| The following is a sponsored post by DBS. The opinions and analysis are those of The Milelion |

Regular users of the DBS Altitude and DBS Woman’s World cards may be pairing them with the DBS Multiplier account in order to increase the interest earned on their bank deposits.

If you’re one of them, here’s a heads up that DBS has made some important changes to the DBS Multiplier account effective 1 May 2019. The good news is that all customers will earn at least the same interest (if not more) as before.

The new Multiplier account allows you to increase your bonus interest by:

- Increasing your balance from $50K to up to $100K

- Adding a new category of transactions

- Increasing the volume of your monthly eligible transactions.

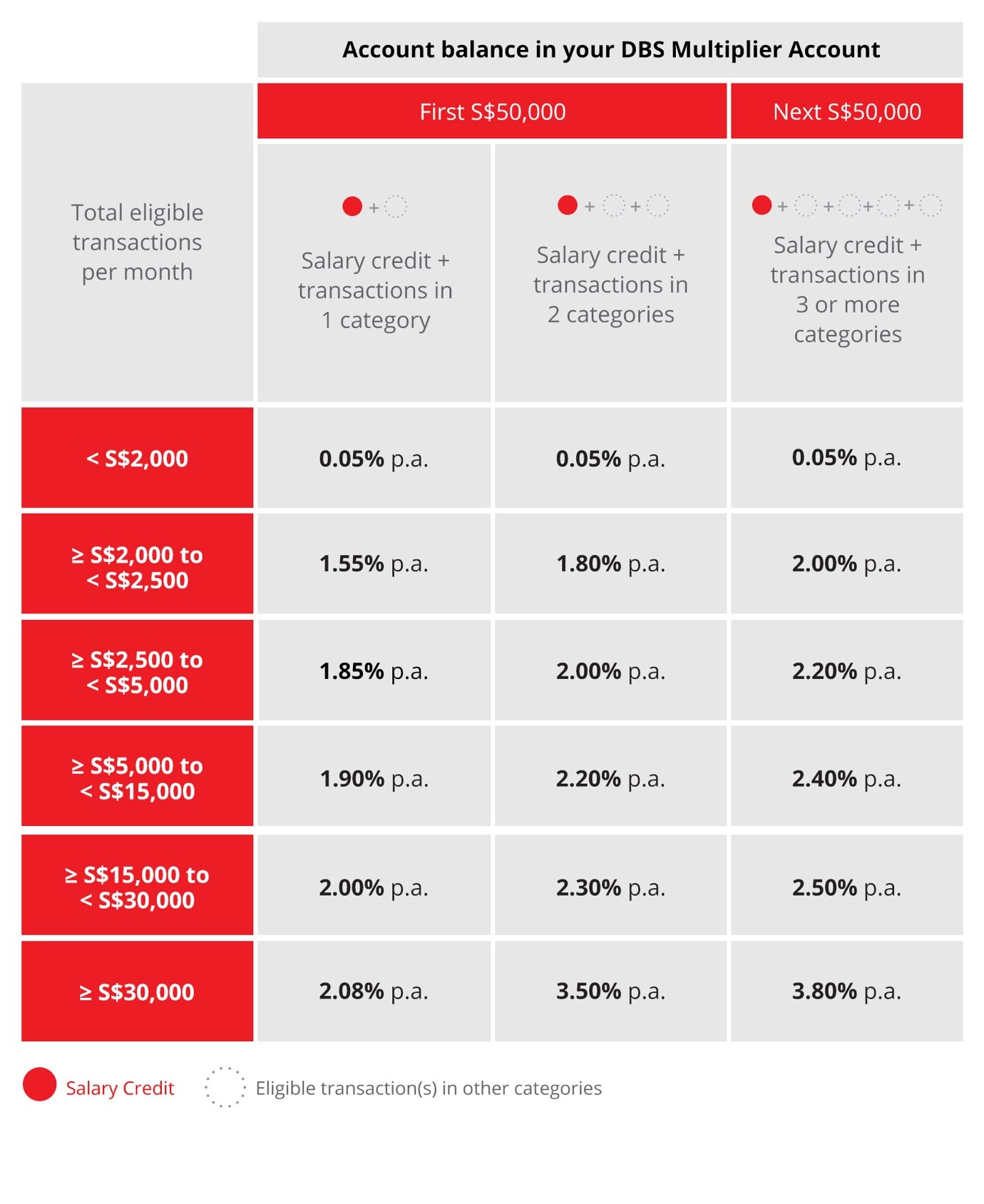

Here’s the revised interest chart that took effect from 1 May 2019.

