After Marriott bought SPG, there was a predictable outcry in the frequent flyer community from those (i.e. everyone) who feared this would lead to the mass dilution of the SPG benefits they had come to know and love.

Hyatt smelled blood in the water and acted quickly, offering a status match to its highest tier, Diamond. Now, this was obviously targeted at SPG elites who wanted to jump ship, but they didn’t specify that anywhere in their offer. The offer went public very quickly, and everyone from Hilton Diamonds to IHG Spires started spamming Hyatt Gold Passport with their details, requesting the match.

The feeding frenzy has since settled a bit- Hyatt is only matching SPG Platinums to Hyatt Diamond (there had been reports coming in of people with SPG Gold getting matched to Hyatt Diamond). I got my confirmation yesterday-

Dear Mr. XXX,

Thank you for your message to Gold Passport. I appreciate the opportunity to assist you.

Congratulations! You have now been upgraded to our Diamond Tier status which is valid through February 2017. As a Diamond member, you will be instantly recognized as one of our valued guests at any Hyatt worldwide.

Diamond membership entitles you to a wide range of exclusive services and benefits. In order to continue to receive exclusive Diamond membership benefits, simply complete 25 stays or 50 nights at any Hyatt hotel or resort worldwide during the course of the calendar year.

We hope you enjoy the privileges of Diamond membership when staying at any Hyatt worldwide. Please let me know if I may be of further assistance.

To all Hyatt Diamonds who earned their status the hard way-I get it, you’re pissed. I’d be too if SPG offered something similar for SPG Platinum. Status matches mean more competition for suite upgrades, longer wait times on the phone, less exclusivity in the lounge. But business is business, and Hyatt saw a good opportunity to take advantage of SPG’s current predicament.

So now that I’m a newly minted Hyatt Diamond, I’d like to share some interesting features of the program that might be relevant to whoever managed to get themselves matched. Since my only real basis for comparison is SPG Platinum, that’s what I’m going to be benchmarking the items below to.

4 suite certificates, each of which can be used for stays of up to 7 days

By far my favourite benefit. Unlike SPG’s SNA (suite night award), where you spend certificates to “indicate a preference” for an upgrade (i.e. they’re still subject to the hotel confirming them), Hyatt offers you the opportunity to get a confirmed upgrade, 4 times a year, of stays of up to 7 nights each. If the hotel is selling suites that night, you can use a suite certificate to confirm it as if you were paying a revenue rate (some people report that hotels are playing games with suite inventory, but fortunately such reports are still the exception rather than the rule)

The one drawback I noted is that suite upgrades are only valid on paid bookings and points + cash bookings, not free night awards. That can be quite a major drawback for some, especially if you’re redeeming your points for a dream property in the Maldives and want to get a guaranteed suite. There is also an exclusion list of properties – Park Hyatt Beaver Creek Resort , Park Hyatt Sydney, Andaz Tokyo, Hyatt Regency Phuket Resort, Hyatt Regency Tulsa, Hyatt Regency Wichita, Hyatt Key West Resort and Spa, Hyatt Manila City of Dreams, Hyatt Santa Barbara, Hyatt Residence Club resorts, Hyatt Place hotels and M life resorts.

Also, note that in the absence of a suite certificate Hyatt’s policy is to upgrade Diamond members into the best available non-suite (vs SPG’s policy of upgrading to the best available room including standard suites).

Breakfast benefit

SPG Platinum offers breakfast as a welcome amenity. Typically you can choose between 500 points, a local welcome gift, or breakfast for each day of your stay for 2 people. Some hotels will go the extra mile and give 500 points + breakfast, but again that’s on a goodwill basis and they don’t necessarily have to.

Hyatt Diamond members receive access to the Regency Club/Grand Club lounge which offers complimentary breakfast. Where no club is available, members will get full breakfast in the hotel restaurant.

Where a club lounge is available but is closed for whatever reason, Hyatt Diamond members get an additional 2,500 bonus points per stay plus full breakfast in the hotel restaurant.

