DBS reintroduced sign up bonuses on the Altitude cards back in September 2018, and has been dutifully updating them every quarter or so.

The latest iteration has just launched, valid for applications between 1 April and 30 June 2020.

What’s different this time is that DBS has added an additional option into the mix. Perhaps knowing that miles may be out of favor in the current environment, DBS is offering an alternative gift in the form of Apple AirPods (the S$239 version), with a lower spending requirement.

How it works

New-to-bank cardholders who apply for a DBS Altitude card (either Visa or AMEX) online by 30 June 2020 can enter one of three different promo codes during application:

- DBSAIRPODS

- DBSALT

- ALTAF

| DBS defines a new-to-bank customer as one who does not currently hold a DBS/POSB principal credit card, and has not in the past 12 months |

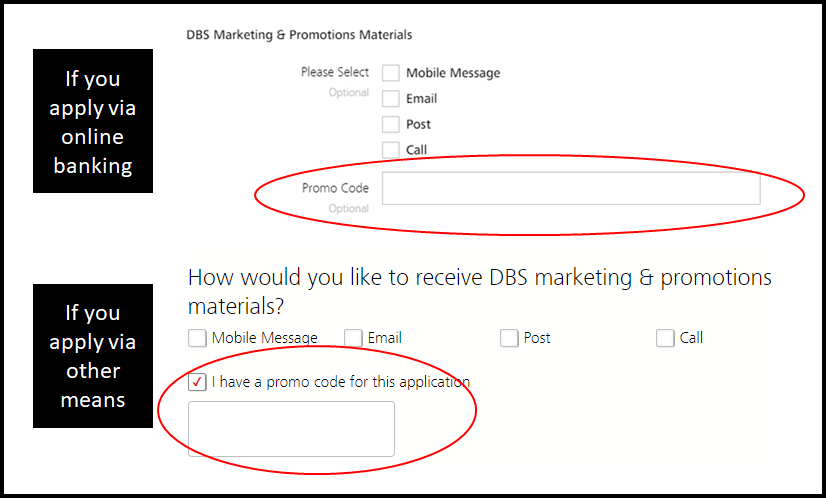

Look for this field to enter the promo code:

Each of these promo codes has a different spending requirement and bonus gift.

| DBSAIRPODS | DBSALT | ALTAF | |

| Spend | S$1.2K in 60 days | S$6K in 90 days | S$6K in 90 days |

| Base Miles @ 1.2 mpd | 1.44K | 7.2K | 7.2K |

| Bonus Gift | Apple AirPods (worth S$239) | 10K | 10K |

| Annual Fee Miles (S$192.60 fee) | N/A | N/A | 10K |

| Total Miles | 1.44K | 17.2K | 27.2K |

| ⚠️ Update: When DBS first announced this promo, the spending requirement for DBSAIRPODS was S$2K in 60 days. However, a new set of T&Cs were published on 6 May 2020 which brought the spending requirement down to S$1.2K in 60 days |

The workings above assume you apply for a DBS Altitude Visa. If you apply for a DBS Altitude AMEX, you enjoy a bonus 50% more miles on your spend in the first 3 months, capped at 10,000 miles. This means your S$6,000 spending would yield a total of 20,800 miles (7,200 [base] + 3,600 [50% bonus] + 10,000 [sign up bonus]).

Do note that DBS excludes the following transactions when calculating whether the qualifying spending has been met:

| a. posted 0% Interest Instalment Payment Plan monthly transactions, b. posted My Preferred Payment Plan monthly transactions, c. interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS; d. payments to educational institutions; e. payments to financial institutions (including banks, online trading platforms and brokerages); f. payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); g. payments to hospitals; h. payments to insurance companies (sales, underwriting and premiums); i. payments to non-profit organisations; j. payments to utility bill companies; k. payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services advertising services, funeral service and legal services and attorneys); l. any top-ups or payment of funds to payment service providers, prepaid accounts and any prepaid accounts (e.g. EZ-Link, GrabPay, NETS FlashPay, Transit Link, Singtel Dash); m. any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers); n. any transactions related to crypto currencies; and o. any other transactions determined by DBS from time to time |

Any supplementary cardholder spending will be combined with the principal cardholder’s in determining qualifying spend.

If you meet the eligibility criteria, the sign up bonus and annual fee miles will be credited to your account within 180 days from the date of card approval. Apple AirPods are fulfilled via the DBS LifeStyle app. You’ll receive a redemption coupon to take to a physical collection centre, within 45 days of meeting the spending criteria.

| Miles Bonus | AirPods Bonus |

| T&C | T&C |

Wait…where’s that 38,000 miles DBS talks about?

Here’s what confuses some people. In DBS’s marketing materials, they allude to a total haul of 38,000 miles.

How they get that figure is by assuming your S$6,000 spending is made entirely on online flight and hotel transactions at 3 mpd. 18,000 base miles + 10,000 bonus miles + 10,000 annual fee miles = 38,000 miles.

Given the current Covid-19 situation, however, spending S$6,000 on flight and hotel bookings seems more theoretical than ever before.

Recap: DBS Altitude basics

| Income Req. | Annual Fee | Miles from Annual Fee | FCY Fee |

| S$30,000 | S$192.60 (first year free option) | 10,000 | 3.25% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 1.2 mpd | 2.0 mpd | Online flights & hotels: 3.0 mpd | No expiry |

The DBS Altitude earns 1.2/2.0 mpd on local/overseas spending respectively, with 3.0 mpd on online flights & hotels, capped at S$5,000 per month.

As a reminder, cardholders can also earn up to 4 mpd on online spending until 30 June 2020 (new cardholders will be automatically registered for this promotion). However, they’ll need to spend at least S$4,500 per month, after which they’ll earn a bonus 2 mpd on the first S$1,000 of online spending (i.e you’ll only earn 4 mpd if you spend in foreign currency).

You receive 10,000 miles for paying the annual fee each year, and the Visa version comes with two free Priority Pass visits.

DBS points earned on the Altitude card never expire, and can be transferred to the following FFPs with a S$26.75 transfer fee:

| Transfer Ratio (DBS Points: Miles) | |

| 1:2 | |

| 1:2 | |

| 1:2 | |

| 1:3 |

The points earned on your DBS Altitude will pool together with those earned from other DBS cards for the purposes of redemption.

Conclusion

It’s good that DBS has introduced an alternative gift with a lower spending threshold, but if it’s Apple AirPods you really want, you can get a (better) pair without spending anything.

Until 10 April, SingSaver is giving away 100 pairs of Apple AirPods Pro each day to new-to-bank customers who get approved for selected SCB credit cards. There’s no spending required, nor annual fees to be paid.

Otherwise, this is basically the same offer as what we’ve seen before. Be sure to compare it to other sign up bonuses currently on the market before pulling the trigger.