Driving holidays are fun, but whenever I’m behind the wheel of a rental car I always have a certain paranoia that something will happen, resulting in a huge inflated repair charge (online horror stories of people getting 4 figure bills for a small scratch come to mind).

The best solution, as always, is insurance. Most travel insurance policies do cover some degree of rental car excess, but to put your mind at ease you might want to consider dedicated rental car insurance.

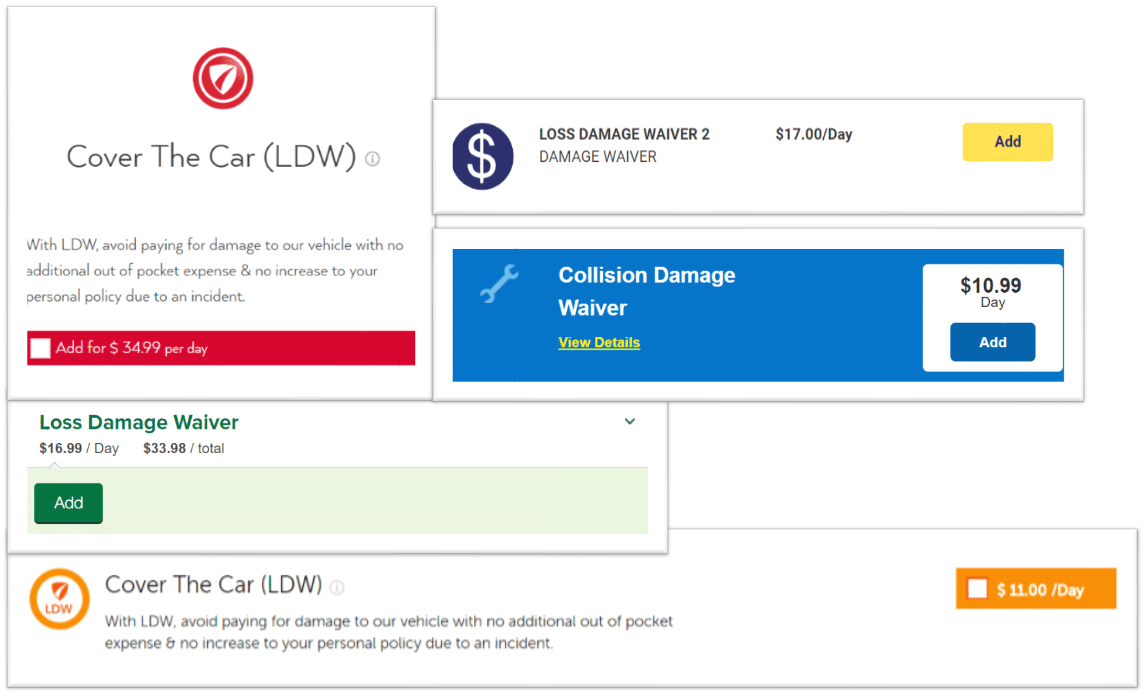

Rental car companies offer their own insurance packages, but these tend to be very expensive. If you’re traveling in the USA or Canada, for example, you’re looking at forking out an extra US$10-30 a day, which can really add up. In Europe and Australia, you’ll find that insurance is usually included in your rate, but with a high deductible. In those cases, you can buy a separate insurance package from the rental company to reduce that deductible to 0, again at a significant mark up.

That’s where third party rental car insurance comes in. The options can be bewildering at first, but in this article, I want to lay out some of the the options available to those of us resident in Singapore (typically defined as having stayed in Singapore for the past 6 months).