Hyatt has by far the best breakfast amenity of any chain, because you can get both breakfast and your welcome amenity.

By the way, let me take this opportunity to point out that Marriott, up till 2013, didn’t even offer top tier elite members breakfast on weekends, after which they started offering complimentary continental breakfast only (and exclude it from some properties)

Guest of Honor benefit

This is an interesting one. When you make a points booking for someone else as a Diamond member, that guest gets all your elite benefits. So if you book a room for Mom and Dad, they’ll get free breakfast, internet, the possibility to upgrade etc. Interestingly this only applies to points bookings, not paid rates or points and cash bookings.

With SPG, this benefit was sometimes extended to rooms you booked with your points but weren’t physically staying at, but this was based on the property’s goodwill and wasn’t official policy.

There’s another cool implication to this policy. Suppose you’re travelling with your family and need 2 rooms. Both rooms then become eligible for lounge access, breakfast, etc. When I travel with SPG and book 2 rooms, only 1 is eligible for my elite benefits. This became an issue in the Westin Bangkok when the staff were really strict about the interpretation of the rules and didn’t allow the occupants of the other room lounge access (which, I should add, was as per policy and I don’t really have any complaints about that).

MLife Match

If you like to go to Las Vegas, you’ll know that MGM is huge- they own the ARIA, Vdara, The Signature at MGM Grand, Bellagio, MGM Grand Las Vegas, Mandalay Bay, The Mirage, New York New York, Excalibur, Monte Carlo, Delano, Luxor.

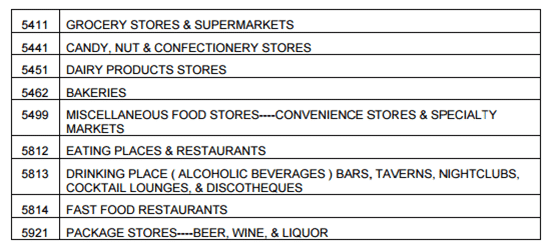

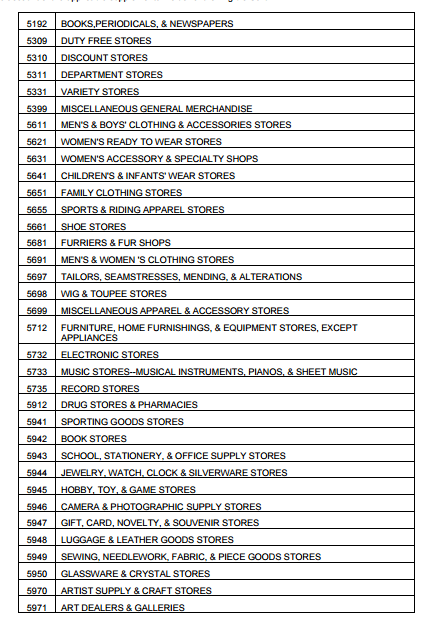

Hyatt Diamond members can get matched to MLife Platinum. This means you get access to special rates on MLife hotels, priority check in, room upgrades on availability, buffet line passes and other nice stuff.

Even if you’re only going to head to Vegas once in your life, it’s a nice benefit to have. Stays at M Life hotels count towards your earning of elite status.

SPG has a similar tie-up with Caesar’s hotels and resorts, but this is a points earning only tie-up, there are no elite benefits to be had.

2 United Club Lounge Passes

A small benefit, but still nice to have. Note that these lounge passes can only be used in United Clubs excluding Arrivals Lounges, United Global First Lounges or Star Alliance Lounges.

Lounges in the USA are comparatively simpler affairs, you’re talking about juice, pastries and fruit at the most.

SPG has a tie-up with Delta but this benefit does not include lounge access, only 1 free bag and priority boarding.

I’m looking forward to using my new Hyatt Diamond membership. I’ve heard very good things on Flyertalk about how Hyatt treats their elite members, so let’s see if they can be SPG 2.0 for me.