Citibank has once again extended the sign up bonus on the Citi PremierMiles card. New-to-bank cardholders who apply by 30 June 2020 can get up to 37,300 miles when they spend S$9,000 in the first 3 months and pay the S$192.60 annual fee.

There’s one difference though: Citi has switched the PremierMiles product over to Mastercard. Say hello to the new Citi PremierMiles Mastercard…

As I mentioned in this article, there aren’t that many changes to be concerned with. You lose the Hilton Gold fast track offer (not that it’s currently running anyway) and the Visa Luxury Hotel Collection, and you don’t earn points on GrabPay top-ups anymore (because the Mastercard MCC for GrabPay top-ups is 6540).

Other than that, it’s business-as-usual. The miles earning rates, annual fee and other features remain exactly the same.

Here’s a refresher on how the sign up bonus works.

New-to-bank customers

New-to-bank customers have a choice of two different bonuses- one if they pay the annual fee, the other if they request a waiver.

| Citi defines a new-to-bank customer as someone who does not currently hold a principal Citi credit card, and has not done so in the past 12 months prior to 1 October 2019 |

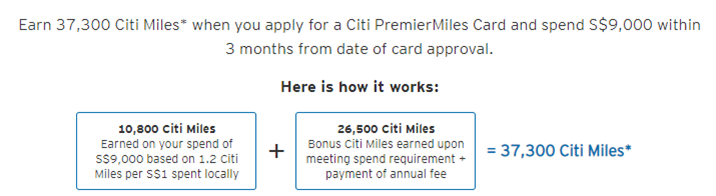

Fee paying: Spend S$9K, Get 37.3K miles total

New-to-bank customers who pay the S$192.60 annual fee and spend S$9,000 within 3 months of approval will receive a total of 37,300 miles.

| Remember that Citi’s definition of “3 months” is rather generous- the qualifying period starts from the date of your card’s approval to three months after the end of the month you were approved. So if you were approved on 5 Feb 2020, for example, you’d have until 31 May 2020 to hit the qualifying spend. |

This is broken down into:

- 10,800 base miles from spending S$9,000 @ 1.2 mpd

- 10,000 miles for paying the S$192.60 annual fee

- 16,500 bonus miles for meeting the spending requirement

The T&C for this sign up offer can be found here.

You can apply through SingSaver to get S$200 cash as a new-to-bank customer.

Get S$200 cash upon approval for the Citi PremierMiles Card

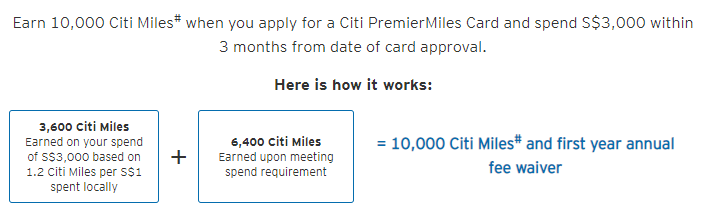

Fee waiver: Spend S$3K, Get 10K miles total

New-to-bank customers who prefer not to pay the annual fee get a smaller sign up bonus.

By spending S$3,000 within 3 months of approval, they’ll earn a total of 10,000 miles. This is broken down into:

- 3,600 base miles from spending S$3,000 @ 1.2 mpd

- 6.400 bonus miles for meeting the spending requirement

The T&C for this sign up offer can be found here.

You can also get S$200 cash when you apply through SingSaver:

Get S$200 cash upon approval for the Citi PremierMiles Card (annual fee waiver)

Existing customers

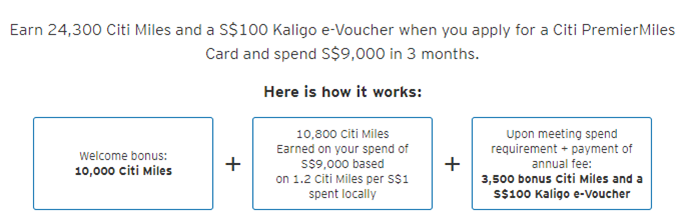

Fee paying: Spend S$9K, Get 24.3K miles total + S$100 Kaligo e-voucher

Existing customers who pay the annual fee and spend S$9,000 within 3 months of approval get a S$100 Kaligo.com e-voucher and 24,300 miles. This is broken down into:

- 10,800 base miles from spending S$9,000 @ 1.2 mpd

- 10,000 miles for paying the S$192.60 annual fee

- 3,500 miles for meeting the spending requirement

The Kaligo.com e-voucher comes with a few strings attached so do take note. You’ll need to go to www.kaligo.com/100gift to spend the voucher, and your stay must be at least two nights. The voucher is valid till 31 December 2020.

