One of the most common questions asked whenever a new sign up bonus or card gets launched is “do PayPal transactions count?”

Will my spending on PayPal count towards the spending requirement? Will my PayPal transactions earn regular miles and points? Is sending money to a friend an eligible transaction? What if I pay a merchant through PayPal?

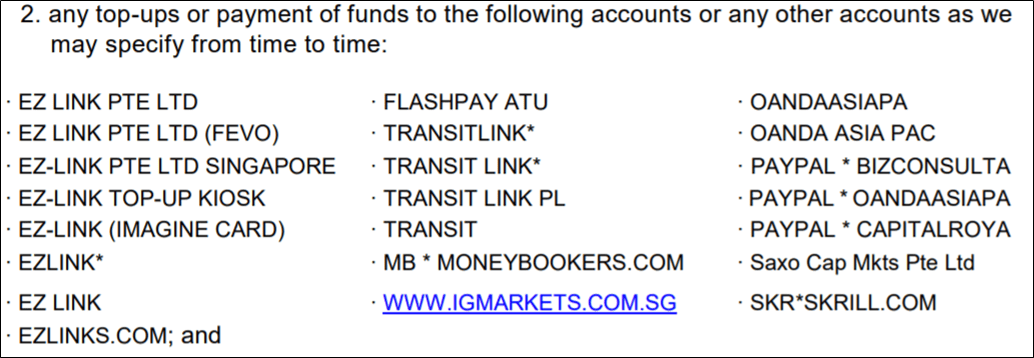

The confusion is understandable. If you read the T&Cs of most credit card sign up bonuses and rewards programs, you often spy PayPal listed among the exclusions.

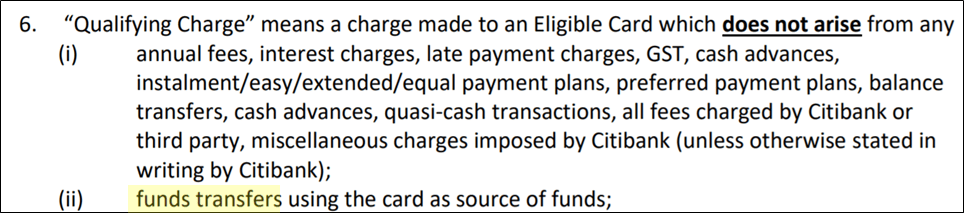

Even if PayPal isn’t explicitly listed, there tends to be a general exclusion for “fund transfers”. This actually has nothing to do with PayPal, but from the casual reader’s point of view, PayPal facilitates the movement of money from one party to another- that sure sounds like a fund transfer.

So how should miles chasers approach PayPal transactions?

What is PayPal’s MCC?

A lot of people begin by asking “what is PayPal’s MCC?” We’ll get to that in a minute, but you first need to understand how PayPal works.

There are two types of PayPal accounts:

- Personal

- Business

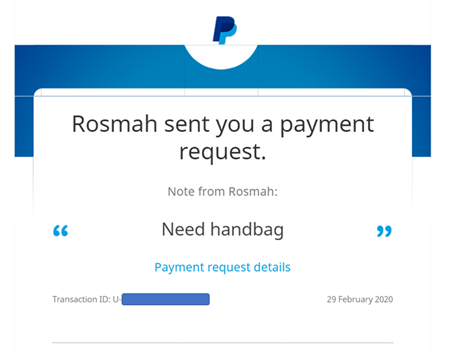

Sending money between two personal accounts is known as a P2P transfer.

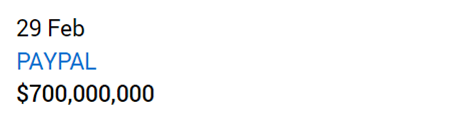

For example, Rosmah may request some funds from Najib (names have been changed to protect privacy), say, $700 million. If Najib has enough funds in his PayPal balance, the transaction is a mere internal debit/credit for PayPal and no external party is involved (except maybe INTERPOL).

