I do love my Citi Rewards Visa.

Ever since last year’s enhancement where the card was tweaked to award 10X/4 mpd on all online transactions (except travel), it’s been a regular fixture in my virtual wallet. I use it for shopping, food delivery, subscriptions, and of course, the occasional crabhey bobup. The 8 mpd promos don’t hurt too.

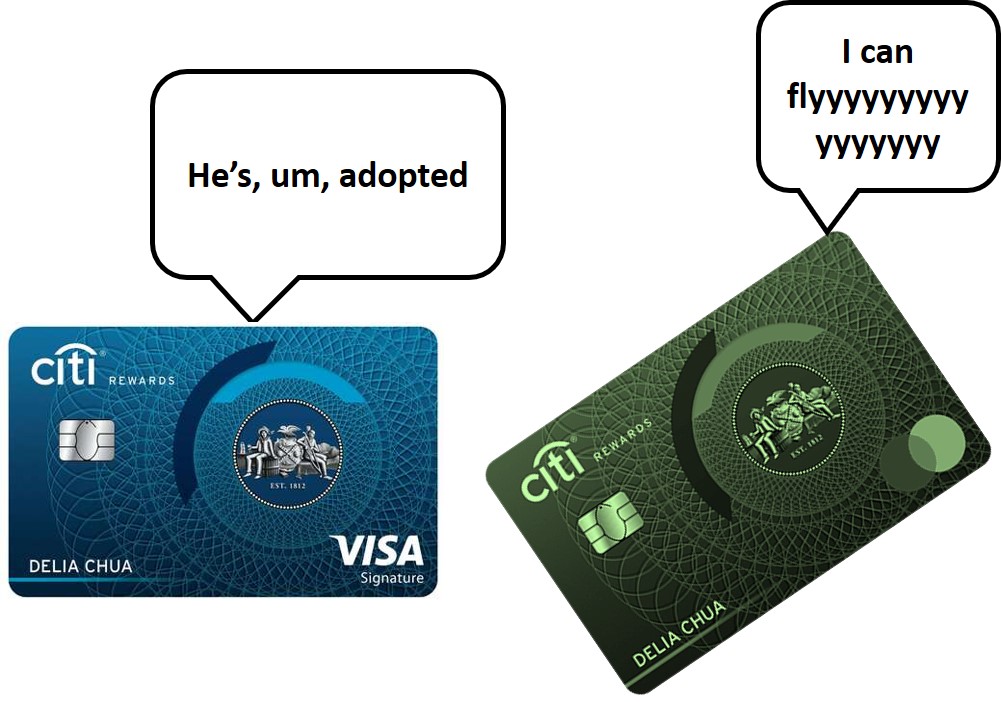

But the Citi Rewards Mastercard? That’s a totally different story.

What’s up with the Citi Rewards Mastercard?

On paper, the Citi Rewards Mastercard is every bit the same as its Visa brethren. It shares the same cardmember’s agreement, the same T&Cs, the same bonus categories, the same caps, the same card art. The only difference is the card association affixed to its bottom right corner.

That’s in theory, at least.

In real life, the miles community has long noted that certain transactions on the Citi Rewards Mastercard don’t earn the bonuses they’re supposed to. Some examples include:

- Amazon SG

- Circles Life

- Deliveroo

- Guardian Online

- iHerb

- foodpanda

- PayPal transactions to merchant accounts

- Playstation Network

- Ryde

- Taobao

| ☝️ This list is far from exhaustive, and YMMV. There are Citi Rewards Mastercard users who report getting 10X on foodpanda, for example, which further thickens the plot. |

These don’t run afoul of anything in the T&Cs, and earn 10X on the Citi Rewards Visa with no drama at all. And yet, something is lost in translation when it comes to the Citi Rewards Mastercard, where 1X is all you get.

That’s not to say the Citi Rewards Mastercard never does what it advertises- Comfort, Gojek, Grab, Lazada, Oddle, Qoo10, and Shopee have all been reported to work just fine. Also, the quirkiness sometimes cuts both ways. There was a period when the Citi Rewards Mastercard was inexplicably awarding 19X on certain merchants, instead of 10X. But more often than not, using the card feels like playing the lottery, one where the winners just receive what they were supposed to get in the first place.

Customers who complain to Citibank usually get the missing points credited on appeal, but this puts the burden of tracking points on them. Who knows how many take it on faith that the card will do, you know, what it says it’ll do, and never bother to check?

