Pop quiz: How many American Express Singapore Airlines cobrand cards are out there?

Most people would be able to name the AMEX KrisFlyer Ascend and AMEX KrisFlyer Credit Card (colloquially known as the AMEX KrisFlyer Blue), but there’s actually two more: the AMEX Solitaire PPS Card and AMEX PPS Card.

As the name suggests, these are reserved for Solitaire PPS Club and PPS Club members respectively. Given their limited audience, they’re understandably less well-known.

I’ve written a fair bit about the AMEX KrisFlyer Ascend and AMEX KrisFlyer Credit Card, but hardly anything about the AMEX Solitaire PPS and AMEX PPS Credit Card. So whether you’re a Lifetime Solitaire PPS who’s seen it all, or a newly-minted KrisFlyer member who’s curious about life behind the curtain, let’s take a closer look at the features and benefits of these two cards- does membership really have its perks?

Overview: AMEX Solitaire PPS & PPS Credit Cards

Here’s a quick summary of the key features of both the AMEX Solitaire PPS and PPS Credit Cards.

You must be a principal Solitaire PPS Club member (supplementary members do not qualify) or a PPS Club member to apply for these cards.

Income requirements

Surprisingly enough, even though the AMEX Solitaire PPS Card and AMEX PPS Card are positioned at the top of the cobrand hierarchy, their income requirement of S$30,000 is below that of the AMEX KrisFlyer Ascend.

I suppose the implicit thinking is that if you’re able to qualify for the PPS membership, your income isn’t really an issue.

Annual fees

Even if income requirements are low, the annual fees more than act as a filter. Both the AMEX Solitaire PPS Card and AMEX PPS Card have S$556.20 annual fees, which would put them in the wheelhouse of the $120K card segment!

That’s tough to justify, given that $120K cards typically offer perks like an unlimited Priority Pass (yes, you get lounge access as a PPS member, but only when flying on Singapore Airlines or Star Alliance partners), airport limo transfers, and miles for paying the annual fee, all of which are missing here.

At least a first year fee waiver is available for both cards, but only if you do not currently hold any other cobrand American Express Singapore Airlines cards. Therefore, someone upgrading from the AMEX KrisFlyer Ascend to the AMEX PPS Card would still have to pay annual fee.

Earn rates

Earn rates for the AMEX Solitaire PPS Card and AMEX PPS Card are rather convoluted.

Both cards earn 1.3 mpd on the first S$3,800 of spending per calendar month, whether in local or foreign currency.

| 💳 Spending up to S$3,800 per month | ||

|  | |

| AMEX Solitaire PPS Card | AMEX PPS Card | |

| Local | 1.3 mpd | 1.3 mpd |

| Foreign | 1.3 mpd | 1.3 mpd |

For spending above S$3,800, the local and overseas earn rate increases to 1.5/1.4 mpd and 2.4/2.0 mpd for the AMEX Solitaire PPS Card/AMEX PPS Card respectively.

| 💳 Spending beyond S$3,800 per month | ||

|  | |

| AMEX Solitaire PPS Card | AMEX PPS Card | |

| Local | 1.5 mpd | 1.4 mpd |

| Foreign | 2.4 mpd | 2.0 mpd |

While these are competitive rates in and of themselves, there’s three major caveats to highlight.

First, the higher earn rates only apply to every S$1 spent above S$3,800. In other words, if you spend S$4,000 on the PPS Credit Card, you’ll earn S$3,800 x 1.3 miles + S$200 x 1.4 miles. This means that your blended earn rate will always be lower, because of the “drag” imposed by the first S$3,800.

| 💳 Example: Weighted Average Earn Rates | ||

|  | |

| AMEX Solitaire PPS Card | AMEX PPS Card | |

| S$3,000 FCY spend | 1.3 mpd | 1.3 mpd |

| S$5,000 FCY spend | 1.56 mpd | 1.47 mpd |

| S$10,000 FCY spend | 1.98 mpd | 1.73 mpd |

Second, local and foreign currency spending is not cumulative for the purposes of determining whether the S$3,800 minimum spend has been hit. In other words, you’ll need to spend more than S$3,800 in local currency alone to unlock the higher earn rates.

Third, Singapore Airlines and KrisShop purchases do not count towards the S$3,800 minimum spend.

Those are some very stingy rules indeed, and since there are other general spending cards which offer the same rates without all this hoop jumping, I don’t see a lot to get excited about here. Don’t forget, you can earn up to 4 mpd on Singapore Airlines tickets with other cards!

What about the Singapore Airlines perks?

AMEX Solitaire PPS and PPS Cardholders are eligible to unlock certain Singapore Airlines perks based on their spending. You might notice these are somewhat similar to PPS Rewards.