By moving from the two category to three category bucket, you can increase your annual effective interest from 1.8-3.5% to 1.9-3.65% (remember, the next $50K earns 2.0-3.8% p.a but your first $50K earns 1.8-3.5% p.a).

By moving from the two category to three category bucket, you can increase your annual effective interest from 1.8-3.5% to 1.9-3.65% (remember, the next $50K earns 2.0-3.8% p.a but your first $50K earns 1.8-3.5% p.a).

What’s more, the cap on bonus interest has now been doubled to $100K, which gives the DBS Multiplier the joint highest cap (alongside SCB’s Bonus$aver) of all high-yield bank accounts in Singapore.

Remember, to earn bonus interest with the DBS Multiplier you need to credit your salary and transact with DBS in up to four different categories: credit card spend, home loan installments, insurance and investments.

| Protip: the DBS Multiplier cannot be opened as a joint account, but if you and your spouse each have a Multiplier account and credit your salary to a separate DBS joint account, the combined total of your salaries is accorded to each of your Multiplier accounts. |

Most miles chasers would at least have a DBS Woman’s World card for 4 mpd on online spending, so the question then becomes which other categories you can add to your relationship. My two picks would be home loan (assuming you’re at that stage of life) and investments.

Most of the other high-yield bank accounts on the market do not recognise home loan installments as a bonus interest category. Maybank SaveUp and the DBS Multiplier are the exceptions, but the former only recognises installments for 12 months while the latter recognises it for the entire duration of the loan. What’s more, joint borrowers are recognised too, so if both you and your spouse have a DBS Multiplier account, you’ll each be able to double count the installment amount towards your monthly transaction volume.

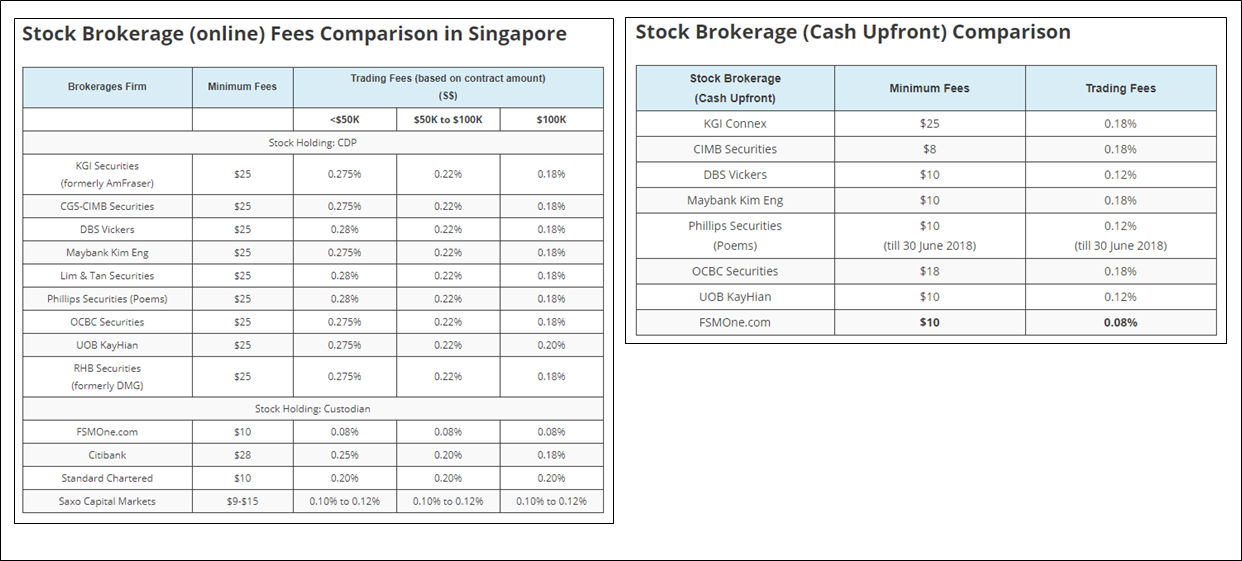

Where investments are concerned, DBS Vickers rates are slightly higher than the competition, but if you’re willing to do cash upfront trades then the 0.12% fee and $10 minimum commission is one of the lowest in the market. Alternatively, you could simply credit your CDP dividends to the Multiplier account instead and keep whichever trading platform you’re currently using (provided, of course, you get dividends credited each month).

