| 💳 The MileLion’s Credit Card Guide (Last update: 17 April 2024) |

| Contents Page |

| All months refer to calendar month and all years refer to calendar year unless statement month or membership year is explicitly mentioned |

How can I find the MCC?

Categorisation all boils down to MCC. Here’s three ways of looking up an MCC before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

Local General Spending

| Card | Earn Rate | Remarks |

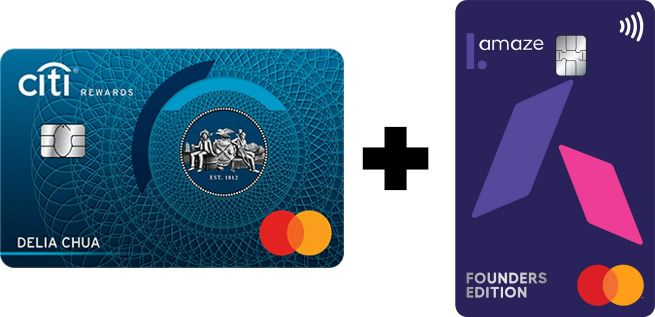

Amaze + Citi Rewards Amaze + Citi Rewards |

4 mpd | Max S$1K per s. month, excludes Travel and Mobile Wallet |

AMEX HighFlyer Card AMEX HighFlyer Card |

1.8 mpd | |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | |

DBS Insignia DBS Insignia |

1.6 mpd | |

UOB Reserve UOB Reserve |

1.6 mpd | |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 mpd | |

DBS Vantage DBS Vantage |

1.5 mpd | |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 mpd | |

UOB PRVI Miles UOB PRVI Miles (AMEX | Mastercard | Visa) |

1.4 mpd | |

SCB Visa Infinite SCB Visa Infinite |

1.4 mpd |

Min S$2K total spend per s. month, otherwise 1 mpd |

DBS Altitude DBS Altitude (AMEX | Visa) |

1.3 mpd | |

Citi Prestige Citi Prestige |

1.3 mpd |

Up to 0.06/0.12 mpd relationship bonus |

OCBC 90°N Cards OCBC 90°N Cards |

1.3 mpd | |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

1.28 mpd | |

HSBC Visa Infinite HSBC Visa Infinite |

1.25 mpd |

1 mpd if first membership year or if previous membership year’s spending below S$50K |

HSBC TravelOne HSBC TravelOne |

1.2 mpd |

|

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | |

SCB Journey SCB Journey |

1.2 mpd | |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | |

BOC Elite Miles Card BOC Elite Miles Card |

1 mpd |

Foreign Currency Spending

| Card | Earn Rate | Remarks |

| 👉 Full article: What’s the best card to use for overseas spending? | ||

Amaze + Citi Rewards Amaze + Citi Rewards |

4 mpd | Max S$1K per s. month, excludes Travel and Mobile Wallet |

UOB Visa Signature UOB Visa Signature |

4 mpd |

Min S$1K max S$2K foreign currency spend per statement month |

SCB Visa Infinite SCB Visa Infinite |

3 mpd |

Min S$2K overall spend per statement month, otherwise 1 mpd |

SCB Rewards+ SCB Rewards+ |

2.9 mpd |

Max S$2.2K foreign currency spending per membership year |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

2.8 mpd (limited time upsize to 3.2 mpd) |

Min S$800 spend per month |

HSBC TravelOne HSBC TravelOne |

2.4 mpd |

|

UOB PRVI Miles UOB PRVI Miles (AMEX | Mastercard | Visa) |

2.4 mpd |

|

UOB Reserve UOB Reserve |

2.4 mpd | |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

2.4 mpd | |

DBS Treasures AMEX DBS Treasures AMEX |

2.4 mpd | |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

2.3 mpd |

|

HSBC Visa Infinite HSBC Visa Infinite |

2.25 mpd | 2 mpd if first membership year or if previous membership year’s spending below S$50K |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

