Here’s The MileLion’s review of the UOB Reserve Card, a daily reminder of the importance of spell-checking your marketing collaterals.

This is UOB’s most elite product, available only to the wellest of the well-heeled, the kind to whom a S$3,888 annual fee is but a rounding error. And, fun fact, it’s also the heaviest credit card in Singapore, tipping the scales at a fatigue-inducing 28 grams (for perspective, the AMEX Centurion is about half that weight).

So is this the heavyweight that UOB wants it to be?

| |

| UOB Reserve Card | |

| 🦁 MileLion Verdict* | |

| The UOB Reserve Card may be the heaviest card in Singapore, but it’ll make your pocket a lot lighter without much to show for it. | |

| 👍 The good | 👎 The bad |

|

|

| *I won’t be assigning my usual Take It/Take It or Leave It/Leave It ratings to cards in the $500K segment, because the service experience, which is a huge factor in a segment like this, is unknown to me as a non-cardholder | |

| 💳 Full List of Credit Card Reviews | |

Overview: UOB Reserve Card

UOB Reserve Card UOB Reserve Card | |||

| Card Details | |||

| Income Req. | S$500K p.a. | Points Validity | 2 years |

| Annual Fee | S$3,888 | Min. Transfer | 5,000 UNI$ (10,000 miles) |

| Miles with Annual Fee | 100,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | N/A |

| Local Earn | 1.6 mpd | Points Pool? | Yes |

| FCY Earn | 2.4 mpd | Lounge Access? | Yes |

| Special Earn | 2 mpd on local luxury spend | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

The UOB Reserve Card is issued on the Visa network, and is made of Alpaca Silver which, contrary to popular belief, is not the product of smelting down alpacas. Instead, it’s an alloy of copper, nickel and zinc, and one of the priciest materials used in the manufacture of metal credit cards.

Go figure it has the heft to match; at 28 grams, this card may even have difficulty fitting into some of the more svelte card readers. The pure metal construction means it does not support contactless payments, so cardholders might just have to add it to their mobile wallet (which kind of defeats the purpose!).

There’s actually two kinds of Reserve Cards out there: the vanilla UOB Reserve, and the diamond-embellished UOB Reserve Diamond Card (because why wouldn’t you want a diamond on your credit card?)

The UOB Reserve Diamond Card has all the benefits of the UOB Reserve Card plus some extra goodies, which I’ll touch on later in this review.

How much must I earn to qualify for a UOB Reserve Card?

The UOB Reserve Card is strictly by invitation only. Applicants must have a minimum income requirement of S$500,000, although this may not be necessary if you have a UOB Privilege Reserve (min. AUM: S$2M) or UOB Private Banking (min. AUM: S$5M) relationship.

Of course these are just general guidelines, and I’m sure the bank retains the flexibility to approve other high-profile individuals.

These requirements would put the UOB Reserve in the so-called “S$500K segment”, which also includes the:

- American Express Centurion Card

- Citi ULTIMA Card

- DBS Insignia Card

Table stakes for this segment include invitations to Illuminati-esque events and “who do you want killed” concierge services, along with eye-popping annual fees.

How much is the UOB Reserve Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$3,888 | 1 / 2 free (metal / plastic) S$648/S$378 for 2nd / 3rd onwards (metal / plastic) |

| Subsequent |

The UOB Reserve Card doesn’t come cheap, but if the annual fee bothers you, then you probably aren’t the right target audience. Principal cardholders will pay S$3,888 in 2023, and S$3,924 from 2024 onwards once the GST increases to 9%.

As for supplementary cards:

- The first supplementary metal card is free for life; second and subsequent metal cards have a S$648 annual fee

- The first two supplementary plastic card are free for life; third and subsequent plastic cards have a S$378 annual fee

Annual fee waiver? What is this, the StanChart X Card? No. There’s no annual fee waiver. Not for you, not for the Prince of Nigeria, not for Lord Barrington. Everyone pays, simple as that.

