Marketing research company JD Power publishes an annual Singapore Credit Card Satisfaction Survey. This always makes for fun reading, sort of like a “state of the union” for credit cards.

Early last month, JD Power released its 2018 edition of the survey. This survey was based on responses from 2,900 credit card customers, collected in September and October. I’ve read through the report and thought there were some really fascinating insights, which I’ll discuss below:

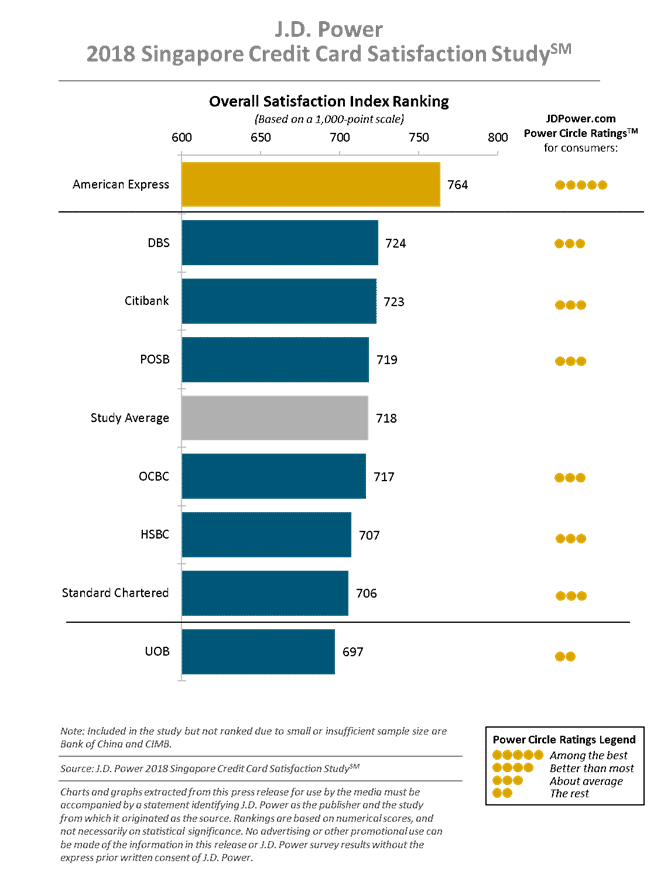

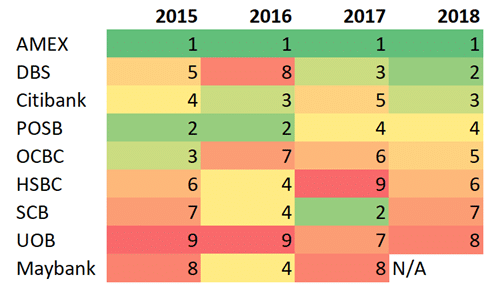

(1) AMEX leads the pack on consumer satisfaction, UOB continues dismal showing

For context, here’s how the banks measured up in previous years:

JD Power measures overall customer satisfaction based on:

- Customer Interaction (29%)

- Rewards (18%)

- Benefits and Services (17%)

- Credit Card Terms (16%)

- Communication (16%)

- Key Moments (4%)

If Customer Interaction (29%) is the heaviest weighted criteria, it’s little wonder that AMEX continually comes out on top. I’ve yet to meet anyone who hasn’t had a good experience with AMEX customer service. They’re polite, efficient and most importantly competent. And when they say they’ll call you back, they really mean it. This doesn’t just apply to high end Platinum Charge or Centurion cardholders- back when I was a lowly AMEX Rewards cardholder the interactions were equally good.

Given that Rewards (18%) is the second most important criteria, some might be surprised to see UOB a constant presence at the bottom. After all, most miles chasers know that UOB has some pretty useful cards.

But surveys are a reflection of perceptions, not reality. UOB cards actually have great rewards, but the problem is the general public is unaware of them. Walk around the CBD during lunch- do you see anyone using a UOB Preferred Platinum AMEX to pay for food? Or a UOB Preferred Platinum Visa where there’s Paywave? When your colleagues need to buy something overseas, does the UOB Visa Signature come to mind?

All these are fantastic products, yet they’re not actively marketed by the bank. Come to think of it, the relatively low position of UOB might also be a reflection of a market that doesn’t really value miles and points (see below).