What’s more, appeals don’t always work. Here’s one particularly frustrating exchange a cardholder had when appealing for 10X points on Deliveroo and foodpanda:

| We acknowledge your inquiry regarding transactions that did not earn 10X Rewards. Please note that every transaction has its corresponding Merchant Code. I have indicated below the corresponding merchant category those transactions fell.

1) 8 April $11.29 Deliveroo – Eating Places and Restaurants These were not categorized under Online transactions. Hence, will not earn 10X Rewards. |

I really don’t understand how a payment on an app that requires an internet connection to work can be considered offline, but maybe he should count himself lucky. Some CSOs are still reading off the old script and insisting that the Citi Rewards card only earns 10X on “bags, shoes and clothes”.

Citibank’s response

I reached out to Citibank for a clarification, and got the following reply:

Each payment card network has their own processing systems and unfortunately, we do not have visibility on how certain merchants are captured in their systems. The respective associations may be better able to advise.

In other words- the problem lies with Mastercard, not us.

Now, I understand that the card-issuing bank has no control over MCCs. MCCs are issued by the merchant’s acquiring bank, and the onus is on them to assign the proper code.

| 💡 Although the acquiring bank is the one which ultimately assigns the MCC, they’re bound to follow the guidelines stipulated by the card associations (AMEX, Mastercard, Visa). If there’s reason to suspect a merchant has been assigned the wrong MCC (this can happen when an acquiring bank tries to solicit business by offering a merchant an MCC with a lower interchange fee), the card association can investigate and order the acquiring bank to rectify it. |

However, when a card’s bonuses are awarded based on an online/offline tag instead of MCC, surely there’s a lot less room for something to go wrong? There should be no question of miscategorization here- so long as the transaction is processed through an online payment gateway, it should get the bonus.

Furthermore, if the problem lies with Mastercard, it would stand to reason that we’d see the same issues with the DBS Woman’s World Card, which like the Citi Rewards, also uses the online/offline dichotomy as the basis for awarding bonus points. Yet I don’t encounter any difficulty earning 10X points on these transactions on my Woman’s card- what gives? Shouldn’t they be “consistently wrong”?

Perhaps someone who better understands payment processing could sound off.

Mastercard’s the only game in town

The quirks of the Citi Rewards Mastercard would be less of an issue if you could choose which version of the card you wanted. However, Citibank Singapore has stopped issuing Visa cards (except for co-brand products) since March 2020 as part of its global migration to the Mastercard network.

It means you can’t get your hands on a Citi Rewards Visa anymore, not unless you already had one before the switch.

| 💳 Existing Citi Rewards Visa cardholder? |

| Don’t worry, you’ll retain your card until expiry. Here’s a quote from a Citi spokesperson:

“In 2015 Citi announced a global partnership with Mastercard to align the company’s consumer proprietary credit and debit portfolios to the Mastercard network. As Asia’s largest credit card issuer this partnership will support further leadership in driving payments innovation. We have been working closely with our clients to ensure this seamless transfer will further make payments simpler, easier and more secure. Our customers can continue to use their existing cards till expiry. Upon expiration, we will seek customers’ consent on converting to a Mastercard and transfer their remaining rewards points to the new card.” |

It also means that existing Citi Rewards Visa cardholders need to carefully consider whether it just might be worth paying the S$192.60 annual fee. This doesn’t come with any renewal miles, so normally if I weren’t able to get a waiver, I’d cancel the card and reapply a few weeks later.

But that’s not a workable strategy anymore, now that the Visa version is dead. Either you pay the annual fee, or you say goodbye to the last card on the market that earns a bonus for slabkay hockups.

How to check your Citi points balance

The long and the short of it is those of you holding the Citi Rewards Mastercard absolutely need to get into the habit of tracking your points.

