Standard Chartered has just launched the X Card with a 100,000 miles sign up bonus, the largest we’ve ever seen in Singapore.

Details have been scarce so far, but now that applications are open, here’s what we know about the X Card, its features, and most importantly, how that 100,000 miles sign up bonus works.

Standard Chartered Visa Infinite X Card Basics

| Income Req. | Annual Fee | Miles from Annual Fee | FCY Transaction Fee |

| S$30,000 (Priority Banking) S$80,000 (Regular) | S$695.50 (Principal) S$107 (Supp.) | 30,000 | 3.5% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 1.2 mpd/ 1.2% cashback | 2.0 mpd/ 2.0% cashback | None | No expiry |

The SCB X Card is made of metal, with a S$80,000 annual income requirement. If you’re a Priority Banking client, you can get the card with just S$30,000 annual income (S$60,000 for foreigners).

The card has a non-waivable annual fee of $695.50. Paying the annual fee gets you 30,000 miles (in the form of 75,000 360° Rewards Points) in the first year. It is not immediately clear from the T&Cs whether you get the 30,000 miles from the second year onwards.

360° Rewards Points earned on the X Card do not expire, and can be transferred to miles in a minimum block of 2,500 points (1,000 miles). You’ll pay $26.75 for each points conversion.

The T&C of the card can be found here.

Spend $6,000 in 60 days to get 100,000 miles

Let’s start with the X Card’s showstopping 100,000 miles sign up bonus, by far the biggest selling point of the product.

This sign up bonus is available to both existing and new to bank customers.

To qualify for the sign up bonus, you must:

- Apply and receive approval for the X Card between 23 July and 31 August 2019

- Activate your X Card within 30 days of approval, and keep your X Card for 6 months after account opening, in good standing

- Pay the S$695.50 annual fee

- Spend S$6,000 in the first 60 days (no later than 31 Oct 2019)

| Update: SCB will be ending the 100,000 miles sign up bonus early. All X Card applicants who apply by 31 July 2019 and get approved by 31 August 2019 will still be eligible. After that, the bonus will become 60,000 miles. |

Technically speaking, the sign up bonus is 70,000 miles, not 100,000, because 30,000 comes from paying the annual fee. Here’s how the breakdown works:

- 30,000 miles will be credited in the form of 75,000 360° Rewards Points within 30 days after card activation

- 70,000 miles will be credited in the form of 175,000 360° Rewards Points by 30 November 2019

When I first heard about this bonus, I was understandably skeptical, believing that there’d be some nasty catch like “limited to the first X customers”.

But there isn’t- so long as you meet the spending criteria and pay the annual fee, the 100,000 miles are yours. It’s great that SCB didn’t go down the route some other banks have gone where sign up bonuses become a lottery.

Note that the 100,000 miles are on top of the base miles, so assuming you spent the $6,000 locally, here’s what your total haul would look like:

| Miles | |

| Miles from first year $695.50 annual fee | 30,000 |

| Spend $6K within the first 60 days | 70,000 |

| Base miles earned from $6K spend @ 1.2 mpd | 7,200 |

| Total Miles | 107,200 |

Even after you take into consideration the non-waivable annual fee, the X Card’s sign up bonus simply blows the competition out of the water. Just take a look at the spend:miles ratio below, if you want some perspective.

Final (but important) point. Note that there are certain categories of spending which will not count towards the $6,000 spending requirement. I’ve highlighted the main ones here, but do refer to the full list in the T&Cs.

|

|

The exclusions are pretty typical, but I’m very surprised we’re seeing CardUp/ipaymy/RentHero transactions explicitly excluded from spending, given that they normally earn miles on the SCB Visa Infinite. I’m less surprised to see that Grab wallet transactions are excluded, since it seems like banks are starting to crack down on this.