Cardholders receive 50,000 UNI$ (100,000 miles) each year the annual fee is paid, which works out to a cost of 3.89 cents per mile. Of course, that working assumes you place no value on the rest of the card’s benefits, which wouldn’t really be fair.

| 👍 Extra miles for Private/Privilege Reserve clients |

If you’re a UOB Private Banking or UOB Privilege Reserve Banking customer, you’ll receive an extra 40,000 UNI$ (80,000 miles) in the joining year, for a total of 90,000 UNI$ (180,000 miles). For avoidance of doubt, you’ll receive 50,000 UNI$ (100,000 miles) in the second and subsequent year, just like everyone else. |

In terms of annual fees, the Reserve is the third most expensive card in the $500K segment, with the highest cost per mile (again, I want to emphasise that pure CPM comparisons don’t make much sense at this level, since cards pack so many other benefits; if CPM were your only metric, no one would want an AMEX Centurion!).

| 💳 Annual Fees, Miles and CPM for Elite Cards (income req.: S$500K) | |||

| Cards | Annual Fee | Miles | CPM |

AMEX Centurion AMEX Centurion | S$7,560 | N/A | N/A |

Citi ULTIMA Citi ULTIMA | S$4,199 | 150K | 2.80 |

DBS Insignia DBS Insignia | S$3,240 | 100K | 3.24 |

UOB Reserve UOB Reserve | S$3,888 | 100K | 3.898 |

Sign-up offer

The UOB Reserve Card does have a sign-up offer, but it’s rather…elevated.

New UOB Reserve Cardholders who make a minimum spend of S$100,000 within the first three months of approval will receive a bonus 50,000 miles. I can’t claim to know what goes on in the mind of someone who qualifies for such a card, but from where I sit an incremental 0.5 mpd isn’t that big a draw.

What’s even stranger to me is that this offer is only available for customers who don’t hold any principal UOB credit cards, and have not cancelled one in the past six months. Really? I’m paying a S$3,888 annual fee, and my entry-level UOB PRVI Miles Card is going to disqualify me from a welcome gift?

You might argue that S$100,000 is pocket change for people in this segment, but for perspective, it takes “only” S$25,000 to unlock the Citi ULTIMA’s 50,000 miles sign-up bonus.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ⭐ Bonus Spending |

| 1.6 mpd | 2.4 mpd | 2 mpd on luxury spend |

SGD/FCY Spending

UOB Reserve Cardmembers earn:

- 4 UNI$ for every S$5 spent in local currency

- 6 UNI$ for every S$5 spent in foreign currency (FCY)

1 UNI$ is worth 2 airline miles, so that’s an equivalent earn rate of 1.6 mpd for local spending, and 2.4 mpd for FCY spending.

This makes the UOB Reserve Card the highest-earning card in the $500K segment, even if its rounding policies are more punitive- though my guess is that the average transaction size on these cards rather negates the effects of rounding.

| 💳 Earn Rates for Elite Cards (income req.: S$500K) | ||

| Cards | Local Spend | FCY Spend |

AMEX Centurion AMEX Centurion | 0.98 mpd | 0.98 mpd |

Citi ULTIMA Citi ULTIMA | 1.6 mpd | 2 mpd |

DBS Insignia DBS Insignia | 1.6 mpd | 2 mpd |

UOB Reserve UOB Reserve | 1.6 mpd | 2.4 mpd |

All foreign currency transactions are subject to a 3.25% fee, so using your UOB Reserve Card overseas represents buying miles at 1.35 cents each.

