Please read before applying: SingSaver sign up gifts take 2-3 months to fulfill. Fulfillment time depends on when SingSaver receives the approvals confirmation report from the bank- once received, gift redemption emails are sent within 72 hours. To check on gift status, write to info@singsaver.com.sg with the following anywhere in the body: “Source: Milelion-Tele ” + Query description“ for faster service. If you’ve not received a response within 3 working days, drop me a message via the contact us option and I’ll look into it. Of the cases so far, the majority of gift delays are either because the gift registration form was not filled in properly (SingSaver’s gift registration form will send a confirmation email within 24 hours of being filled), or the bank did not send the approvals report on time. Refer to this infographic to understand the process:

SingSaver is continuing its credit card sign up campaigns for the month of November, with exclusive cash gifts and vouchers available for new and existing customers. After you’ve signed up, be sure to click on this link to get to the gift redemption form, which will tell SingSaver how to send you your gift (you can find your application reference number here).

How do November’s offers differ from October?

- Citibank has extended its sign up bonus for the PremierMiles Visa card to 31 January 2019. The terms remain the same: customers who have not held a Citibank credit card in the past 12 months and spend $7,500 within 3 months will get a total of 30,000 miles, subject to the payment of the first year’s $192.60 annual fee

- UOB PRVI miles cards are available once more, with $50 for both new and existing customers

AMEX KrisFlyer Ascend & KrisFlyer Blue

| New to Bank | Existing Customer | |

| AMEX KrisFlyer Blue | $150 | $150 |

| AMEX KrisFlyer Ascend | $150 | $150 |

Apply for the KrisFlyer Blue and KrisFlyer Ascend here

SingSaver has continued its $150 sign up gift for the KrisFlyer AMEX cobrand cards for November. Can’t figure out which card is right for you? Have a read of our comparison article of the KrisFlyer Blue versus KrisFlyer Ascend.

Here’s the how the KrisFlyer Blue and Ascend stack up in terms of miles earning power:

| KrisFlyer Blue | KrisFlyer Ascend | |

| Local Spending | 1.1 mpd | 1.2 mpd |

| Overseas Spending | 2.0 mpd for June and December | |

| Bonus for Grab (capped at $200) | 3.1 mpd | 3.2 mpd |

| Singapore Airlines/Silk Air tickets bought online | 2.0 mpd | 2.0 mpd |

The earn rates may not be the highest in the market, but their sign up bonuses certainly are. New customers to the KrisFlyer Blue can spend $3,000 to get 15,800 miles:

- 5,000 bonus miles on the first spend

- 7,500 bonus miles with $3,000 spent within 3 months of approval

- 3,300 base miles on the total $3,000 spent

The KrisFlyer Ascend is offering a spend $10,000 get 43,000 miles offer which is broken down as follows:

- 5,000 bonus miles on the first spend

- 26,000 bonus miles with $10,000 spent within 3 months of approval

- 12,000 base miles on the total $10,000 spend

I’d recommend getting these cards when you know you have big ticket spending coming up that will allow you to hit the threshold.

Do remember the KrisFlyer Ascend also comes with Hilton Silver status and a complimentary night hotel stay voucher, four SATS/Plaza Premium lounge access vouchers and a fast track offer for KrisFlyer Elite Gold.

You can only apply for either the Blue or the Ascend card. The first year annual fee is waived for the Blue but not the Ascend (S$337.05 per year). This SingSaver promotion is available for applications submitted by 30 November 2018.

Choosing to use the SingPass MyInfo feature during application (which connects to your SingPass account to auto-populate some fields) will get you a bonus $20 NTUC voucher. This is fulfilled by AMEX, not SingSaver, and the full terms and conditions for the MyInfo promotion can be found here.