What can you do with 100,000 miles? Well, assuming you transferred them to KrisFlyer, it’s enough for…

- A one-way First Class ticket to Dubai (75,000 miles)

- A round-trip First Class ticket to Hong Kong (81,000 miles)

- A round-trip Business Class ticket to Japan or South Korea (94,000 miles)

- A one-way Business Class ticket to Europe (92,000 miles) or the USA (95/99,000 miles)

Earn 1.2/2.0 mpd (or cashback) on your spending

The X Card lets you earn either miles or cashback at the following rates:

| Points | Miles Equivalent | Cashback Equivalent | |

| Local Spending | 3 360° Rewards Points per S$1 | 1.2 mpd | 1.2% |

| FCY Spending | 5 360° Rewards Points per S$1 | 2.0 mpd | 2.0% |

There is no minimum spend required or cap on the miles/cashback you can earn.

In my opinion, it makes absolutely no sense to pay $695.50 for the X Card and use it for cashback, so let’s just focus on the miles earning rates. Unfortunately, these are below what other premium cards in the market are offering.

| Local Spend | FCY Spend | |

| BOC Elite Miles World Mastercard | 1.5 | 3.0 |

| SCB Visa Infinite^ | 1.4 | 3.0 |

| UOB PRVI Miles | 1.4 | 2.4 |

| UOB Visa Infinite Metal Card | 1.4 | 2.0 |

| Citi Prestige, Citi PremierMiles AMEX | 1.3 | 2.0 |

| HSBC Visa Infinite# | 1.25 | 2.25 |

| OCBC VOYAGE | 1.2 | 2.3 |

| SCB X Card, DBS Altitude, Citi PremerMiles Visa, Maybank Visa Infinite, AMEX KrisFlyer Ascend* | 1.2 | 2.0 |

| AMEX KrisFlyer Credit Card* | 1.1 | 2.0 |

*2.0 mpd rates only apply in June and Dec

^Only applies if you spend >$2K a month, otherwise 1 mpd for both

#Only applies if you spend >$50K in a year, otherwise 1/2mpd for local/overseas

Perhaps the challenge for SCB was they couldn’t “outdo” the earning rates on their Visa Infinite card, but even so, it does seem a bit underpowered to only offer 1.2/2.0 mpd on such a high end card. I get that there’s probably a tradeoff between generosity on sign up bonuses, and generosity on everyday spend, but it does mean there’s less incentive to keep the card after the first year (see below).

Do keep in mind that SCB’s foreign currency transaction fee is the highest in the market at 3.5%, and therefore it’s advisable to hit your $6,000 sign up bonus target with local spending.

The X Card should also support SC’s new EasyBill service, which lets customers earn miles from rental, tax, insurance, and education payments for a fee of 2%. This means you’re paying 1.67 cents per mile- not the cheapest way of buying miles in Singapore, but on par with Citi PremierMiles Visa cardholders using PayAll.

New Transfer Partners include Miles & More, MileagePlus and Accor

This is a big one for me. Ever since Mileslife left the market, it’s been difficult to earn so-called “exotic” points currencies. Most banks in Singapore offer KrisFlyer or Asia Miles, but not much beyond that (with the exception of Citibank, which has 12 transfer partners).

Historically, SCB has only offered KrisFlyer. But it seems like they’re launching a whole new selection of airline and hotel(!) loyalty programs with the X Card.

Out of this selection, Miles & More, MileagePlus, and Le Club AccorHotels are the programs where it’s not been possible to earn points/miles through credit cards before. I’m particularly excited about MileagePlus, because they don’t impose fuel surcharges on redemptions, and they have a few nifty tricks like the Excursionist Perk (as those who have attended Alternative Frequent Flyer Programs will know).

Keep in mind, I’m assuming that all airlines will have the same transfer ratio, as the SCB Rewards Portal has not yet been updated with these new partners. I’ll also need to see the transfer rates to Accor and IHG before commenting further.

If indeed this card allows you to earn so many different currencies, it does somewhat offset the lower earning rates, provided you don’t use it to earn KrisFlyer miles (because then you’d be much better off using a higher earning, fewer partners card).

Use points for travel credit

One of the unique features that SCB is hyping about the X Card is the ability to use 360° Rewards Points to offset qualifying travel purchases.