The T&C for this sign up bonus can be found here.

You can sign up through SingSaver to get S$30 cash as an existing customer. However, if you opt for this you won’t get the Kaligo voucher or the sign up bonus offer.

If you want the 24,300 miles and S$100 Kaligo e-voucher, sign up through the link below:

Get 24.3K miles and a S$100 Kaligo voucher upon approval for the Citi PremierMiles Card

Fee waiver

Existing customers can also opt for a waiver of the first year’s annual fee. If you do, that’s all you get- no bonus miles, no nothing.

Applying through SingSaver still gives you S$30 cash.

Get S$30 cash upon approval for the Citi PremierMiles Card (annual fee waiver)

What counts as qualifying spend?

Qualifying spend refers to retail transactions charged to the card, and excludes the following:

|

Other payments like insurance, education or government services will count towards the S$9,000 threshold, but will not earn any base points. Now that the card is on the Mastercard network, you won’t earn any base points for GrabPay top-ups either.

Citibank has confirmed that spending on Citi PayAll will count towards the S$9,000 spending requirement, which is good news for those with rent, education expenses, taxes or condo fees to pay.

| Cost per mile @ 1.2 mpd | |

|

1.67 |

| Based on 2% admin fee. Certain Citi customers may be targeted for lower rates |

|

Citi Miles are one of the most valuable transfer currencies in Singapore

Citi PremierMiles cardholders get access to 11 different frequent flyer programs and one hotel partner, the widest selection of any bank in Singapore.

| Transfer Ratio | |

| 1:1 | |

| 1:1 | |

| 1:1 | |

| 1:1 | |

EVA Air Infinity Mileagelands EVA Air Infinity Mileagelands |

1:1 |

| 1:1 | |

| 1:1 | |

| 1:1 | |

| 1:1 | |

| 1:1 | |

Thai Airways Royal Orchid Plus Thai Airways Royal Orchid Plus |

1:1 |

| 1:1 |

A S$25 conversion fee applies for every transfer, and do note that Thank You points earned on the Citi Prestige/Citi Rewards cards do not pool with Citi Miles, so you’ll have to redeem them separately.

The flexibility of Citi Miles means they’re a great way to enjoy sweet spots in programs like Etihad Guest, British Airways Avios and Turkish Miles&Smiles.

For example, you could redeem a Singapore to Europe round-trip Business Class flight for just 90,000 miles with Miles&Smiles. That’s half the price that Singapore Airlines charges (albeit with fuel surcharges), which means you could fly two people with Miles&Smiles for the cost of flying one with KrisFlyer.

Recap: Citi PremierMiles Card Basics

| Income Req. | Annual Fee | Miles from Annual Fee | FCY Fee |

| S$30,000 | S$192.60 | 10,000 | 3.25% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 1.2 mpd |

2.0 mpd | Agoda: 7.0 mpd | No expiry |

The Citi PremierMiles Card earns 1.2 mpd on local spend and 2.0 mpd on overseas spend. You can also book hotels and earn up to 7 mpd on Agoda. Citibank awards points on every dollar of spending, and the minimum spend to earn points is S$1.

The Citi PremierMiles Card comes with a Priority Pass membership that provides two complimentary visits per calendar year. Note that this is slightly different from most other credit cards on the market, which award their free visits per membership year.

Conclusion

The Citi PremierMiles Card is a solid general spending card to have in your wallet- in fact, it’s one of the options in my Miles Game Starter Pack for anyone just getting into the miles and points game.

I’ve updated the post on current credit card sign up bonuses in Singapore to reflect this latest offer.

Existing PremierMiles holders will still remain on the Visa network right?

I know this is an old article, but as an existing Visa customer I only read this today after I called up the bank and aske them to switch my card to a MC. Apparently only targeted customers can be allowed and I am not in that approved list.. so.. I need to apply afresh as a new Premier miles card if i need a MC. Doesn’t make sense but that is what it is apparently..