If Najib does not have enough funds in his PayPal balance, he may use a credit card to top-up the difference. In this case, PayPal is the merchant of record; the transaction will code as a money transfer and won’t earn points on almost every credit card.

Transactions between a personal and a business account are known as B2C transactions.

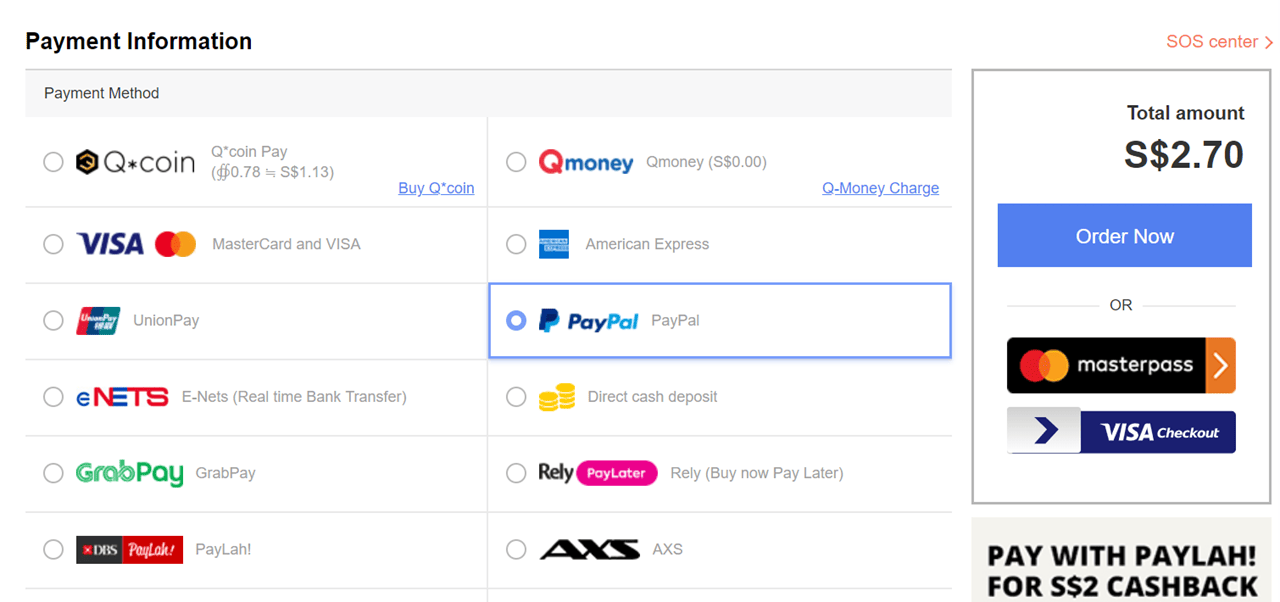

For example, you may make a purchase on Qoo10 and check-out using PayPal.

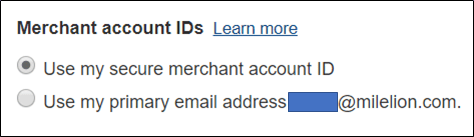

At the payment screen, you’ll see a note at the bottom showing how your transaction will appear on your card statement.

And indeed, when you go to your online banking portal, you’ll see exactly that:

Even though PayPal processes this transaction, the MCC reflects that of the underlying merchant, in this case Qoo10.

So in other words, there’s no point asking “what is PayPal’s MCC?” Instead, it’s more helpful to ask yourself “who am I sending money to?”

If you’re sending money to a friend’s personal PayPal account, this will code as a money transfer and won’t earn any rewards points. If you’re using PayPal for an e-commerce transaction, this codes as if you were paying the merchant directly using your credit card, and points are awarded accordingly.

| Note: Some Citi Rewards Mastercard users are reporting that they’re not earning any points on their PayPal transactions, notwithstanding the fact they’re to merchants and not personal accounts. I honestly don’t know why that should be the case, and it’s something only Citi customer service can explain. |

How do I tell whether the merchant is using a personal or business account?

