Here’s The MileLion’s review of the Maybank XL Rewards Card, a visceral reminder that life does indeed go downhill after 40. Everything hurts, your back goes out more than you do, and you’re officially off the guest list for Maybank’s latest rewards card.

And with 4 mpd on all foreign currency (FCY) spend — even education, hospitals and utility bills — as well as dining, shopping, travel and entertainment, this is a party you might actually want to attend.

Maybank XL Rewards Card Maybank XL Rewards Card |

| 🦁 MileLion Verdict |

☑ Take It

☐ Take It Or Leave It

☐ Leave It

|

What do these ratings mean?

|

| With 4 mpd on all FCY spend and a wide range of bonus categories, the Maybank XL Rewards Card is an easy card to recommend— provided you’re not a day over 40. |

| 👍 The good |

👎 The bad |

- 4 mpd on all FCY spend, dining, shopping, travel and entertainment

- Still earns points for education, hospitals and utility bills

- Amaze-compatible

- 2-year annual fee waiver (and should be fairly easy to waive after that)

|

- Not available to anyone 40 and older

- Limited transfer partners

- TREATS Points expire after 12-15 months

- S$500 minimum spend required for bonus miles

- No Google Pay support and clunky app ecosystem

|

| 💳 Full List of Credit Card Reviews |

Overview: Maybank XL Rewards Card

Let’s start this review by looking at the key features of the Maybank XL Rewards Card.

|

| Apply |

| Income Req. |

S$30,000 p.a. |

Points Validity |

12-15 months |

| Annual Fee |

S$87.20

(F2YF) |

Min.

Transfer |

25,000 points

(10,000 miles)* |

Miles with

Annual Fee |

N/A |

Transfer

Partners |

4 |

| FCY Fee |

3.25% |

Transfer Fee |

S$27.25 |

| Local Earn |

0.4 mpd |

Points Pool? |

Yes |

| FCY Earn |

4 mpd

|

Lounge Access? |

No |

| Special Earn |

4 mpd on dining, shopping, travel, entertainment |

Airport Limo? |

No

|

| Cardholder Terms and Conditions |

*For KrisFlyer; 5,000 miles for Cathay and Malaysia Airlines, 2,000 points for Air Asia

|

Do note that the XL Card comes in two flavours. In addition to the XL Rewards Card covered in this review, there is also the XL Cashback Card.

Both the Rewards and Cashback card have the same annual fee, bonus categories and minimum spend requirement, but instead of 4 mpd, the XL Cashback Card earns up to 5% cashback, capped at S$80 per month.

There is nothing stopping you from applying for both the Rewards and Cashback variants if you wish. In this case, you must meet the S$500 minimum monthly spend (more on that later) on both cards to enjoy 4 mpd or 5% cashback.

How much must I earn to qualify for a Maybank XL Rewards Card?

The Maybank XL Rewards Card has a minimum income requirement of S$30,000 p.a.

But the real hurdle isn’t income. It’s age.

Maybank will only accept XL Card applications from customers aged 21-39 years old; anyone 40 or older will be automatically rejected. Eligibility is based on age at the time of application, and you can submit an application so long as you’re 39 years and 364 days old or younger.

We can argue till the cows come home whether this counts as segmentation or discrimination (po-tay-to, po-tah-to?), but at the end of the day, Maybank isn’t breaking any laws. MAS guidelines stipulate a minimum age and income for credit card applications, not a maximum.

Singapore has no equivalent of the Equal Credit Opportunity Act (which in the US prohibits age-based discrimination when granting credit facilities), and if Maybank wants to issue this card only to left-handed Jedi knights who say “Ni”, then that’s their prerogative.

OK Boomer: Can the Maybank XL Card really exclude applicants aged 40 and older?

For the avoidance of doubt, you can retain this card even after you turn 40 (it’s not like Maybank sends a collection agency to your house to confiscate it), and it will still be renewed every time the expiry date comes around. However, if you choose to cancel it, you will never be able to apply for an XL Card again!

How much is the Maybank XL Rewards Card’s annual fee?

| |

Principal Card |

Supp. Card |

| First 2 Years |

Waived |

Free |

| Subsequent |

S$87.20 |

Free |

The Maybank XL Rewards Card has an annual fee of S$87.20, which is waived for the first two years.

Subsequent years’ fees can be waived with a minimum spend of S$6,000 in a membership year. It remains to be seen how strictly Maybank enforces this rule, but given that this represents just 50% of the annual bonus cap, it shouldn’t be too hard for most cardholders to hit.

All supplementary cards are free for life.

What welcome offers are available?

Maybank is currently offering the following welcome bonus for the Maybank XL Cards.

