First off, let me state that if you read the title and went “well, duh”, then congratulations, this article isn’t for you!

But given how many times I hear this question, I thought I’d write a post to properly lay out the shortcomings of a one card strategy. If you’re a miles convert who’s tired of explaining this to family and friends, feel free to point them here.

Why one card just isn’t enough

Now I completely understand why some people prefer to use one card for everything and call it a day. After all, we want convenience. We don’t want to bulk up our wallets with multiple cards, juggle multiple payments each month, or keep track of multiple ibanking logins.

If you’re playing the miles game, however, using one card for everything is like being stuck in the slow lane. It means more spending to earn the same reward, fewer free flights, and leaving value on the table. Here’s why:

You miss out on sign up bonuses

If you’re just starting out in the miles game, sign up bonuses are like the cheat code for rapid miles accumulation. Spend a lump sum within a given period, and there’s a pot of miles waiting for you at the end of the rainbow.

By using a one card strategy, you’re missing out on many opportunities to capitalise on big ticket spending. A wedding here, a renovation there…all these are great ways of generating a large amount of miles from spending you’d need to do anyway.

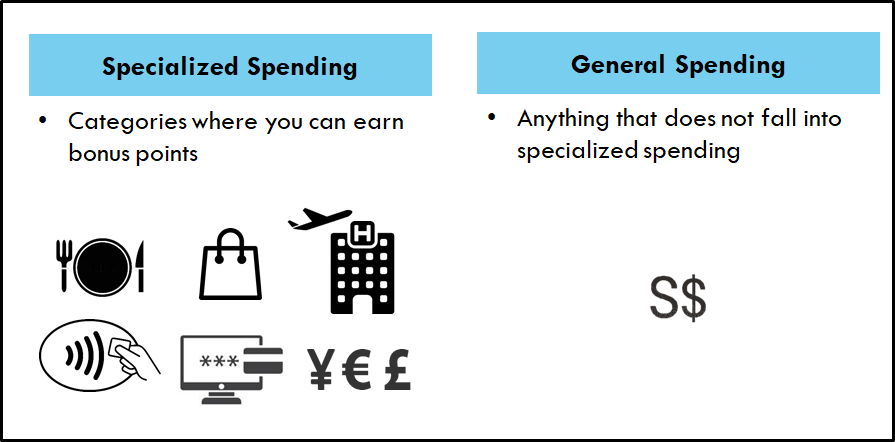

You miss out on specialized spending bonuses

Even if you don’t qualify for sign up bonuses, you’re still missing out on specialized spending bonuses by using a one card strategy.

What is specialized spending? Simply put, it’s categories of spending which banks award bonus points for, such as dining, online shopping, contactless payments, travel or foreign currency transactions.

This is what we mean by using the “right card in the right situation“, because on average, you can earn about 4 mpd with specialized spending bonuses. Needless to say, someone doing this will accumulate miles a lot faster than someone using the same card everywhere and earning 1.2-1.5 mpd.