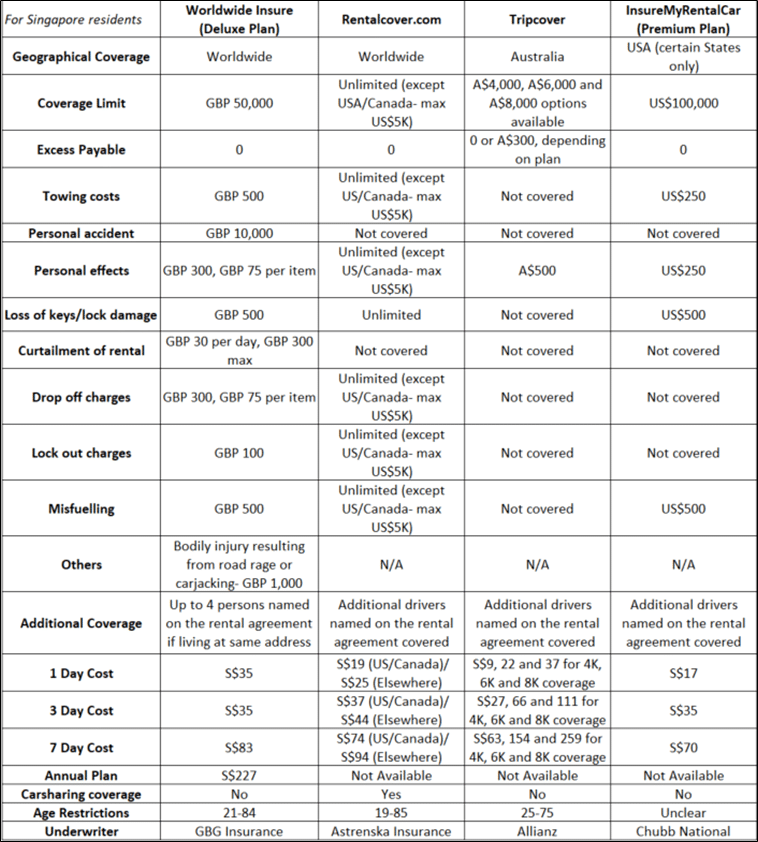

Here’s a summary table to kick us off:

Here are 3 questions to ask when selecting a policy:

- What is my residency?

The first and most important question. Your residency determines the type of plans and coverage available to you. I’ve made the above table with the assumption that you are resident in Singapore (which has nothing to do with citizenship- more about where you’ve stayed the past 6 months). There may be more options if you’re a resident elsewhere.

- How much coverage do I need?

The amount of coverage you require differs depending on the country you’re going to drive in. In Europe and Australia, for example, CDW/LDW is usually already included in your rental cost. This means that what you really need coverage for is the deductible (the amount of the damage you’re liable to pay before the rental company picks up the rest).

In the USA or Canada, however, CDW/LDW is optional. Rejecting it means you’ll need higher coverage because the rental company can go after you for up to and including the total value of the vehicle should the worst happen.

- What kind of provider am I using?

There is a difference between car rental and car sharing. Car rental is what Avis, Budget, Hertz, National, Europcar, Sixt, Thrifty, Dollar, Alamo, Advantage etc offer. Car sharing is what startups like Turo and TravelCar offer, where you rent the vehicle of another individual under a P2P arrangement. With the exception of Rentalcover.com, none of the plans here (or travel insurance plans for that matter) cover car sharing.

Let’s take a closer look at each of the four providers in the table above.

Worldwide Insure (Worldwide)

Worldwide Insure’s policy is underwritten by Bulstrad Life Vienna Insurance Group. You can view the full policy wording here.

A few years ago, this was one of the best value plans on the market. In recent times, however, the price has gone up. When I first wrote about Worldwide Insure in 2015, coverage cost roughly GBP 3 per day, with an annual Standard package available for GBP 51 and Deluxe for GBP 59.

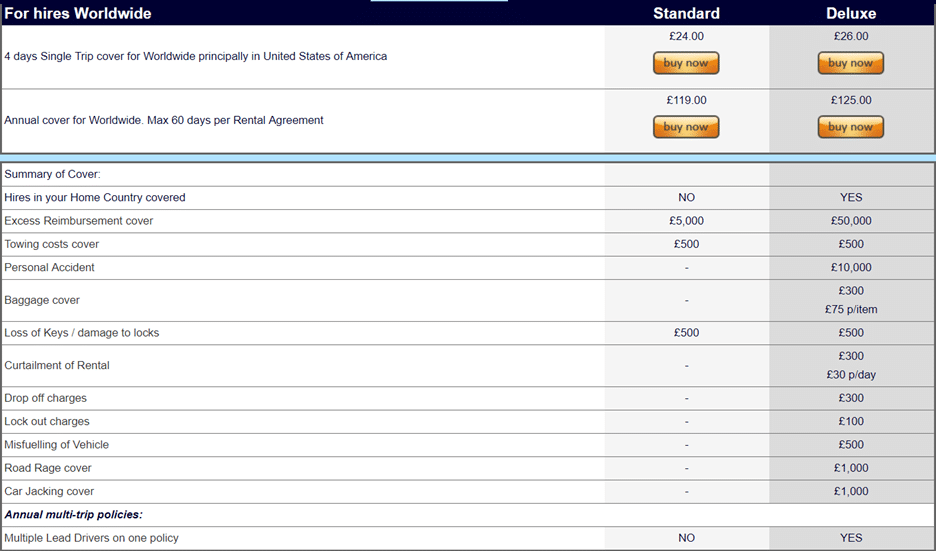

Here’s a quote I just pulled from their website:

As you can see above, the daily coverage cost is now about GBP 6 per day, with the Standard and Deluxe packages more than doubling in price. Given the small price difference between Standard and Deluxe and the vast difference in coverage (GBP 5,000 vs GBP 50,000), it really doesn’t make sense to go for the former.

Here are a few other things to note:

- The policy covers you plus up to 4 others named on the rental agreement provided you live at the same address

- If you opt for an annual plan, the cap on your rental duration is 60 days.

- The policy explicitly excludes Iceland

- This policy does not cover cars with a retail price in excess of GBP 50,000

- Unlike other dedicated rental car policies, this one includes personal accident/bodily injury coverage

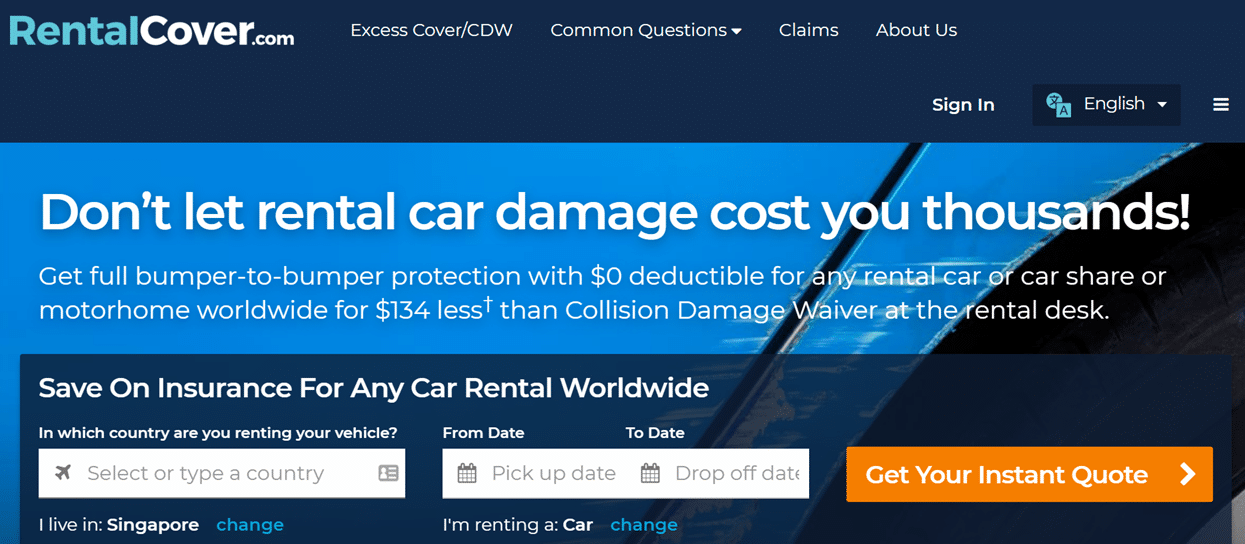

Rentalcover.com (Worldwide)

Rentalcover.com’s policy is underwritten by Astrenska Insurance. You can find the full policy wording here. Do note that the exact wording may differ depending on which geography you’re renting from, so be sure to check when you’re booking.

a

Rentalcover.com offers high coverage, at a price to match. You’re really paying for peace of mind though, that no matter how expensive a car you rent you’ll be covered by the policy.

One crucial thing to note about RentalCover.com is that the coverage works differently depending on whether you’re renting in the USA/Canada or outside of it. If you’re renting in the USA/Canada, your maximum coverage is US$5K. You therefore need to opt in for CDW/LDW because this policy is not designed to cover the entire value of the car. If you’re renting outside the USA/Canada, policy coverage is unlimited.

Here’s how customer service puts it:

We would like to inform you that for visitors going to the USA we offer an Extra Cover USA, specifically designed for those customers whose car booking includes a “CDW” or “LDW” policy, the basic insurance.