2.24 mpd | |

DBS Altitude DBS Altitude (AMEX | Visa) |

2.2 mpd | |

DBS Vantage DBS Vantage |

2.2 mpd | |

OCBC VOYAGE OCBC VOYAGE |

2.2 mpd |

|

OCBC 90°N Cards OCBC 90°N Cards |

2.1 mpd | |

Citi ULTIMA Citi ULTIMA |

2 mpd | |

DBS Insignia DBS Insignia |

2 mpd | |

Maybank Visa Infinite Maybank Visa Infinite |

2 mpd | |

SCB Journey SCB Journey |

2 mpd | |

Citi PremierMiles Citi PremierMiles |

2 mpd | |

Citi Prestige Citi Prestige |

2 mpd |

Up to 0.06/0.12 mpd relationship bonus |

BOC Elite Miles Card BOC Elite Miles Card |

2 mpd |

|

Air Tickets

| Card | Earn Rate | Remarks |

| 👉 Full article: What’s the best card to use for air tickets? | ||

|

|

6 mpd |

For selected airline bookings on Expedia and UOB Travel |

| 4 mpd |

Max S$1K per month for Lady’s Card and S$2K per month for Lady’s Solitaire. Travel must be chosen as bonus category | |

| 4 mpd (if FCY) |

Min S$1K max S$2K foreign currency spend per statement month | |

DBS Woman’s World Card DBS Woman’s World Card |

4 mpd | Max S$1.5K per month |

HSBC Revolution HSBC Revolution |

4 mpd |

Max S$1K per month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd | SIA & Scoot only |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

2.8 mpd (limited time upsize to 3.2 mpd) |

Min S$800 spend per month. Capped at S$10K |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

2 mpd | SIA only |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

2 mpd | SIA only |

Amaze

| Card | Earn Rate | Cap |

| 👉 Full article: What’s the best card to use with Amaze? | ||

UOB Lady’s Card UOB Lady’s Card |

4 mpd1 | S$1K per month |

UOB Lady’s Solitaire UOB Lady’s Solitaire |

4 mpd2 | S$2K per month |

Citi Rewards Card Citi Rewards Card |

4 mpd3 | S$1K per s. month |

OCBC Rewards OCBC Rewards |

4 mpd4 | S$1.1K per month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd5 | None |

UOB PRVI Miles MC UOB PRVI Miles MC |

1.4 mpd | None |

Citi Prestige Citi Prestige |

1.3 mpd | None |

OCBC 90°N MC OCBC 90°N MC |

1.3 mpd | None |

Citi PremierMiles Card Citi PremierMiles Card |

1.2 mpd | None |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | None |

| 1. Pick 1: Beauty & wellness, dining, entertainment, family, fashion, transport, travel (T&Cs) 2. Pick 2: Beauty & wellness, dining, entertainment, family, fashion, transport, travel (T&Cs) 3. All transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc.) (T&Cs) 4. Electronics, clothes, bags, shoes and shopping (T&Cs) 5. Dining, shopping, travel, transport. Must spend at least S$800 on SIA Group transactions in a membership year (T&Cs) |

||

Atome

| Card | Earn Rate | Cap |

Citi Rewards Citi Rewards |

4 mpd | Max S$1K per s. month |

DBS Woman’s World Card DBS Woman’s World Card

|

4 mpd | Max S$1.5K per month |

HSBC Revolution HSBC Revolution

|

4 mpd | Max S$1K per month |

| Note: it may be necessary to trigger the payments manually in order to get points credited. | ||

CardUp

Charitable Donations

| Card | Earn Rate | Remarks |

| 👉 Full article: What are the best cards for charitable donations? | ||

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

SGD: 0.4 mpd FCY: 2.8 or 3.2 mpd (limited time upsize) |

Min S$800 spend per month |

Maybank Visa Infinite Maybank Visa Infinite |

SGD: 1.2 mpd FCY: 2 mpd |

|

AMEX Platinum Charge AMEX Platinum Charge |

0.78 mpd | |

Dining

| Card | Earn Rate | Remarks |

| 4 mpd |

Capped at S$1K per month for Lady’s Card and S$2K per month for Lady’s Solitaire. Dining must be chosen as bonus category | |

HSBC Revolution HSBC Revolution |

4 mpd |

Limit S$1K per month. Must use contactless. Excludes fast food and misc. food stores from 1 May 24 |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd |

Min S$800 spend on SIA-related transactions in a membership year |

Education

| Card | Earn Rate | Remarks |

| 👉 Full article: What’s the best card for education expenses? | ||

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

SGD: 0.24 mpd FCY: 2.8 mpd (limited time upsize to 3.2 mpd) |

Min S$800 spend per month |

UOB Reserve Card UOB Reserve Card |

SGD: 1.6 mpd FCY: 2.4 mpd |

|

| SGD: 1.4 mpd FCY: 2.4 mpd |

||

UOB Privilege Banking Card UOB Privilege Banking Card |

SGD: 1.2 mpd FCY: 2 mpd |

|

| SGD: 1.2 mpd FCY: 2 mpd |

||

Food Delivery

| Card | Earn Rate | Remarks |

UOB Lady’s Card & UOB Lady’s Solitaire UOB Lady’s Card & UOB Lady’s Solitaire |

4 mpd |

Cap S$1K per month for Lady’s Card and S$2K per month for Lady’s Solitaire. Dining must be chosen as bonus category |

