The following post is sponsored by Standard Chartered Bank. All opinions expressed (and editorial snark) are those of The Milelion.

Most people know how to earn miles through spending. But can you earn miles through saving? Well, that’s what Standard Chartered Bank (SCB) is offering right now with its SGD Miles Time Deposit campaign.

From now till the 30th September 2016, you can earn 10,000 miles for every S$27,000 of fresh funds deposited in an SCB 6-months time deposit, up to a maximum of 60,000 miles with a S$162,000 deposit of fresh funds.

| Placement | Tenor | SGD Miles Time Deposit |

| S$27,000 – S$162,000 | 6 months | 10,000 KrisFlyer miles for every S$27,000 fresh funds deposited |

Some of you will remember that I wrote about a similar promotion by SCB back in June. Back then, the promotion was 10,000 for every S$25,000 deposited for 6 months, with a maximum of 60,000 miles.

So what’s changed since then? Interest rates for one.

On 21 June, a quick check on MoneySmart showed that the best rate you could get for a 6-month SGD time deposit was 1.6% p.a. As of 9 Sept, the best interest rate in the market is 1.5% p.a. Here’s how the current SCB offer compares to its previous.

| Deposit amount | KrisFlyer miles from SGD Miles Time Deposit | Best available alternative | Cost/Mile | |

| June promotion | $25,000 | 10,000miles | S$200 at 1.6% p.a. interest | 2 cents |

| Current promotion | $27,000 | 10,000miles | S$203 at 1.5% p.a. interest | 2.03 cents |

The upshot is that this is, for all intents and purposes, the same deal as last time round- a chance to acquire miles at an opportunity cost of 2 cents each (as opposed to an actual cash outlay).

Who would this best work for? The profile I have in mind is someone who is cash rich but miles poor, who wants to acquire miles without spending money outright. If you put down the maximum deposit of S$162,000 in fresh funds, you will have 60,000 miles by 31 October 2016, i.e within 2 months of depositing your money.

Presumably, there are those who would rather have S$1,215 of cold hard cash (based on an alternative of 1.5% p.a interest), and I can totally understand that. But as we’ve said time and time again, the value of miles comes in their variable value.

Let’s look at some of the things you could do with those 60,000 miles and decide whether they’re better (or worse) than S$1,215 of cash.

Good Ideas

Fly in First or Business Class with SQ (S$3,600-4,800)

There are quite a few permutations of potential trips you could do here. I’m highlighting China in particular because it’s a chance for you to experience SQ’s latest cabin products (on the 77W) or even Suites (if you get the A380 flights). However, you could also do the same trip to India if you’re so inclined for the same number of miles described below

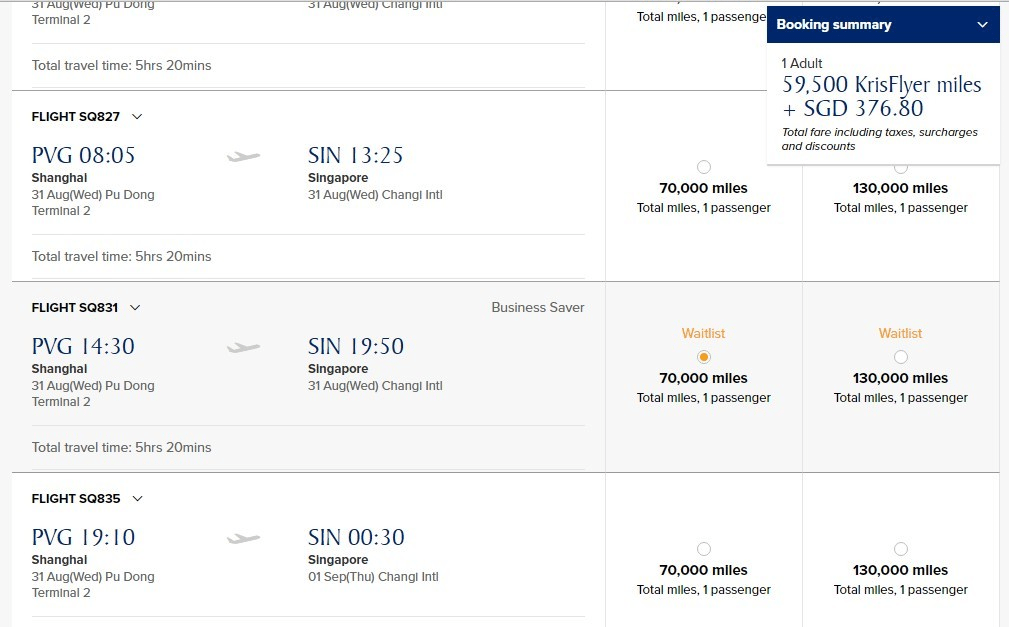

Round trip Business

Flights to China and India are around the 5 hour mark, which is a good amount of time to enjoy the Business Class product. You can get a round trip ticket for 59,500 miles and S$376.80 of taxes.

This ticket retails at S$4,151.80, so you get about 6.3 cents per mile. Remember that depending on your aircraft type, you may either get the old J seat (A380s, some 777s), which unfortunately is showing its age on some of the older aircraft

Or the 2013 new J seat, which is awesome.

If you’re confused as to which aircraft has what seats, check out this post on SQTalk. Those weird sequences of numbers (eg 9V-SRM) are aircraft tail numbers (think of them as license plate numbers), you can check out FlightAware of FlightRadar24 to see which aircraft are flying which routes.

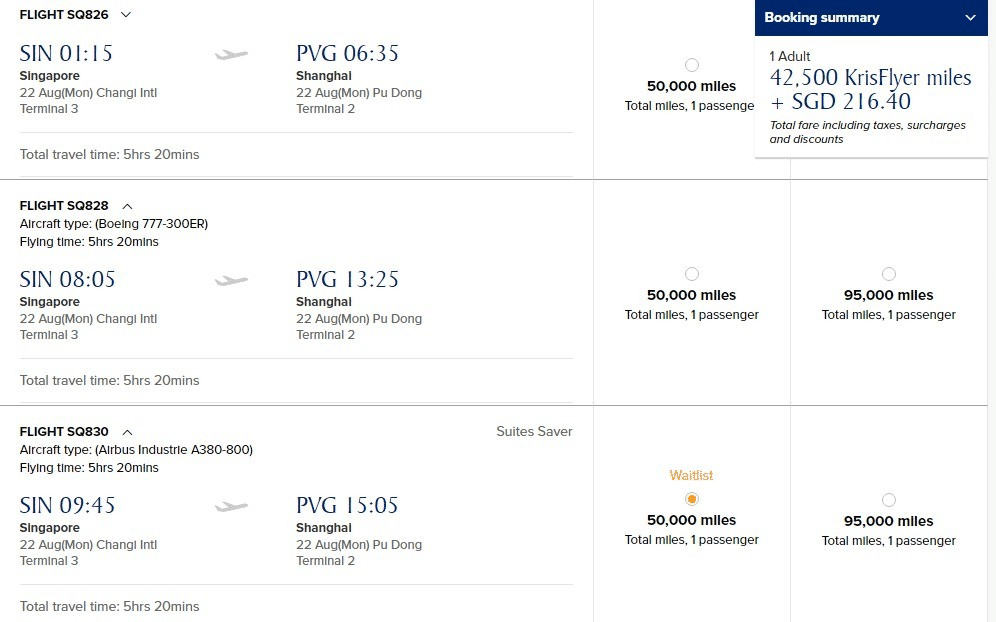

One way Suites

SQ’s Suites are available on flights from SIN to BOM, DEL, PVG and PEK.

In the above example of SIN-PVG, you can redeem a Suites ticket for 42,500 miles and S$216.40. This flight retails at S$3,756.40 one-way, so you’re looking at 8.3 cents per mile. Not to mention you’ll have 17,500 miles leftover.