These are defined as (MCC codes in brackets):

|

|

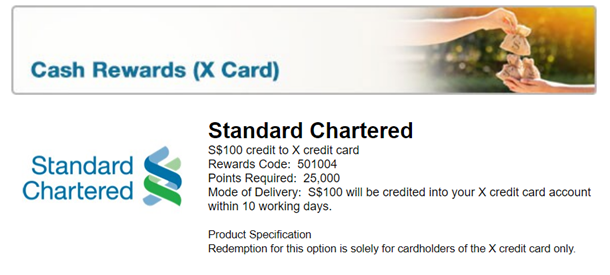

Cardholders can redeem a minimum of 250 360° Rewards Points for S$1 in credit against such qualifying travel transactions.

On the surface, this makes very little sense. The rate is exactly the same as what you’d get if you converted your 360° Rewards Points to cashback. In that case, wouldn’t you be better off simply doing that, since there’s no restriction on qualifying transactions?

The answer comes from SCB’s rewards catalogue, where we see that you need a minimum of 25,000 360° Rewards Points to redeem a S$100 statement credit. This means that the travel credit option “breaks up” the minimum block, allowing you to cash out at lower amounts.

Even so, if the goal was to save cash on travel, wouldn’t you be better off simply getting a no-cap cashback card like the SCB Unlimited Cashback or the AMEX True Cashback card?

You’d enjoy 1.5% cashback on all transactions (and 2.5% for foreign currency transactions on the AMEX True Cashback), which is a superior return to the 1.2%/2% earned on the X Card. Furthermore, that cash could be applied towards anything you want, not just travel transactions.

So this travel credit option is strange, to say the least, and I can’t see anyone using it at its current rates. In any case, based on the X Card’s points conversion ratio, opting for travel credit over miles yields an implicit valuation of 1 cent per mile, not the best use of your points (but notably on par with what Singapore Airlines would give you if you paid for revenue tickets with miles).

Two complimentary lounge visits a year

The X Card comes with complimentary lounge access, but unfortunately it’s a major weak spot in the product.

You get just two complimentary lounge visits per membership year, far below what you’d expect from a card with an annual fee of $695.50. For the sake of comparison, here’s how similar cards measure up.

| Card | Annual Fee | Lounge Visits |

| AMEX Platinum Charge | $1,712 | Unlimited + 1 guest- Priority Pass, AMEX Lounges, Delta SkyClubs |

| Citi Prestige | $535 | Unlimited + 1 guest- Priority Pass |

| HSBC Visa Infinite | $488 (Premier)/ $650 (Regular) | Unlimited- Lounge Key |

| OCBC VOYAGE | $488 | Unlimited- Plaza Premium |

| Maybank Visa Infinite | $600 | Unlimited- Priority Pass |

| SCB Visa Infinite | $588.50 | 6 visits- Priority Pass |

| UOB Visa Infinite Metal Card | $642 | 4 visits- Dragon Pass |

| SCB X Card | $695.50 | 2 visits- Priority Pass |

Two free visits a year is more in line with a mass market card like the DBS Altitude or Citi PremierMiles Visa, and it’s going to be difficult to convince people to pay that amount from the second year onwards, after the 100K sign up bonus is gone.

To apply for your Priority Pass, cardholders will need to send an SMS from their registered mobile number to 77222 with the format SCX<space>PP<space><last 4 digits of X Card>

They will receive a unique code that they can enter here to fill out the application form on Priority Pass’s website. This bypasses the need to send in a physical form.

My overall take on the X Card

The X Card’s marketing and hefty annual fee means that SCB clearly sees it as competing with cards in the $120K segment.

To be sure, the X Card’s sign up bonus is incredible, and that’s reason enough to get it. In fact, if you meet the income requirement, this is hands down the best card for building your miles balance quickly, and you should absolutely apply.

But I’m just wondering how much staying power the X Card has after the first year. The miles earning rates aren’t fantastic (although, as noted, the ability to earn “exotic” airline currencies could offset that), and its lounge access is way below par. Moreover, it doesn’t have an airport limo benefit, or any of the unique features that other premium cards have like airport fast track (HSBC Visa Infinite), private club access (OCBC VOYAGE, AMEX Platinum Charge/Reserve), Jetquay access (Maybank Visa Infinite), or the fourth night free on hotels (Citi Prestige).

