Complimentary airport limo rides offer cardholders the convenience of being picked up or dropped off for their flight, not to mention a little ego boost when they see a sign with their name on it!

Unfortunately, due to rising operating costs, banks have been tightening the terms of this benefit. In recent years, we’ve seen increases to the minimum spend, reductions in the number of ride entitlements, and increases in the cost of add-ons like child seats, midnight surcharges and additional stops.

In this post, we’ll explore the credit cards that still include airport limo benefits, the eligibility requirements and entitlements, and—most importantly—the terms and conditions you need to know.

| 🚗 Best Credit Cards for Airport Limo Rides |

Summary: Credit cards with airport limo rides

The following credit cards offer complimentary airport limo rides.

| Card | Qualifying Spend |

Cap |

| Income Req. ≥S$30K | ||

UOB PRVI Miles AMEX UOB PRVI Miles AMEX(T&C) |

S$1K (FCY) per quarter for 2 rides | 2 per quarter SG |

| Booking Book at Maxicab.sg 2 days prior to departure |

||

HSBC Premier Mastercard HSBC Premier Mastercard(T&C) |

S$12K per quarter for 1 (Premier) or 2 (Premier Elite) rides | 1 (Premier) or 2 (Premier Elite) per quarter SG |

| Booking Book via link sent to email at least 24h in advance |

||

| Income Req. ≥S$120K | ||

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card(T&C) |

None | 1 per year SG Overseas |

| Booking Register at travelwithus.mastercard.com and book at least 48h in advance |

||

HSBC Visa Infinite HSBC Visa Infinite(T&C) |

S$2K per month for 1 ride First 2 [Regular] or 4 [Premier] per year are free |

24 per year Includes free rides SG |

| Booking Book via Ten Concierge website at least 24h in advance |

||

Maybank Visa Infinite Maybank Visa Infinite(T&C) |

S$3K per month for 1 ride | 8 per year SG |

| Booking Call Maybank Cards Priority Customer Service at least 72h in advance |

||

OCBC VOYAGE OCBC VOYAGE(T&C) |

S$12K per quarter for 2 rides |

2 per quarter SG |

| Booking Book via STACK, or call 6593 9999 at least 48h in advance |

||

Citi Prestige Citi Prestige(T&C) |

S$12K per quarter for 2 rides | 2 per quarter SG |

| Booking Book via Citi Prestige Digital Concierge on Citi Mobile app at least 48h in advance |

||

StanChart Beyond Card StanChart Beyond Card(T&C) |

None | 2 per year* Priority Banking & Priority Private only SG Overseas |

| Booking Book via Teleport.sg at least 48h in advance |

||

| *StanChart advertises 10 rides per year for Priority Private Beyond Cardholders. However, this figure already includes the 8 rides that Priority Private customers normally enjoy, without having to hold the Beyond Card. | ||

In addition to these, there are also a handful of ultra-premium credit cards which offer an airport limo benefit. I’ll address these at the end, because their benefits are — surprisingly — a lot more restrictive, usually requiring the purchase of a First or Business Class ticket.

The key points of difference among the various cards are:

- spending requirements

- whether rides are valid for pick-up, drop-off, or both

- whether rides are valid in Singapore, overseas, or both

- ride validity

We’ll look at each of these in turn.

Spending requirements

| 🚖 Limo Entitlement: Spending Requirement |

||

| Card | Min. Spend | Unlocks |

StanChart Beyond Card StanChart Beyond Card |

No min. spend required, 2 free rides offered per calendar year | |

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

No min. spend required, 1 free ride offered per calendar year | |

UOB PRVI Miles AMEX UOB PRVI Miles AMEX |

S$1K FCY per quarter* |

2 rides |

HSBC Visa Infinite HSBC Visa Infinite |

S$2K per month^ |

1 ride |

Maybank Visa Infinite Maybank Visa Infinite |

S$3K per month | 1 ride |

HSBC Premier Mastercard HSBC Premier Mastercard |

S$12K per quarter | 1 ride (Premier) or 2 rides (Premier Elite) |

OCBC VOYAGE OCBC VOYAGE |

S$12K per quarter |

2 rides |

Citi Prestige Citi Prestige |

S$12K per quarter | 2 rides |

| *Excluding online transactions ^First 2/4 free for regular/HSBC Premier customers |

||

There are three cards which award airport limo rides without requiring any minimum spend.

- HSBC Visa Infinite: 2 (regular) or 4 (HSBC Premier) free rides per calendar year, with additional rides unlockable through spend

- StanChart Beyond Card: 2 free rides per calendar year

- UOB Lady’s Solitaire Metal Card: 1 free ride per calendar year

Other cards require cardholders to meet a certain minimum spend to unlock either one ride or two.