Local luxury spend

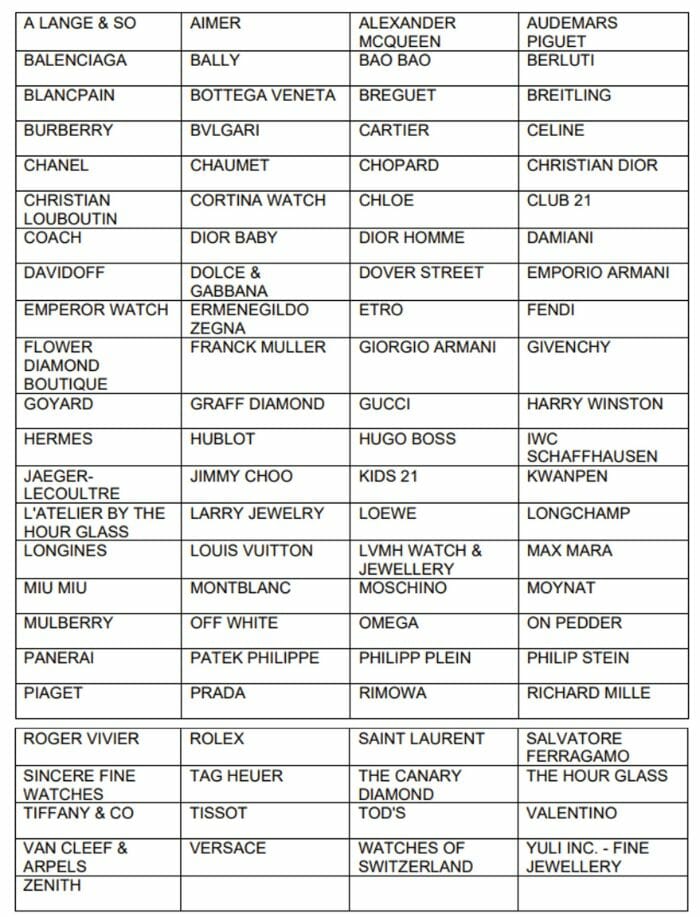

UOB Reserve Cardholders will earn an extra 1 UNI$ for every S$5 spent on local transactions at luxury merchants, defined as:

This means an overall earn rate of 5 UNI$ per S$5 (2 mpd), capped at the first S$20,000 per calendar month. Any spend above this amount will earn the usual 1.6 mpd.

Some of these luxury merchants are on the AMEX 10Xcelerator list, however, so if you have an AMEX Platinum Charge or Centurion, you could be earning a much better 7.8 mpd on up to S$16,000 of spend per calendar year.

When are UNI$ credited?

Base UNI$ are credited when your transaction posts, which generally takes 1-3 working days.

The bonus UNI$ for local luxury transactions will be credited within seven days of the start of the following calendar month.

How are UNI$ calculated?

Here’s how you can work out the UNI$ earned on your UOB Reserve Card.

| Local Spend | Round down transaction to nearest S$5, then divide by 5 and multiply by 4. Round down to the nearest whole number |

| FCY Spend | Round down transaction to nearest S$5, then divide by 5 and multiply by 6. Round down to the nearest whole number |

This means the minimum spend required to earn miles is S$5. Spend S$9.99, and you’ll earn the same points as someone who spent S$5. Spend S$4.99, and you’ll earn nothing at all!

This means that the UOB Reserve Card actually earns fewer points on smaller transactions than the Citi ULTIMA or DBS Insignia, despite all three ostensibly earning 1.6 mpd.

To illustrate:

UOB Reserve UOB ReserveEarn rate: 1.6 mpd |  Citi ULTIMA Citi ULTIMAEarn rate: 1.6 mpd | |

| S$5 | 8 miles | 8 miles |

| S$9.99 | 8 miles | 14.4 miles |

| S$15 | 24 miles | 24 miles |

| S$19.99 | 24 miles | 30.4 miles |

| S$25 | 40 miles | 40 miles |

| S$29.99 | 40 miles | 46.4 miles |

| S$35 | 56 miles | 56 miles |

| S$39.99 | 56 miles | 62.4 miles |

Of course, the question is what the average size of a transaction on such cards is. If you’re spending four-digit amounts, for example, the number of miles lost to rounding really is negligible.