It seems almost churlish to talk about this when there’s 100,000 miles on offer, but that’s a one-time, upfront thing. What happens after that? I can imagine a ton of people applying for the sign up bonus alone, but will they really pay $695.50 in the second year for a card with two complimentary lounge visits and a 1.2/2.0 mpd earn rate?

That’s something the X Card team will have to consider in the months to come, and perhaps we’ll see additional perks and benefits added later on that help keep the X Card competitive even after the sign up bonus ends. But if we don’t, then this could be a campaign that costs SCB a whole lot, for very little long-term payoff.

Conclusion

A 100,000 miles sign up bonus is something few of us thought we’d ever see in Singapore, and for those with upcoming big ticket spending, it’s an absolute no-brainer.

I’m sure there’ll be much more to say about the X Card in the days and weeks to come, but in the meantime, be sure to get approved before 31 August if you want to snag the 100,000 miles sign up bonus.

Join the SCB X Card Telegram group for more discussions about the card.

Just to point out that the X Card also doesn’t have free unlimited wifi (through Boingo) while in the air, unlike the Citi Prestige.

I’m highly doubtful that the card is made of pure metal, probably a plastic-metal hybrid… but I’ll still sign up anyway, for the free miles!

Not exactly free if you’re paying a nearly $700 annual fee.

Thank you for the info. Understand that’s eligible for tuition fees?

Would this be a form of bill payment? I;m wondering about this too

Checked with CSO and she said it is eligible…but still, if anyone can double confirm, that would be nice.

can anyone advise is payment of govt hospital bill considered as payment to govt agencies? thanks!

I’m also curious on this as well. I’ve tried googling and some forums like HWZ did mention you can earn miles/points from hospitals (both govt restructured and pte).

Any experts to double confirm on this as well?

If any bank classify a Govt restructured hospital like SGH or NUH or Polyclinic as government agency or statutory board, they should be taken to court.

Hi I didn’t sign up for the wait list but I’d like to sign up for the card. Am I still eligible for the 100k sign up bonus?

yes

Thanks for the article Aaron.

SC probably realizes that CardUp & likes are a reliable way for many to meet their spend requirement for the X card. Explicitly excluding these services but exempting EasyBill is a sure-fire way for SC to internalize these additional revenues ($120 from the 2% fee) and make this service more “mainstream”.

I wouldn’t be surprised if Citi is taking notes for any upcoming spend bonus promos.

indeed! so if cardup etc are blacklisted, it’s odd that easybill is too.

Might be worth rephrasing the below, given that it seems to suggest the EasyBill is supported.

” X Card should also support SC’s new EasyBill service, which lets customers earn miles from rental, tax, insurance, and education payments for a fee of 2%.”

but it is supported.

easybill doesnt count towards 6k spending, but it can still be used to buy miles at 1.67 cents each.

In the same vein, Grab transactions won’t count towards the 6k spending but could get the normal 1.2mpd? It’s expressly excluded in para 57(n) but not in para 26(n).

Yup, that’s my understanding

Weird that when I applied on their website I clicked on the “i” icon it showed 30k income for local and 60k for foreigner. This is after I logged into online banking to apply. Might just be a typo, but could be 30k for priority banking clients similar to the priority VI?

that is strange, but you might be right.

Yes, i saw it at 30k too, so its targeted at the citi pm and dbs alt cards? Since all earn 1.2 mpd with 30k requirement.

30k is for priority banking cust

Looks like the website has been fixed and slightly incorrect initially.

It is 30k for local and 60k for foreigner if you are priority. Otherwise 80k for both local or foreigner if not priority.

That makes a lot more sense! Will update when I’m home

Aaron I got a theory that banks and (any other companies) always want to win – so even if they manage to offer a money losing campaign upfront, they almost certainly will crawl it back from us later on. I think of a money losing campaign will get people fired, shares dropping and investors getting mad so..

I akin this to printers being sell dirt cheap but their ink cartridges later sell for crazy prices!