Double KrisFlyer miles voucher

AMEX PPS Cardholders who spend at least S$15,000 on Singapore Airlines tickets via singaporeair.com or the Singapore Air mobile app from 1 July to 30 June each year of membership will receive a double KrisFlyer miles accrual voucher.

All tickets must originate in Singapore, and be purchased in Singapore dollars to count towards the S$15,000 minimum spend.

This voucher allows members to double the KrisFlyer miles they earn on eligible flights, capped at 10,000 miles. For example, if a K class ticket normally allows you to earn 50% of the miles, you’ll earn a further 50%.

This voucher can only be used by the cardmember, and is valid on bookings with a maximum of two flight segments. Both segments must include Singapore as a departure or arrival point, and the flights must be operated by Singapore Airlines. Only KrisFlyer miles are doubled; elite miles and PPS value stay the same.

While bonus miles are nice, I certainly wouldn’t consider this benefit to be a game-changer. In fact, I’d view it as “compensation” for missing out on 4 mpd opportunities when using the PPS Credit Card to buy Singapore Airlines tickets.

S$15,000 of spending means an opportunity cost of up to 30,000 miles (based on a 2 mpd differential), so 10,000 miles doesn’t even begin to make up for it.

50% off KrisFlyer miles redemption voucher

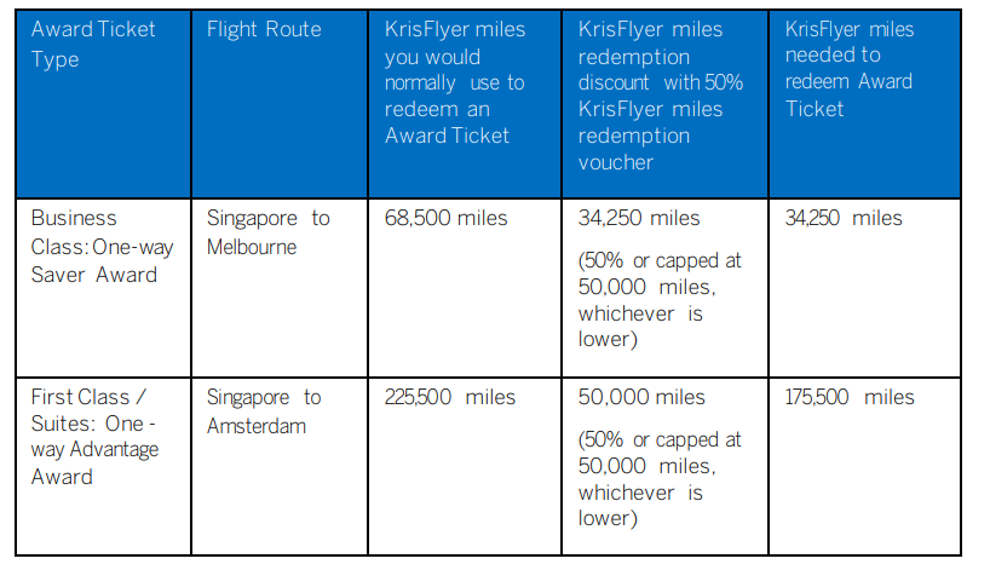

AMEX Solitaire PPS or PPS Cardholders who spend at least S$75,000 from 1 July to 30 June each year of membership will receive a voucher for 50% off a redemption booking in any class, capped at 50,000 miles.

The voucher can be used for the cardholder or a redemption nominee, but is only valid for a single passenger. Bookings can have a maximum of two flight segments, and both must include Singapore as the arrival or departure point.

You can only use the voucher for flights operated by Singapore Airlines; it’s not valid for Star Alliance or other partner redemptions. The voucher cannot be combined with any other discount or promotion, so you can’t use it on a Spontaneous Escapes award, for example.

Here’s an illustration of how the benefit works:

As much as I’d love to save 50,000 miles off a redemption, S$75,000 is a significant amount of spending, with the corresponding opportunity cost. Assuming all that S$75,000 could have been put on 4 mpd cards, 50,000 miles wouldn’t even scratch the surface.

One sector Business to First Class upgrade voucher

AMEX Solitaire PPS Cardholders who spend at least S$50,000 on Singapore Airlines tickets via singaporeair.com or the Singapore Air mobile app from 1 July to 30 June each year of membership will receive a one-sector upgrade voucher from Business to First Class.

This voucher only applies to commercial bookings (i.e. not redemption tickets) in the J, C, U or Z booking classes, and only for flights operated by Singapore Airlines.

