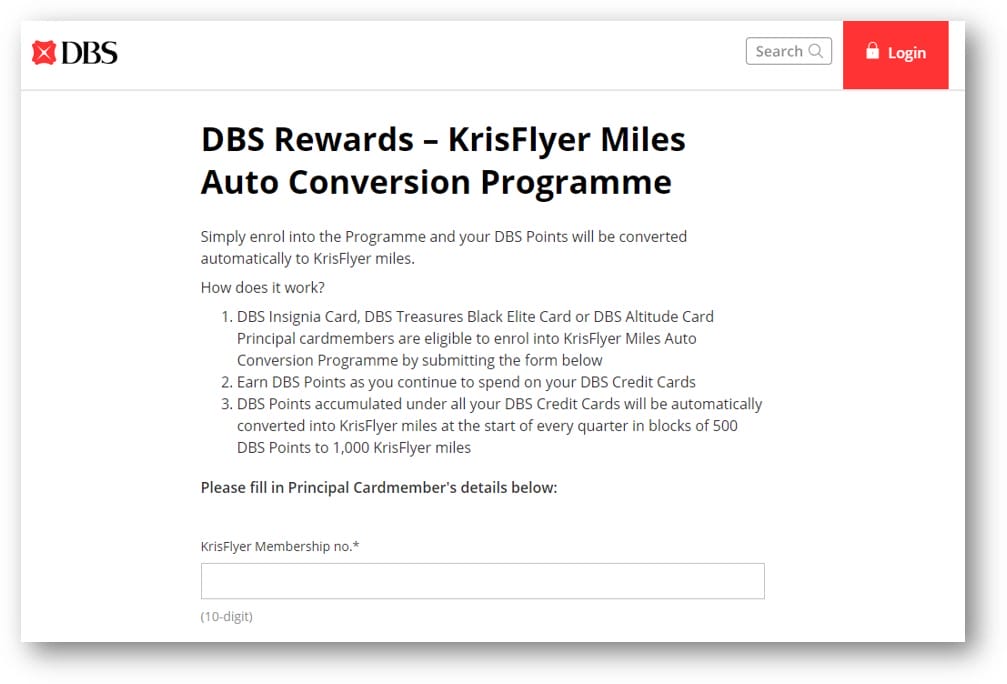

Interested cardmembers must enrol via this online form, which will be processed within 14 working days. An email will be sent upon successful enrolment.

How does it work?

Upon successful enrolment, an automatic conversion will be effected at the end of every quarter by the 10th day:

- 10 January

- 10 April

- 10 July

- 10 October

All a principal cardmember’s DBS Points will be converted in blocks of 500 DBS Points (1,000 KrisFlyer miles).

Note that this is 10X smaller than the standard conversion block of 5,000 DBS Points (10,000 KrisFlyer miles), so it helps to minimise orphan points in your account.

Here’s an example of a cardholder with a DBS Altitude Card (registered in the auto-conversion programme) and a DBS Woman’s World Card, with a total of 4,200 DBS Points.

| Card | DBS Points |

DBS Altitude Card DBS Altitude CardAuto-Conversion | 1,000 |

DBS WWMC DBS WWMC | 3,200 |

| Total | 4,200 |

| Converted | 4,000 |

| Remainder | 200 |

During the auto-conversion, 4,000 DBS Points will be converted to 8,000 KrisFlyer miles, with 200 DBS Points left in the cardmember’s account.

By the way, DBS always converts the soonest expiring points first, so the 4,000 points will be broken down into 3,200 from the WWMC, and 800 from the Altitude. That’s a good thing, since DBS Points earned on the WWMC expire after just one year!

After each successful conversion, the cardmember will receive an email notification from DBS, with the total number of DBS Points converted into KrisFlyer miles. All conversions will be processed within the usual timeframe, i.e. 1-3 working days.

Can I still make ad-hoc conversions?

Yes.

Cardmembers enrolled in the Auto Conversion Programme can still opt to make ad-hoc conversions to KrisFlyer miles, with a waiver of the usual S$27 fee.

However, these conversions must be made in blocks of 5,000 DBS Points (10,000 miles).

Is it worth enrolling?