AMEX Platinum and True Cashback Cards

| New to Bank | Existing Customer | |

| AMEX Platinum Credit Card | $150 | $150 |

| AMEX True Cashback | $150 | $150 |

Apply for the AMEX Platinum and True Cashback cards here

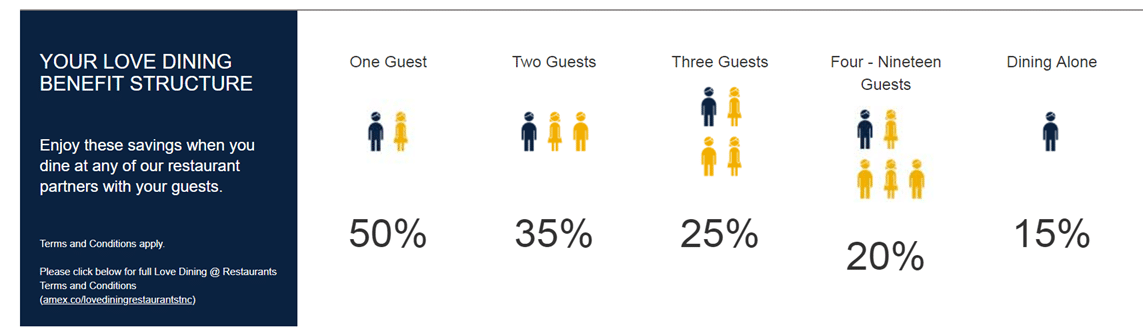

AMEX Platinum card members get access to the Love Dining program, where you get up to 50% off at restaurants like Harry’s, Lawry’s, Si Chuan Dou Hua, The Song of India, Wooloomooloo Steakhouse, TWG Tea Garden and other selected restaurants. Love dining also covers restaurants at the Conrad Centennial, Marriott Tangs Plaza, St Regis Singapore and W Sentosa Cove.

A Far Card Classic Membership (worth $425) is also provided. This gives up to 50% off the food bill at:

- Fairmont Singapore

- Swissôtel The Stamford Singapore

- Swissôtel Merchant Court

Cardholders receive a one night certificate for the Swissôtel The Stamford Singapore worth S$529 upon payment of the first year annual fee, and those who spend $4,500 within 3 months of approval get a Samsonite Sigma 76cm Expandable Spinner bag.

I’m not the biggest proponent of cashback but you may find the True Cashback card useful in transactions where the miles cards you have are precluded from earning any points (e.g. parking transactions, school fee payments, charitable or non-profit payments).

The AMEX True Cashback card offers a flat 1.5% cashback with no cap (you enjoy 3% cashback for the first 6 months capped at S$5,000 spend). The first year annual fee is waived.

SingSaver is offering $150 for successful True Cashback and Platinum Card applications. This promotion is available for applications submitted by 30 November 2018.

Choosing to use the SingPass MyInfo feature during application (which connects to your SingPass account to auto-populate some fields) will get you a bonus $20 NTUC voucher. This is fulfilled by AMEX, not SingSaver, and the full terms and conditions for the MyInfo promotion can be found here.

Citi Prestige

| New to Bank | Existing Customer | |

| Citi Prestige | $200 NTUC, Grab or Taka vouchers | $50 NTUC vouchers |

Apply for the Citi Prestige card here

In my opinion, the Citi Prestige is one of the best cards in the $120K credit card segment, thanks to the fourth night free hotel benefit, unlimited Priority Pass visits for the principal cardholder and a guest, complimentary Boingo Wi-Fi (including access on certain airlines so you can surf in-flight for free), a relatively easy-to-unlock limo benefit and comprehensive travel and purchase insurance.

Louis has written an extensive analysis of the Citi Prestige’s value proposition, suffice to say that the discounted event invitations and other occasional perks offered by the concierge make this a very compelling card to have.

SingSaver is giving $200 of NTUC, Grab or Taka vouchers for new Citibank applicants ($50 for existing Citibank customers) to sweeten the deal. This promotion is available for applications submitted by 30 November 2018.

Citi PremierMiles Visa & Citi Rewards Visa

| New to Bank | Existing Customer | |

| Citi Rewards Visa | $200 NTUC, Grab or Taka vouchers | $50 NTUC vouchers |

| Citi PremierMiles Visa | $200 NTUC, Grab or Taka vouchers | $50 NTUC vouchers |

Apply for the Citibank PremierMiles and Rewards card here

The amazing Apple Pay-Citibank 20X promotion may be over, but both the Citibank Rewards and Citibank PremierMiles Visa are still useful for your miles earning strategy.

The Citi PremierMiles Visa earns 1.2 mpd locally and 2.0 mpd overseas (2.4 mpd from 4 October till 31 December), with up to 7 mpd on Expedia and 10 mpd on Kaligo. The card also comes with two complimentary lounge visits a year via Priority Pass (this will be changed to DragonPass in the future)

There’s currently an ongoing sign up bonus for the Citi PremierMiles card, where you get 30,000 miles in total with paying the annual fee and spending a minimum of $7,500 within the first 3 months. You’re still eligible for this bonus if you sign up via SingSaver.