It’s good to know how things work in theory, but how do I know in practice whether I’m paying a personal or business account?

With some merchants, it’s extremely obvious that you’ll be dealing with a business PayPal account. For example, there’s no chance Ebay, Qoo10, or ASOS are using personal PayPal accounts.

However, if you’re dealing with a blogshop or other small business, it’s not outside the realm of possibility that the owner never got around to setting up a business PayPal account.

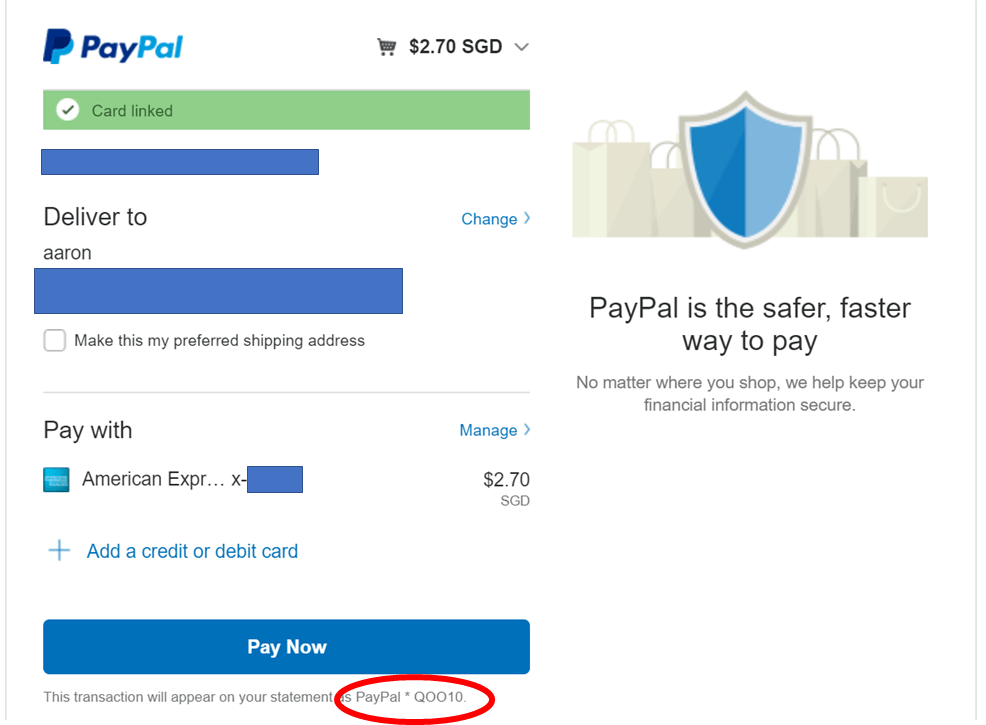

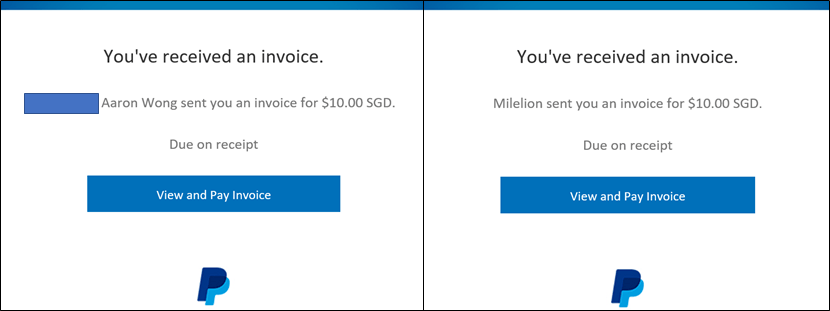

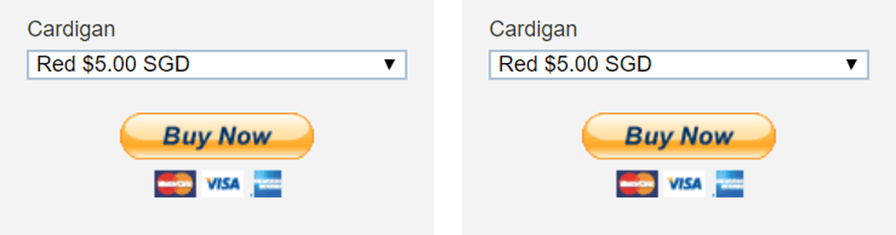

The problem is, invoices and payment buttons generated by personal and business PayPal accounts look identical.

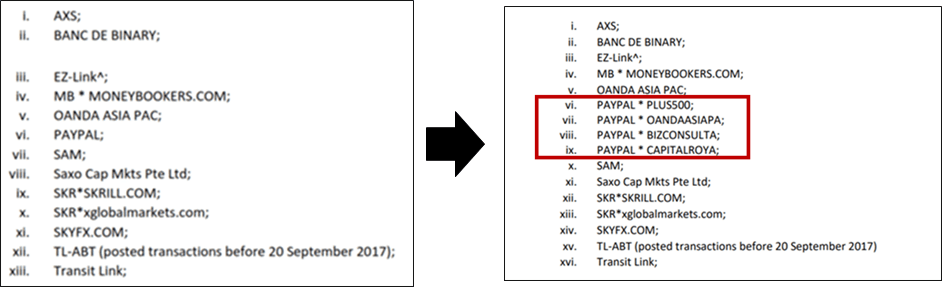

What you can do is navigate to the payment screen, and look at the top left hand corner. Check if a merchant’s name is displayed, or an email address.

If you see the merchant name, it must be a business PayPal account. Personal PayPal accounts don’t have the ability to list a merchant name.

If you see an email address, it’s probably a personal PayPal account. Business accounts can opt to display an email address instead of their merchant name if they wish, but the default option is to show the merchant name.

I can’t think of why any business would opt to display an email address instead of their merchant name, since it helps to reduce spam. Therefore, this can serve as a quick way of checking the nature of the underlying PayPal account.

As a side note, I’ve heard some people say that you can look at your card statement, and if it shows PayPal*(merchant-name), then it must be a B2C transaction. Not quite- it’s possible to generate invoices from a personal PayPal account, and still have them tagged as PayPal*(name-of-sender). That’s what I’ve shown in the dummy invoice below, which I generated from my personal PayPal account.

Conclusion

If all this PayPal stuff confuses you, you’re not alone- banks get confused too. All too many times, customers have been flat out told that PayPal transactions don’t earn points as they’re mobile wallet/fund transfer platform/non-retail transactions etc.

For example, during the recent SCB X Card sign up bonus, some CSOs were telling cardholders that all PayPal transactions (regardless of personal/business) would not count towards the spending requirement. This turned out to be incorrect, as many people happily reported on bonus crediting day.

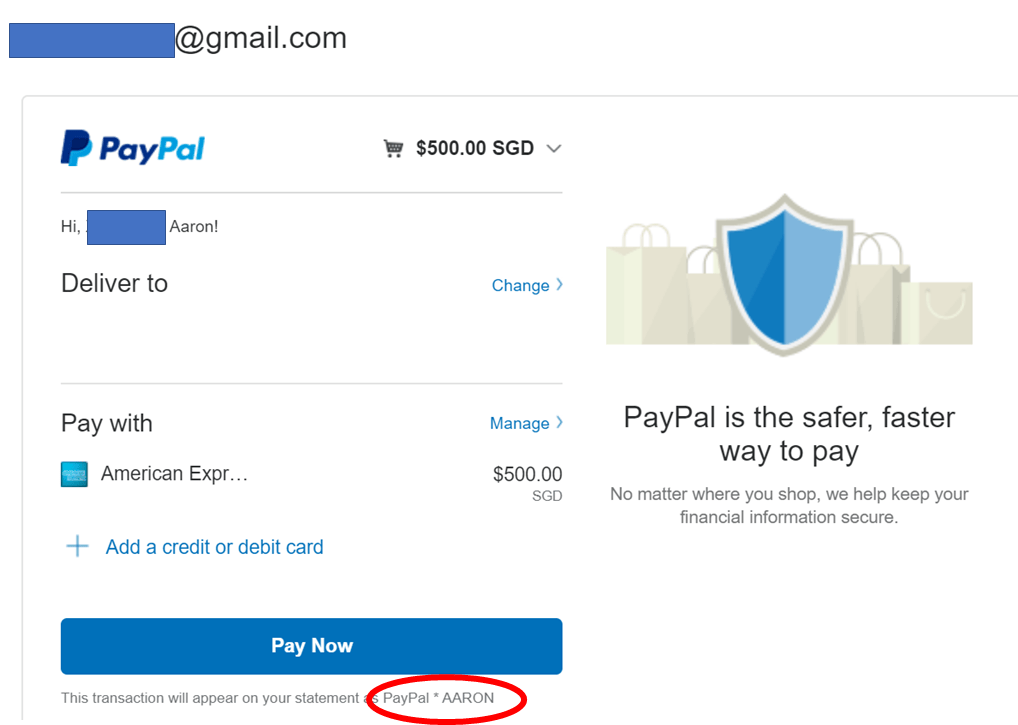

As another example, a year and a half ago Citibank released a new set of T&Cs which would exclude all PayPal transactions from earning points. Thank goodness they came to their senses and updated the T&Cs to exclude just the regular investment and money transfer merchants.

So if there’s so much uncertainty within the banks themselves, imagine what it’s like for consumers!

Even though I know “by right” what should happen with PayPal transactions, I still get very nervous when dealing with large amounts. Just recently, The Milelioness had a four-digit payment to make for a dental course, and after much deliberation, I decided to use the OCBC 90N (fortunately, it was an FCY transaction and I felt quite certain I’d get 4 mpd anyway).

If you’ve had other experiences with earning points on PayPal transactions, or know better ways of identifying personal/business accounts, do sound out below!

(HT: Thanks to Benjamin from the Telegram Group for providing some of the information used to craft this post)

great choice of pseudonyms 🙂

it was my random name generator, i swear.

I believe you

Thanks for the article !

I need to make a Paypal Transfer for around THB 170k. From the article, I managed to figure out the receiver (a clinic) is indeed a professional account; now the question is which credit card to use ?

I understand Paypal will take 4% conversion fee; does that mean my credit card will actually be charged in SGD (i.e. not considered as FCY expense ) ?

Thinking of using a FCY card (if it works), or get Amex KFA to get the bonus. Any thought ?

Thanks !

paypal will let you choose to be billed in FCY, and you should do that as their conversion rate will be crap. then you should use the card with the highest fcy payoff, eg boc elite miles/scb visa infinte/scb x card (with the 3 mpd bonus right now). otherwise, you can consider using a card which you’re trying to hit the sign up bonus on- just be careful that hospitals are not on the exclusion list

Thanks; for THB payment, I figured out AMEX credit cards can’t be used via Paypal.

If I use UOB VS, for SGD 2,000 equivalent, choosing FCY billing as you suggested, is there a risk that the payment venue becomes Singapore, making the expense ineligible for miles ?

Seems indeed that SCB VI could be a good choice here; I will then factor PayPal fee to get the all in cpm.

Should be safe with DBS WWMC? Any reports of failure to rewards 10x points?