Pairing bank accounts with your miles strategy

Picking a bank account used to be quite the conundrum for miles chasers, because the highest yielding accounts were historically not associated with the highest yielding miles cards (e.g the SCB Bonus$aver requires you to use the Bonus$aver credit card and doesn’t recognise spending on the SCB Visa Infinite).

But quite a lot has changed in the past couple of years: OCBC has added a mass market points offering in the form of the OCBC Titanium Rewards card, BOC introduced its first miles card in the BOC Elite Miles World Mastercard, and UOB refreshed their UOB Lady’s Cards portfolio by adding new bonus categories.

These developments mean that the opportunity cost of playing the miles game has been lowered- it doesn’t necessarily mean giving up big interest in your bank account. The way I see it, miles chasers currently have the following permutations to choose from:

- DBS Multiplier and DBS Altitude/DBS Woman’s World Card

- BOC Smart Saver and BOC Elite Miles World Mastercard

- Maybank SaveUp and Maybank Horizon Visa Signature

- OCBC 360 and OCBC Titanium Rewards/ OCBC VOYAGE

- UOB One and the UOB Lady’s Card (only for ladies, sadly)

Here’s how those accounts measure up.

| Account | Pair with | Cap | Maximum Effective Interest |

| DBS Multiplier | DBS Altitude/Woman’s World | $100K | 3.65% |

| BOC Smart Saver | BOC Elite Miles World Mastercard | $60K | 3.55% |

| OCBC 360 | OCBC Titanium Rewards/VOYAGE | $70K | 3.40% |

| Maybank SaveUp | Maybank Horizon Visa Signature | $50K | 3.06% |

| UOB One | UOB Lady’s Card | $75K | 2.44% |

| General Spending & Specialized Spending | General Spending only | Specialized Spending only |

Two things to note about the table above.

First, all miles chasers will be using a combination of general spending and specialized spending cards. The latter give bonuses in specific categories of spending, the former are good everywhere else. However, not all bank accounts support both types of cards.

For example, the UOB One counts spending on the UOB Lady’s card, a specialized spending card which earns 4 mpd in one (two for the UOB Lady’s Solitaire) of seven bonus categories (beauty, dining, entertainment, family, fashion, transport, travel). However, the UOB One does not count spending on the UOB PRVI Miles card, so you’re lacking a general spending option here.

In contrast, the DBS Multiplier counts spending on both the DBS Altitude (general spend) and the DBS Woman’s World (specialized spend: online). This is one key advantage of the account for miles chasers. True, the OCBC 360 counts spending on both the general spending OCBC VOYAGE and the specialized spending OCBC Titanium Rewards, but remember the VOYAGE is a $120K+ offering, while the DBS Altitude is available at the $30K income level.

Second, it’s not correct to just look at maximum effective interest, because that’s a theoretical maximum. For example, you’d need a total transaction volume of at least $30K per month to hit the full 3.65% with the DBS Multiplier, which is unlikely unless you’re passing massive sums through your cards or earning a very high salary.

So the ideal combination for miles chasers depends on your individual circumstances. For example, someone who doesn’t have a housing loan and wants to handle their own investments might like the BOC Smart Saver, because with a monthly card spend of ≥$1.5K, salary credit of ≥$6K and three bill payments per month, they could max out the 3.55% interest cap.

If you’re self-employed or working on a freelance basis, the Maybank SaveUp is useful because it doesn’t require a salary credit to earn bonus interest. So long as you interact with the bank in other ways like bill payments (curiously enough, bill payments for Maybank credit cards don’t count), card spending, loans, insurance and investments you can still hit a very healthy 3.06%.