If you’re an Excel geek, here’s the formulas you need to calculate:

| Local Spend | =ROUNDDOWN (ROUNDDOWN (X/5,0) * 4,0) |

| FCY Spend | =ROUNDDOWN (ROUNDDOWN (X/5,0) * 6,0) |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for UNI$?

A full list of transactions that do not earn UNI$ can be found in the T&Cs at Point 1.5.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Government Services

- Insurance

- Prepaid account top-ups (e.g. GrabPay, YouTrip)

- Real Estate Agents & Managers

As a premium product, the UOB Reserve Card avoids some of UOB’s exclusion categories such as education, hospital bills and utilities. These will still earn UNI$ as per normal.

For avoidance of doubt, UNI$ will be awarded for CardUp transactions.

What do I need to know about UNI$?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 2 years | Yes | Waived |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 5,000 UNI$ (10,000 miles) | 3 | 48 hours (KF) |

Expiry

Surprisingly enough, UOB does not offer evergreen UNI$ for its UOB Reserve Cardholders. Their UNI$ will expire after two years, just like any other UOB card.

Evergreen UNI$ are only offered to UOB Reserve Diamond Cardholders; see below for more details.

Pooling

UNI$ pool across cards. If you have 7,500 UNI$ on the UOB Reserve Card and 2,500 UNI$ on the UOB PRVI Miles Card, you can redeem 10,000 UNI$ at one shot.

Since UOB Reserve Cardholders enjoy waived conversion fees, the benefit of pooling here isn’t so much saving on fees, but rather combining UNI$ to meet the minimum block of 5,000 UNI$.

It also means that you don’t need to transfer your UNI$ out before cancelling the UOB Reserve Card, assuming it’s not your last UNI$-earning card.

Transfer Partners & Fee

UNI$ transfer to KrisFlyer and Asia Miles at a 1:2 ratio, with a minimum transfer block of 5,000 UNI$ (let’s ignore AirAsia, because converting points there is like throwing them away):

| Frequent Flyer Programme | Conversion Ratio (UNI$: Partner) |

| 5,000 : 10,000 | |

| 5,000 : 10,000 | |

| 2,500 : 4,500 |

The S$25 conversion fee is waived for UOB Reserve Cardholders, and since UNI$ pool, you can use the UOB Reserve Card as a conduit to cash out UNI$ earned on other UOB cards for free.

UOB also has an auto-conversion option for KrisFlyer, which costs S$50 per year. UNI$ will be automatically converted on the last day of the calendar month, in blocks of UNI$2,500 (half the regular conversion block).

|

| FAQs |

| T&Cs |

| Read Point 53-55 |

However, you’ll need to keep a minimum balance of UNI$15,000 (30,000 miles) in your account at all times. This is a hefty working capital balance! Make what you will of UOB’s reason for this policy…

Why must a minimum balance of UNI$15,000 be kept KrisFlyer auto conversion programme? This is to give card members the flexibility to convert the UNI$ to other items from UOB Rewards Catalogue. Card members can still choose to convert this UNI$15,000 to KrisFlyer miles by the one time miles redemption process through UOB Rewards Catalogue, subjected to S$25 conversion fee and must be in blocks of 10,000 miles. |

Since UOB Reserve Cardholders enjoy free conversions, however, the auto-conversion option is less useful. In fact, it might even be unwanted, since it locks you into KrisFlyer, and the 3-year expiry on your KrisFlyer miles starts as soon as they are converted (had you kept your UNI$ on the UOB side, you’d enjoy two extra years of validity).

Transfer Times

Based on my experience, UNI$ transfers to KrisFlyer are completed within 48 hours.

If you need your points credited instantly, you can do so via Kris+. 1,000 UNI$ can be transferred to 1,700 KrisPay miles, which can then be transferred to KrisFlyer miles at a 1:1 ratio.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

Transfers are immediate, but those 1,000 UNI$ would normally have earned you 2,000 KrisFlyer miles, so you effectively take a 15% haircut.