- First 2,000 new-to-bank customers: S$60 cashback upon activating the card and making a minimum spend of any amount

- Subsequent new-to-bank customers: S$10 cashback upon activating the card and making a minimum spend of any amount

The 2,000 cap is shared between the XL Rewards and XL Cashback variants, and this offer is only available for new-to-bank customers, defined as those who:

- Do not currently hold any principal Maybank credit cards or CreditAble accounts

- Have not cancelled any principal Maybank credit cards or CreditAble accounts in the past 9 months

However, I would recommend applying for a different product as your first Maybank card.

Maybank is currently offering a Samsonite INTERLACE Spinner 67/24 Exp (worth S$520) for new-to-bank customers who apply for any Maybank card — except the XL Cards — and spend at least S$1,300 in the first two months of approval.

There is no eligibility cap for this offer, and if you’re thinking of getting a Maybank XL Rewards Card, then I’d highly recommend getting a Maybank Horizon Visa Signature or World Mastercard too.

The T&Cs for this offer can be found here.

How many miles do I earn?

| 🇸🇬 SGD Spend |

🌎 FCY Spend |

⭐ Bonus Spend |

| 0.4 mpd |

4 mpd |

4 mpd on dining, shopping, travel, entertainment |

The Maybank XL Card earns 10X TREATS Points per S$1 (4 mpd) on:

- All online and offline FCY spending

- Online and offline SGD spending in the following categories

🍽️ Dine

|

5811 |

Caterers |

| 5812 |

Restaurants |

| 5814 |

Fast Food |

| 5462 |

Bakeries |

🛍️ Shop

|

5262 |

Marketplaces |

| 5310 |

Discount Stores |

| 5311 |

Department Stores |

| 5331 |

Variety Stores |

| 5399 |

Misc. General Merchandise |

| 5621 |

Women’s Ready to Wear |

| 5631 |

Women’s Accessory and Specialty |

| 5651 |

Family Clothing |

| 5655 |

Sports and Riding Apparel |

| 5661 |

Shoe Stores |

| 5691 |

Men’s and Women’s Clothing Stores |

| 5699 |

Misc. Accessory and Apparel |

| 5941 |

Sporting Goods Stores |

| ✈️ Travel |

3000 – 3299, 3300 – 3308, 4511 |

Airlines |

| 4722 |

Travel Agencies |

| 7011 |

Hotels and Lodging |

| 📽️ Play |

4899 |

Cable, Satellite, Pay Television and Radio |

| 5813 |

Bars, Cocktail Lounges, Nightclubs |

| 5815 |

Digital Goods: Books, Movies, Music |

| 7832 |

Theatres |

| 7993 |

Video Amusement Game Supplies |

| 7994 |

Video Game Arcades |

The 4 mpd earn rate requires a minimum spend of S$500 per calendar month, and is capped at S$1,000 per calendar month. If you fail to meet the minimum spend, or spend above the cap, you’ll earn just 0.4 mpd, so it’s crucial to track your spending accurately.

| S$400 |

160 miles

(S$400 x 0.4 mpd) |

| S$600 |

2,400 miles

(S$600 x 4 mpd) |

| S$1,500 |

4,200 miles

(S$1,000 x 4 mpd + S$500 x 0.4 mpd) |

The Maybank XL Rewards Card covers a wide range of bonus categories, and can be your daily driver for:

- Air tickets

- Agoda, Booking.com, Hotels.com, Traveloka, Trip.com and other OTAs

- Amazon, Shopee, Lazada and other e-commerce websites

- Disney+, Netflix, Spotify and other streaming services

- Deliveroo, foodpanda, GrabFood and other food delivery platforms

- Hotels (including Airbnb)

- KKday, Klook, Pelago

- Movie tickets

- Restaurants, bars, cafes and fast food

The only major expense categories that aren’t covered are groceries, petrol and transport, but you could indirectly earn 4 mpd on these by buying vouchers from HeyMax, where all transactions code as MCC 5311.

|

| Sign up here |

- Airalo

- Amazon

- Best Denki

- Courts

- Deliveroo

- Foodpanda

- Giant

- Grab

- IKEA

- Klook

- Lazada

- Muji

|

- Natureland

- NTUC FairPrice

- Oddle Eats

- Pelago

- Pupsik

- Ryde

- Shein

- Shell

- Sheng Siong

- Sephora

- TADA

- TANGS

- ZALORA

|

| All voucher purchases code as MCC 5311 (Department Stores) |

Maybank cards are also noteworthy for having far fewer exclusion categories than most other cards on the market. In particular, it’s still possible to earn rewards for education, hospitals and utility bills. These transactions, if charged in FCY, will even earn 4 mpd with the XL Rewards Card (in SGD, they’ll earn 0.4 mpd).

Maybank has an FCY transaction fee of 3.25%, so using the Maybank XL Rewards Card for FCY spend represents buying miles at 0.81 cents each, assuming you’re in the 4 mpd zone.