I have mixed feelings about UOB’s consistent poor showing in this study (dead last in 2015, 2016 and 2018, third last in 2017). On the one hand, I find their Credit Card Terms (16%) to be unnecessarily confusing and sneaky, given their habit of:

- Rounding all spending down to the nearest $5 when calculating points

- Requiring that payment processing be done outside of Singapore in order to qualify for overseas mileage bonuses

- Automatically deducting UNI$ to cover your annual fee

- Running limited quantity credit card promotions that leave you guessing whether you’re still eligible

On the other, I wouldn’t say they’re the absolute worst bank I’ve ever dealt with. In my experience, they tend to get problems solved…eventually. Still, if this study serves as a wake up call and gets them to reform their T&Cs, all the better (although one could argue the alarm’s been ringing for 4 years and UOB’s hit the snooze button every time).

(2) Cashback still overwhelmingly preferred over miles

Fine, this isn’t the first time we’ve heard this, but I continue to be amazed at the gap between cashback and miles preferences in Singapore.

A recent ShopBack survey of 700 cardholders showed that 80% of respondents preferred cashback over miles and points. The JD Power data only further reinforces this idea- when it comes to rewards redemption, 56% of customers prefer cashback, and only 8% prefer miles (the remaining 36% presumably prefer using credit card points for shopping vouchers, which in itself is also pretty cringe-worthy).

I’ve made the argument for miles over cashback so often that I sound like a broken record, but I guess when it comes down to brass tacks, cashback is a lot more intuitive. It’s a one-step process- earn cashback, spend cashback. Miles are more opaque- first you have to earn them, then you have to figure out what to do with them. Everyone knows what to do with cash, but fewer people know what they can (or should) do with miles.

Besides, the narrative in the media tends to reinforce the idea that cashback cards are superior, and the idea of “cash is king” has been so drilled into some peoples’ psyche that it’s hard to convince them otherwise.

Some say that the only reason the miles game here is relatively generous (at least compared to places like Malaysia) is because the masses haven’t hopped on the bandwagon yet. I disagree- the reason the Singapore miles game is more generous is because of our relatively high interchange fees.

In places where interchange is capped, credit card rewards become a lot less generous. We see that in Europe (one possible upside of Brexit is more generous credit card rewards in the UK as EU limitations on interchange fees are removed), we see that in Australia, and we’re seeing that in Malaysia too( in 2015 the central bank decided to cap interchange fees). High interchange fees allow banks to offer more generous rewards, and merchants tend to absorb at least some of the impact in order to keep prices competitive.

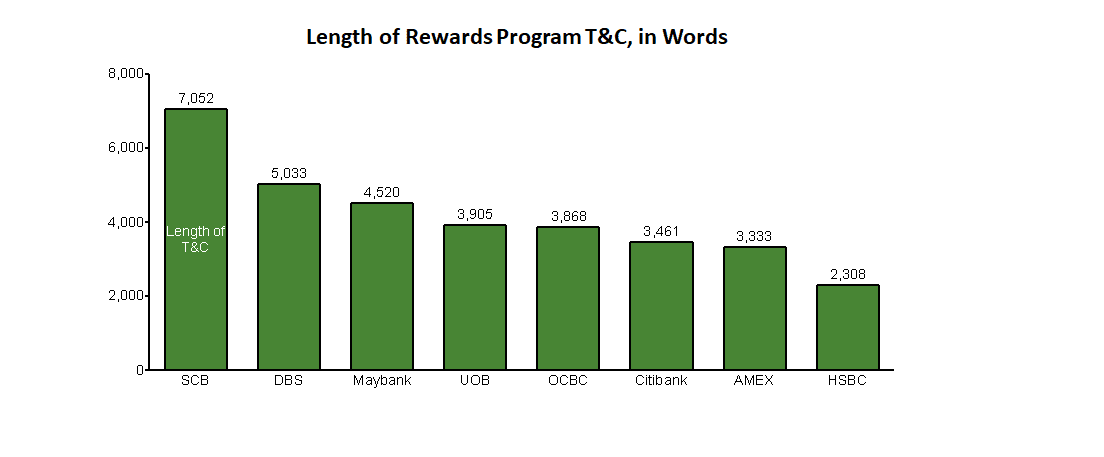

(3) Consumers less satisfied and more confused with rewards programs

66% of cardholders choose their primary card based on rewards offered. But JD Power’s data shows a 9 point decrease in satisfaction with credit card rewards programs from 725 in 2017 to 716 in 2018. A 9 point fall may not appear to be significant, but it’s important to remember that between 2016 and 2017 a 21 point increase in satisfaction was seen.