Surprisingly, despite its entry-level positioning, the UOB PRVI Miles AMEX has the lowest spending requirement of all: just S$1,000 in foreign currency (excluding online transactions) will unlock two rides. That’s significantly more generous than the rest of the pack, with the Citi Prestige, HSBC Premier Mastercard and OCBC VOYAGE requiring a whopping S$12,000 spend per quarter!

Each bank will have their own definition of qualifying spend, but in general, it refers to transactions that are not on the rewards exclusions list.

| ❓ Qualifying Spend: Important Notes |

|

For Citi Prestige Cardholders, spending on Citi PayAll will count towards the minimum spend requirement for the limo, provided the admin fee is paid. Also, Citi is unique in the sense that they will include non-rewards-earning transactions like insurance premiums, hospitals, education and charitable donations in the computation of qualifying spend, though you still won’t earn any rewards points for it. Refer to this article for more information. For UOB PRVI Miles AMEX Cardholders, do note that spending must be in foreign currency, excluding card-not-present transactions. In other words, buying things online or over the phone won’t count |

All eligible spending is calculated based on posting date, not transaction date. Take care if you’re making any significant spend towards the end of the period, because merchants may take 2-3 days to post transactions (e.g. a transaction made on 30 January may only post on 1 February).

Finally, do note that with the Citi Prestige and UOB PRVI Miles AMEX, you can ride first, spend later. That’s because these two cards award limo rides on a reimbursement basis. Your card will first be charged for the amount of the ride, and should you meet the minimum spend requirement in that quarter, a statement credit will follow.

Pick-up vs drop-off

Some credit cards only allow rides to be used for drop-offs, while others allow them for pick-ups as well.

This is a subtle but important difference:

- Airport pickups are generally more costly to provide because the driver needs to budget time for flight delays, immigration, and baggage collection

- Airport drop-offs are more straightforward- if you don’t show up beyond a certain time, your ride leaves without you

Ideally you’ll want your free limo rides to be redeemable for trips both to and from the airport, which all cards allow except the HSBC Visa Infinite, HSBC Premier Mastercard and UOB PRVI Miles AMEX.

Special mention to the OCBC VOYAGE which covers not just Changi Airport, but also the following checkpoints:

- Seletar Airport

- Marina Bay Cruise Centre

- Singapore Cruise Centre

- Tanah Merah Ferry Terminal

- Queen Street Bus Terminal

- Woodlands Checkpoint

- Tuas Checkpoint

Singapore vs overseas

Most credit cards limit airport limo rides to Singapore, but others let you utilise rides overseas

The UOB Lady’s Solitaire Metal Card’s single limo ride can be used either in Singapore or other supported cities.

The StanChart Beyond Card allows you to utilise limo rides overseas, but the catch is that depending on city, a single ride may use multiple entitlements. For example, a trip from Tokyo Narita airport to the Hilton Tokyo requires a whopping four ride utilisations!

Ride validity

Once you’ve unlocked your limo rides, they’re valid for a certain period. Be sure to use them before they expire!

The limo rides with the longest validity periods are the HSBC Premier Mastercard, StanChart Beyond and UOB Lady’s Solitaire Metal Card.

For the HSBC Premier Mastercard, you can use your limo rides up to one year from the date of issuance, and for the StanChart Beyond and UOB Lady’s Solitaire Metal Card, limo rides must be utilised within the same calendar year in which they were awarded.

Do note that with the Citi Prestige, all that’s required is that you book the limo rides by the end of the calendar quarter in which the minimum spend is met. The actual utilisation can be for any future date.

For example, on 3 May 2025 I charge S$12,000 in qualifying spend to my Citi Prestige Card. This earns me two complimentary limo rides, which I must book by 30 June 2025. The actual utilisation date can be beyond 30 June 2025.

Other important terms

Below I’ve compiled some other points you should take note of, such as the advance notice required, charges for late night service, maximum passengers permissible and the grace period before additional waiting charges apply.

