Back in October 2019, Citibank started running a new series of sign up bonuses on the Citi PremierMiles Visa card, which were set to end on 31 January 2020.

These offers have now been extended to applications received by 31 March 2020, with some minor changes.

New-to-bank customers

New-to-bank customers have a choice of two possible bonuses- one if they pay the annual fee, the other if they request a waiver.

| Citi defines a new-to-bank customer as someone who does not currently hold a principal Citi credit card, and has not done so in the past 12 months |

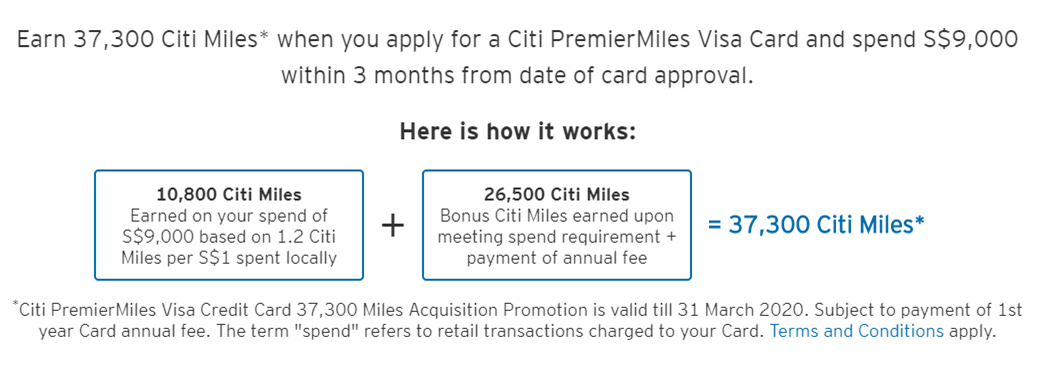

Fee paying: Spend S$9K, Get 37.3K miles total

New-to-bank customers who get approved for the Citi PremierMiles Visa card and spend S$9,000 within 3 months of approval will receive a total of 37,300 miles, provided they pay the S$192.60 annual fee.

| Remember that Citi’s definition of “3 months” is rather generous- the qualifying period starts from the date of your card’s approval to three months after the end of the month you were approved. So if you were approved on 5 Feb 2020, for example, you’d have until 31 May 2020 to hit the qualifying spend. |

This is slightly less than the previous 40,000 miles offer, and the reason for the difference comes from the base miles. Until 31 December 2019, the Citi PremierMiles Visa awarded 1.5 mpd on local spending provided the cardholder spent at least S$3,000 in a statement month. That’s since been reduced to 1.2 mpd, so the net loss in miles is 2,700.

Here’s the breakdown of the total miles:

| Old Offer | New Offer | |

| Base Citi Miles | S$9,000 @ 1.5 mpd= 13,500 | S$9,000 @ 1.2 mpd= 10,800 |

| Citi Miles from paying S$192.60 annual fee | 10,000 | 10,000 |

| Bonus Citi Miles | 16,500 | 16,500 |

| Total Citi Miles | 40,000 | 37,300 |

The T&C for this sign up offer can be found here.

You can apply via SingSaver to get S$200 of cash as a new-to-bank customer, provided you click through the link below:

Get S$200 cash when you apply for the Citi PremierMiles Visa (pay annual fee)