Although the CDW/LDW of your rental company does not have any deductible (meaning that, you will not have to pay a deductible in case of an accident because the rental company takes over the total value of the vehicle), the drivers could continue to incur significant expenses, costs not contemplated in the LDW. Therefore, this policy covers these possible costs up to a total of US$2,800.00. Please note that this amount is enough to cover any cost that the driver is obliged to pay in addition to the LDW policy (Partial Collision Damage and Theft Coverage). If you want, you can also increase the policy limit up to US$5,050.00 by logging into your RentalCover account.

Our Extra Cover USA in addition to covering any type of damage to the rented vehicle (repair and replacement of windshields, tires, headlights and mirrors etc), includes free assistance on the road and covers damages, costs and other fees that are not included in the LDW policy of your company rental.

Here are a few other things to note:

- This is the only policy that covers car sharing

- The policy covers any additional drivers named on the rental agreement

- There is no annual plan option, so you will need to buy a new policy every time you rent

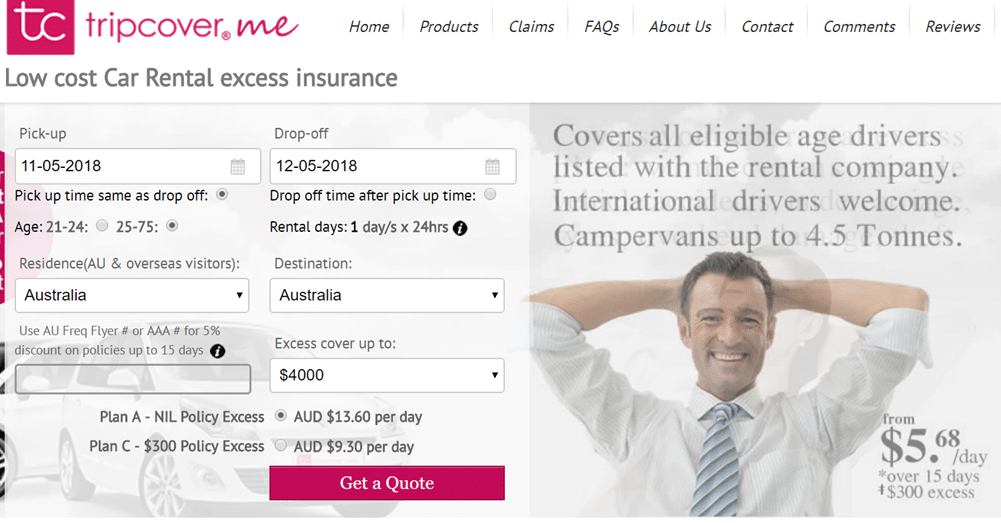

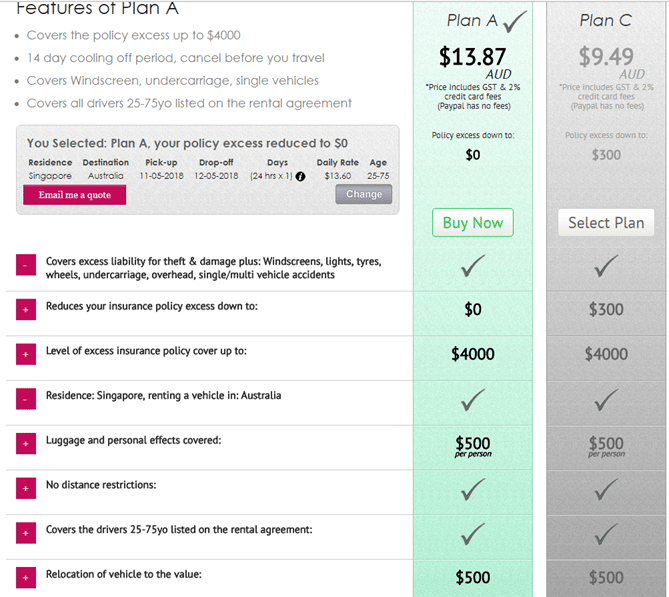

Tripcover (Australia)

Tripcover’s policy is underwritten by Allianz. You can view the full policy wording here.

You may have seen another Australia-only policy out there offered by Hiccup; it’s basically the same things as this. These policies can cover Australian residents when they travel overseas, but will only provide coverage in Australia for those of us resident in Singapore.