What do you think?

well, it’s not quite the right analogy. with printers and ink, buying a specific printer locks you in to buying a specific type of ink. with the x-card, there’s no lock in as such. if you don’t want to pay the AF in the second year, you can walk away, having already more than recouped your first year AF through the 100k miles. what is more likely the case is that the KPIs have incentivized the team to go for acquisition. because 100k miles is as good an acquisition offer as I’ve ever seen. perhaps the goal is to cross… Read more »

I am more worried about the potential miles devaluation going forward…

Thanks for the reply. Really nice to hear from you as always Aaron – your comments are very insightful. I agree that with the X card, people can cancel it after a year, and it is vastly different from investing in a printer. Well, regarding Daniel’s comment below, I guess it happens. I think it is common to have a really nice upfront promotion, then after years go by, the points become a huge liability and that shows up badly in the P&L. Then devaluation occurs. That is what happened in Krisflyer if I’m not wrong. I will also state… Read more »

exactly! miles (and points) can only be devalued- hence the moral of the story is earn and burn!

Just applied and got approved with slightly below 60k annual income. I think it’s not a hard requirement. JSYK if anyone below wants to enjoy the 100k miles sign up bonus

You submitted your latest 6 months CPF or monthly payslip?

I used Singpass Myinfo link, so I presume it used my info on past 6 months CPF contribution. The card was instant approved

hi can it be used for purchasing of vouchers like NTUC, Takshimaya etc?

Yes, i am curious about this too.

I don’t see why not. The card issuing bank won’t know what you spend on, just the amount you spent and with which merchant.

Do you know whether SCB pools reward points? Like Citi which doesn’t, like UOB which does, or hybrid like DBS?

You mentioned that the sign up bonus is 70,000 miles, not 100,000, because 30,000 comes from paying the annual fee. Does this mean we can still get the 70,000 miles for the $6000 spend if we do not pay the annual fee?

Annual fee is non-waivable.

can anyone advise if purchasing NTUC vouchers count towards the 6k min spend?

call to ask them? i[‘m not sure how they could tell though unless NTUC has separate MCC codes

Unless they get level 3 transaction data, there is no way to tell you bought vouchers

Pardon my ignorance, what is level 3 transaction data? And how do we know if NTUC/StandChart got it?

Level 3 data is line item level. So if I went to guardian, we can see that I bought Rogaine and various kinds of flatulence reducing medication, for example. No way of knowing if they have it

Hi Aaron,

I have read thru the terms and conditions.

Do you thinks purchasing Hyatt points and Alaskan airline will qualified towards the $6000 “need to spend” in 60 days.

My BOC card treated the alaskan miles purchase as a foreign retail transaction.

Should be the same for SC X card.

Planning to do some miles and hotel point shopping soon 🙂

Thanks for advise.

Of course it will. Points.com is safe

Subject to 3.5% fee?

Hummm good point…… will have to factor that in the calculations. But I think still worth it. Maybe a mixture of local spend and miles/ hotel. Use BOC for the overseas spending.

Thanks!!

Minimum Annual Income

For Priority/Private Banking customers:

Singapore Citizens and Permanent Residents: S$30,000

Foreigners with Employment Passes: S$60,000

For all other customers: S$80,000

Does paying for grab rides directly using the credit card (Ie not via grab pay) count towards the 6k requirement?

I would expect that to count toward the 6k. Anyone know the MCC to confirm?

Anyone having issue with applying online? I keep getting an error and I even went to a branch to check on my “profile” with SCB and the RM mentioned that there is some IT issue now with the surge of applicants.

Having error after error , try again later

Still having error (A05). ZZZZ

Just applied and got instantly approved. Seems a compelling miles-buying proposition in the first year but remains to be seen whether it’s worth keeping after that. 100k miles as a Christmas present, hopefully!

Thanks Aaron for the insights.

Just has it approved. Applied since I’m heading for a trip next month.

Just to point out that the cost of buying miles through this promo is actually $0.062/mile – not exactly a compelling proposition in terms of cost.