Therefore I wouldn’t recommend taking this option, unless you need a small top-up to redeem a flight, or have an orphan UNI$ balance (<5,000 points).

Other card perks

UOB Payment Facility

The UOB Payment Facility is a “no questions asked” bill payment facility that lets you buy as many miles as your credit limit allows.

The regular admin fee UOB Reserve Cardholders is 1.9%, but this has been cut to 1.7% until 31 December 2023.

How it works is you specify how much you’d like to charge to the facility, e.g. S$5,000, and designate a bank account. UOB will then:

- Deposit S$5,000 into your designated bank account

- Charge S$5,085 to your credit card (S$5,000 + 1.7% admin fee)

- Awards UNI$ on the S$5,000 at a rate of UNI$2.5 per S$5 (the admin fee does not earn miles)

This gives you a total of 2,500 UNI$ (5,000 miles; the admin fee doesn’t earn miles). You take the S$5,000 UOB deposited to pay off your card bill, and your out of pocket cost is basically the admin fee. The miles divided by admin fee is the cost per mile (1.7 cents).

1.7 cents may not be the cheapest way of buying miles in Singapore; CardUp and Citi PayAll can often be cheaper. However, the main advantage of the UOB Payment Facility is that it’s “no questions asked”- you don’t need an NOA, tenancy agreement, invoice or other document. So long as you have the credit limit, you can buy the miles, simple as that.

Unlimited lounge visits (+1 guest)

Principal UOB Reserve Cardholders enjoy an unlimited-visit Priority Pass, together with one guest. Supplementary cardholders receive an unlimited-visit Priority Pass, without the guest allowance. There is no limit to the number of supplementary cardholders who can receive a Priority Pass.

Compared to other S$500K cards, this lounge benefit is second only to the AMEX Centurion.

| Card | Lounge Network | Free Visits (Per Year) | |

| Principal | Supp. | ||

AMEX Centurion AMEX Centurion | Priority Pass, Plaza Premium, AMEX & Centurion Lounges, and others | ∞ + 1-2 guests | ∞ + 1-2 guests |

Citi ULTIMA Citi ULTIMA | Priority Pass | ∞ | ∞* |

DBS Insignia DBS Insignia | Priority Pass | ∞ | N/A |

UOB Reserve UOB Reserve | Priority Pass | ∞ + 1 guest | ∞ |

| *For up to two supplementary cards | |||

Of course, if you’re regularly travelling in First or Business Class (as most UOB Reserve Cardholders probably are), then a lounge membership may not be all that important.

4 complimentary airport limo transfers

Principal UOB Reserve Cardholders are entitled to four complimentary one-way limo transfers per membership year.

These rides can be used for transfers to and from:

- Changi Airport

- Valencia Yachts reserved via UOB Reserve Concierge

- dinner reservations under the Reserve Dining programme

- cruises/staycations bookings made via the UOB Travel Concierge

All bookings and reservations must be charged to the UOB Reserve Card (e.g. you need to buy your air tickets with the card to qualify for an airport transfer).

Credit where it’s due, it’s good that UOB is offering airport limo rides beyond just the airport. At the same time, however, four rides is barely anything, especially compared to the competition.

| Card | Limo Benefit | Remarks |

AMEX Centurion AMEX Centurion | Purchase First or Business Class ticket via Centurion Concierge | Round-trip transfer within Singapore, and on arrival at selected airports overseas |

Citi ULTIMA Citi ULTIMA | Purchase First or Business Class ticket with card | One-way transfer in Singapore or overseas |

DBS Insignia DBS Insignia | N/A* | |

UOB Reserve UOB Reserve | Make dining, cruise, staycation or flight booking via UOB Travel Concierge | Capped at 4X uses per year |

| *The DBS Insignia does not offer any airport limo benefit that I’m aware of, but if you get the card by virtue of being an Treasures Private Client then you enjoy unlimited airport transfers anyway | ||

2 complimentary meet & greet services

Principal UOB Reserve Cardholders are entitled to two complimentary Meet & Asist or Fast Track Airport Immigration services per calendar year.

