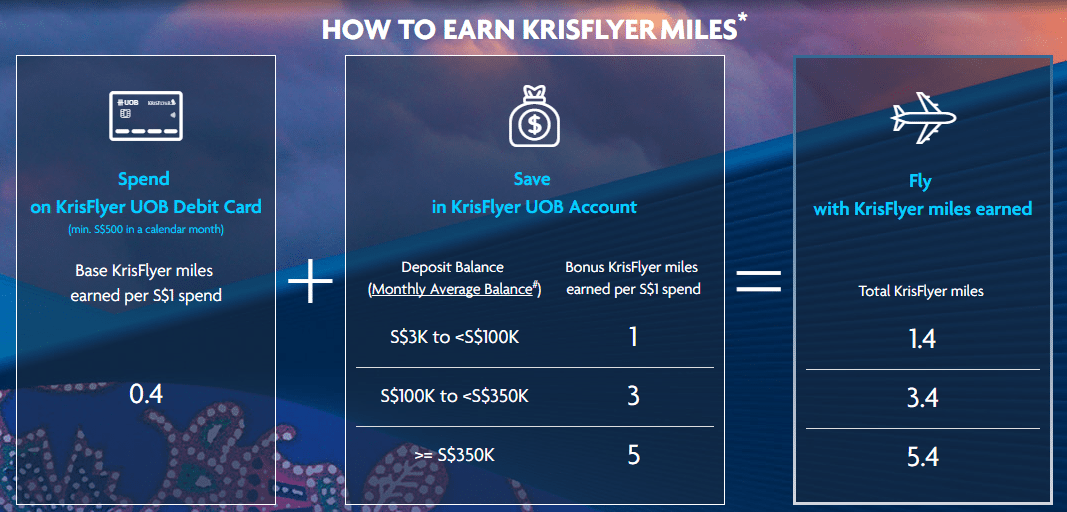

UOB launched a new product yesterday, the Krisflyer UOB account that allows you to earn miles through your debit card spending. The rate of miles earning varies depending on your total balance in your account.

The premise sounded intriguing, but there were few details. Would there be a cap on miles earning? Would the account earn any interest? What other terms would be lurking beneath the surface?

Well, the product webpage and T&C have since gone live so I’ve spent some time examining the fine print.

And I cannot begin to tell you how bad this product is.

Here’s the product summary-

Fees & Charges

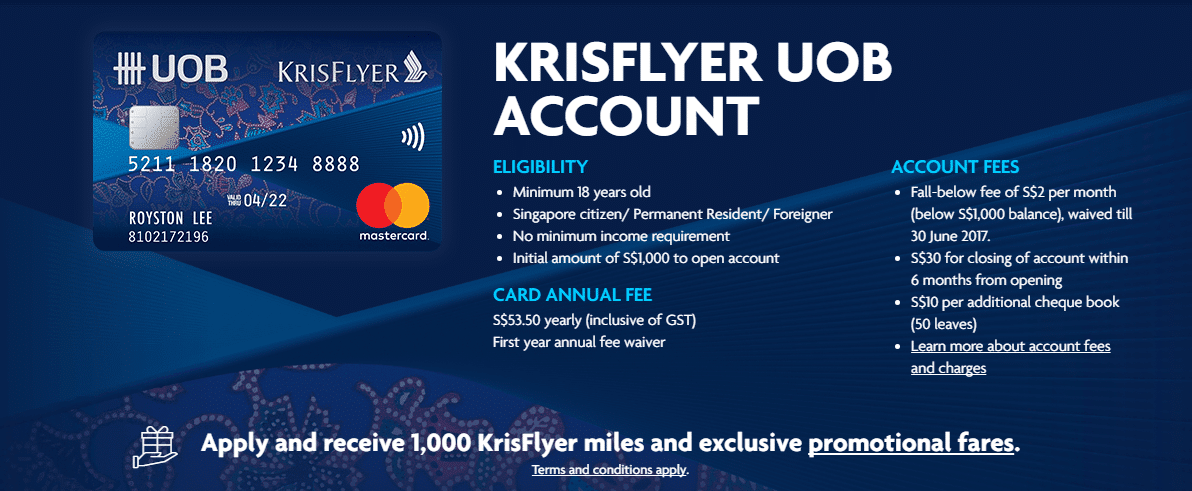

-Initial opening balance of S$1,000

-Annual fee of S$53.50 for debit card with first year waived

-Minimum balance of S$1,000 must be maintained, otherwise S$2 per month fall-below fee applies

-S$30 early closing penalty (within 6 months of opening)

-S$10 per additional chequebook

Features

-1,000 bonus miles when you apply and charge a min of S$500 to the Krisflyer UOB Debit card within 30 days of approval (first 50,000 applicants- UOB strikes again!)

-Base mpd: 0.4 (with min S$500 spending in a calendar month)

-Bonus mpd: You earn this additional component depending on your overall account balance

- S$3K to <$100K: 1 mile

- S$100K to <S$350K: 3 miles

- More than S$350K: 5 miles

-Automatic miles conversion to Krisflyer

Benefits on Scoot & Tiger Airways

– Priority check-in and boarding

– Additional baggage allowance

– Standard seat selection

– Convenience fee waiver

Why is this so bad? Let me count the ways

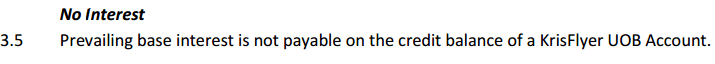

No interest is earned on this account

I suspected this yesterday, but now it’s confirmed. You gotta spend money to earn miles. Your money will earn ZERO interest in this account.

That is implausibly bad. I mean, I love miles as much as the next dude (correction: way more than the next dude) but I’m not going to have S$100K sitting idle just so I can earn 3.4 mpd on my spending. Besides, if you know how to maximise your 4 mpd opportunities this becomes an even worse deal.

For many people, this will already be a dealbreaker. But it gets better…

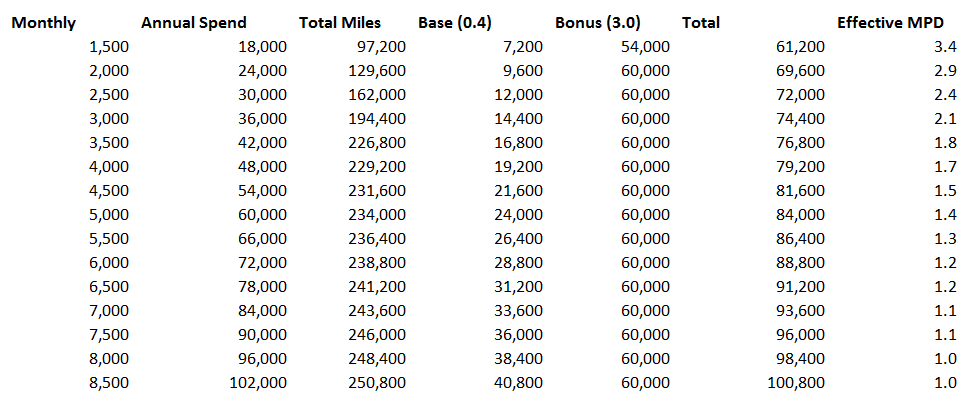

Your bonus miles are capped, making your effective mpd lower the more you spend

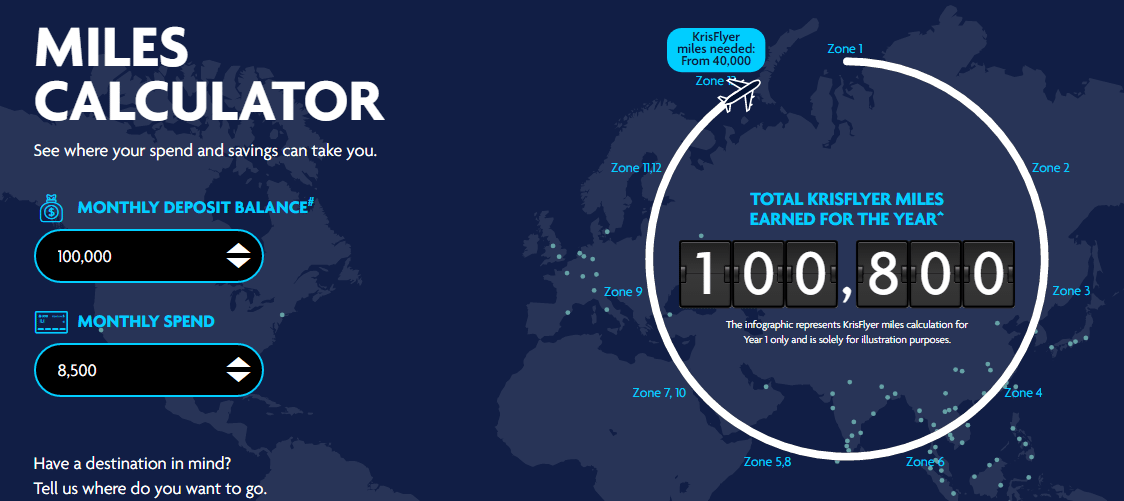

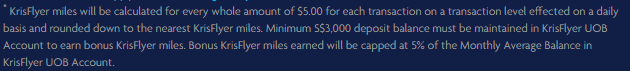

The T&C alludes to a cap, but doesn’t specify what that cap is. However, if you look at the bottom of the promotional webpage, you’ll see this little line that has a dramatic impact on how you view the product-

In case you can’t read that, it says

Bonus Krisflyer miles earned will be capped at 5% of the Monthly Average Balance in the Krisflyer UOB account

This confused me at first because it was comparing miles to money, something that’s not immediately intuitive. What I understand now is that the maximum number of miles you can earn per month is capped at 5% of your monthly average balance (MAB).

So, if your MAB is $350K, you can earn a maximum of 5% of $350K= 17,500 per month. See why that’s confusing? You’re comparing miles and money.

Assuming something possessed you to put $350K in a 0 interest earning account, your math would look like this-

Can you see that once you get beyond S$3,500 of monthly spending, you’re only earning 0.4 mpd on each incremental dollar? That is insane.

Look at the last column- the more you spend, the lower your effective MPD. For someone spending $8,000 a month (not too far a stretch for someone who can afford to park $350K in the bank at 0 interest), you’re earning an effective mpd of 2.5.

If you opt for a more sane amount of maybe ~$100K, the picture gets worse-

Suppose you spent $5,000 a month. You’d be earning 1.4 mpd, which is something you could get with a UOB PRVI miles card, without having to park $100K in a 0 interest earning account.

Play around with the calculator if you want, but the basic facts don’t change. The presence of the cap means that not only do you lose out on the interest, you lose out on what the product is ostensibly supposed to be good for- miles earning.

The bonus miles are for a promotional period only

If those caps weren’t enough to put you off, do note that the T&C imply that the bonus miles (1/3/5 depending on your MAB) is for a promotional period only. No knowing what will happen after that ends.

The Tigerair/Scoot benefits aren’t real benefits

Even if you’re the type who does a lot of regional travel on budget carriers, I wouldn’t get too excited about these benefits-

- Priority Check-in: Your entire party enjoys priority check-in and boarding. This is nice to have, but not something I’d pay for anyway

- Complimentary Seat Selection: This would be a fairly decent benefit, but for the fact that it’s limited only to the principal cardholder. So if I’ve booked a party of 3, only I get to select my seat for free. That kind of defeats the purpose, given that I’d want to seat us all together. If anything it sound suspiciously like a way of upselling you to shell out for the other 2

- Complimentary Additional Baggage: Pfffft. Not a real benefit because of the strings attached. It requires you to buy a minimum 20kg baggage allowance, after which you’ll get a bonus 5kg. And you only get this benefit if you buy the baggage allowance at the time of booking. If you add baggage after initial purchase, you’re SOL.

- Convenience Fee Waiver: This was always a major source of annoyance to me, so I was glad to see a waiver was offered. But once again, it’s not really a benefit. You need to spend S$250 on a Scoot/Tigerair booking in a single transaction, then you’ll get a fee waiver voucher that can be used on your next booking, and here’s the best part. You only get one fee waiver voucher per year

These “benefits” are easily the most ham-fisted and stingy I’ve ever seen (and this from a longtime Krisflyer member). It’s like they really didn’t want to give anything, but finally relented as a favor to you. It’s almost bordering on satire.

I gave OCBC a hard time for its sponsored post, but if I were their marketing team I’d be jumping all over this so called “benefit” as a prime example of how other banks don’t market transparently. If they put front and centre the limitations (most noticeably the fact that the convenience fee waiver is ONCE a year), do you think they’d dare to market this as boldly?

Is there an upside?

It’s really, really hard to think of anything good that can come out of this. But HWZ user dahnoob has a decent idea-

This is actually a decent product to replace the PRVI, provided that you have $3000 lying around and don’t mind locking them in. The advantage of this debit card over the PRVI is that you don’t need to pay anything for points transfers, and they happen automatically every month. The drawback is of course the lack of interest free payment period. Realistically, you would want to put in more than $3k, because charges are debited from the account itself. God knows whether UOB will refuse you your 1.4mpd because ‘your balance fell below $3000 on 21 April, between 10.30pm to 10.35pm’.

(I strongly suggest you read the rest of his/her analysis because it’s spot on)

I agree with him/her. If you’re someone who doesn’t hit the income requirement for a PRVI card (S$80K per annum) but you do spend >S$500 a month, you could put S$3K in this account and ensure that your MAB is above that. It’ll be a bit of micro management, but you’d then have a PRVI card without the conversion fees. Note that you wouldn’t enjoy the 2.4 mpd on overseas spend, of course.

EDIT: As Tim pointed out on the comments below, even if you do this the 5% mileage cap comes back to bite you. A 5% mileage cap on a $3K MAB is 150 bonus miles. 150! Your effective is hence a lot lower than 1.4 mpd.

As per UOB’s own calculator a MAB of $3K with monthly spend of $500 gets you 4.2K miles a year or 0.7 mpd. Wow. The odds keep stacking up against you.

How could they even think this would work?

UOB says it anticipates to draw in S$1.5B from funds deposited into these new accounts. Let me assure you that not a single cent of that S$1.5B will be from me.

I have no idea what was going through the minds of the UOB product team when they came up with this. Who did they think they were targeting?

- Students? (But which students spend >$500 a month (cool kids probably))

- Young professionals who can’t get a “proper” miles earning card? (Now that the DBS Altitude income requirement is only $30K this doesn’t hold water)

- Retirees? (But can’t they get a secured credit card or simply hold on to the ones they had before retirement?)

- Cash rich/miles poor people? (You don’t get cash rich by being investment dumb, and I’m sure this group would have identified the 5% cap as a major barrier to adoption)

- Gullible people? (probably)

I’m sure over the next few weeks you’re going to have a friend who knows you’re into miles come up to you and say “wah did you hear about the new UOB thing? 5.4 miles leh!” Your job, nay, your duty, is to correct this poor soul and ensure they do not get anywhere near this product.

Say something nice about this product? Sure. I think the card is damn chio.

UOB Team, whatever you’re smoking, I want lots of it.

This is a product for starters albeit being masqueraded elegantly for the elites. I am no class person and l live very well with it. But i have a problem with people of no class acting very high class, 5.4mpd 🙂

You’re right. I couldn’t help but be curious as to how the numbers could work out, and it seems to make sense more for the rich who still prefer to have their assets in liquid, accessible cash. Given the max scenario up there of $350k account balance and monthly spending of $3,240, you’ll be earning 226,800 miles. Assuming a valuation of 2c/mile, that $4,536 worth of interest and card rebate. Since it’s hard to really separate these two, for simplification purposes that amounts to an interest of 1.3% p.a. on $350k. I guess under these circumstances it makes sense given… Read more »

This is bullshit! UOB is really a joke. I would be surprise if they can raise 1.5 billion!

AXS payment has been excluded as expected, otherwise as a debit card you still can make use of it to pay certain loans via AXS e-station/AXS mobile app and earn 1.4 MPD… If anyone tries this and gets credited with miles do let me know hahah

I like the card. Look nice. Hahahha

When I saw the card at the top, I was like, yeah I’ll get it for the card, looks damn pretty (I do that, kay, don’t judge) and then as I read on.. just.. no way. Come on, UOB. S$1.5b doesn’t appear just like that.

i wonder if they got some bump on the stock price after the $1.5B announcement.

Confirm have lah – unless their stakeholders also use their credit cards. Then they would already have known about UOB’s (trademark) sleight of hand.

LOL

This is really a big joke, which makes my day.

“wah did you hear about the new UOB thing? 5.4 miles leh!”

-> My reply: ya, 5.4 miles is how far you should stay away from this card! MileLion say one! 😛

Thanks ah. Never mention his biceps

You are the best lah, thanks!

LOL,

wow nice analysis

Not sure if anyone noticed the definitions at the end of the TnCs. Apparently only Dining, Online Travel, Online Fashion, Samsung Pay and Apple Pay transactions are eligible for miles.

Thank you Aaron, I was not going to apply for it (or any of their other products) but I’m glad you gave them a well-deserved slap 🙂

No that’s such a waste! Not all their products are bad. Prefered platinum Visa is an awesome product. 4mpd for online and paywave is one of the best around plus its an easy feat. Groceries can buy online or paywave physically at the store. Just watch out for them $mart merchants.

agree with what Zul is saying. I call things out on a case by case basis. I think this particular UOB product sucks, but I love the opportunities UOB gives me to get 4mpd on overseas, online and dining (signature, ppv, ppa).

Hey Zul, UOB PPV- Do you get 4mpd for Redmart? As far as I know, you won’t get 4mpd for Deliveroo and Grab, which I’m sure are popular merchants.

Being a debit card, it could have opened up many doors otherwise not accessible to credit cards…

Then they decided to throw in the TnCs.

Thanks Aaron

Definitely I won’t apply

Just read dahnoob’s post in HWZ, and your analysis is spot on to his! The scoot / tiger privileges looks horrible. I’m definitely staying away from this card, because the MileLion say so!

What comes before ‘who do you think they are targeting?’ Would be ‘who do you think they hired in the marketing team’ ?

You should compare to UOB PPV instead of PRVI. PPV 4 miles per dollar for online and contactless payment, totally wins this Krisflyer debit card (except the 80k income requirements)

This card is a disaster from the start!

I don’t get the dahnoob analysis above. The 1.4mpd consists of 0.4 base plus 1 bonus. Bonus miles restricted to 5% of balance. Take $3,000 balance, that’s a 150 bonus miles cap (or $150 spend). Given you need $500 min spend before getting miles, at $3k balance your effective mpd is waaay lower than 1.4mpd. I posted in the previous topic, the biggest issue with this scheme is the bonus miles cap, which effectively limits their exposure to paying out miles. I pointed out in my previous post that based on this cap, you will only earn about 1.7% “interest”… Read more »

hmmmm. you’re right. I think I might have missed a step there. I think his broader point was that you’d be earning 1.4 mpd in a marginal sense but way less on an average sense. let me add a disclaimer there, thanks! edit: the other point to note is that you’d have to keep an MAB >$3k in a practical sense because you’d have bills that need to be paid instantly and you can’t drop below 3K for any extended period of time. That will make your effective slightly higher (as your cap is raised) but doesn’t help things a… Read more »

So my question is – why does UOB think that it can get 200,000 people to sign up for this card?

they think everyone is stupid

same reason why people cash out their dbs points/uni$ for shopping vouchers/cash rebates

Why not? Care to share?

Why does UOB have to overcomplicate something that should be relatively straight forward and simple, to the point of making themselves look stupid?

Look at this Bankwest account in Australia:

http://www.bankwest.com.au/personal/everyday-accounts/everyday-transaction-accounts/bankwest-qantas-transaction-account

Can’t UOB just be simple and do something like that?

The MDs at UOB loves to hire people who analyse and sound very technical.

How I know? I work there.

It’s a bank filled with MDs who love presentations and lots of technical jargons; and there’s enough A-students hired who are happy to do that.

It already sounded bad on the surface, but wow you really dug into the fine print and showed how pathetic this product is. It’s a card for financially foolish wannabes. Sigh.

Check out #KrisFlyerUOB on Instagram. Reality is.. depressing.

UOB defends its KrisFlyer UOB account

Product designed for customers who want travel perks in lieu of earning interest, it says in response to critical blog post

“The bank was defending its KrisFlyer UOB account launched on Tuesday after blogger Aaron Wong trashed it, saying among other things that no interest is earned on the account and that the 5 per cent bonus cap makes the “effective miles per dollar lower the more you spend” ”

http://www.businesstimes.com.sg/banking-finance/uob-defends-its-krisflyer-uob-account

Aaron, well done! You are an authority recognized by the market and the media!

Those of us who read, discern, think, and use credit cards for miles will know what a crappy product this is versus what else is available out there.

Glad to see the media pick up on this. UOB are entitled to defend their product of course. But given the choices available, I wouldn’t touch the Krisflyer UOB Debit Card with a 10 foot pole … make that a 100 foot pole.

Will be useful if you have a really big spending. Deposit 500k, spend 100k to get the 5miles + then cancel it/leave 3k in it?

Bonus miles will be just 17500 per month. You also get 0.4 base miles, so you get a grand total of 57500 miles for your 100k one off spend.

That must be the worst earning rate ever.

I didnt read in details but just giving the idea. I’m sure u can tweak it accordingly. Where can u find 5.4miles for ur spend anyway

Read the article, you’ll find yourself.

Think u don’t get what i am trying to say. Tweak the numbers, get 5.4x miLes per $ spent, take out ur money.. what’s so hard to uds

Ah here’s the spoon feed generation. Those who have time to scroll down and comment three times, but do not have 5 mins to read the article.

Sorry, I have a bad relationship with such people. You can wait for a sympathetic person to guide you.

Can believe u are so rigid. It’s just an idea. Math for u. U have a 25k spending coming up (say Ur son’s wedding, judging by Ur tone, u sounds like a 50 years old guy) put in 525k for a month, spend 25k, get 135k miles. Numbers are for illustration, scale it accordingly.

This. Is who uob are targeting.

Those who get sucked in by UOB’s typically misleading headlines and don’t bother to read the TnCs.

Does Singapore have misleading advertising laws?

This is like the citi prestige card where they tell you get up to 30pct more additional citi dollars based on your citigold relationship but when your bonus miles get credited, u will have the shock of your life. I applaud the person who wrote such deceptive English which is still on your website and even fooled Aaron in the beginning. Well done Citi.

Sorry, assumed 350k balance. For 500k balance and one off 100k spend, total miles earned will be 65k.

Lol. If you have 500k lying around, I don’t think you’re short of any other elite credit cards (for miles) since you’re probably already in priority banking.

You might want to research on your own before giving “examples”.

I think Bonus miles earned is capped at 5% of your monthly average in account. So, if u have 500k in account, the maximum bonus miles. More or less, is 25k. No matter how much u spend. Plus u get the 0.4 normal miles. So think. ?

So I think.

Did anyone notice that the .4 miles will be rewarded on $5 spending? I.e. 2miles per $5 spending, meaning to saying if you $9.90 on a item you are still getting 2miles.

Not exactly 1.4mpd

Correction, 3 miles earned if you spend 9.90.

This is this rubbish $5 rounding thing that I have been harping on in a few threads that UOB does. But advertising it on a miles per dollar basis. Disgraceful.

[…] those of you who are unsure about what we are talking about, we recommend for you to read this now-viral article from MileLion. The article, among other articles including a well-written one on MoneySmart, has prompted a quick […]

[…] 5.4 miles arose. Hardcore local air miles website The MileLion even went so far as to proclaim “The KrisFlyer UOB Account is Dead on Arrival”. So is the KrisFlyer UOB Account that […]

I activated my card yesterday and I was charged $21.40.

[…] product relying on influencer marketing techniques that were badly done. Not only was the product held to be something of a terrible proposition, but the parroting of the marketing message by Singaporean influencers such as Brad Lau, Melissa […]

Good link and calculation. The Scoot benefits are actually worth 0. The payment page on flyscoot.com does not work if you are logged in with your Scoot UOB Krisflyer account. You need to login in order to get the benefits. So 0 benefits of the UOB Krisflyer card if using Scoot. Payment with the UOB Krisflyer card is still possible if you are not logged in. But then no priority check-in & boarding, no add. baggage allowance, seat selection is either way a joke if you dont travel alone, and the BIG plus, you need to pay the credit card… Read more »

while some of the criticism is valid, there is still a pretty decent use case for this card: 1) General spend card for those other expenses not covered by the 4mpd cards. Say $250-500pm of spend on utilities, public transport etc. Assuming 25-50k of MAB, as long as you spend a max 1% of MAB ($250-500) you still get 5.4 mpd netting you 15k-30k miles per year. Not bad. Assuming a realistic EIR 0.5% (1% eir products have other issues/ hurdles to meet), that’s $250 of foregone interest on $50k MAB + 7200 miles or another $130 (1.2mpd general spend… Read more »

Yes you are missing something. The bonus mile is only 1mpd for MAB less than 100k, hence you would get 1.4 mpd capped to 2,500 bonus miles if you maintain a balance of 50k.

No, it has been updated. Bonus miles are now 5 mpd regardless of MAB. Doesn’t change that it’s a bad product though.

True, as long as the 5% maximum bonus miles remains, it is a terrible product. It’s just way too low, someone savvy enough to have a million dollars in cash to sit around in 0% interest accounts wouldn’t care for that potential 50k kf miles.

while some of the criticism is valid, there is still a pretty decent use case for this card: 1) General spend card for those other expenses not covered by the 4mpd cards. Say $250-500pm of spend on utilities, public transport etc. Assuming 25-50k of MAB, as long as you spend a max 1% of MAB ($250-500) you still get 5.4 mpd netting you 15k-30k miles per year. Not bad. Assuming a realistic EIR 0.5% (1% eir products have other issues/ hurdles to meet), that’s $250 of foregone interest on $50k MAB + 7200 miles or another $130 (1.2mpd general spend… Read more »