The DBS Multiplier works well for someone who wants flexibility. If your credit card spending fluctuates dramatically each month, or if you happen to keep a larger-than-average amount of cash on hand, then the lack of a minimum spend requirement for individual categories plus the higher cap of $100K can work for you.

Furthermore, if you’re the kind who can spend a lot on your credit cards (e.g small business owner, consultant with expense account) or simply earns a very high salary, the Multiplier’s ≥$30K transaction band with its effective interest of 3.65% can be appealing too. Don’t forget, you can double count your spouse’s salary on a joint account to bump you into the next interest tier.

Conclusion

If you’re already using the DBS Multiplier account to complement your miles chasing strategy, these changes represent an opportunity to earn greater interest by increasing your account balance or the number of categories transacted with the bank.

Playing the miles game and earning higher interest on a hurdle account are no longer mutually exclusive goals, so be sure to align your two strategies!

Signing up for cards or making purchases through the links in this article may generate a referral commission that supports the running of The Milelion. Found this post useful? Subscribe to our Telegram Channel to get these posts pushed directly to your phone, or our newsletter (on the right of your screen) for the latest deals and hacks delivered to your inbox.

I could be wrong but for investment on DBS Vickers, only “Buy” are considered as valid transactions.

Yes. Worthwhile noting also that for Treasures customers, ‘Buy” transactions on the Treasures online platform also counts for investments. Given their fees for their custodian account is pretty competitive, this might be a better option (assuming it is available to you, of course).

It should be noted that anything about $50k gives 0.05% p.a. unless you hit 3 or more categories. Hitting 2 categories still gives 0.05% p.a. for amounts in excess of $50k. Also, any amount above $75k is not insured under SDIC.

Are you serious? That you can’t even take that 25K exposure to a Aa1 rated bank?

Edited comment for language. Please, think of the children

Buy unit trust to fulfil investment criteria. $100 minimum, 0.82% sales charge means cost is 82 cents.

Surprised no one mentioned the SSB ladder to fulfill the investment criteria. Buy $500 of SSB every month and credit money from cdp to your dbs account. From the 7th month onwards, you’ll get cdp money every month, fulfilling the criteria for the next ten years.

I only just learned about this! that’s pretty interesting, might try it

Could you please explain / elaborate on the “SSB ladder” for the benefit of uninitiated folks (me)? What’s SSB ladder?

SSB gives you interest every 6 months. you need to buy SSB for 6 consecutive months and the interested will be credited to your account as dividends.

Total amount invest is $3012 inclusive of fees and you will unlock the category of investment for 10 years provided Multiplier is still around.

Must the dividend be credited to multiplier acct or any DBS acct? Same for SSB bons ladder, must the SSB be bought under multiplier acct or my other DBS Acct for the interest to be recognized?

Thank you

Any DBS/POSB account is fine for the investment portion.

can be bought from any bank account. what counts as investment category for Multiplier is the dividend credited into your DBS acct.

From https://www.dbs.com.sg/personal/deposits/bank-earn/multiplier:

“Credit your dividends to any DBS/POSB deposit account.

Dividends must be credited via GIRO, from Central Depository Pte Ltd (CDP).

”

The original poster wanted to know if the dividend needs to be credited to multiplier account or any DBS account. The answer seems to be “any DBS account”

@Aaron – you might want to change the wording in the sentence “Alternatively, you could simply credit your CDP dividends to the Multiplier account instead….” to “… multipler account/any other DBS account under the same name” to avoid confusion

hi millelion – thanks for the article! I don’t quite understand this pro-tip. Could you elaborate a little pls?

“the DBS Multiplier cannot be opened as a joint account, but if you and your spouse each have a Multiplier account and credit your salary to a separate DBS joint account, the combined total of your salaries is accorded to each of your Multiplier accounts.”

Isn’t it a requirement to have your salary deposited in the Multiplier account and not to any other DBS account?

thank you!

John earns $5K. Jane earns $8K. Both credit their salary to a joint DBS account. Both also have their own dbs multiplier account. John and Jane will each get a $13K salary credit counted towards their dbs multiplier interest calculation notwithstanding the fact that their salary technically doesn’t go into the dbs multiplier.