Please read the instructions here before applying for any SingSaver cards!

| SingSaver’s new #whatsnext campaign may be offering superior offers to some of the gifts listed on this page. Be sure to check out this post before applying. |

SingSaver’s March credit card offers are now live, with exclusive cash gifts and vouchers available for new and existing customers. After applying, remember to fill up the gift redemption form with your application reference number, which enables SingSaver to deliver your gift.

Citi PremierMiles Visa & Citi Rewards Visa

| New-to-Bank | Existing Customer | |

| Citi Rewards Visa | $200 NTUC, Grab or Taka vouchers | $30 NTUC vouchers |

| Citi PremierMiles Visa | $200 NTUC, Grab or Taka vouchers | $30 NTUC vouchers |

Apply for the Citi Rewards Visa here

Apply for the Citi PremierMiles Visa 30K welcome offer here (first year fee must be paid)

Apply for the Citi PremierMiles Visa here (first year fee waiver)

The Citi PremierMiles Visa earns 1.2 mpd locally and 2.0 mpd overseas, with up to 7 mpd on Expedia and 10 mpd on Kaligo. The card also comes with two complimentary lounge visits a year via Priority Pass (this will be changed to DragonPass in the future). Citi Miles earned through the Citi PremierMiles Visa do not expire.

There’s currently an ongoing sign up bonus for the Citi PremierMiles Visa, where you get 30,000 miles in total with paying the annual fee and spending a minimum of $7,500 within the first 3 months. You’re still eligible for this bonus if you sign up via SingSaver.

The Citi Rewards card continues to be the go-to card for online and offline shopping, where you’re buying bags, shoes or clothes, or shopping at department stores. Earn 10X points (4 mpd) on the first $1,000 of spending each month.

Do note, however, that Citibank is currently offering a sign up bonus for the Citi Rewards card until 31 Mar 19 that offers up to 22,800 miles for spending $3,000. In order to get that bonus, you’ll need to apply through this link– which means no SingSaver gift.

Citibank points don’t pool, but the good news is they have the widest selection of partner airlines in Singapore. Citi gives you a choice of 12 different frequent flyer programs to transfer your points, including useful ones like British Airways Avios and Etihad Guest.

New-to-bank customers get $200 of NTUC, Grab or Taka vouchers when they’re successfully approved for a Citibank card, and existing customers get $30.

The first year annual fee is waived on both cards (but you will need to pay the annual fee on the Citi PremierMiles Visa if you want to get the 30,000 mile bonus), and this promotion is available for applications submitted by 31 Mar 2019.

Standard Chartered Visa Infinite

| New to Bank | Existing Cardholder | |

| SCB Visa Infinite | S$100 | S$50 |

Apply for the SCB Visa Infinite here

The SCB Visa Infinite is part of the so-called “$120K” group of entry level prestige cards (although its income requirement technically is $150K). You earn 1.4 and 3.0 mpd on local and overseas spending respectively if you spend more than S$2K in a statement period, otherwise you’re looking at 1.0 mpd for everything.

The card has a non-waivable annual fee of $588.50, for which you get 35,000 welcome miles. That said, it does not have an unlimited Priority Pass (6 visits only) nor does it have airport limo service.

However, remember that the $100 SingSaver gift reduces the first year annual fee to $488.50, which means you acquire 35,000 miles at 1.396 cents each, a very good price to buy miles.

Also remember that the SCB Visa Infinite offers one of the best tax payment facilities in the market. For a processing fee of 1.6%, you can earn 1.4 mpd assuming you spend at least S$2K in total during a given month. That works out to just 1.14 cents per mile, making the SCB VI a pretty interesting proposition for people who want to buy miles on the cheap.

This promotion is available for applications submitted by 31 Mar 2019.