The Citi Rewards earns 10X points (or 4 mpd) for spending on online shopping, department stores and anywhere which sells shoes, bags, or clothes, capped at $1,000 each month. It’s even known to earn 10X with some other merchants which technically don’t fall under these categories…join the Telegram Group or Milelion’s Den if you want to learn which ones.

Citibank points don’t pool, but the good news is they have the widest selection of partner airlines in Singapore, with 12 programs to choose from. Two useful programs they partner with are Etihad Guest and British Airways Avios– refer to the links for some ideas how to spend those points.

The first year annual fee is waived on both cards, and this promotion is available for applications submitted by 30 November 2018.

HSBC Revolution

| New to Bank | Existing Customer | |

| HSBC Revolution | $150 cashback | $100 cashback |

Apply for the HSBC Revolution here

The HSBC Revolution is a useful backup card to have because it earns 2.0 mpd on online, local dining and local entertainment transactions. 2.0 mpd on dining is less than the Maybank Horizon Visa Signature’s 3.2 mpd, but HSBC’s definition of dining is broader. HSBC considers fast food to be part of dining, and explicitly states that spend at clubs, pubs, bars will get 2 mpd. There also is no minimum spend amount required to earn this.

Fun fact: you can pair the HSBC Revolution with your EZ-Reload service and earn 2 mpd on the first S$200 spent on EZ-link top ups each month. That’s more than the 1.4 mpd you’d earn by using your UOB PRVI Miles Mastercard with ABT.

Unlike the rest of the cards here, the HSBC sign up gift is in the form of cashback. That’s to say, the gift is awarded by the bank, not SingSaver. If you applied normally through the HSBC website, you’d get $100 of cashback as a new customer if you spend $600 within 30 days. Applying through SingSaver gives you an additional $50 of cashback for a total of $150.

Existing cardholders will get $100 cashback when they sign up through SingSaver ($50 otherwise) and spend $600 within 30 days.

This offer applies to applications received before 30 November 2018.

Standard Chartered Visa Infinite

| New to Bank | Existing Cardholder | |

| SCB Visa Infinite | S$100 | S$50 |

Apply for the SCB Visa Infinite here

The SCB Visa Infinite is part of the so-called “$120K” group of entry level prestige cards (although its income requirement technically is $150K). You earn 1.4 and 3.0 mpd on local and overseas spending respectively if you spend more than S$2K in a statement period, otherwise you’re looking at 1.0 mpd for everything.

The card has a non-waivable annual fee of $588.50, for which you get 35,000 welcome miles. That said, it does not have an unlimited Priority Pass (6 visits only) nor does it have airport limo service.

Remember that the SCB Visa Infinite offers one of the best tax payment facilities in the market. For a processing fee of 1.6%, you can earn 1.4 mpd assuming you spend at least S$2K in total during a given month. That works out to just 1.14 cents per mile, making the SCB VI a pretty interesting proposition for people who want to buy miles on the cheap.

This promotion is available for applications submitted by 30 November 2018.

UOB PRVI Miles

| New to Bank | Existing Cardholder | |

| UOB PRVI Miles AMEX, Visa or Mastercard | S$50 | S$50 |

Apply for the UOB PRVI Miles card here

The UOB PRVI Miles is a general spending workhorse, earning 1.4/2.4 mpd for local/overseas spending without any cap or minimum spend requirement. Those earning rates may be below the 2.0/5.0 mpd being offered by the BOC Elite Miles World Mastercard, but I can guarantee you you’ll get your UOB PRVI Miles card faster than the BOC.

You can also earn 6 mpd for hotel and selected airline bookings made on Expedia. If you opt for the PRVI Miles AMEX, spending $50,000 in a membership year will get you 20,000 loyalty miles, and you can redeem up to 8 complimentary airport transfers per year.

Whether you’re an existing or new UOB customer, SingSaver is giving $50 of cash to successful applicants for the PRVI Miles card. This promotion is available for applications submitted by 30 November 2018.

Should I get 2 variant of the uob prvi card,as an exiting cardholder, will that be only $50 or $100?

50 per approved card.

Please can you add the annual card fee – if any – for each card. Thank you

Singsaver offering $200 for each card if sign direct with them. Aaron you earning $50 for each card?

Nope. I wish.

Do Singsaver and Moneysmart promos stack? Moneysmart seems to be offering 15000 miles for the HSBC Revolution. See https://www.moneysmart.sg/credit-cards/hsbc-revolution-credit-card

nope. one or the other.