DBS Woman’s World Card DBS Woman’s World Card |

4 mpd | Cap S$1.5K per month |

Citi Rewards Citi Rewards |

4 mpd |

Cap S$1K per statement month |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

4 mpd | Cap S$1.1K per month |

HSBC Revolution HSBC Revolution |

4 mpd |

Cap S$1K per month. Unlikely to earn from 1 May 24 |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd |

Min S$800 spend on SIA-related transactions in a membership year |

SCB Journey SCB Journey |

3 mpd | Limit S$1K per s. month, must be online in SGD |

Grab/gojek/TADA/other ride hailing

| Card | Earn Rate | Remarks |

UOB Lady’s Card & UOB Lady’s Solitaire UOB Lady’s Card & UOB Lady’s Solitaire |

4 mpd |

Cap S$1K per month for Lady’s Card and S$2K per month for Lady’s Solitaire. Transport must be chosen as bonus category |

| 4 mpd |

Cap S$1.5K per month | |

Citi Rewards Citi Rewards |

4 mpd |

Cap S$1K per statement month |

HSBC Revolution HSBC Revolution |

4 mpd |

Limit S$1K per month |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

3.2 mpd | Capped at S$200/month, Grab only |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

3.1 mpd | Capped at S$200/month, Grab only |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd | Min S$800 spend on SIA-related transactions in a membership year |

SCB Journey SCB Journey |

3 mpd | Limit S$1K per s. month, must be online in SGD. |

Groceries/Supermarket

| Card | Earn Rate | Remarks |

| 👉 Full article: What’s the best card for groceries? | ||

| 4 mpd | Capped at S$1K per month for Lady’s Card and S$2K per month for Lady’s Solitaire. Family must be chosen as your bonus category | |

SCB Journey SCB Journey |

3 mpd | Limit S$1K per s. month, must be online in SGD |

Hospitals

| Card | Earn Rate | Remarks |

| 👉 Full article: What are the best cards for medical expenses? | ||

AMEX HighFlyer Card AMEX HighFlyer Card |

1.8 mpd | Excludes public hospitals |

UOB Reserve UOB Reserve |

1.6 mpd | |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 mpd | |

SCB Visa Infinite SCB Visa Infinite |

1.4 mpd | Min S$2K overall spend per statement month, otherwise 1 mpd |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit Card |

1.3 mpd | Excludes public hospitals |

AMEX PPS Credit Card AMEX PPS Credit Card |

1.3 mpd | Excludes public hospitals |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | Excludes public hospitals |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

1.28 mpd | Excludes public hospitals |

HSBC Visa Infinite HSBC Visa Infinite |

1.25 mpd | 1 mpd if first membership year or if previous membership year’s spending below S$50K |

SCB Journey SCB Journey |

1.2 mpd | |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | Excludes public hospitals |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | Excludes public hospitals |

AMEX Centurion AMEX Centurion |

0.98 mpd |

Excludes public hospitals |

AMEX Platinum Charge AMEX Platinum Charge |

0.78 mpd |

Excludes public hospitals |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd | Excludes public hospitals |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

0.69 mpd | Excludes public hospitals |

AMEX Rewards Card AMEX Rewards Card |

0.63 mpd | Excludes public hospitals |

Hotels

| Card | Earn Rate | Remarks |

| 👉 Full article: What’s the best card for hotels? | ||

| 10 mpd on Kaligo, 7 mpd on Agoda | Refer to T&Cs for exclusions | |

|

|

8 mpd on Expedia, 6 mpd on Agoda & UOB Travel | Refer to T&Cs for exclusions |

| 4.3 mpd on Agoda | Refer to T&Cs for exclusions | |

UOB Lady’s Card & UOB Lady’s Solitaire UOB Lady’s Card & UOB Lady’s Solitaire |

4 mpd |

Cap S$1K per month for Lady’s Card and S$2K per month for Lady’s Solitaire. Travel must be chosen as bonus category |

| 4 mpd | Cap S$1.5K per month. Reservation must be fully prepaid online. | |

HSBC Revolution HSBC Revolution |

4 mpd | Exercise caution: MCC 7011 excluded! Cap S$1K per month. Must be online or use contactless payment |

| 3 mpd | Agoda, AirBnB, Booking.com, Expedia, Hotels.com, Kaligo, Traveloka, Trip.com, UOB Travel (with min S$800 spend on SIA-related transactions in a year) | |