Here’s how to do it:

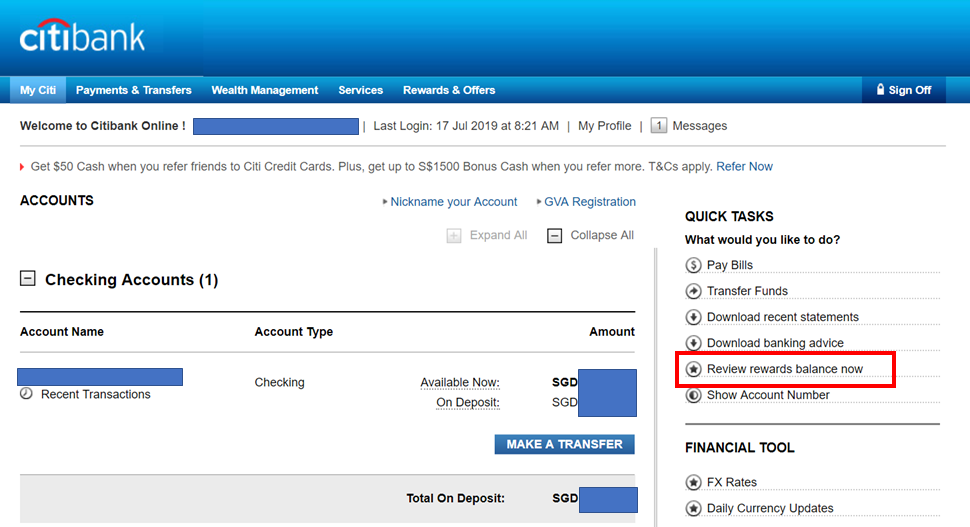

- Login to your Citibank account

- Click on “Review rewards balance now”