So something has clearly happened this year that’s made consumers less satisfied with rewards. JD Power has suggested that the issue is a lack of knowledge about how to navigate rewards programs. In their words-

Customers are still facing issues on how to earn and burn their rewards. The study finds that only 26.5% of cardholders fully understand how to earn rewards compared to 73.5% who do not understand how to. Those customers who fully understand how to earn are 76-points more satisfied than those who do not.

39% of cardholders fully understand how to redeem rewards compared to 61% who do not understand how to. Those customers who fully understand how to redeem are 69-points more satisfied than those who do not.

It doesn’t take a brain surgeon to see that customers who know the ins and outs of a rewards program are going to derive more satisfaction than those who don’t. What’s more frustrating than seeing your friends jet off in First Class for free while you’re left wondering why all your lunch spending on your Citi Rewards card (don’t laugh, I see this way too often) isn’t getting you anywhere?

There’s a crucial takeaway here, however. If a lack of knowledge is undermining customer satisfaction with rewards programs, then the right answer isn’t to offer better rewards- it’s to ensure customers know how to maximize those already in place.

I realise that’s almost blasphemy from someone obsessed with miles chasing, and I know we love a good ol’ fashioned rewards arms race. One bank launches an uncapped 8 mpd Apple Pay promo, so another offers an uncapped 5 mpd on overseas payments. One startup allows customers to earn miles from bill payments, so a bank tries to dramatically undercut their fees. It’s absolutely brilliant for hobbyists like us, but in the long term, it’s simply not sustainable (especially if interchange fees do get regulated in the future). Put it another way- what’s the only thing better than 3 mpd? 4 mpd. What’s the only thing better than 4 mpd? 5 mpd.

Before everyone gets the pitchforks out, I highly doubt that any bank executive is going to read this and say “great idea, I’m going to cut rewards now and focus on education!” Why? It’s simple economics- education has a positive externality. If DBS teaches people how to use DBS Rewards points better, there’s no reason why customers can’t take those principles and apply them to UNI$, or Citi Miles, or any other rewards program.

Moreover, the beneficial effects of education are only seen in the long term, but a crazy promo can really drive KPIs in the short term. To the extent that product managers are compensated on short term metrics (card usage, customer acquisition, media buzz) instead of long term profitability, there’s no incentive for them to take up the burden of educating the market.

That’s why I’d be very surprised to see any bank take up the mantle of educating consumers on better earning and burning. It may be the “right” thing to do, but it’s not easy to internalize the benefits (and if you’re a bank executive, good luck quantifying that for your annual performance review).

Conclusion

I love reading reports like this because they give me so much to think about the miles game in Singapore. Where does it stand, where is it heading, what’s driving those trends, and what does it mean for the way we play it?

What do you think about the report, and do you agree with my conclusions? Discuss it below, or in our Telegram and Facebook groups!

I totally agree, glad someone at last mentions the interchange fees matter.

I reckon the points&miles game is much better suited to people positioned to take advantage of it, i.e. folks who are more savvy in personal finance issues and those that can afford to do the legwork to find out how to benefit the most. The average Joe has little time or patience to manage 15 credit cards and 30 loyalty programmes and calculate how to squeeze the most value out of each mile.

Wait til next year when boc comes in top with rewards and bottom in everything else…

Boc user base too small for it to appear in a survey like this haha

Isnt it more beneficial for the banks (and maybe mile chasers) for the mass to be uneducated. Therefore, banks can come up with better and higher “headline earn rate”. As a result, many will be drawn in by the headline rates and think its a good card to spent on but unable to fully optimize the bonus , thereby reducing ultimate cost to the banks even if they went on an arms race. i.e., just because Bank X offers 8mpd promotions, its effective payout rate might be much much less and the primary purpose is marketing and inducing people to… Read more »