Insurance Premiums

| Card | Earn Rate | Remarks |

| 👉 Full article: What’s the best card for insurance premiums? | ||

| 1.2 mpd | Capped at S$3K per month | |

| 1.2 mpd | Chubb only | |

| 1.1 mpd | Chubb only | |

Kris+

| Card | Earn Rate | Remarks |

| 👉 Full article (including other card options): What’s the best card for Kris+? |

||

DBS Woman’s World Card DBS Woman’s World Card |

4 mpd | Max. S$1.5K per month |

Citi Rewards + Amaze Citi Rewards + Amaze |

4 mpd | Max. S$1K per s. month. Do not use Citi Rewards Card alone- no bonuses |

KrisFlyer UOB Card KrisFlyer UOB Card |

3 mpd | No cap |

Online Transactions

| Card | Earn Rate | Remarks |

DBS Woman’s World Card DBS Woman’s World Card |

4 mpd | Cap S$1.5K per month |

Citi Rewards Citi Rewards |

4 mpd |

Cap S$1K per statement month |

|

|

4 mpd | For online shopping, cap S$1.1K per month |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

4 mpd | For on online shopping and entertainment, limit S$1.1K per month |

HSBC Revolution HSBC Revolution |

4 mpd | For online shopping and travel, limit S$1K per month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd | For online shopping and travel, with min S$800 spend on SIA Group in a membership year |

PayWave or Mobile Payments

| Card | Earn Rate | Remarks |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

4 mpd | Except at places which award UOB$. Limit S$1.1K per month. Must use mobile payments; no points for paying with physical card |

| 4 mpd | Except at places which award UOB$. Min S$1K, Max S$2K per statement month |

Petrol

| Card | Earn Rate | Remarks |

| 👉 Full article: What’s the best card for petrol? | ||

| 4 mpd | Capped at S$1K per month for Lady’s Card and S$2K per month for Lady’s Solitaire. Transport must be chosen as your bonus category | |

| 4 mpd | Min. S$1K max S$2K combined spending on petrol and PayWave per statement month | |

|

|

4 mpd | No cap |

Public Transportation (SimplyGo)

| Card | Earn Rate | Remarks |

| 👉 Full article: What’s the best card for public transportation? | ||

| 5.6 mpd |

Capped at S$818 per statement month | |

| 4 mpd | Capped at S$1K per month for Lady’s Card and S$2K per month for Lady’s Solitaire. Transport must be chosen as your bonus category | |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd | Min S$800 spend on SIA Group in a membership year |

Shopping

| Definition of shopping will differ by bank. Always refer to T&Cs for updated MCC list |

| Card | Earn Rate | Remarks |

AMEX Platinum Charge AMEX Platinum Charge |

7.8 mpd | On the first S$16K spent per year at 10XCELERATOR merchants, 3.9 mpd afterwards |

| 4 mpd | Cap S$1K per month for Lady’s Card and S$2K per month for Lady’s Solitaire. Fashion must be chosen as your bonus category, selected MCCs only | |

HSBC Revolution HSBC Revolution |

4 mpd | Cap S$1K per month on selected MCCs. Must use contactless or online payments |

Citi Rewards Citi Rewards |

4 mpd | Cap S$1K per statement month on selected MCCS |

OCBC Rewards OCBC Rewards |

4 mpd | Cap S$1.1K per month on selected MCCs & merchants |

AMEX Platinum Reserve AMEX Platinum Reserve |

3.47 mpd | For 10Xcelerator merchants |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

3.47 mpd | For 10Xcelerator merchants |

Telco Bills (Singtel, Starhub, M1 etc)

| Card | Earn Rate | Remarks |

| 4 mpd | Capped at S$1.5K per month, for bills paid via app. No points if set up as recurring credit card payment | |

Citi Rewards Citi Rewards |

4 mpd | Capped at S$1K per statement month, must be paid online or via app . No points if set up as recurring credit card payment |

AMEX HighFlyer Card AMEX HighFlyer Card |

1.8 mpd | |

| 1.2 mpd | ||

| 1.1 mpd |

Utilities

| Card | Earn Rate | Remarks |

| 👉 Full article: What’s the best card for electricity bills & utilities? | ||

Maybank Manchester United Card Maybank Manchester United Card |

2.0 mpd + 3% cashback (on days where Man Utd win) 0.4 mpd + 1% cashback (otherwise) |

|

UOB Reserve UOB Reserve |

1.6 mpd | |

SCB Visa Infinite SCB Visa Infinite |

1.4 mpd | Min S$2K overall spend per statement month, otherwise 1 mpd |

SCB Journey SCB Journey |

1.2 mpd | |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | |