[Update 2: SIA has reversed its decision and will not be levying credit card surcharges]

[Update 1 : The FAQ section has been updated since I wrote the article this morning. Originally, it mentioned the credit card fee would be applied to the all inclusive fare for “certain fare types”

That’s since been updated to state it’s explicitly for Economy Lite.

Does that make it better? A bit. But my beef is still with the principle behind the move, namely that a full service carrier like SQ shouldn’t be charging credit card fees. Regardless of ticket class.]

The writing has been on the wall for some time that Singapore Airlines is starting to give serious thought to improving profitability via unbundling. A major warning bell was sounded last month when the airline announced it would start charging economy class passengers in certain fare buckets for seat selection.

Here’s what I wrote at the time:

It is disappointing to me that a carrier which takes great pains to brand itself as premium would start nickel and diming economy passengers for seat selection…SQ will of course position this as “giving our highest fare paying customers preferred treatment”…make no mistake, though, this marks a strategic change in the way SQ thinks, and it makes me wonder what other changes we’ll see…

Well, it appears we have an answer.

Singapore Airlines will impose credit card surcharges for flights ex-SIN starting 20 January

Let’s start with the facts.

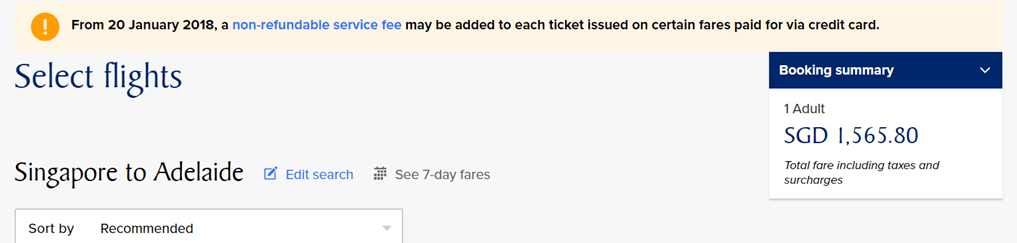

From 20 January 2018 (incidentally, the same date SQ’s new fare buckets kick in), Singapore Airlines will levy a 1.3% non-refundable credit card surcharge, capped at S$50, for air tickets booked through Singaporeair.com, the SIA office or your travel agent.

This non-refundable surcharge will not apply to:

- Redemption tickets

- Ancillary products like preferred seats or excess baggage

- Additional fares or fees collected when changes to original booking are made

- Payments made with debit cards or alternative methods like Paypal

- Payments made with the Singapore Airlines Krisflyer Credit Card

At a 1.3% surcharge, the S$50 cap will only be triggered if your all-inclusive fare is more than S$3,846, which means that almost every economy and premium economy fare will feel the full force of the surcharge. [Update: it has been clarified this only applies to Economy Lite fares]

Why is SQ levying a credit card surcharge?

Short answer:

Long answer: here’s an illuminating tidbit from the FAQ section explaining why a surcharge is levied.

When you use a credit card to pay for your flights out of certain countries, Singapore Airlines incurs costs relating to the acceptance of credit cards.

Well, er, yeah SQ. It’s called a cost of doing business. It’s something that countless other merchants (including, might I add, other full service carriers) absorb. What you’re doing is like a convenience store charging a “cashier fee” at check out because they need to pay the cashier a salary to handle my payment.

And how are the fees set?

Our fees are based largely on local market practices.

SQ is of course not the first airline to levy credit card surcharges in Singapore. Here’s a sampling of what some other carriers charge.

- Scoot- $10 per flight

- Air Asia- $8 per flight

- Jetstar- $10 per flight

But wait, stop. Does anyone see what’s wrong with the picture here? Why am I even comparing SQ to budget airlines? Why am I drawing comparisons between an airline which offers this:

And an airline for which the height of luxury is priority boarding?

SQ cites “local market practices” in determining how these fees are set. That’s wrong on two levels. First, it indirectly implies that the relevant market practice to benchmark themselves to is that of budget airlines. Second, I realise the data is somewhat out of date, but an audit by Visa in November 2012 found 2.8% of merchants were imposing surcharges or minimum spend policies for card usage. 2.8% is hardly market practice.