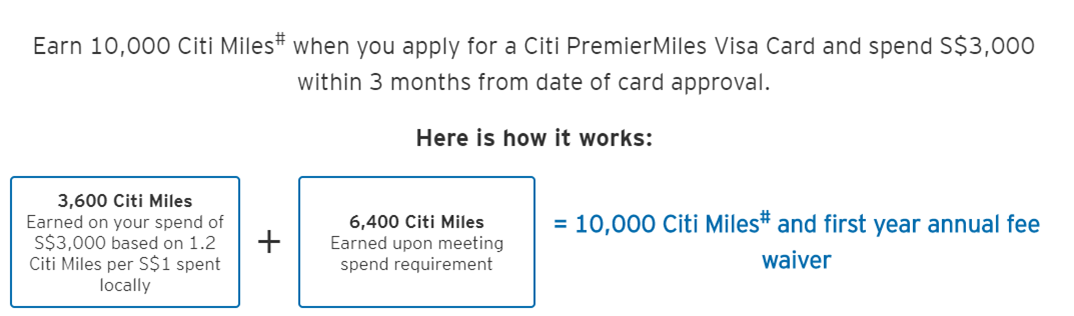

Fee waiver: Spend S$3K, Get 10K miles total

New-to-bank customers who prefer not to pay an annual fee get a sign up bonus too, but smaller.

By spending S$3,000 within 3 months of approval, they’ll earn a total of 10,000 miles. This is broken down into:

- 3,600 base miles from spending S$3,000 @ 1.2 mpd

- 6.400 bonus miles for meeting the spending requirement

The T&C for this sign up offer can be found here.

You can apply via SingSaver to get S$200 of cash as a new-to-bank customer, provided you click through the link below:

Get S$200 cash when you apply for the Citi PremierMiles Visa (annual fee waiver)

Existing customers

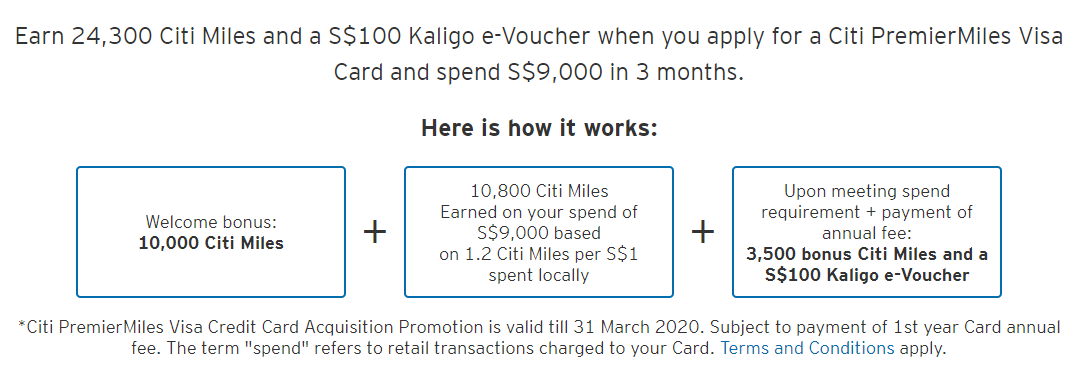

Fee paying: Spend S$9K, Get 24.3K miles total + S$100 Kaligo e-voucher

Existing customers can pay the first year fee and spend S$9,000 within 3 months of approval to get 24,300 miles and a S$100 Kaligo.com e-voucher. The 24,300 miles are broken down into:

- 10,000 miles for paying the S$192.60 annual fee

- 3,500 miles for meeting the spending requirement

- 10,800 base miles from spending S$9,000 @ 1.2 mpd

The Kaligo.com e-voucher comes with a few strings attached so do take note. You’ll need to go to www.kaligo.com/100gift to spend the voucher, and your stay must be at least 2 nights. The voucher is valid till 30 June 2020.

The T&C for this sign up bonus can be found here.

You can get S$30 cash if you sign up through SingSaver. However, if you opt for this you won’t get the Kaligo voucher or the sign up bonus offer.

Fee waiver

Existing customers can also opt for a waiver of the first year’s annual fee. If so, that’s all you get- no bonus miles, no nothing.

Applying through SingSaver still gives you S$30 cash.

Get S$30 cash when you apply for the Citi PremierMiles Visa (annual fee waiver)

What counts as qualifying spend?