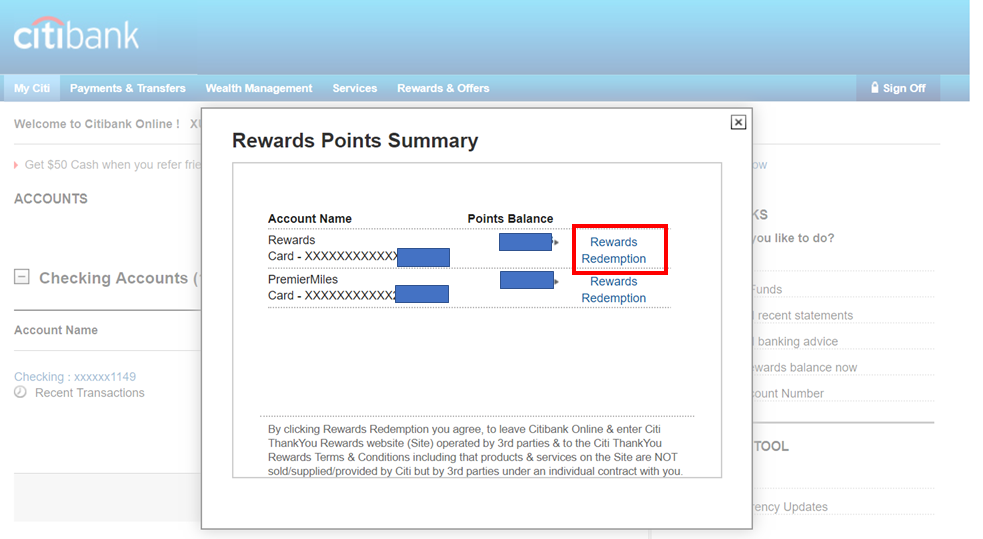

3. Click on “Rewards Redemption” next to the card account you wish to view

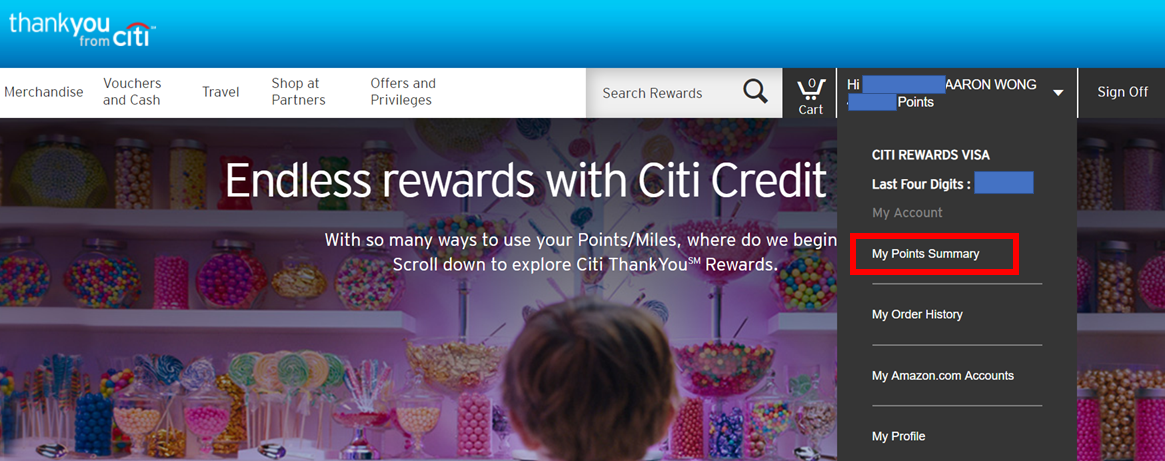

4. Hover the mouse over your name and points balance on the top right hand corner. Click on “My Points Summary”

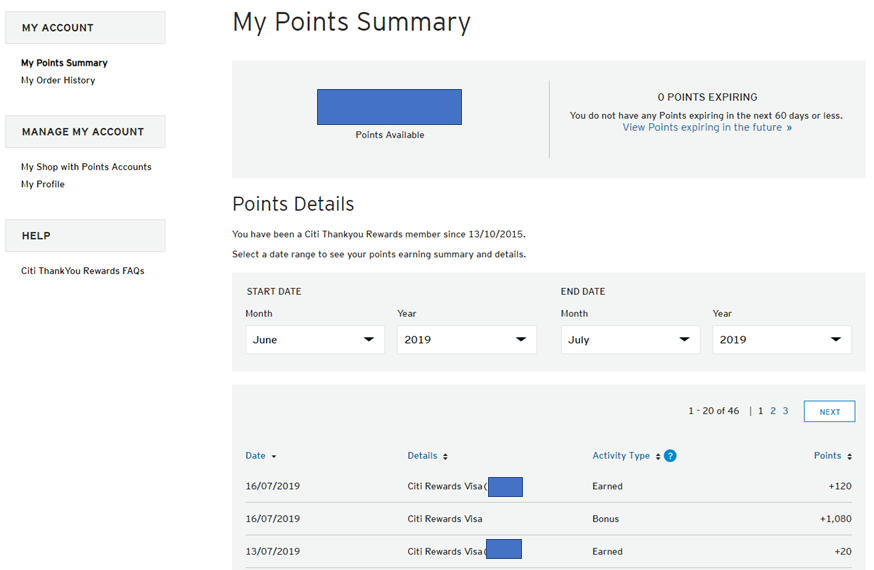

5. You can view your points breakdown all the way back till the date you opened your account

| ⚠️ Reminder: For 10X points on the Citi Rewards Visa/Citi Rewards Mastercard, both the base 1X and the bonus 9X will post together with the transaction |

Use the following formulas to reconcile your points:

1X: Round down transaction to nearest S$1, then multiply by 1.0

9X: Round down transaction to nearest S$1, then multiply by 9.0

While Citibank offers a more detailed points breakdown than other banks, it’s still far from ideal. That’s because they consolidate the points from all transactions that post on the same day.

For example, if I spent S$10, S$20, and S$30 on 10X categories and all three transactions post on the same day, I’d see a 60 base points figure (S$60 @ 1 point per S$1) and a 540 bonus points figure (S$60 @ 9 points per S$1). That assumes everything did indeed earn 10X as planned- there may be some disentanglement required otherwise.

If you’re interested in the formulas for calculating points on other specialized spending cards, be sure to check out our guide here.

Conclusion

The Citi Rewards Mastercard is temperamental, to say the least. If not for the fact that Citi points have so many useful transfer partners, I’d probably advise people to spare themselves the trouble and just use the DBS Woman’s World Card instead.

I don’t know whether the problem ultimately lies with Citibank or Mastercard, but I do know it doesn’t lie with the customer. Get it sorted, guys.

What other transactions have you had problems with on the Citi Rewards Mastercard?

No problems. I get my 10x points with Iherb using the mastercard.

Think some of them can’t count or have hit their cap.

They can’t even get their hotline sorted. Forget it.

While this article is on the Citi Rewards MC, Citibank is by far not the only bank that has this problem of correctly tracking online spends. DBS Womans World also doesn’t track spends at Google and iTunes as online – when queried their customer keeps saying it depends on how merchants pass through the transactions to the bank! How else is Google and iTunes anything but online?! I’ve lost steam just thinking of having to call them every month to regularise these correctly.

Every card has its quirks but you need to learn to work around them, not to fight them. The most probable reason why transactions at Google and iTunes don’t get 9X is that they are coded under subscriptions and professional services MCC, which is rightfully excluded for all DBS cards, and has nothing to do with whether these are online or not. However DBS is generous in the sense that they’ll credit you the points manually if you can provide the e-receipt, so appeal once, get the points, then switch to another card and move on. That’s how you play… Read more »

For DBS WWMC, must you really spend >$25,000 to obtain the fee waiver? Do you just cancel and reapply again?

Since points expire every year, I guess you would have to consistently do the transfer and they last a total of 4 years in total?

No, no, yes.

How much spending would typically qualify for a fee waiver for the WWMC?

normally they will waive once you request via their online weblink or phone tree menu.

So I wrote an online banking message to get my x9 points for an online transaction I made. The response I got simply stated my transaction did not qualify. I replied to the CSO stating of the revised T&Cs and that my transaction was online in nature. The response I got quoted the MCC code of my transaction and that it is not “bags, shoes and clothes”. I had to reiterate the revised T&Cs as it seems the CSO didn’t bother to read it up. I got a response stating they will investigate and revert. A week later, still nothing.… Read more »

I never get bonus points for purchases on Apple App Store or PlayStation Network. Didn’t bother to argue with CSO but simply switched to another general spending card.

This is the problem with specialized spend – it isn’t for the time-starved. I agree with drawar and Maxime Min. My own observations: 1. Earning miles is nice. But time is more valuable. Sometimes a high general spend is just easier. Fire and forget. 2. Best issuer for bonus categories is AMEX. The online tracking is exceptional. And the phone service is best in class outside of 500K cards – they even arrange to call you back at specific timeslots if they cannot resolve an issue during the first call. 3. Points that do not expire are actually pretty important.… Read more »

I don’t disagree with you, some people’s time is more valuable than the extra few miles that you can squeeze out. If you can’t be bothered to keep track of what cards for what purposes, you might benefit from the UOB krisflyer card, and put $500 of SIA spending on it. That gives you 1.2 mpd on gen spend and 3 mpd on online shopping, dining, transport, and SIA group spending.

That’s a good suggestion. Direct to KF miles so one less point expiry to remember even if the delayed miles seems fiddly. 3 mpd for dining and online is nice. Online travel (I’ll explain) and transport aren’t useful for me unless they include petrol. The interesting thing is points/miles really depend on one’s circumstances. My SQ revenue tickets are billed to Amex for the IAP discount (5-20%) although only about 2mpd, since SQ doesn’t offer 1-for-1 with any bank. Non-SQ full-price revenue tickets I try to bill to a 1-for-1 (about 40+% off) card if it’s cheaper than AMEX/IAP and… Read more »

I have a simple hypothesis and I hope Aaron can harness his contacts to verify. Let’s just assume banks and merchants are bona fife and they don’t change the mcc deliberately. Perhaps it depends on WHEN and HOW the merchants upload or process their claim (I’m not sure the exact description)? Customer pays, but there could be offline processing of receipts by merchants, thus offline? If there was STP, then it’s online. But if batched, then offline.

my recent transaction on foodpanda paid thru MC on 13 May, did not get bonus 9X. While another foodpanda transaction thru Visa on 16 May and checked today got their 9X. Baffled.

The irk i have on this 2 cards is, if Citibank, you are gonna treat them differently versus what is spelled out in the T&C, then jolly well put 2 sets of T&C. why bother to lump them all together in 1 T&C and when we complain, you simply ignore the wordings and condition (online requirement) that is clearly spelled out in T&C. the CRMC experience for the online portion has been the least gratifying since the T&C was widened since 2019. It isn’t really widened per se. Appalling to say that among all the bank’s T&C that i dealt… Read more »

To whom it may help, here’s a template I’ve used successfully to claim missing points via their online “Compose mail” functionality. The whole process takes about 2 months, or many follow-ups, but it’s still better than calling their hotline imho 😉 Note: Be careful not to add “special” characters like the single quote “‘” into the message, or you will get an error. Because, you know, mainframes. Dear Citi Team, Thank you for some great card products! I am referring to transactions made on various online merchants on my Citi Rewards Mastercard (ending xxxx). There are several examples where these … Read more »

Can share does the mastercard version spend on Qoo10 and Lazada (not redmart) earn x 10?

Tks

If we keep the visa, does it mean no more waiver of annual fees?

Could you please explain why the Citi Rewards card works for travel when charged via Instarem? Thanks!