An upgrade is a nice treat, but having to spend S$50,000 on Singapore Airlines tickets to unlock it? I’m sure members of other frequent flyer programs are shaking their heads right now- while Emirates Skywards and Cathay Marco Polo elite members enjoy regular upgrades, Singapore Airlines elites really have to earn theirs the hard way.

Are these perks worth having?

Quite frankly, I don’t think any of these vouchers are worth earning.

It’d be one thing if they came with the annual fee, but you also need to spend as much as S$75,000 to unlock them. This makes it a bad proposition in my book, since the opportunity cost of spending alone would offset most if not all of the benefit.

Put it another way: the AMEX Solitaire PPS and PPS Credit Cards cost more than a Citi Prestige, and require you to spend an eyewatering amount to earn vouchers which rebate a fraction of the miles you could have earned from channelling your spending elsewhere!

Conclusion

If you’re willing to put in the legwork to come up with a credit card game plan and optimise your spending, you won’t find much use for the AMEX Solitaire PPS or PPS Credit Cards. And even if you’re a die-hard “one card” person, you’ll arguably find better value elsewhere.

Therefore, unless there’s some hidden benefits I’m unaware of, my advice would be to stick to the regular AMEX cobrand cards.

On a largely theoretical point because it doesn’t do much to change your conclusion, the PPS card analysis should take into account the vouchers are cumulative, ie spend $75k and you get vouchers worth 60k #nitpick As an aside, given sq’s general approach to upgrades (I have no status but still I am 0% on upgrades with SQ. Meanwhile, similarly no status but I am 100% on upgrades with air France (1 from 1)), was amused at a promotion sq ran recently – buy return bkk-sin economy tickets with MasterCard (can’t remember if it had to be flex or any… Read more »

Having the AMEX platinum charge card offsets the annual fee so if you have the charge card then no annual fee and if you earn less the 120k then this is an option

Seem to me that this more of a status symbol card. Look I am PPS and I am qualified for this card

Look I earn more than $x a year and I qualified for the AMEX Platinum. And the list goes on. Doh.

This is not a status symbol card if you have a car. PPS AMEX is a platinum Amex card. This has been the best option for petrol in Singapore. SPC 21% off and 1.3mpd. No need to collect points (like Shell), no need to use apps, no need to watch total monthly spends, no orphan points because of automatic mile conversion so no need to feel pressured to add non-petrol spend on this card. And you can give 2 free supplementary cards to family members so cheaper petrol for everyone and more miles for the principal. And no annual fee… Read more »

yup, solid points here. i was about to mention sinopec but they have 2 locations, so it’s not going to be an option at all for many people.

With COVID the perks like 50% miles and Double mile accrual is not useful and do hope AMEX and SQ can tweak the benefits for this year. I actually hit $75k spend and got the 50% mile redemption but really not sure I can use it. For the $15k spend on SQ I actually hit $12.5k in Feb and would have achieved the double mile accrual on a regular year but by Mar all SQ spend had stopped. Called AMEX about it and they so kindly extended the timeframe from 30 June to 30 Sep. I totally laughed at their… Read more »

Is there a typo?

in the first table you wrote 2.0MPD for QPPS and 2.4 for PPS.

but in the second table the other way round for FCY

typo. fixed, thanks!

You can just focus on being a credit card analysis. Rather than spamming different cards for application why not just focus let the audience know which card provide best mpd 🙏 and obviously not lead them in the wrong direction hopefully

there’s no one size fits all strategy. Everybody has different spending behavior and preferences.

somebody who’s spending a lot more on retail would have a different strategy than someone spending on dining. someone who drives a lot would care more about petrol discounts than someone who grabs/gojeks everywhere. you get the picture.

No Ken, I enjoy these articles – why don’t you just close your eyes if you’re not interested. Besides, he’s already told you which card to use for a whole multitude of MCCs hasn’t he?

I’m a PPS solitaire supp member and I got the card

The PPS card is actually better than it seems as they sometimes send “spend x get a gift” promotions (in addition to the normal Amex offers). Also, not many exclusions.

So, while I don’t think it’s worth the annual fee, I’ll definitely keep the card as long as they keep waiving the fee.

Hi Aaron, thanks for the analysis. Do you know what happens to the card when the cardholder loses the PPS status with SQ?

from what i hear- nothing. you just keep the card (and its benefits) till the card expiry date. update: got an official reply from AMEX To apply for the Amex Singapore Airlines PPS Club Credit Card, the applicant needs to be an existing Singapore Airlines PPS Club principal member. To apply for the Amex Singapore Airlines Solitaire PPS Credit Card, the applicant needs to be an existing Singapore Airlines Solitaire PPS Club principal member. Upon approval of the Card, membership is valid for 2 years, after which continued membership is subject to the Card Member having a valid Singapore Airlines… Read more »