No minimum spend is required for this benefit. Cardholders will need to make bookings at least 72 hours before the desired pick-up time, and the principal cardholder must be one of the passengers. Guest fees are chargeable.

Reserve Dining programme

UOB Reserve Cardholders have access to pre-booked tables at the following restaurants under the Reserve Dining programme:

- Burnt Ends (1 Michelin Star)

- Cloudstreet (2 Stars)

- Esora (1 Star)

- Hamamoto (1 Star)

- Les Amis (3 Stars)

- Meta (1 Star)

- Odette (3 Stars)

- Oshino (1 Star)

- Sommer (1 Star)

- Zen (3 Star)

Each booking is limited to two diners per reservation, and you must book and pay for a set menu at the time of reservation. No refunds, amendments or cancellations are allowed.

That would be a handy benefit, if not for the fact it’s limited to Wednesdays only, and not if said Wednesday is the eve of a public holiday or public holiday, or a special occasion such as Easter Weekend, Mother’s Day, Father’s Day, F1 Weekend and Thanksgiving. Come to think of it, these are probably the dates when a guaranteed table would come in the most useful!

This perk is available from May 2023 to April 2024, subject to further extension.

Golf perks

Principal UOB Reserve Cardholders will enjoy four complimentary weekday green fees per calendar year, for play on weekdays (excluding public holidays).

This benefit is available at the Sentosa Golf Club and Tanah Merah Country Club.

| 🏌️ Sentosa Golf Club Terms |

|

| 🏌️ Tanah Merah Country Club Terms |

|

100,000 bonus miles

Principal UOB Reserve Cardholders who spend at least S$250,000 in a membership year will receive 100,000 bonus miles upon card renewal. S$250,000 is no small sum, though I assume the average cardholder might not find that much of an issue.

Keep in mind, this is just an incremental 0.4 mpd, so it’s not something you should go out of your way to achieve.

Complimentary travel insurance

| Coverage | Amount |

| Accidental Death | US$1,000,000 |

| Medical Benefits | N/A |

| Travel Inconvenience |

|

| Policy Wording | |

UOB Reserve Cardholders enjoy complimentary travel insurance when they charge their airfare to their card.

However, it’s surprisingly threadbare. While there’s US$1 million coverage for accidental death, and the standard travel inconvenience cover, there’s nothing at all for overseas medical expenses, emergency medical evacuation, trip cancellation or trip interruption.

I certainly wouldn’t be comfortable relying on this as primary coverage, that’s for sure.