For those of you who may be wondering why I didn’t go as hard after SQ when they announced that some economy passengers would need to pay for seat selection, my answer to that is while it’s annoying, if you squint hard enough you can still make an argument that “ok, this at least benefits those who pay higher fares because they get first choice of seats”. Furthermore, anyone holding Krisflyer Elite Silver or higher could avoid the fee.

But these surcharges are different. They apply across the board. It doesn’t matter if you’re a regular Krisflyer member or a Lifetime Solitaire PPS. You still pay 1.3%. There is no way of spinning this, no amount of mental gymnastics or doublespeak that the Singapore Airlines corp comms team can come out with to make it sound like a benefit.

This is a money grab move by SQ, pure and simple. And for an airline that wants to position itself as a cut above the rest, it’s shameful that they’d dig from the bottom of the barrel when it comes to such policies.

Is this illegal?

Let’s be very careful about our terminology here. “Illegal” refers to something that breaks the law, and that’s not what this is. It is, however, a violation of the service agreement that exists between card issuers like Visa/Mastercard and the merchant.

History has shown us, however, that card issuers lack the ability to enforce the agreement. Does anyone remember 2013, when Visa withdrew acceptance from all taxi operators over the 10% surcharge they were levying on transactions? After a couple of years they backtracked on that move, and from 1 Jan 2016 Visa was once again accepted by taxi companies, still with the 10% surcharge.

Visa tried to save face over the climbdown by claiming that the landscape had changed and most people were using their Visa cards to pay via taxi booking apps and hence not incurring the surcharge anymore. But the fact remains that the taxi companies won.

It seems absurd to say a billion dollar enterprise like Visa doesn’t have sufficient clout to get merchants to play by the rules, but that’s exactly what this is. Visa can wield its enforcement team against small and medium enterprises, perhaps, but the big boys openly charge surcharges with impunity. And given that Visa has let the matter slide, I tend to conclude they don’t have the means or the will for stronger enforcement.

So yes, SQ’s move goes against the terms of its agreements with card issuers, but good luck relying on that to stop this from happening.

What can I do about it?

We can all get really angry on the internet! That’d show ’em!

![]()

Alternatively, you can:

Book via OTAs- The obvious answer would be to start looking at booking through OTAs like Expedia, assuming the ticket cost is the same. When SQ mentions that travel agents will also be subject to this fee, I believe they’re talking about offline travel agents like ASA Holidays. It’s silly in a way, because in an age where airlines and hotels are trying to incentivize people to book direct (Lufthansa charges a 16 Euro fee for anyone booking tickets via OTAs), Singapore Airlines is doing the exact opposite.

Use Paypal: Paypal transactions do not attract surcharges, so this is an option if you’d prefer to still use a credit card. I believe that using your DBS WWMC should earn you 4 mpd because Singapore Airlines will be using a merchant (as opposed to personal) Paypal account, but if anyone could confirm this that would be appreciated.

Use Shopback: If for whatever reason you don’t want to use Paypal, consider using Shopback’s 0.5% cashback because that at least offsets the 1.3% fee somewhat. You need to pay with Visa to enjoy the cashback.

Write to your MP: Also, start an online petition and write an angry letter to the ST Forum page because we know those things totally work.

It’s also worth noting that holders of the Krisflyer cobrand cardholders will be exempt from such fees, but nothing would annoy me more if SQ starts using this as a marketing point for the card as if it’s some big benefit. Remember also that the cobrand portfolio offers 2 mpd on SQ ticket purchases, well below the 3 and 4 mpd you could earn with the DBS Altitude and DBS WWMC respectively.

I suspect that this move will cause more than a few keyboard warriors to call for a boycott and swear off flying SQ. Let’s be realistic, such a move will accomplish little and when all is said and done, many people (myself included) will still pick SQ because of their superior product and schedule ex-SIN. I don’t like it, I don’t support what they’re doing, but what can I do? Besides, I can still circumvent the surcharge via OTAs or Paypal.

That to me is why this move is so cynical. SQ knows it’s got a captive market, that many people are SQ-or-bust types and that it has the most lucrative departure slots at Changi locked up. A 1.3% fee, while annoying, won’t be a deal breaker for many. Therefore, in so many words, they’re doing this because they can.