Comparing a one card strategy to a portfolio strategy

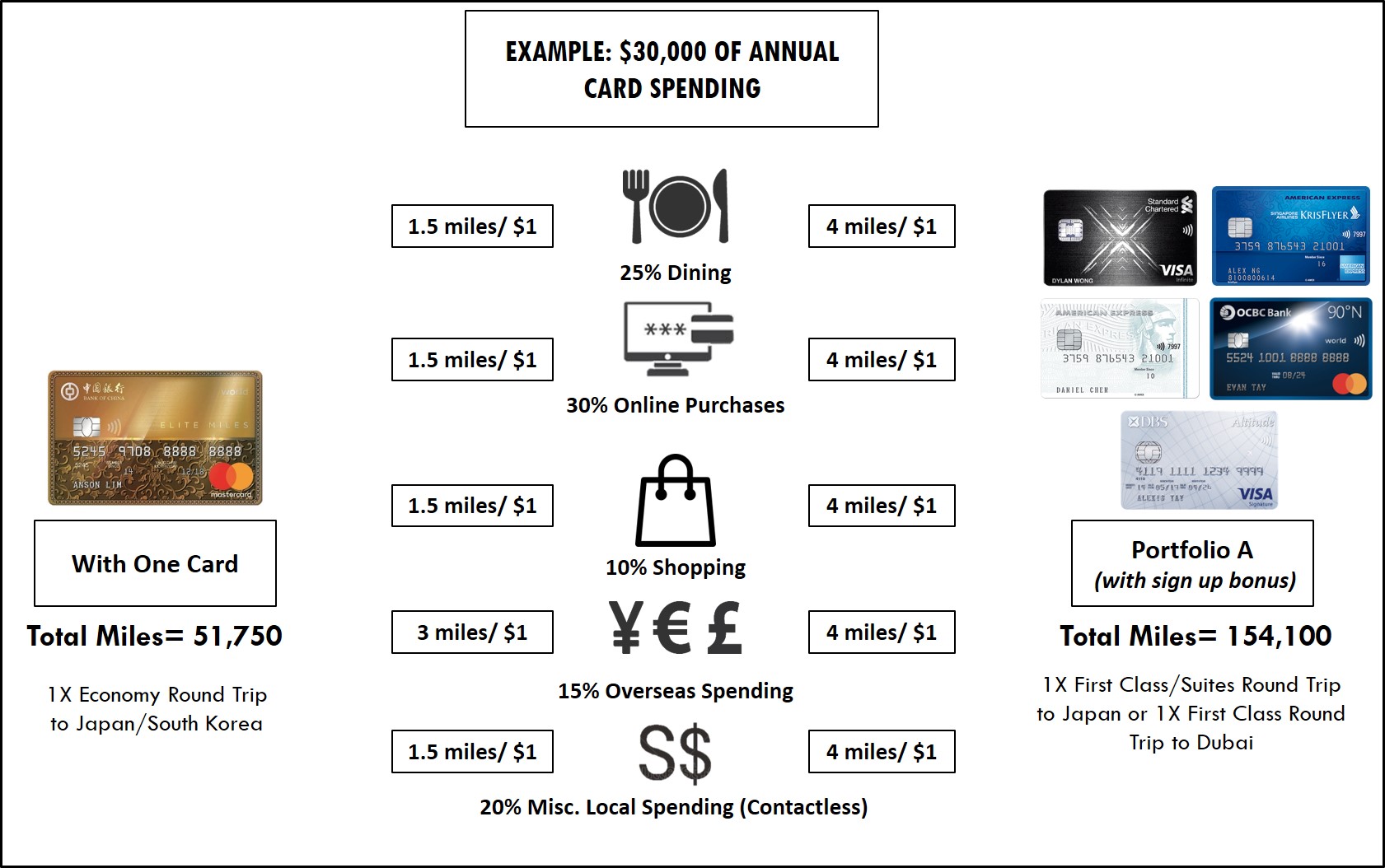

Let’s say you’re just starting off in the miles game, and want to use one card for everything. You’ve done your research and feel pretty good about picking one of the highest earning miles cards in the market- the BOC Elite Miles World Mastercard (clearly, you don’t mind drama). You like the fact that you’ll earn 1.5/3.0 mpd on local/overseas spending, significantly more than other cards like the DBS Altitude or UOB PRVI Miles.

Now assume you spent $30,000 over the course of a year, split into 25% on dining, 30% on online purchases, 10% on shopping, 15% overseas and 20% on miscellaneous spending. All in all, you’d have 51,750 miles by the end of the year. That’s a decent haul, enough for a round-trip Economy Class ticket to Tokyo.

But consider the alternative. Let’s say you looked to maximize your sign up bonuses, and applied for five different cards- the SCB X Card, Citi PremierMiles Visa, AMEX Rewards Card, OCBC 90N and DBS Altitude. The same $30,000 of spending would yield 154,100 miles in total, almost 3 times the miles. That’s enough for a round-trip Suites ticket to Tokyo, with 14,100 miles to spare.

| Working (Includes base + bonus miles) |

|

Now, you could point out that someone who follows this strategy will have to pay a total of ~$800 in annual and conversion fees. That’s fair enough, but put it another way-if I stood at the check-in counter and offered Economy Class passengers to Tokyo 14,100 miles plus an upgrade to Suites on both legs for $800, I’d have no shortage of takers.