If you already had an impending big ticket purchase on the other hand…16mpd is an outsized return

how did you get $0.062/mile? Shouldn’t it be $695/100,000miles or $695/107,200miles?

On the assumption that one wouldn’t have spent the $6k otherwise, if one has to manufacture the spend in order to get the 107,200 miles from this promo then it is $6,695.50/107,200, which is buying miles at 6.2 cents per mile.

If the $6k already needed to be spent, that is where the outsized value of this promotion comes in with the additional cost in the form of the annual fee.

Hello, that’s not how you compute cpm for buying miles … you don’t include your spend for computation, only the fees. Well, unless you are paying $6k + 695.5 fees then your computation is correct.

You clearly did not read either of my posts, but thanks for attempting to clarify anyway.

Good lord you can’t just assume one wouldn’t have 6k to spend aka would have to manufacture the spending *facepalm* If you do that, no promo would make sense ever unless it’s DBS Altitude, which doesn’t require bay spending for promo miles…

LOL

Food for thought?

Can we place a 10k Fix deposit and get this card if one doesnt hit the income requirements & not priority banking?

Noticed that there is also a miles promo for SCB priority banking.

https://av.sc.com/sg/content/docs/sg-priority-sign-up-promotion-tncs.pdf

Assume I can meet the mentioned conditions (new-to-bank, not previously with SCB priority, etc) and have 300k in fresh funds that is idling. Is it worth to sign up for SCB priority and place the amount in their time deposits for 3 months just to get the 100k miles?

Hi Aaron,

Will installment be consider for the 6k spending and get miles too?

I read the T&Cs and my understanding is installments at point of sale (e.g. watch purchase at hour glass) is considered by the monthly installment amount only. If you purchased a watch then converted it to installment after purchase then full amount is considered.

You managed to do what Ricky couldn’t. Read,

So many exclusions, including cardup & telco bills, how do they expect people to meet the 6k spend target?

If spend target cannot be met, who will pay 700 bucks annual fee that serves no purpose, since the main key is the 70000 bonus miles for 6k spend?

Do they want the customers and spending or do they want a huge advertising efforts n lacklustre response?

nope, bank always want customers – but not customers like you

They dont expect you to meet it.

Lol, I already made the $6k spent yesterday when I got the digital card

Now that’s the kind of customer SCB wants. LOL.

Not to sound cruel but 6k spending in two months is pretty easy to meet in many situations, especially given the income bracelet this card targets…….

Hi Aaron – would donations be considered under the $6k spending? i don’t see donation being in the excluded list – thanks

it is odd that they did not explicitly exclude it, but i’d feel nervous trying.

Thanks Aaron – appreciate your response

Would it not be retail transaction unless SCB does not charge merchant fees when I use the Visa Infinite X Card for online donation?

Based on the T&C that came out, it was not specifically excluded as some other card issuers have done . But yes, I am nervous….. but paying the $700 annual fee for 30,000 miles doesn’t add up

Donations are generally excluded by many banks. WHY are you taking this risk? Also WHY are you not calling the bank to check and confirm?

Same bloody issue again.

A lot of people here treating Aaron like their own financial adviser and X Card consultant..

Alot of questions can be found in the T&C and failing which you can direct to the proper X Card CSOs for their advise and “whether this quality for points and stuffs” which, as their SCB agent, is legally binding too (based on whatever they tell you)

You guys, a lot of you are mistreating Aaron. He is being very nice but you need to respect his time too man.

Peace out.

totally agree.

This site has steadily been attracting more and more cheapskate idiots who treat Aaron as their personal butler and concierge. Lots of whining and crying. Just look at the poster a couple of posts above – whining about so many exclusions and how they expect people to meet. Well, the hard truth that these cheapskate readers can’t accept is that if you can only spend $6k through manufactured or quasi-manufactured spend, then the bank is not really interested in you. Those who can spend $6k easily in a retail store/boutique for example, that’s what the bank is looking for and… Read more »

Ouch, that hurts… lmao

Well said ! I couldn’t agree with you more !

Ouch – the truth does hurt.