Here are a few other things to note:

- Coverage here comes in 3 flavors, with total coverage of A$4K, $6K or $8K. That may sound lower compared to the coverage limits of the other 3 policies, but remember this is specifically for rental in Australia where insurance comes standard with the car. Ergo, this policy is meant to help you cover some of the excess for which you’d otherwise be liable, rather than the cost of the entire car

- The policy can have two sub-versions depending on what option you pick: either a A$300 deductible or 0 deductible . The price difference is really negligible so I’d just reduce it to 0 if I were you

- This policy will cover any additional drivers named on the rental agreement

- No annual plan is available, so you will need to buy a new policy every time you rent

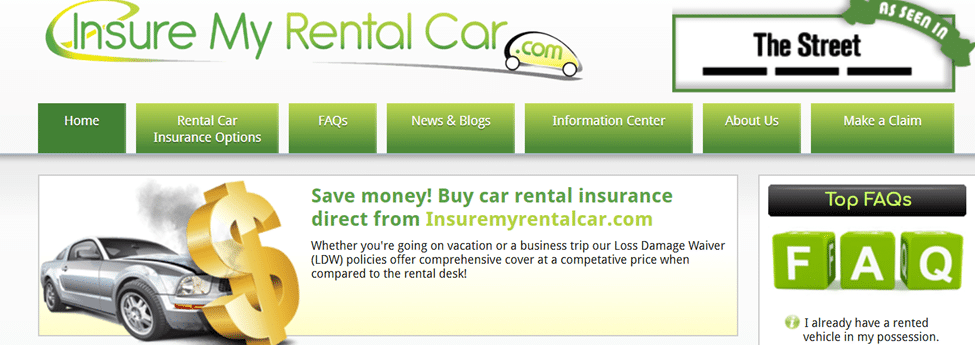

InsureMyRentalCar

InsureMyRentalCar’s policy is underwritten by Chubb National and ACE American Insurance. You can view the full policy wording here.

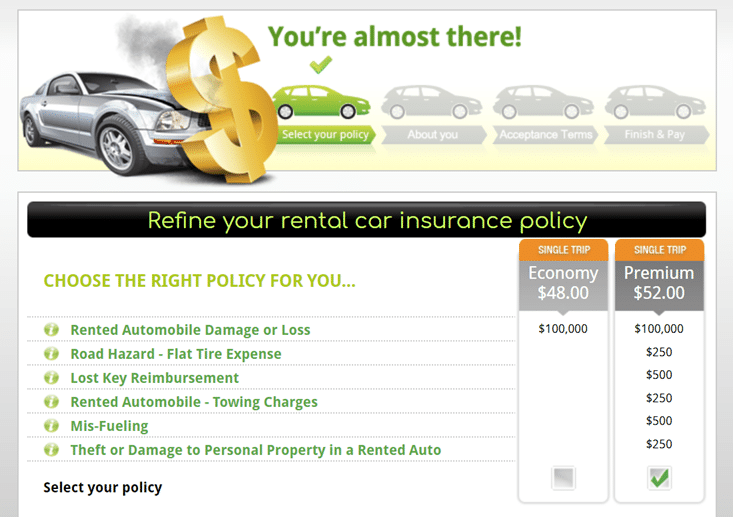

There is a small price difference between the Economy and Premium plans, and for the difference I’d much rather take Premium.

Here are a few other things to note:

- This policy does not cover the following states: Iowa, Kansas, Louisiana, Massachusetts, Montana, New York, North Carolina, North Dakota, Oregon, Rhode Island, South Carolina, Texas, Virginia, Washington and West Virginia.

- But who cares, California’s included!

- This policy will cover any additional drivers named on the rental agreement

- No annual plan is available, so you will need to buy a new policy every time you rent

- I was not able to find age limits in the policy wording. If you have your heart set on this policy you’ll need to contact them to ask

Conclusion

It always makes sense to do some research beforehand on the CDW/LDW options offered by the rental company and compare the costs to what you’d pay with a third party rental car insurance policy. In some cases, you might be more than happy to pay the rental company’s rates (although US$35 a day in the States with Avis seems…excessive).

If not, be sure to check if your travel insurance provides you with the necessary coverage. Most policies cover between S$2-4K of damage, which may or may not suit your needs depending on where you’re heading. Such coverage would be insufficient for travel to the US and Canada, especially if you reject CDW/LDW, but might be ok for Australia or Europe.