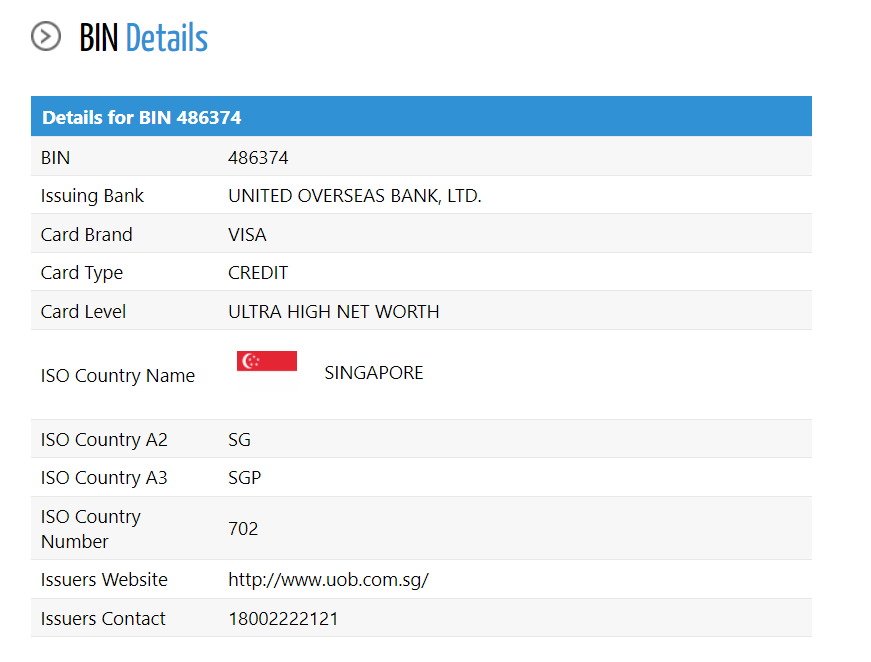

Visa Infinite privileges

While the UOB Reserve Card’s card face says Visa Infinite, it’s actually part of the unpublished Visa Ultra High Net Worth tier. Don’t believe me? Run the card number through a BIN checker.

The question then becomes: what does the Visa Ultra High Net Worth tier offer? Honestly, I don’t know. So far I’ve only been able to find a special golfing programme where availability is much better compared to regular Visa Infinite (probably because there’s less competition for slots), but that’s about it.

In any case, UOB Reserve Cardholders enjoy all the regular Visa Infinite benefits, such as:

- Avis President’s Club status

- 50% off weekday golf at 50 participating golf clubs across Southeast Asia

- 50% off weekday golf at Sentosa Golf Club

- Visa Luxury Hotel Collection

UOB Diamond Reserve Card

Like every monied club, there’s always a higher tier of exclusivity, a secret level where the super elite can look down their noses at the regular elite.

That comes in the form of the UOB Reserve Diamond Card, which UOB Reserve Cardholders will be upgraded to if they spend at least:

- S$1 million a year on the UOB Reserve Card

- S$10 million a year on the UOB Payment Facility

Those are frightening sums (at least for me), but the reward takes bling to the next level: a card with an actual diamond embedded into it. How much does it cost to make? Well, if you want an additional supplementary card, each will cost you S$1,080 (and you’re limited to two).

Thankfully, it’s not a mere cosmetic upgrade. UOB Reserve Diamond Cardholders receive additional privileges, as summarised below:

|  | |

| UOB Reserve | UOB Reserve Diamond | |

| Earn Rate |

| |

| Points Expiry | 2 years | None |

| Lounge Access | Principal: Unlimited Priority Pass (+1 guest) Supplementary: Unlimited Priority Pass | |

| Limo Transfers | 4 per year | |

| Meet & Assist | 2 per year | 8 per year |

| Golf Games | 4 per year | 6 per year |

| Free 2nd Hotel Night | N/A | Once per quarter |

| Meal On Us | N/A | Once per quarter |

| Mandala Club Invite | N/A | Yes |

| The physical Diamond Card has a validity of five years, but Diamond-tier privileges will be rescinded if the customer does not meet the qualifying spend in the subsequent 12-month membership period. In other words, you might have a physical UOB Reserve Diamond Card, but the features of a regular UOB Reserve Card. | ||

UOB Reserve Diamond Cardholders enjoy non-expiring points (why that’s a perk reserved only for those who spend a million dollars a year, I do not know), extra meet & assist usages, and extra golf games.

There’s also three additional perks that UOB Reserve Cardholders don’t get:

- Free 2nd hotel night

- Meal on Us

- Mandala Club invite

Free 2nd hotel night

Principal UOB Reserve Diamond Cardholders are entitled to one complimentary hotel night when they book two consecutive nights with UOB Travel Planners. This perk is capped at one use per calendar quarter, and a maximum rebate of S$400.

Yes, S$400. That seems incredibly stingy, when the Citi ULTIMA Card is giving out 2nd night free stays left and right (and without a S$1 million spending requirement, mind you).

