The birth of my daughter in April 2015 meant that my wife and I have not had the chance to travel together (besides across the causeway) for more than 1.5 years. We were thrilled to be able to fly again, but also apprehensive about travelling with an 8 month old infant for the first time. What do you do when confronted with the possibility of dealing with a screaming baby for 5.5 hours? Fly Business of course!

SQ 223

Singapore (SIN) – Perth (PER)

Monday, 21 December 2015

Depart: 0925hrs

Arrive: 1440hrs

Duration: 5hr15min

Aircraft: Boeing 777-200

Seat: 17H (Business Class)

Cost: 27625 Krisflyer Miles (after 15% online discount) + S$220.50 (per person 1-way)

1-way Infant-in-Lap ticket for S$259.10

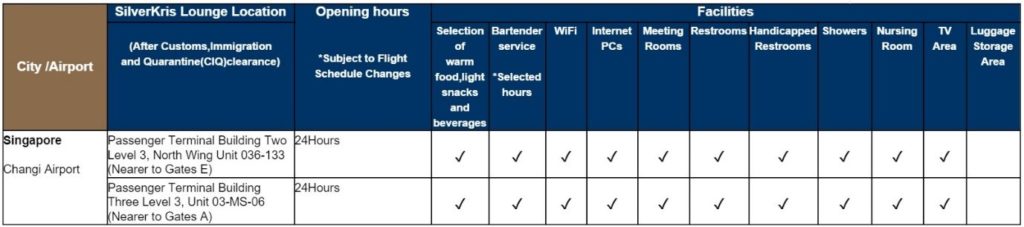

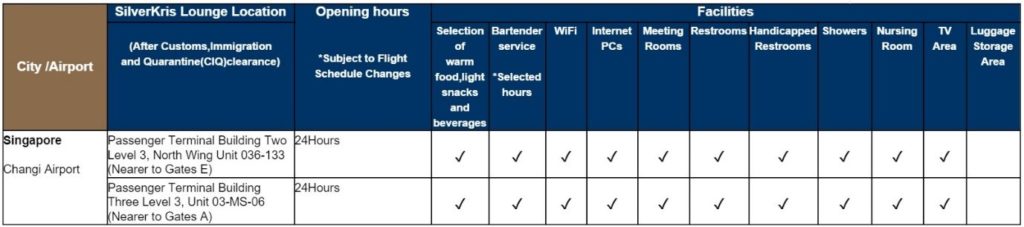

We arrived at Changi T3 at about 7am. My wife needed some time to nurse before boarding, and I readily agreed to the early start to the day as that would give us more time to check out the lounge and do some window shopping. There was no queue at the Business Class row and our bags were tagged and checked-in within 5 minutes. We cleared immigration quickly and promptly made our way to the SilverKris Lounge.

The T3 SilverKris Lounge is a short walk towards the ‘A’ gates (turn left after immigration) and on the 3rd floor. We presented our boarding passes at the reception and were directed into the Business Class section. In the past, we would have made a beeline for the buffet and bar for a quick snack, this time it was to the nearest attendant we could find. “May I know where the lounge nursing room is?”

The attendant confidently replied “There’s no nursing room in the lounge”, at which my wife immediately shot me a death stare.

Now if you are travelling with children, Changi Airport has one of the most comprehensive kid-friendly facilities around the world. There are a multitude of diaper-change rooms and nursing rooms both ground- and air-side, and even an entire ‘Family Zone’ in Terminal 2 (http://www.changiairport.com/en/airport-experience/attractions-and-services/baby-care-room.html). In fact, I’ve read some local parenting blogs which extol Changi as an excellent place for a family excursion for kids of all ages; even when ground-side there is a wide selection of food and entertainment options. I know I could spend at least an hour gawking at the life-sized X-Wing and TIE fighter display, for one!

I was so tempted to queue…

As such, I found it difficult to believe that the flagship lounge of our famed national carrier, in the best airport in the world, does not have a nursing room. And also because I have already done my research. 🙂

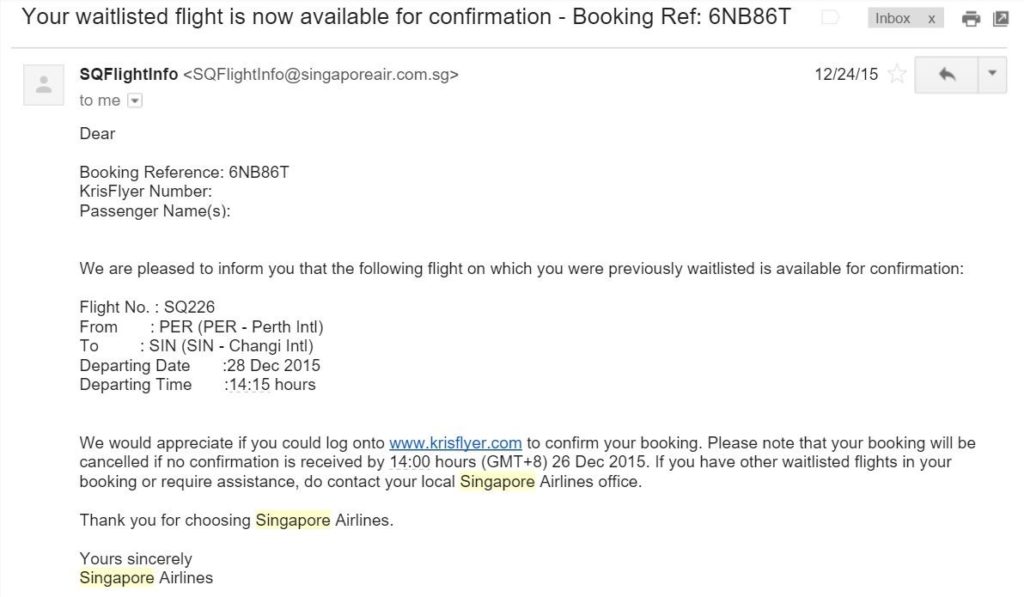

Anyway, not wanting to argue, I made my way back to the reception and asked the staff there the same question. This time I was pleasantly surprised by the response.

“I’m so sorry but the nursing room in the Business Class section is currently under renovation. Allow me to bring you to the First Class section”. Well that made for a good start to our first family holiday! I was genuinely pleased with that bit of service and thought it was a nice touch that they ‘upgraded’ us without even any hesitation on their part.

Passengers flying First or Suites class on Singapore are entitled to use The Private Room. As such, the First Class section is mainly used by Solitaire PPS Club members not flying F or R, and First Class passengers on other Star Alliance carriers. As such, most of the patrons were also holding Business Class boarding passes, and I felt right at home looking around!

Changi T3 SilverKris First Class Lounge

Changi T3 SilverKris First Class Lounge

View of the Bar

View of the Bar

Seating Area

The lounge is understandably smaller, and the décor is largely similar to the Business Class section, with large comfy seats in leather, and a mix of marble and carpeted floors. The darker colour theme gave the lounge a more dignified feel, and I loved the high ceilings throughout the lounge. There were a number of partitions creating sub-sections of seats, imparting a more private feel as a whole. For example, there was a large family of 5 with young children seated in the far section in the last picture above, and I did not even notice they were there until I ventured to take a peek around the partition.

The large, full height windows overlooked the large common ‘A’ gate (gates A1-5), which was super crowded at that point in time with 2 flights due for departure. I was sure reminded of why we spend so much effort accumulating points to fly premium!

The service was far more attentive than that in the often crowded J area. I had coffee, snacks from the tea trolley, stocked up my thermos with hot water for the flight ahead, all while seated in a sofa and without lifting a finger. 🙂

It is difficult to select a seat when there are so many to choose from, but this was the one I chose eventually. First world problems.

Staffed bar, with the staff missing in the photo

Staffed bar, with the staff missing in the photo

Sit-down dining area

Besides the staffed bar, which had a large selection of coffees, TWG tea, and an expanded collection of booze, the lounge also had a dedicated sit-down dining area. The food on offer was not much of an upgrade from the Business Class section. There were a few ‘live’ stations with local delicacies but besides that it wasn’t overly impressive. In fact, the dining area was pretty crowded, and my wife and I decided to head back to the Business Class section (where we rightfully belonged – she’s not as thick-skinned as me and felt paiseh for hanging around the First Class section for as long as we did) for our breakfast. Kudos to the staff who in no way made us feel that we have over-stayed our welcome. I doubt any of them besides the reception staff even knew we were not supposed to be there!

For those who need to work, there is a quiet work section with desks and computers.

Work area with desks and computers

Work area with desks and computers

A quick note of the nursing facilities if you happen to be in need of one. My wife describes it as adequate but underwhelming.

First Class Lounge Diaper-change and Nursing Room

As mentioned, for an airport with comprehensive family facilities, which are spacious and well stocked even ground-side, this room was a little cramped, felt bare, and lacked even a hot water dispenser. There was a basket of amenities (pictured) which included (of all things) small cups, mouth rinse (???) and lotion, but that was about it. You don’t need to be a parent to know that those are pretty useless items when trying to deal with a hungry or soiled child. Even the children’s stickers on the wall and mirror looked sad. Maybe it was me setting unrealistic expectations but I thought it would look better than a common heartland mall’s nursing room.

That being said, my wife was very pleased with the large leather couch and side table available.

Large couch and table for baby paraphernalia

In all fairness, I doubt many Solitaire PPS Club members would be in need of such facilities. Also, there aren’t many First Class passengers on other Star Alliance carriers to begin with, much less those with nursing infants. For us, hot water was hand-delivered to the nursing room on demand, so the point about the dispenser is moot. J

On hindsight, I guess I should be pleased that they even had a nursing room. Neither the Qantas Club lounge in PER, nor the 5 Royal Orchid / Silk Lounges in BKK had a nursing room; and their idea of a diaper change facility is a plastic fold-down changing table in a normal toilet so…

With the whole family satiated, we made our way to our gate and whizzed past the economy crowd unto the plane. Damn that never gets old (at least not yet)!

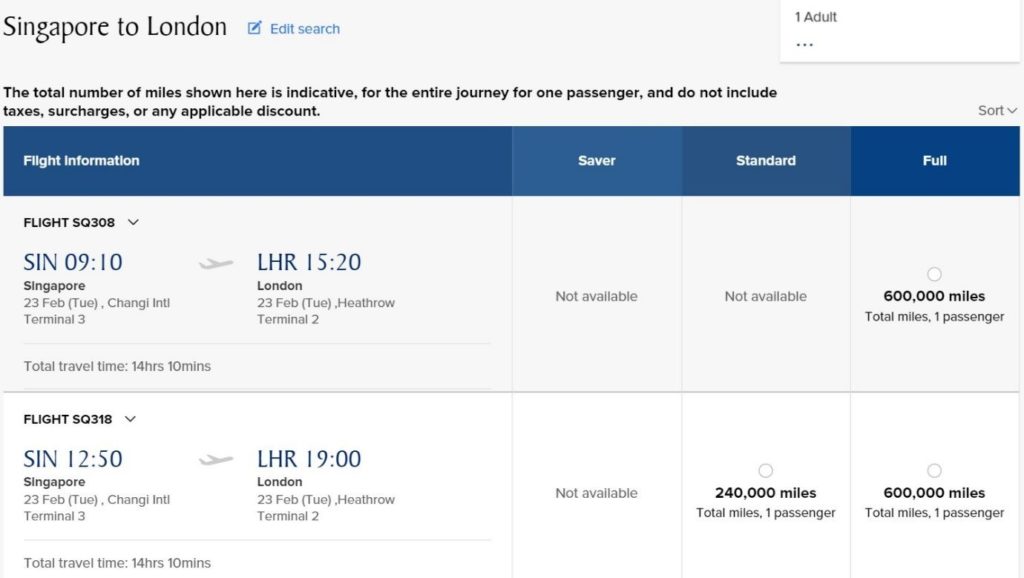

SQ223 is a Boeing 777-200 which features the standard SQ regional angled-flat business class product in a 2-2-2 configuration. There are 4 flights from SIN to PER daily, 2 of which are on the Airbus A330-300 with the other 2 on the B772. The hard product is identical on both planes, but business class on the B772 is divided into 2 separate cabins. The front cabin has 20 seats, whereas the one closer to the economy cabin has 18. In contrast, the A333 has a single Business Class cabin with 30 seats. It’s a minor difference between the 2 planes but I do feel a smaller cabin does give a cosier feel.

We were placed into the aft cabin due to our request for a bassinet seat, which turned out to be an excellent thing given that it was all but empty except for us and 2 other solo travellers.

Standard SQ regional Business Class seats

Standard SQ regional Business Class seats

Almost empty aft business class cabin. No wonder there was abundant saver award space!

Almost empty aft business class cabin. No wonder there was abundant saver award space!

Compared to other regional products, I really feel SQ has one of the best in the market. The fixed back shell with the little extensions at the side gives it a similar feel to the old long haul seat (haven’t had the chance to try the new one yet!), and at 27 inches the seat width is even wider than some other carriers’ long-haul business class products. There are some that say a wider seat is not necessarily better, which I agree with in principle. However, I’d like to say that a wider seat certainly can’t hurt!

We settled right in with the customary hot towel and welcome drinks. It was a challenge keeping my daughter from trying to get a taste of my Taittinger Brut though!

Welcome drinks

There was a long taxi to the runway followed by a queue, but after about 15 minutes we were airborne.

Take-off queue

Meal service started soon after. Now at this point the flight became a bit of a blur because my daughter was rudely awakened from her blissful nap by the take-off and started morphing into a Kraken (remember that scene from Pirates of the Caribbean?). We had to take our meals in turn, beginning with my daughter’s post-weaning meal.

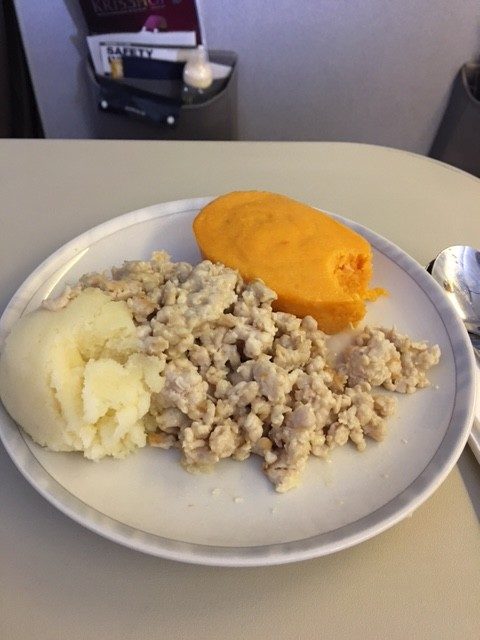

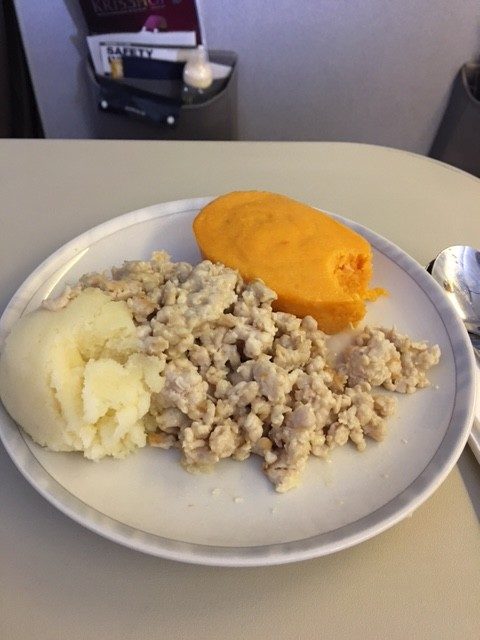

It was described as ‘Minced chicken with mash potatoes and steamed pumpkin’. And we loved it. We meaning all 3 of us. My daughter finished about a quarter of the relatively huge serving, and my wife and I gobbled up the rest. This is in stark contrast to when we flew on Thai Airways on the return leg, where we were brandished 2 ice-cold packets of baby food. SQ even made a fair attempt at plating food for a baby!

SQ Post-weaning meal. This tastes A LOT better than it looks.

It was our turn now, and no SQ flight would be complete without their Chicken and Beef Satay. As usual, the meat serving was generous and juicy, and the peanut sauce was great.

Chicken and Beef Satay

This was followed by the appetizer; the prawns were huge and succulent, baut the cheese was a little on the bland side. Can’t be faulted for that I guess, overall an excellent starter.

Marinated King Prawn and Bocconcini with grilled vegetable

and basil pesto

We had opted for the Book the Cook service prior to the flight, and it did not disappoint. My wife had the Chargrilled Soya-flavoured Beef. In the air, picking the red meat dish is sometimes hit and miss because it can be easily overdone and tough. But this dish was perfect. My wife and I both like our beef marbled, as opposed to the beefier dry-aged taste, so we were lucky that what was offered was exactly our cup of tea. In fact, this meal is the best meal I’ve had on a plane thus far. Now I know I’m not that well-travelled, but I am picky about my steaks even when on land, and I am still craving another bite of that beef now that I’m looking at its picture.

Chargrilled Soya-flavoured Beef

Classic Lobster Thermidor

Classic Lobster Thermidor

It was the Classic Lobster Thermidor for me, which was tasty and had generous servings of juicy lobster, but it paled in comparison to the beef.

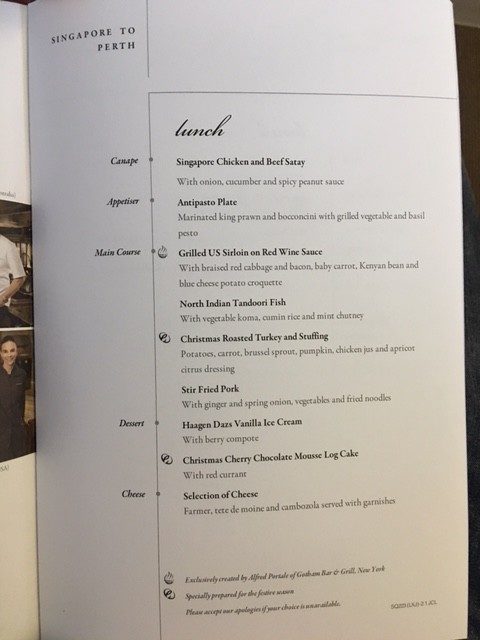

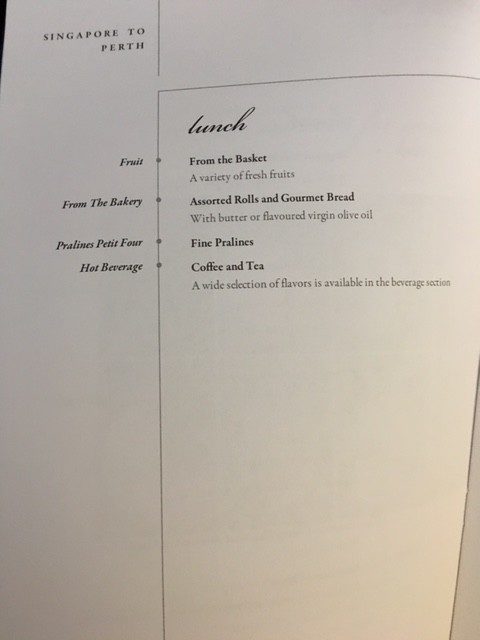

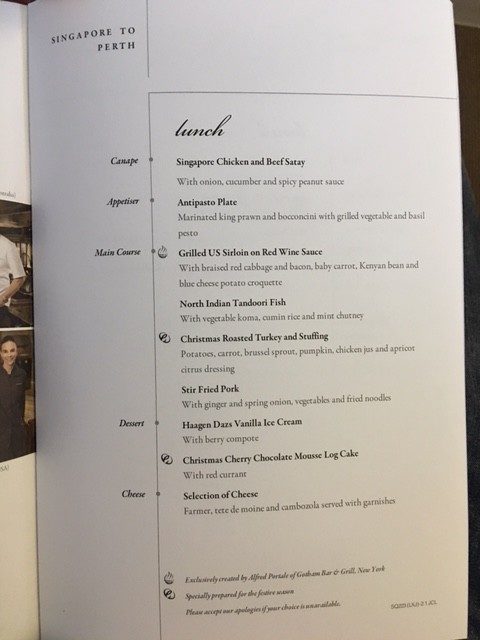

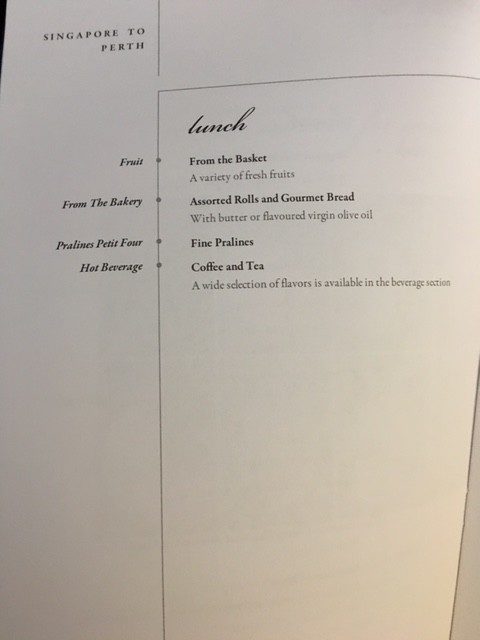

For those interested, the regular menu for the SIN PER lunch service reads as follows;

SIN PER Lunch Menu

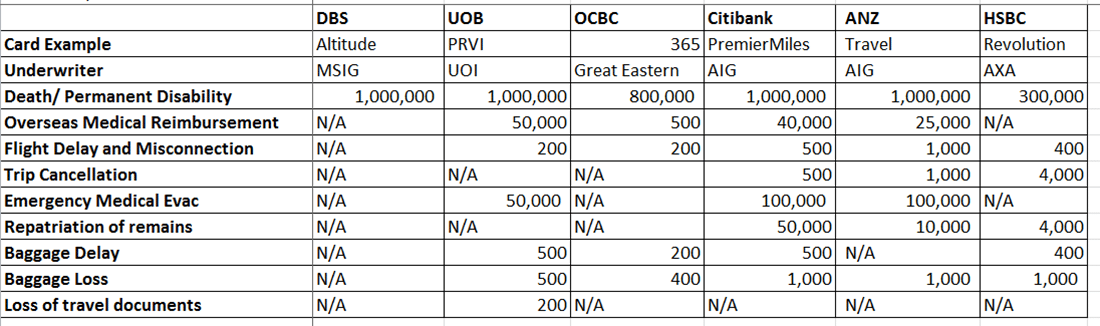

Service on the flight was standard SQ – quick, efficient, professional and always done with a smile. They accommodated our many requests without hesitation. Some trip reports do say that while it is polished and standardized across the board, the in-flight service on Singapore Airlines can be robotic and impersonal at times. That was difficult for me to appreciate in the past, but I must say I felt a little of that on this flight. Travelling with children inevitably makes one a more ‘difficult’ passenger – I needed to make more weird requests, not to mention the countless times clogging up the galley with my crying baby (we figured we’d rather disturb the FAs than the other passengers). The FAs were always present and willing to help, but did not bother trying to engage us (or my daughter) on a personal level.

This is in contrast to our return leg on Thai Airways Royal Silk Class. While the FAs were not as polished as our Singapore Girls (I was handed an unfolded tablecloth and had to lay it out myself), I found that they were much more engaging. The senior flight steward on the TG flight even offered to carry and entertain my daughter while my wife and I ate.

I know this is being picky, and it doesn’t really affect my view of the airline much. However, seeing as how much of SQ’s marketing still continues to revolve around the Singapore Girl, it is always worth keeping a tab on.

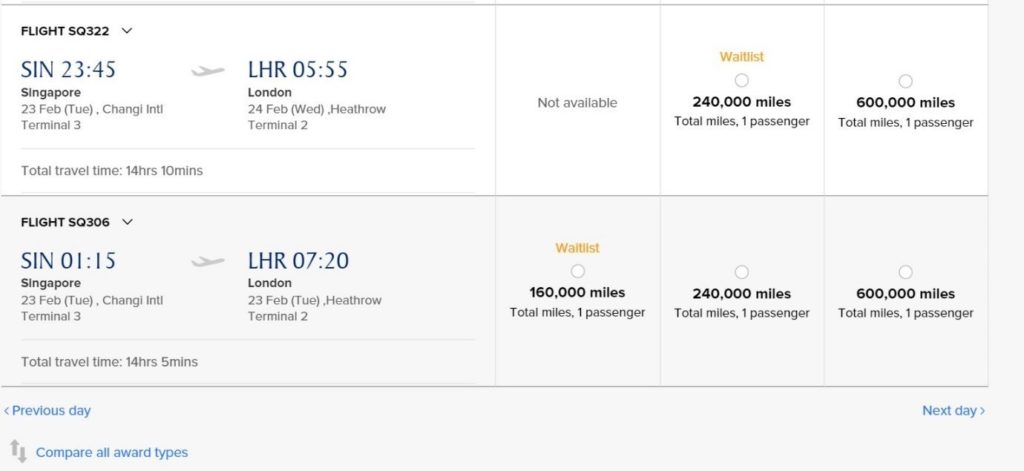

A closing note on infant tickets. As to be expected, the 1-way infant-in-lap ticket was pricey and not value for money. I was charged S$259.10, when a return ticket would have only cost around S$350. Theoretically an infant-in-lap ticket only costs 10% of the adult fare, but it is usually on the adult full fare, and the taxes and surcharges are sometimes not waived (this differs from carrier to carrier). On Economy the fare would usually be quite affordable, but when flying premium things add up pretty quickly. Before getting too excited and snapping up those Saver award seats, it is worth giving the carrier a call to get a rough gauge of the prices both return and 1-way. I was shocked when TG charged me S$560.70 for a 1-way infant-in-lap ticket on our return (PER-BKK-SIN) leg!

In summary, SQ Regional Business Class probably will not feature very highly one’s lists of aspirational products to fly, but for that added comfort and convenience on a family holiday, I feel it is well worth it shelling out the miles for.

View of the Bar

View of the Bar