Qualifying spend refers to retail transactions charged to the card, and excludes the following:

|

Other payments like insurance, education or government services will count towards the S$9,000 threshold, but will not earn any base points.

Citibank has confirmed that spending on Citi PayAll will count towards the S$9,000 spending requirement, which is good news for those with rent, education expenses, taxes or condo fees to pay.

| Cost per mile @ 1.2 mpd | |

| 1.67 |

| Based on 2% admin fee, certain Citi customers may be targeted for lower rates | |

Citi Miles are one of the most valuable transfer currencies in Singapore

Citi PremierMiles Visa cardholders get access to 11 different frequent flyer programs and one hotel partner, the widest selection of any bank in Singapore.

| Transfer Ratio | |

Singapore Airlines KrisFlyer Singapore Airlines KrisFlyer | 1:1 |

| 1:1 | |

| 1:1 | |

Etihad Guest Etihad Guest | 1:1 |

EVA Air Infinity Mileagelands EVA Air Infinity Mileagelands | 1:1 |

Flying Blue Flying Blue | 1:1 |

IHG Rewards Club IHG Rewards Club | 1:1 |

Malaysia Airlines Enrich Malaysia Airlines Enrich | 1:1 |

Qantas Frequent Flyer Qantas Frequent Flyer | 1:1 |

Qatar Airways Privilege Club Qatar Airways Privilege Club | 1:1 |

Thai Airways Royal Orchid Plus Thai Airways Royal Orchid Plus | 1:1 |

| 1:1 |

A S$25 conversion fee applies for every transfer, and do note that Thank You points earned on the Citi Prestige/Citi Rewards cards do not pool with Citi Miles, so you’ll have to redeem them separately.

The flexibility of Citi Miles means they’re a great way to enjoy sweet spots in programs like Etihad Guest, British Airways Avios and Turkish Miles&Smiles.

For example, you could redeem a Singapore to Europe round-trip Business Class flight for just 90,000 miles with Miles&Smiles. That’s half the price that Singapore Airlines charges (albeit with fuel surcharges), which means you could fly two people with Miles&Smiles for the cost of flying one with KrisFlyer.

Recap: Citi PremierMiles Visa Basics

| Income Req. | Annual Fee | Miles from Annual Fee | FCY Fee |

| S$30,000 | S$192.60 | 10,000 | 3.25% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 1.2 mpd | 2.0 mpd | Agoda: 7.0 mpd | No expiry |

The Citi PremierMiles Visa earns 1.2 mpd on local spend and 2.0 mpd on overseas spend. You can also book hotels and earn up to 7 mpd on Agoda. Citibank awards points on every dollar of spending, and the minimum spend to earn points is S$1.

The Citi PremierMiles Visa comes with a Priority Pass membership that provides two complimentary visits per calendar year. Note that this is slightly different from most other credit cards on the market, which award their free visits per membership year.

Conclusion

The Citi PremierMiles Visa is a solid general spending card to have in your wallet- in fact, it’s one of the options in my Miles Game Starter Pack for anyone just getting into the miles and points game.

If you’re a new-to-bank customer, you can also consider the ongoing Citi Rewards Visa sign up bonus instead. This gives you up to 22,800 miles for spending S$3,000, and does not require the payment of the annual fee. The catch is that you can only spend on 10X categories to earn the 22,800 miles, but it isn’t that difficult given that all online transactions (except travel) earn 10X.

I’ve updated the post on current credit card sign up bonuses in Singapore to reflect this latest information.

Hi Aaron,

I’m keen to sign-up but I’m torn between Citi PremierMiles and Citi Rewards Visa. Which one do you think is better? Appreciate if you can give me some advice. Thank you.

“Better” is incredibly subjective. What are you looking for? The Citi rewards visa is great for online spending (and grabpay top ups, however long that lasts for). The Citi premiermiles visa is a good general spending card that covers everything else. Nothing stopping you from getting a Citi rewards card for sign up bonus then a pmv with first year fee waiver