Here’s the main pros and cons of enrolling in the DBS KrisFlyer Miles Auto Conversion Programme:

Pros

- Pay a single fee for four automatic conversions a year

- Enjoy fee-free ad-hoc conversions

- Reduces the minimum conversion block from 5,000 DBS Points (10,000 KrisFlyer miles) to 500 DBS Points (1,000 KrisFlyer miles)

- Avoids a situation where you forget about the 1-year expiry of DBS Points on the DBS Woman’s World Card and end up wasting them

Cons

- The 3-year expiry on your KrisFlyer miles starts as soon as they are converted. Had you kept your DBS Points with your Altitude, Insignia or Treasures Black Elite Card, they would never expire

- Effectively locks you into KrisFlyer, as opposed to DBS’s other transfer partners (you can still make ad-hoc conversions to Asia Miles or Qantas between quarters, but it’s likely you’ll need to end participation in the Automatic Conversion Programme to acquire a critical mass)

Ultimately, whether the Auto Conversion Programme makes sense depends on your miles transfer patterns.

If you only care about KrisFlyer miles, and if you make more than one transfer to KrisFlyer per year, the Auto Conversion Programme already pays for itself (S$54 vs S$43.20). That’s assuming the early start of the 3-year expiry period for KrisFlyer miles doesn’t bother you.

In fact, you might even argue that this could be a good thing, since it encourages you to earn and burn, rather than earn and hold. There’s no point keeping your credit card points on ice indefinitely, since they don’t earn interest, and frequent flyer programmes undergo devaluations every 3-5 years.

What if I want to withdraw?

If you wish to withdraw from the KrisFlyer Miles Auto Conversion Programme, you’ll need to fill out this form.

Do note that there will be no whole or partial refund of the S$43.20 enrolment fee, and the withdrawal request will take 10 working days. During this period, the automatic conversion may still be processed, so if you want to opt out, be sure to do so well in advance of the 10th of January/April/July/October, as applicable.

Following a successful withdrawal, you’ll be charged the usual S$27 fee per conversion.

How does this compare to the UOB automatic conversion programme?

DBS isn’t the only bank to offer an automatic conversion scheme; UOB does so too.

Here’s how the two programmes compare:

| DBS | UOB | |

| Annual Fee | S$43.20 | S$50 |

| Availability | Selected cards | All cards |

| Auto Conversion Frequency | Quarterly | Monthly |

| Auto Conversion Block | 1,000 miles | 5,000 miles |

| Ad-hoc Conversion | Free | S$25 |

| Min. Balance on Bank Side | None | 15,000 UNI$ (30,000 miles) |

Compared to DBS, UOB automatically converts points every month, as opposed to every quarter, and is available to all cards.

Apart from that, however, it’s almost universally worse. The programme is slightly more expensive at S$50, the conversion block is bigger at 5,000 miles, ad-hoc conversions still cost you S$25, and the best part of all? UOB will only convert UNI$ in excess of 15,000 (30,000 miles). That’s a hefty working capital balance!

Why do you need to keep 15,000 UNI$ on hand? Well, UOB would have you believe that it’s for your benefit, so you have the “flexibility to convert the UNI$ to other items from UOB Rewards Catalogue”.

Why must a minimum balance of UNI$15,000 be kept KrisFlyer auto conversion programme? This is to give card members the flexibility to convert the UNI$ to other items from UOB Rewards Catalogue. Card members can still choose to convert this UNI$15,000 to KrisFlyer miles by the one time miles redemption process through UOB Rewards Catalogue, subjected to S$25 conversion fee and must be in blocks of 10,000 miles. |

Make of that what you will.

Conclusion

DBS cardmembers can choose to enrol in the KrisFlyer Automatic Conversion Programme, which offers four quarterly conversions per year for a flat fee of S$43.20. This has the added benefit of reducing the minimum transfer block from 5,000 to 500 DBS Points, although it also means starting KrisFlyer’s 3-year expiry clock early.

If you make at least two conversions a year, the Automatic Conversion Programme is well worth considering.

I think its quite likely just for the specific card enrolled as the registration page asks for the card number. If you have 3 cards, you’d likely need to enrol 3 times (and pay 3 separate fees).

Anyway this offer doesn’t make sense, unless you’re the sort earning a crazy amount of points every quarter and looking to use them right away. Otherwise the current on-demand one-time fee conversion works. Unlimited conversions for a flat fee? Let’s put that in the 2018 wishlist!

It’s a nice option if you earn frequently with the supported cards, which I do not. If, like you, people spread out their spending across cards then this just seems not that appealing.

Hey! I just chatted with a DBS customer service agent and she told me that points from all DBS cards will be converted, regardless of the one you signed up with.