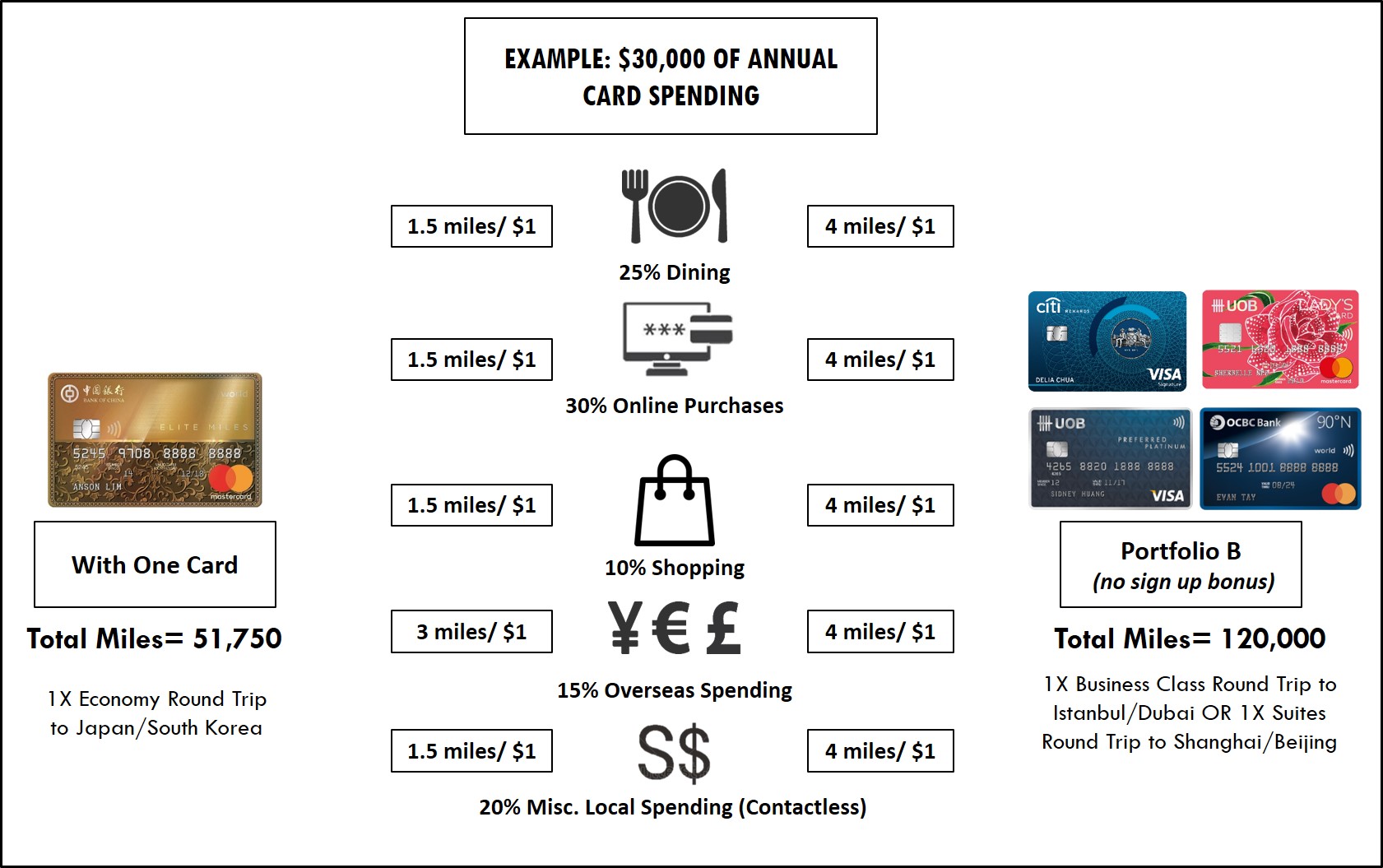

Even if you don’t qualify for sign up bonuses, you could still adopt the strategy below and earn more miles by using the right card in the right situation:

- Citi Rewards Visa for online purchases and offline shopping

- OCBC 90N for overseas spending

- UOB Lady’s Card for dining (only available for women, but let’s go with that for argument’s sake)

- UOB Preferred Platinum Visa for contactless spending

In a best case scenario, you’d have up to 120,000 miles, less than with sign up bonuses but still significantly more than with a one card strategy. To put that into perspective, it’s enough for a round-trip Suites ticket to Shanghai (where you can try the 2017 Suites on SQ833/830), quite the upgrade from an Economy Class jaunt to Japan/South Korea.