Prepayment is required in full at the time of booking, and the free night is forfeited if the reservation is changed or cancelled.

If you ever needed a textbook definition of “giving with one hand”, this would be it.

Meal on Us

Principal UOB Reserve Diamond Cardholders receive a complimentary meal for two persons, once per calendar quarter.

A redemption letter will be sent by the 30th/31st of each end calendar quarter via mail. I would assume these are at suitably high-end restaurants, perhaps the ones under the Reserve Dining programme.

Mandala Club invitation

Principal UOB Reserve Diamond Cardholders receive an invitation to join the Mandala Club. Should their application be approved, the joining fee and first year’s club membership fees (just shy of S$8,000 in total) will be funded by UOB.

Tatler provides the following background:

Mandala Club is a next-generation private member’s club that strives to be a little different from its traditional predecessors. It serves as a networking space for Singapore’s entrepreneurs, business and thought leaders as well as creatives across various industries.

Previously home to Straits Clan, the 22,000 sq ft, four-storey building comprises a gym, entertainment, meeting, and event spaces.

Last year, Mandala Club launched its Mandala Masters series, inviting world-renowned chefs to take over its ground floor restaurant. Mauro Colagreco’s Mirazur, and Gaggan Anand, have previously taken up residency at Mandala, with more to come.

Art lovers will appreciate Mandala Club’s museum-worthy collection of artwork by artists such as Salvador Dali and Pablo Picasso.

Is this a big draw? I really couldn’t say. It seems like the kind of chi-chi place for captains of industry to rub shoulders, and if that’s what you’re looking for then sure, knock yourself out.

Terms & Conditions

Conclusion

| |

| UOB Reserve Card |

Is the UOB Reserve Card worth S$3,888?

I’m not sure I’m convinced. While it offers good lounge benefits, other perks like limo transfers, meet & greet and complimentary golf are surprisingly limited in quantity. The Reserve Dining guaranteed-tables programme is limited to Wednesdays, the complimentary travel insurance is lacking, and don’t even get me started on that very miserable sign-up bonus.

It’s not like the picture improves all that much for UOB Reserve Diamond Cardholders. The free meal is a nice touch, but the S$400 hotel rebate is almost derisory. I can’t speak to the value of a Mandala Club membership, but you’d think the bank could offer something a bit more over the top for cardholders spending up to S$10 million a year!

I’m sure there could very well be unpublished benefits that I’m unaware of, but assuming that’s all there is, then it just doesn’t feel like the best use of money.

Even if you have too much of it.

looking at the benefits made me laugh, do they really understand the customer whose annual income exceeding half a million. Can’t imagine who’d like to pay $3,852 for the membership fee would take the economy class and need a PP for the lounge. Very funny…

+1

Agree. Even for mass affluence, I really don’t understand positioning PP as status. Almost everyone gets it, what’s the big deal?

Other than the cachet of the Centurion, Ultima seems sensible

Before i open fd account and trust UOB with my pension i was solvent.

Today refusesal to play fair trader and refund my losses u o b leaving me hand to month preventing me to return home insolvent while keeps on boasting Bilions illgots profits.

Public should be warned. Without prejudice.

Jm. Uk expat.

Other than Amex centurion, out of $500k card only UOB has hotel elite status?

UOB reserve gets you free GHA titanium status upgrade

For the 200k spend qualification criteria, does this all have to be on a single UOB card or can it be spread across multiple UOB cards in the same 12 month window?

On the contrary, rich people are actually huge misers and the 3.8k+ IS going to matter to them as they scrutinise hard for value.

UOB Reserve gives the principal a complimentary birthday cake from Fullerton Hotel Cake Boutique yearly and also free upgrade to GHA Discovery Titanium status. Another point to note is spending $250k a year on the card will get you another bonus 100,000 miles upon renewal of card. So you will get 200,000 miles a year for the annual fee of $3888 which is a much better value for paying the annual fee.