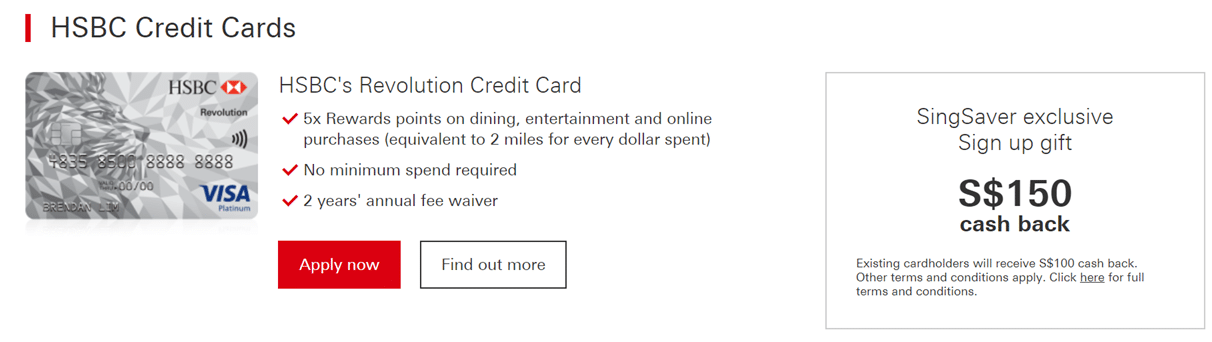

HSBC Revolution

| New to Bank | Existing Customer | |

| HSBC Revolution | $150 cashback | $100 cashback |

Apply for the HSBC Revolution here

The HSBC Revolution is a useful backup card to have because it earns 2.0 mpd on online, local dining and local entertainment transactions. 2.0 mpd on dining is less than the Maybank Horizon Visa Signature’s 3.2 mpd, but HSBC’s definition of dining is broader. HSBC considers fast food to be part of dining, and explicitly states that spend at clubs, pubs, bars will get 2 mpd. There also is no minimum spend amount required to earn this.

Fun fact: you can pair the HSBC Revolution with your EZ-Reload service and earn 2 mpd on the first S$200 spent on EZ-link top ups each month. That’s more than the 1.4 mpd you’d earn by using your UOB PRVI Miles Mastercard with ABT.

Unlike the rest of the cards here, the HSBC sign up gift is in the form of cashback. That’s to say, the gift is awarded by the bank, not SingSaver. If you applied normally through the HSBC website, you’d get $100 of cashback as a new customer if you spend $600 within 30 days. Applying through SingSaver gives you an additional $50 of cashback for a total of $150.

Existing cardholders will get $100 cashback when they sign up through SingSaver ($50 otherwise) and spend $600 within 30 days.

This offer applies to applications received before 31 Mar 2019.

UOB PRVI Miles

| New-to-Bank | Existing Cardholder | |

| UOB PRVI Miles (All variants) | S$50 | S$50 |

Apply for the UOB PRVI Miles Visa here

Apply for the UOB PRVI Miles Mastercard here

Apply for the UOB PRVI Miles AMEX here

The UOB PRVI Miles is a general spending workhorse, earning 1.4/2.4 mpd for local/overseas spending without any cap or minimum spend requirement. Those earning rates may be below the 1.5/3.0 mpd being offered by the BOC Elite Miles World Mastercard, but I can guarantee you you’ll get your UOB PRVI Miles card approved faster than the BOC.

You can also earn 10 mpd for hotel and airline bookings made through selected OTAs like Expedia, Agoda and UOB Travel.

If you opt for the PRVI Miles AMEX, spending $50,000 in a membership year will get you 20,000 loyalty miles, and you can redeem up to 8 complimentary airport transfers per year.

The first year annual fee is waived, and whether you’re an existing or new UOB customer, SingSaver is giving $50 of cash to successful applicants. This promotion is available for applications submitted by 31 Mar 2019.

Does anyone knows if UOB Privi Pay adds to the $50,000 spent in a membership year for their AMEX version?