En route you can look forward to The Private Room, Krug Champagne and all the other niceties of SQ’s First Class.

You could redeem the 60,000 miles for a round trip ticket to SFO/LAX in the USA, but you know how I feel about redeeming miles for economy class tickets. Plus, there are so many promotional fares out there on other airlines, so this represents very poor value.

Underwhelming ideas

If you want to do any of the following, you should reconsider.

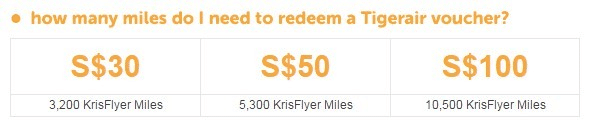

Redeem Scoot/Tigerair Vouchers (S$560)

With 60,000 Krisflyer miles, you can get 5X $100 vouchers (52,500 miles) and 2X $30 vouchers (6,400 miles) to have S$560 of vouchers and 1,100 miles leftover.

I’ve written what I think about this, but TL;DR, the value is so low it’s not worth bothering with.

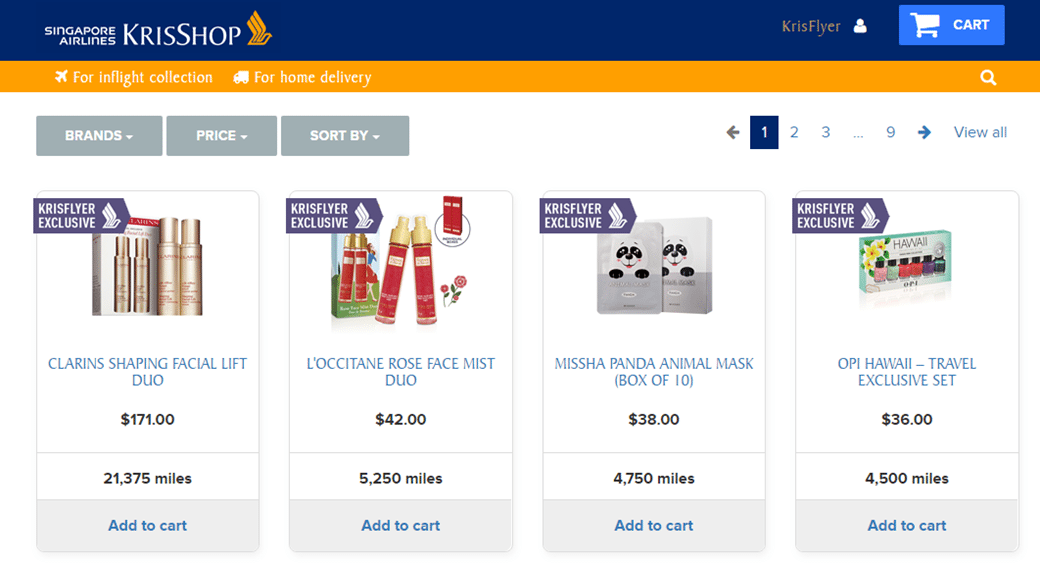

Purchase items on Krisshopair.com (S$480)

You can use your Krisflyer miles on Kirsshop at a value of 0.8 cents per mile. So your 60,000 miles will get you roughly S$480 of value.