My bigger concern now is whether other airlines will follow suit for tickets ex-SIN. It’s still early days, but for what it’s worth I reached out to a Cathay Pacific spokesperson who confirmed that “we do not have plans to levy credit card transaction fees for bookings made on our website at the moment”. Watch this space, I suppose.

Conclusion: Race to the bottom

I think it’s no coincidence that the commencement date of the 1.3% surcharge implementation ties in with the start of the new fare buckets. SQ is clearly trialing a new direction, strategically, to see the extent to which it can have a full service product but a budget airline pricing model. And by budget airline pricing model I don’t mean cheap fares, I mean charging for everything that’s not nailed down.

Where will this lead us? Who knows, but I can guarantee you there’ll be more changes afoot in the near future. At a time where other developed countries are moving away from surcharges, it’s disappointing to see the opposite happening in Singapore.

Singapore Airlines for me will still continue to be a great way to fly. But they’re certainly doing all they can to burn some of their goodwill with customers.

Really sad that it has come to this…For years, SQ was my default. Then came the revamped website which really put me off each time I tried to book. Now this. I’ll pass for now.

what a cheap move! when will they start charging us to use the toilet?

If they dared charge us for using their crummy toilets I would definitely boycott them. Their toilets are not as clean as they should be and neither are their equipment. I found a scrunched up slip of paper in a storage area under the central armrest on a flight Sin-BKK. So they have been scrimping and saving on maintenance as well.

And yet friends who have travelled to Australia and South Africa told us of incredibly low fare deals they have obtained – cheaper than flying MAS for sure.

Only Singaporeans flying out of Singapore are squeezed every which way!

Lifted from the sales circular sent to travel agencies:

“The new CCSF will be 1.30%, capped at SGD50. It will apply to the all-inclusive fare for selected

booking classes (Q, N, V, K), on SQ 618 tickets issued in Singapore and wholly or partly paid

for using an SQ-accepted credit card. The CCSF will not be applied to mixed RBD bookings

(QNVK + non QNVK ie YBEMHW).”

Have to wait and see when it kicks in whether it’s only on those a/m economy classes.

Quoted from the SQ site: “For tickets issued in Singapore, the credit card service fee will only be applied to the all-inclusive fare for Economy Lite Fares.”

Does that mean Economy Standard tickets and above are unaffected?

Yes, they just updated the FAQ. That wasn’t there earlier today when I did this writeup. Will update when I get some time

Maybe we can make a complaint for abuse of dominant position to the competition commission…

Why bother – we will surely lose. I’d bet on it.

We won.

SQ reversed their decision.

It doesn’t apply because they’re not preventing other competitors from entering the market.

Soon SQ will no different than AirAsia or Scoot where they charge everything

Sadly the present management don’t seem to have any clue on how to run the airline other than focusing on the nitty-gritty things, with little understanding of the customers and competitive landscape. Its route map beyond asia is so pathetic, and Krisflyer is one of the worst FPP around.

all butt hurt sour

SIA is no longer a premium airline. Once you start sweating the small stuff, people stop associating you with luxury because the EXPERIENCE no longer feels premium. It’s this hit to its image that’s really sad.

Their in-flight meals are getting worst. These cost saving measures make it worst. Goodbye SQ, definitely switch to other carriers !

Well, you could also add an additional point – use debit card to pay. I used it to pay for Easyjet and Ryanair fares…and yes…budget airlines again…wow….this is shameful

why don’t they just included it in the ticket price without exposing the fee to the customer? whats the benefit of exposing the transaction fee, all you get is backlash and disappointment.

when you structure a deal in business, you dont expose all the intricacies of the total price to the customer.

Not sure that booking via an OTA will circumvent the credit card fee – I’ve booked your example airlines (Scoot, Jetstar) via Expedia before and the surcharge for using a credit card is included as an airline card fee if I’m not mistaken.

If you use your credit card to pay through PayPal, you’ll still be hit with a 1.0% Dynamic Currency Conversion (DCC) surcharge because you are charged SGD but PayPal processes your payment outside Singapore.

Channel news asia has reported that the charges only apply to economy lite category

yup. this morning when the FAQ went up it mentioned “certain fares” which was a really horrible way of communicating it. I’ve updated the post to reflect this. No doubt it lowers the severity of the change, but I’m still all sorts of worried about what it portends.