People need to bear in mind that banks and airlines are businesses whose aim is to make money for their shareholders. As a business they will take good care of their best customers, and try their best to exclude freeloaders.

And yes, Aaron is not a personal concierge. Do please RTFT&Cs.

Also prevalent in the Telegram group – too many people (some earnest, mostly entitled) expecting to be spoon-fed. On the other hand, they generate web traffic…

Email received: Thank you for registering with the Milelion promo code TML.

But Looks like no benefit doing so……

Does anyone know donations to charity qualify? Otherwise I’ll give it a miss as I can’t think of $60k retail spend in 60 days. It’s not specifically excluded in the terms and conditions unless I missed something somewhere.

My guess is the benefit is ML gets a referral commission from SCB.

We do not earn any referral commission for this product

yeah right bro ;D

That comment was uncalled for.

If Aaron were less magnanimous, you’d find yourself down the barrel of a defamation suit given the innuendo in this statement. Luckily, he’s not that type of person who goes around suing just because he can.

there was supposed to be a priority waitlist for shutterwhale and milelion readers, but because of technical issues the launch got pushed a couple of days. in the end, priority emails were sent out on the morning of the 25th, but the site was also opened for general applications. no idea what happened there. c’est la vie

i was alerted to this from milelions email and also applied using the milelions stanchart link when this post came out. thank u aaron

no worries. Aaron. I’ll be happy for you to receive compensation for referring us and writing up on flights or cards. Like we sharing the AMEX Plat rewards when I applied for it after reading through your nuerous articles on TML

Thank you! Really appreciate that

Unfortunately this card and the 100k miles is not for people like you. It’s meant for either the rich or people with the knowledge to game the system. Though you made a typo, $60k spent in 60 days is possible. I clocked S$75k in 1 month for the free yacht.

Hi Aaron, thank you for the excellent writeup.

Do you or any milelioners know if payment for private hospital bills qualify towards the $6K?

I didn’t see any mention of this in the T&Cs.

My new baby boy is expecting to deliver next week so it will be great if the bill qualify.

https://www.sc.com/sg/help/contact-us/

And by the way, is your new baby boy pregnant?

Same situation as Brian. Curious to know if private hosp counts towards $6k

Personal Banking

(65) 6747 7000

(24-hour)

Priority Banking

(65) 6846 8000

(24-hour)

I’m wondering if you are expecting Aaron to know or call for you to check. If it is not clearly stated in the T&C, you should just call in to SCB. If Aaron gives you the wrong info, are you going to hold him accountable? If the CSO give the wrong info, at least you can hold SCB for it.

Applied this morning.. and just got an email that says NOT approved. What is this? SCB has too many applicants..?? I am holding the CIti Prestige card, and my annual is > 100k.

Called the CSO and he says computer decides to approve or reject. He is not able to give any reason for the rejection…

Anybody has same experience here?

One possibility is your credit bureau score. Banks will check applicants’ credit bureau score for all credit facility and loan applications. Have you inadvertently missed any payments recently?

All my credit cards are linked to Giro. never missed a payment in my life …

This month, though, i have a 7k spending on my Citi cards due to insurance payment and some big item. But i am not billed yet. Could that be the reason? Cannot think of any other explanation??

rejected twice, despite Priority Banking status. have emailed my RM to see if she can help.

aaron, really? Keep us updated. Still thinking should I try applying again…

They don’t have to take the risk of you “hacking” to earn the 70k bonus miles ;D

Have you also tried applying without logging into online banking (i.e. like a new to bank) with MyInfo?

actually i am new to bank.. no internet banking acct with them. the last manhattan card with them was cancelled eons ago

I see maybe the old fashioned route with computerized salary slip or CPF/Income tax statement would be best way. I didn’t use MyInfo either but am existing client.

I applied for their VI card recently as a new to bank customer by submitting payslip and income tax NOA because MyInfo refused to work for me.

