I don’t generally write about corporate cards on The Milelion, and for good reason. The vast majority of these are rubbish when it comes to perks- at least, perks for the individual.

After all, corporate cards are meant to benefit companies. Companies care about cashflow, convenience, and control. They’re decidedly less fussed about whether employees can rack up points for personal use. Rewards are an afterthought on corporate cards, and if they do exist, you’re lucky to get anything more than a paltry 0.4 mpd. Sign up bonuses? Unheard of. Lounge access? Surely you jest.

That’s why I found the launch of the American Express Singapore Airlines Business Credit Card to be intriguing, because it combines the features of a corporate card with those you’d usually find in a consumer-facing product.

Apply for the AMEX SIA Business Credit Card here

The American Express Singapore Airlines Business Credit Card earns HighFlyer points instead of KrisFlyer miles, and is available to companies that participate in HighFlyer (if they don’t currently participate, an account will be opened with the card). Employees who hold the card require a minimum income of $30,000.

| What is HighFlyer? |

| HighFlyer is Singapore Airlines’ loyalty program for SMEs. The program is free to join and does not require any minimum spend commitment; all you need to sign up is an ACRA business registration number.

HighFlyer is essentially a cash rebate scheme. Companies earn 5 HighFlyer points per S$1 spent on Singapore Airlines, SilkAir, Scoot, Lufthansa, and SWISS (excluding airport fees and government taxes) and can redeem them at a rate of 1,000 HighFlyer points= S$10. This is an effective rebate of 5%, which may not sound like a lot to consumers, but makes a world of difference for cash-strapped SMEs. HighFlyer points are valid for 3 years, and cannot be earned on Q, N, V and K booking classes (i.e Economy Lite fares). They can be converted into KrisFlyer miles for nominated employees at a rate of 2 HighFlyer points= 1 KrisFlyer mile. |

AMEX Singapore Airlines Business Credit Card: Key Benefits

The AMEX Singapore Airlines Business Credit Card comes with an annual fee of S$299, which includes two complimentary supplementary cards.

Cardholders earn their company 8.5 HighFlyer points on Singapore Airlines, SilkAir and Scoot transactions (this includes the 5 base HighFlyer points that all HighFlyer companies already earn), and 1.8 HighFlyer points on transactions elsewhere.

Based on the conversion rates, you can see this as a cashback card with 8.5% rebates on Singapore Airlines, SilkAir and Scoot transactions and 1.8% elsewhere, or a miles card with earn rates of 4.25 mpd and 0.9 mpd respectively.

Given that the the best consumer-facing cards will give you “only” 4 mpd on SIA tickets (DBS Woman’s World Card, UOB Lady’s Card, DBS Altitude (till 31 Dec)), and 1.5% cashback on general spending (AMEX True Cashback, SCB Unlimited), that’s actually quite impressive. Of course, the HighFlyer points are essentially a captive currency and can’t be spent freely like cashback, so that’s something to consider too.

Purchases of Singapore Airlines tickets will enjoy 0% interest for six months, and other purchases get 51 days of interest-free credit. Employees who purchase tickets with the card will still be entitled to accrue miles for personal use, based on the fare class purchased.

In terms of personal benefits, cardholders enjoy:

- Two complimentary visits to Priority Pass lounges

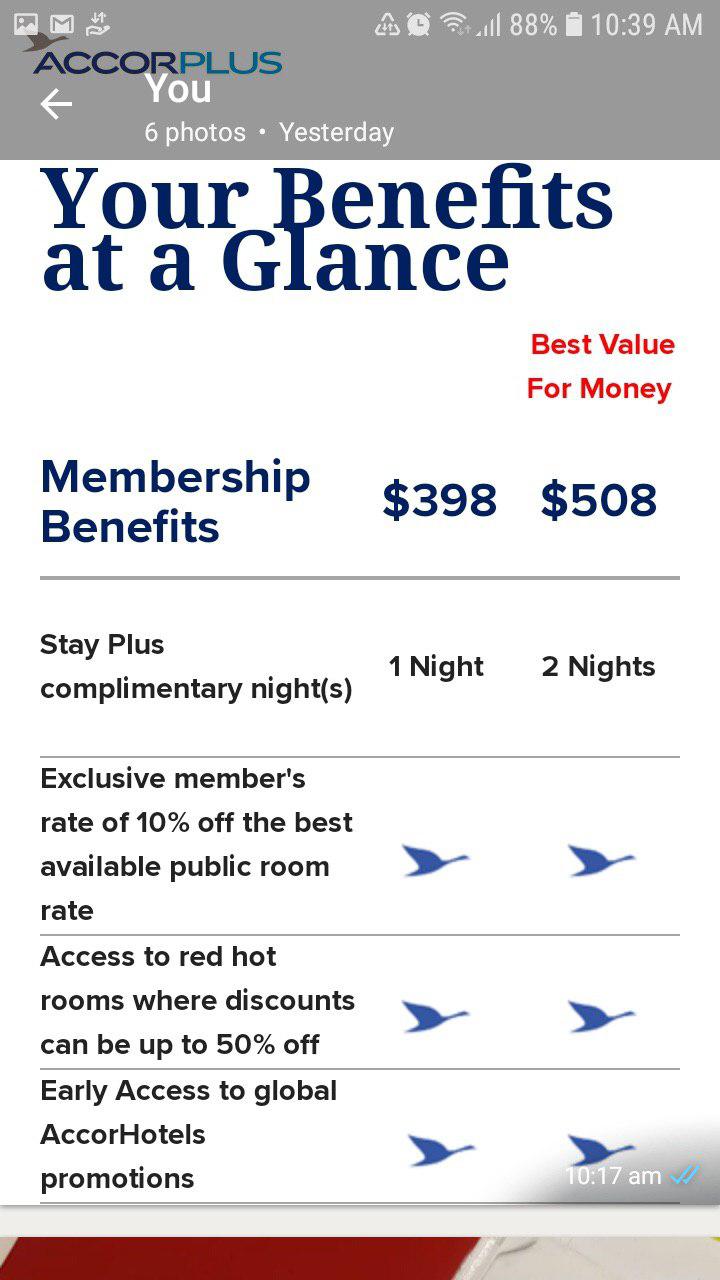

- A complimentary Accor Plus membership with one free stay every year and up to 50% off dining

- Hertz Gold status with 10% off best available rates and one class upgrades

- A fast track to KrisFlyer Elite Gold status with S$15,000 or more spent on Singapore Airlines group transactions in the first year of card membership

- Complimentary travel insurance when travel tickets are bought with the card

As far as corporate cards go, these benefits are pretty good. Apart from the UOB Regal Business Metal card, this is the first corporate card I can think of in Singapore that offers complimentary lounge access. Also, the free Accor Plus membership is potentially great value, considering the fact it normally retails for S$398.

The KrisFlyer Elite Gold fast track offer is the same as the one available to consumers via the AMEX KrisFlyer Ascend. Do note that status earned this way is only valid for the first year; in subsequent years you’ll need to requalify the usual way, with 50,000 elite miles.

AMEX Singapore Airlines Business Credit Card: Sign up bonus

It’s strange to see sign up bonuses on a corporate card, but card members will enjoy up to 50,000 HighFlyer points, broken down into

- 5,000 HighFlyer points with S$500 spent on SIA group in the first year

- 30,000 HighFlyer points with S$5,000 spent in the first 3 months of membership

- 15,000 HighFlyer points with S$10,000 spent each year on SIA group

In other words:

| HighFlyer Points | KrisFlyer Miles | |

| Spend S$500 | 5,000 | 2,500 |

| Spend S$5,000 | 35,000 | 17,500 |

| Spend S$10,000 | 50,000 | 25,000 |

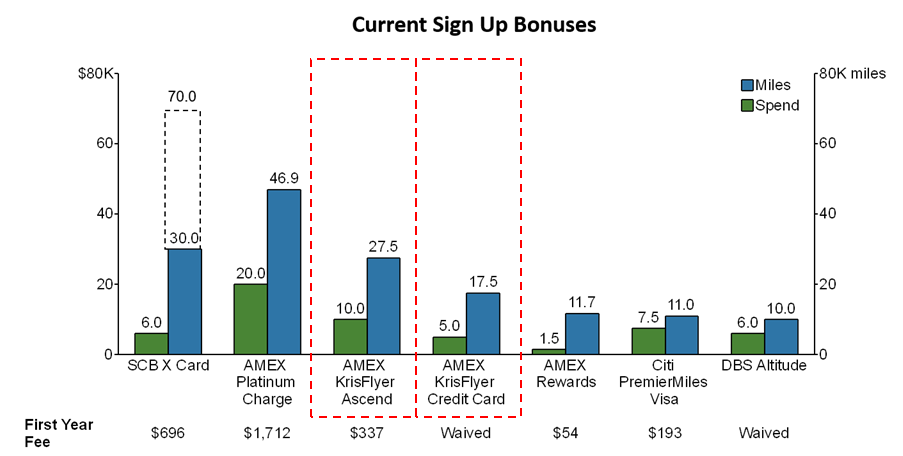

I know you’re not supposed to compare this to consumer cards, but it’s interesting to note that the spend S$5K get 17.5K miles/ spend S$10K get 25K miles scenarios are almost identical to those offered for the AMEX KrisFlyer credit cards.

I’m convinced this is no coincidence, because one of the objectives of this card is presumably to attract small business owners who would otherwise be using personal cards. Therefore, the AMEX Singapore Airlines Business Credit Card at least be on par with those offers.

How does this compare to other corporate cards?

As I said earlier, this card isn’t entering a particularly competitive market. Here’s how it compares against what I think are the two most compelling corporate cards currently available.

| *It is not clear whether this particular Accor Plus membership includes a complimentary night’s stay. I was not able to find the T&C of the UOB Regal card, so if anyone has them, please send them over! |

The mere fact that a card like the Maybank Business Platinum would even make it into this comparison is a commentary on the sad state of corporate cards in Singapore, but it does appear to be the best of a bad bunch (if you know of any better ones, by all means shout out in the comments below), given it earns points and can offer lounge access.

The UOB Regal is no doubt the rolls royce of the segment, but based on its annual fee and positioning, I’m assuming it’s out of reach to very small companies. Moreover, it seems to be the kind of card that the boss carries, not employees- I can’t think of too many SMEs willing to shell out S$642 for everyone.

The lower annual fee of the AMEX Singapore Airlines Business Credit Card means it’s more likely to be adopted by the rank-and-file, and employees should be happy with the benefits they can enjoy for personal use like Accor Plus and Priority Pass.

Conclusion

Owners of SMEs will definitely want to take a close look at the AMEX Singapore Airlines Business Credit Card to see if it can help with their travel and cashflow needs. If you’re an employee in such a company who’s currently being forced to use a no benefits corporate card, it’s worth getting your finance team to take a look at this too.

Wow thanks for this!! Definitely going to look into it. So as a small business owner, I assume the best value I can get is to just use it for flights (on the airlines listed) and nothing else?

8.5% off flights is as good as it gets for an SME which doesn’t have the big volume negotiation ability of an MNC. 1.8% off other spending, well, it’s better than your general spending cashback cards (1.6% at most- maybank man utd card), but you need to keep in mind you’re comparing 1.8% in “sia money” versus 1.6% in cash.

Thank you! This is my favourite blog ❤️

Aaron, thanks for this valuable post! One question, I have looked through the Terms and Conditions, it did not state anything about earning PPS status if one uses the business card to purchase SQ premium tickets. Can I assume that those tickets bought with this card will still clock up PPS Value?

yes, they earn miles and pss value as per normal.

A bit off-topic: Far card dining is gone, just boomz…no more.

One free night on A+ with no group dining voucher for the free membership gifted on Amex highflyer