For some time now SQ has been a premium airline with the soul of a budget airline. Its own employees are confused — are they fish or fowl?

This article, particulary the header, is written out of proportion. Although nobody likes levy of any kind but the lite fare in Y class has its mileage bumped from 10 to 50%. It isn’t entirely 0 to the passenger and whether is it a 0 sum is up to individual. Using the word “disgraceful” is very inappropriate.

Think we’ll need to agree to disagree on that one. It’s great that SQ has increased accrual rates from 10 to 50% (whether a 10% accrual rate was reasonable in the first place is a whole different matter), but the other shoe is that with that change has come two things that you would never think to associate with a full service airline, much less one of the best airlines in the world like SQ- credit card fees + pay to pick your seat. Here’s my question: where does it stop? If SQ wants to market itself as a class… Read more »

Where is the disgraceful part?

like i said, i think this is something we’ll have to agree to disagree on! Although I do hope you can come for one of our meetups, because talking in person helps to avoid misunderstandings. first drink’s on me! (only back in feb though)

It would stop when someone bites the bullet. Hopefully with BA doing the same across the continent that they will crash and burn and serve as a warning to legacy carriers to stay where they are

Goodbye Sq…… I will be flying Emirates from now on… They r just better than u now…. I used to prefer Sq…. Not anymore…. Your service is nothing special…. U charge more for tickets…. And then now this…. I would pay for a company to treat me well and not to nickel and dime. Why stop there…. Just convert into a budget model so u can charge everything!

Utterly Disgusted

@Najib – you are aware that Emirates (also) charges for seat selection in economy?

Great write up; you put into words what many of us have felt over the years. Perhaps the thing that rankles most is that loyal customers residing in Singapore are subject to higher ticket prices than customers residing overseas for the same ticket sectors. The food is poor even in biz class and as mentioned the FPP is awful.

Well I had long stopped travelling on SIA where locals (singaporeans) are treated as 2nd Class citizens. However i am also impressed the way the air staff are trained to distinguish between locals and foreigners.

Even when asked for a glass of water they never came back but it was different when a foreigner asked.

In today’s aviation, we have options and good pricings.

I read with interest on the article, specifically “”SQ knows it’s got a captive market” and “that it has the most lucrative departure slots at Changi locked up”. I have stopped flying with SQ, either for business or leisure, over the past 24 months (except for one flight to PVG), simply because of SQ’s loyalty to their products and not to the customer. Not once over the past 24 months have I felt handicapped, or deprived of a “superior” product. On the subject of most lucrative departure slots at Changi locked up, the scales would tip against SQ then, when… Read more »

so you would not fly with SQ even if it offers a cheaper fare?

An open ended question. Does the cheaper fare offered by SQ (or any other airline for that matter) comes with restrictions, tied to any credit card promo, minimum stay periods etc. I did not say in my comment that I will never fly SQ. I did fly with SQ for a flight to PVG. All I am saying is that I am no longer blindly loyal to SQ.

SQ just announced that they are reversing their decision.

?

Yes, just read about SQ”s decision. Didn’t they expect such a reaction in the first place? Reflect badly on their planning and execution.

A somewhat clumsy [sounds better than ungraceful] back tracking of missteps

I agree with your article. SQ cannot brand itself as a premium airline but behave like an LCC. It’s marketing 101. I still would probably fly SQ and keep my KF account due to reasons you’ve mentioned but would be a lot more open to considering alternatives. And if they go down this line of behaving like an LCC, I will quite likely rethink my FFP strategies.

I am glad they have reversed the decision. But it makes them seem as if this move wasn’t a well-thought out one!

[…] – Money Smart: 5 Expensive Habits Singaporeans Should Consider Breaking in 2018 – Milelion: Singapore Airlines’ move to charge credit card fees is a disgraceful money grab […]

SQ used to be my default airline to fly, not anymore after this year.

Unless there’s a very cheap fare on SQ or the airlines that fly to the destination I’m going is worse, I’ll probably fly other airlines. Not gonna deactivate my KF account as I’ll still use it-albeit mostly on other Star Alliance airlines that doesn’t use cheap tricks of LCCs – if I was ok with LCC standard I would have booked an actual LCC ticket instead.

From now on if I’m traveling to the US I would take ANA/Asiana.