💳 FCY Fees by Issuer and Card Network

|

| Issuer |

↓ MC & Visa |

AMEX |

| Standard Chartered |

3.5% |

N/A |

| American Express |

N/A |

3.25% |

| Citibank |

3.25% |

N/A |

| DBS |

3.25% |

3% |

| HSBC |

3.25% |

N/A |

| Maybank |

3.25% |

N/A |

| OCBC |

3.25% |

N/A |

| UOB |

3.25% |

3.25% |

| BOC |

3% |

N/A |

| CIMB |

3% |

N/A |

Does it work with Amaze?

The Maybank XL Card can be paired with Amaze. There are four scenarios to consider, based on currency (SGD or FCY) and whether the transaction falls under a whitelisted category (Dining, Shopping, Travel, Play).

| Whitelisted categories |

XL Rewards

(4 mpd) |

Amaze + XL Rewards

(4 mpd + 2% fee) |

| All other spend |

Use a different card |

XL Rewards

(4 mpd + 3.25% fee) |

SGD spending, non-whitelisted category

Don’t use Amaze, or the XL Rewards Card for that matter. You’d earn only 0.4 mpd either way, but Amaze would make it even worse with its 1% admin fee for SGD transactions.

SGD spending, whitelisted category

Don’t use Amaze. Using a naked XL Rewards Card would be sufficient to earn 4 mpd, and again, we don’t want to incur the 1% admin fee for SGD transactions if we don’t have to.

FCY spending, whitelisted category

Use Amaze + XL Rewards to reduce the FCY fee to ~2%, while still earning 4 mpd.

FCY spending, non-whitelisted category

Use a naked XL Rewards Card to earn 4 mpd, with a 3.25% FCY fee.

If you brought Amaze into the picture, you’d earn 0.4 mpd with a ~2% FCY fee, because the transaction effectively becomes SGD spending in a non-whitelisted category.

Transaction date or posting date?

Technically speaking, Maybank tracks minimum spend and bonus caps by posting date, not transaction date.

In practice, however, all transactions charged in a given month and posted by the 10th of the following month are considered to be part of the month in which they were charged.

| Month X |

By the 10th of Month X+1 |

Month X |

| Month X+1 |

By the 10th of Month X+2 |

Month X+1 |

In other words, you can comfortably spend up till the last calendar day of the month, and not have to worry about transactions “leaking” into the following month (it’s not impossible, but 10 days should be more than enough time for even the slowest of merchants to post).

Which cards track spending by transaction date vs posting date?

When are TREATS Points credited?

Points crediting with the Maybank XL Card works slightly differently from other Maybank cards.

Both the 1X base and 9X bonus TREATS Points are credited on the 11th of the following calendar month, in one lump sum. In other words, you shouldn’t expect to receive any points from the XL Card in the month of spending.

How are TREATS Points calculated?

As the Maybank XL Rewards Card is new, I have yet to confirm the formula used to calculate points. I will update this section when we have more clarity, hopefully by mid-September 2025.

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for TREATS Points?

A full list of transactions that do not earn points can be found in the T&Cs at point 2.2. I’ve highlighted a few noteworthy categories below:

- Betting and gambling transactions

- Brokerage and securities transactions

- Charitable donations

- Government services

- Insurance premiums

- Prepaid account top-ups, e.g. GrabPay and YouTrip

As mentioned earlier, education, hospitals and utilities are not on the exclusion list, and you will earn 0.4/4 mpd for these transactions in SGD/FCY.

What do I need to know about TREATS Points?

| ❌ Expiry |

↔️ Pooling |

💰 Transfer Fee |

| No expiry |

Yes

|

N/A |

| ⬆️ Min. Transfer |

✈️ No. of Partners |

⏱️ Transfer Time |

| Varies |

4 |

1-2 working days

(to KF) |

Expiry

TREATS Points earned on the XL Rewards Card expire one year from the quarterly period in which they were earned, which means a validity of 12-15 months.

| 1 January to 31 March 2025 |

31 March 2026 |

| 1 April to 30 June 2025 |

30 June 2026 |

| 1 July to 30 September 2025 |

30 September 2026 |

| 1 October to 31 December 2025 |

31 December 2026 |

If you spend at least S$24,000 in a membership year on the XL Rewards Card, you can qualify for a Rewards Infinite membership, which makes your TREATS Points non-expiring. However, this requires spending beyond the S$1,000 monthly bonus cap, and is not advisable.

A simpler alternative is to hold a Maybank Visa Infinite or Maybank World Mastercard, since their complimentary Rewards Infinite membership also applies to TREATS Points earned on the XL Rewards Card.

How does the Maybank Rewards Infinite programme work?

Pooling

TREATS Points pool with other Maybank cards. If you have 20,000 TREATS Points on the Maybank XL Rewards Card, and 5,000 TREATS Points on the Maybank Horizon Visa Signature, you can redeem 25,000 TREATS Points at one go.