What this illustrates, I hope, is that the convenience of a one card strategy comes at a hefty cost.

Viable one card options

Now, if in spite of everything I’ve said you absolutely, positively must use one card for everything, then you’re going to want to look at general spending cards that at least incorporate a range of specialized spending bonuses.

| Card | General Spend | Special Spend | Remarks |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply here | 1.2 mpd (local and foreign) | 3 mpd on SIA-group, dining, food delivery, transport, travel | Min. S$500 spend on SIA Group per year |

DBS Altitude DBS AltitudeApply here | 1.2 mpd (local) 2.0 mpd (foreign) | 3 mpd on online airfare and hotel bookings | Capped at S$5K per month |

It’s important to highlight that the specialized spending bonuses on general spending cards will still pale in comparison to outright specialized spending cards. This is not optimizing; it is making the best of a sub-optimal situation.

Conclusion

Can I use one card for everything? Yes, but you won’t get anywhere fast. It’s kind of like buying a washer dryer. It’s convenient, but the drying will never be as good as a stand-alone dryer (something I’ve discovered to my chagrin over the past few months).

| Want to earn miles fast? There’s no need to jam 10 cards into your wallet- check out our Miles Game Starter Pack for a quickstart guide |

Look, it’s not that miles chasers love complicating their lives. We don’t. If there were really a card that gave you awesome earning rates on everything, we’d be all over it so fast.

Unfortunately, that’s just not how this works, and we’ve accepted the implicit deal that the cost of a free flight is some short term headache in applying for, tracking and maintaining multiple cards.

But trust me, when you’re sitting in Business Class with a glass of champagne, that’s the last thing you’ll think about.

Another awesome piece, Aaron.. If only I had this piece five years ago… That’s okay tho… not wasting/ throwing away miles anymore.. or at least much much less (when using wrong card, or get caught by wrong MCC)…

Thanks, Aaron! 🙇🏻♂️🙇🏻♂️🙇🏻♂️

haha we all make mistakes when we first start. i remember how happy i was putting everything on my trusty ol’ capitaland debit card…

Hi thanks for sharing.

So what are the top three card do you use personally?

on a day to day basis probably my uob ppv (contactless), boc elite miles (love hate relationship with it, but need the spending for bonus on my boc smartsaver) and whatever specialized spending card the situation dictates

Thanks for replying.

PPV is my first go to card. although general spending is UOB priv so i can consolidated all the Uni. 90N for oversea for now.

Oh yes forgot the 90n. Yup that’s my default for fcy

Hi Aaron what is the updated version now of the cards you use?

Hi Aaron, I’m curious on your dryer situation. Do you intend to switch out the 2-in-1 machine for a stand-alone dryer?

The amount of non-miles information I’ve gained from reading your article is immense.

Hahahaha yes. Moving to my permanent house in dec and a stand alone dryer is awaiting delivery. Never again with the combination machines

also with separate dryers and washers you can do 2 loads at once!

Just wondering, what about those who is not a high spender who only spend $700 / month + only travel once a year? If using multiple card strategies, will there be a risk of orphaned miles?

I belived multiple card strategies will only work if you are a big spender (e.g $1500 to $2000 / month) because there is a minimum block of miles (e.g 10,000 miles) required to perform a transfer?

fair point- your equation will change a bit if you’re spending $700 a month. however, even if you are you still shouldn’t be using one card- try and focus your spending with a bank that pools points, eg uob. uob prvi miles + uob pp visa + uob lady’s card (if you qualify) would already be much better than just uob prvi miles.

Noted. For DBS case would be DBS Altitude + WWMC. Right?

Bingo

WWMC is only 12 months validity.

Need to keep a watch and ensure you have sufficient to redeem the min block.

Yea noted. The 1 year validity of WWMC is pretty much risky, in case if cannot hit the 10,000 miles block within a year.

I redeemed what DBS points I could in March to take advantage of the spontaneous escapes, but it still means I have some points expiring in Dec this year. Is DBS flexible about extending the miles validity?

I have the exact same spending pattern as you, except that most of my spending is in a non-bonus category (google play in-game purchase). So I’ve stuck to using PRVI miles so far. UOB did send me the woman’s card, so I’ll probably use it for simplygo (now that I know UOB pools points).