When I applied for the X card, I merely had to login to my Internet banking account and apply without even using MyInfo, and it was approved instantly.

hmm… maybe i will try this approach next week. using Myinfo would be totally computer approval. Manual submission would mean human review.. more leeway given i hope 🙂

Seriously???

maybe the reached the quota of 100,000 miles to be awarded. (just like Huawei running out of $54 Hp)…….. LOL

Just received my approval email 14 hours after applying last night via mobile banking app.

Now got to think how to charge $6,000 to the card in 60 days….

i am still waiting for my application status!

Applied when I got the link. Till now still no news, only received copy of my application. Ask CSO, give me standard answer of usually approval 7-14 days. Then what is the instant approval all about Wah Lao eh

Probably due to overwhelming response. Mine was approved on the same day.

I applied 8am on Thursday, was approved mid-day Friday and I could activate my card and add to Apple Pay on Saturday morning. My friend applied and was approved on Saturday itself but card cannot be activated yet. So timing my vary but should be pretty quick.

Finally received my card. 13 days after application. And they have cut cost already coz my box had NO LED lights when I open Hahahaha. Finally bought our year end holiday tickets and confirmed our 100k bonus miles

Same case here, have Citi Prestige card as well and even have a bank loan with SCB, but just received the rejection email. My credit score is BB due to too many enquiries, never defaulted on any payment before. This must be the first time I got rejected too.

Hi bro, what do you mean by “too many enquiries”? and why will that lead to a low credit score? and how you check your score from credit bureau? we have to pay for it right?

When my credit card application was rejected by SCB, I was able to login to CBS to get a free report. When you keep applying for credit facility in a short span of time, your credit score will be affected, albeit slightly only. Still cannot fathom the criteria of rejection.

Anyway applied for another card using my wife’s name and managed to get the approval the next day.

I got the X card appying via mobile app and without submitting any documents and no login of Myinfo.

But 9 months ago, OCBC rejected my application for Voyage card. 4 months after that, I got the Amex Plat Charge.

After OCBC rejected me, I got my free Enhanced Credit report from Credit Bureau Singapore (just to see if there was something -ve I was not aware of). I had a score of 2000 (max 2000/2000) and graded AA. I didn’t bother to call. Not desperate for OCBC card.

Seriously. It’s a mystery to me how banks work.

i see…. I did apply for another credit card, and approved just 1 week before, so that affects my credit score? So if i wait for another 3 weeks or so from now, will my score reset back to original, and no problem for scb approval??

Thanks all the bros here for sharing 🙂

My experience was the exact opposite. I applied with MyInfo and approval was *immediate*.

They gave me the CC number and CVV via Internet banking even before the physical card was sent by mail. The guy on their helpline patiently worked it out with me in setting up Internet banking. I have already set it up on Apple Pay and use it like I would use any other CC. Quite impressed by the service.

I gather from the comments that those who applied through Singpass MyInfo received instant approval, along with a digitized card.

I got instant approval through the same application method. Try doing that.

*I tried logging in to my SCB iBanking account but I couldn’t apply for the card due to some error. I tried Singpass MyInfo WITHOUT logging in and managed to get instant approval. Card was reflected in my iBanking after login

Krisflyer is not one of the frequent flyer listed. it means i cannot credit the 100k to Krisflyer ? Is that true?

PSA: SQ miles are under the SC Rewards Redemption webpage (only via browser) and not the Transfer Rewards (in app). Also, make sure you claim under Air Miles (Visa Infinite) as it costs more rewards points to claim under non-VI. The redemption process is not very coherent from my experience. If you want to claim Cashback or SQ Miles Only, it is done via SC Rewards online page. If you want to claim miles for other airlines you have to do it in the online banking app “Credit Card Rewards” and “Transfer Rewards”. Similarly to claim travel credit you can… Read more »

I know this is a miles card but isn’t it a very good cashback card too? 100000 Miles is 250000 points which is $1000 rebate.

Excluding the 1.2mpd on the $6000 spend, its still a 5% cashback card? After netting off the annual fee from the $1000 rebate.

does anyone know how to confirm if you have qualified (spent 6k) for the signup bonus? I am pretty sure i did but just want to confirm. Called their customer service they just asked me to check T&C clause 53 which says we will be notified via SMS, but i didnt received any SMS.