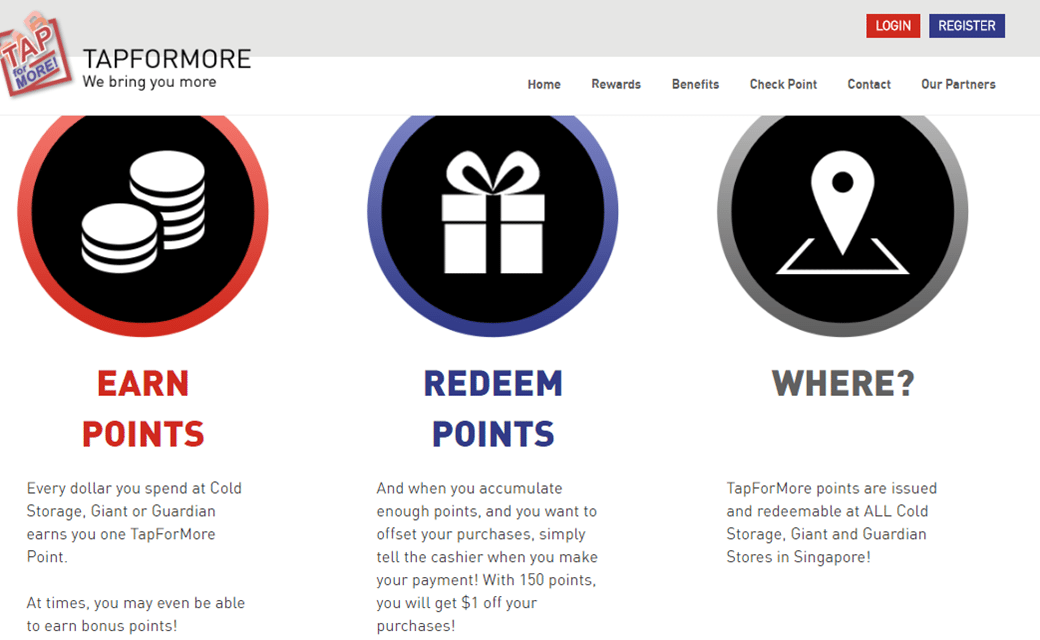

Get 66,000 TapForMore points (S$440)

I’ve written about the possibility of converting Krisflyer miles to TFM points but to recap: 150 TFM points= S$1 off a purchase, so 66,000 TFM points= S$440 off your purchases.

Conclusion

I can see how some people who are interested in portfolio diversification or who intend to open a time deposit anyway would be interested in this. If you’ve got an upcoming redemption in mind but are just short of miles, this would be a good way of getting some quick miles into your account (as per the T&Cs, the miles will be credited to your account by 31 Oct 2016, instead of when the time deposit matures 6 months later but fees and charges may be imposed for early withdrawals)

As with all promotions, please familarize yourself with the T&Cs, which you can find here. Note that if you need to withdraw your funds early, the miles won’t be clawed back but fees and charges may be imposed including a replacement fee of S$270 for every S$27,000 placed in the time deposit.

All in all, I think this can be an option for you if you want to earn miles without shelling out for annual fees. And it’s always good to save some money in the process.

Convinced? Sign up here before 30 Sept.

This article was produced in conjunction with Standard Chartered Bank (Singapore) Limited. All information provided is on an “as is” basis and for informational purposes only, not intended for trading purposes or advice. It is not an offer, recommendation, or solicitation to anyone to enter into any investment transaction. It has not been prepared for any particular person or class of persons and does not constitute and should not be construed as investment advice nor an investment recommendation. It has been prepared without regard to the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser on the suitability of an investment or financial product for you, taking into account these factors before making a commitment to invest in an investment or financial product. Standard Chartered and The Milelion are not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. For the most updated information on SGD Miles Time Deposit promotion, please click here.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$50,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Now that SC need your help with advertorial, any chance they can take back the blended tea for something (anything!) else? 😛

Standard Chartered Bonus$aver sign up gifts, by order of probability

1. Samsung Galaxy Tab 3 (54%)

2. $20 NTUC Voucher (16%)

3. CP910 Selphy Photo Printer (12%)

4. Customised Blended Tea (8%)

5. Others (10%)

you’re just jealous.

:D:D:D I’m totally #basic!

[…] Well, assuming you parked that same $27,000 in a 6-month SGD time deposit earning 1.5% per annum, that money could have gotten you around $202.50 in interest. (Hat tip: MileLion for doing the comparison on his excellent blog) […]