Citi Prestige

HSBC Visa Infinite

Maybank Visa Infinite

Maybank Visa Infinite Maybank Visa Infinite |

|

| Adv. Booking | 72 hours |

| Late Night Fee | Not mentioned |

| Max Pax. | Not mentioned |

| Grace Period | 30 mins |

| Changes & Cancellation |

|

OCBC VOYAGE

OCBC VOYAGE OCBC VOYAGE |

|

| Adv. Booking | 48 hours |

| Late Night Fee |

None |

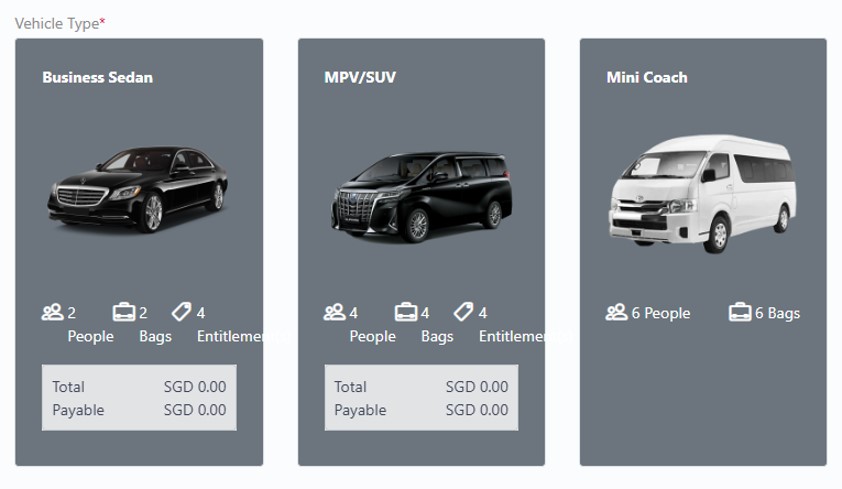

| Max Pax. | Sedan: 3 MPV: 4 (no upgrade charge) |

| Grace Period | 15 mins S$10 per 15-min block after. Auto cancel at 45 mins |

| Changes & Cancellation | S$80 for cancellations with <48 hours notice |

| Other Charges |

|

StanChart Beyond Card

StanChart Beyond Card StanChart Beyond Card |

|

| Adv. Booking | 48 hours |

| Late Night Fee (12 a.m to 6.59 a.m) |

S$12 (SG) (S$40 (Overseas) |

| Max Pax. | 3 |

| Grace Period | 15 mins S$11 per 15-min block after. Auto cancel at 45 mins |

| Changes & Cancellation |

|

| Other Fees |

|

UOB PRVI Miles AMEX

What about the $500K cards?

You might be wondering why none of the so-called $500K cards have been mentioned yet. Leaving aside how niche the appeal is, their airport limo benefits are surprisingly more restrictive than cheaper cards!

For example, the Citi ULTIMA only awards a one-way limo transfer if you purchase a First or Business Class ticket using the credit card, while the UOB Reserve requires a dining or travel reservation to be made via the concierge.

| Card | Limo Benefit | Remarks |

AMEX Centurion AMEX Centurion |

Purchase First or Business Class ticket via Centurion Concierge | Round-trip transfer within Singapore, and on arrival at selected airports overseas |

Citi ULTIMA Citi ULTIMA |

Purchase First or Business Class ticket with card | One-way transfer in Singapore or overseas |

DCS Imperium DCS Imperium |

No min. spend required | Capped at 4x local rides and 1x overseas ride per calendar year |

DBS Insignia DBS Insignia |

N/A* | |

UOB Reserve UOB Reserve |

Make dining, cruise, staycation or flight booking via UOB Travel Concierge | Capped at 4X uses per year |

| *The DBS Insignia does not offer any airport limo benefit that I’m aware of, but if you get the card by virtue of being an Treasures Private Client then you may enjoy free airport transfers | ||

The only S$500K card with easy limo rides is the DCS Imperium, which offers four local and one overseas ride per calendar year without any minimum spend. However, this card is otherwise massively underwhelming, given its S$3,584 annual fee.

Alternative airport limo benefit

While slightly different from the ones above, both the KrisFlyer UOB Credit Card and Maybank Privilege Horizon Visa Signature (not to be confused with the Maybank Horizon Visa Signature) offer cardmembers Grab codes valid for rides to and from the airport.

Maybank’s is slightly better because it’s a guaranteed benefit, unlike the KrisFlyer UOB one which is subject to a monthly redemption cap.

| Card | Offer | Remarks |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

2x S$15 Grab codes |

|

Maybank Privilege Horizon Visa Signature Maybank Privilege Horizon Visa Signature |

2x S$20 Grab codes |

|

Conclusion

The airport limo benefit isn’t as common as it was in the past, but there’s still a few cards out there offering this perk.

In my opinion, the card with the “best” limo benefit still remains the UOB PRVI Miles AMEX. The annual fee can be waived, and the spending requirement is the lowest of all.

Is an airport limo benefit still useful to you?