This also means that if you cancel your Maybank XL Rewards Card, you won’t lose your accumulated TREATS Points unless it happens to be your very last TREATS-earning card.

Transfer partners & fees

TREATS Points can be transferred to four airline partners at the following ratios.

| Frequent Flyer Programme |

Conversion Ratio

(TREATS Points: Partner) |

|

25,000 : 10,000 |

|

12,500 : 5,000 |

|

12,500 : 5,000 |

|

4,000 : 2,000 |

Malaysia Airlines Enrich and AirAsia Rewards are close to worthless in my opinion, so that leaves Asia Miles and KrisFlyer as the only realistic options.

All conversions have an admin fee of S$27.25.

Transfer time

Conversions to KrisFlyer miles are generally completed within 1-2 working days.

Other card perks

Complimentary travel insurance

Maybank is offering the first 15,000 Maybank XL Rewards and Cashback Cardholders a complimentary Etiqa Trip XpLorer Protect policy, which offers coverage of up to S$5,000 for accidental injuries and illness during leisure trips.

This policy lasts for 12 months, and will not auto-renew. If you’re eligible to receive this policy, you’ll receive an email notification when your XL Card is approved.

Needless to say, this should not be taking the place of a comprehensive travel insurance policy, as there’s no coverage for accidental death or permanent disablement, travel inconvenience (e.g. delayed flights, lost luggage), personal liability or loss of personal belongings.

That said, it does cover so-called “adventurous activities” such as abseiling, bungee jumping, sky diving, hot air ballooning, rock climbing and skiing, which may not be covered by other policies. So you should see this as supplementary coverage for an otherwise comprehensive policy, not a replacement.

Terms & Conditions

Summary Review: Maybank XL Rewards Card

Maybank XL Rewards Card Maybank XL Rewards Card |

| Apply |

| 🦁 MileLion Verdict |

☑ Take It

☐ Take It Or Leave It

☐ Leave It

|

With 4 mpd on a wide range of everyday spending categories, including all FCY spend, the Maybank XL Rewards Card is an easy card to recommend. That’s especially the case if you’re already holding a Maybank Horizon Visa Signature, or better yet, a Visa Infinite or World Mastercard, since these unlock non-expiring points through Rewards Infinite.

While I do wish its bonus cap were slightly higher, S$1,000 per month is in line with similar cards like the Citi Rewards, DBS Woman’s World Card and UOB Lady’s Card, so I can’t really complain.

The main drawback is its controversial age cap, and if you’re approaching the big 4-0, I’d highly recommend applying for an XL Rewards Card now, even if you have no immediate use for it. There’s no annual fee for the first two years anyway, and once you pass 40, the door closes permanently.

So that’s my review of the Maybank XL Rewards Card. What do you think?

AMEX Platinum Charge

AMEX Platinum Charge AMEX Platinum Reserve

AMEX Platinum Reserve AMEX Platinum Credit Card

AMEX Platinum Credit Card

UOB Reserve Card

UOB Reserve Card UOB Privilege Banking Card

UOB Privilege Banking Card

KrisFlyer UOB Credit Card

KrisFlyer UOB Credit Card All Other UOB Cards

All Other UOB Cards

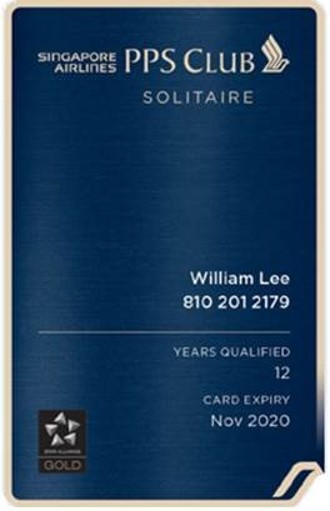

Solitaire PPS Club

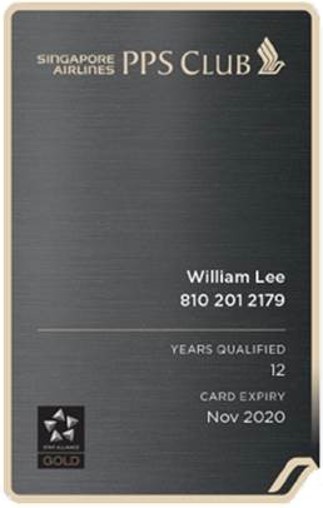

Solitaire PPS Club PPS Club

PPS Club

KrisFlyer Elite Silver

KrisFlyer Elite Silver KrisFlyer

KrisFlyer

UOB Lady’s Card

UOB Lady’s Card UOB Lady’s Solitaire

UOB Lady’s Solitaire

HSBC Revolution

HSBC Revolution Maybank Horizon Visa Signature

Maybank Horizon Visa Signature