Mileslife is an app that offers users the opportunity to accelerate their miles earning on dining, hotel stays and recreational activities. I’m always careful to check the Mileslife app before booking or paying for anything to see if I can earn some miles for no extra cost to me.

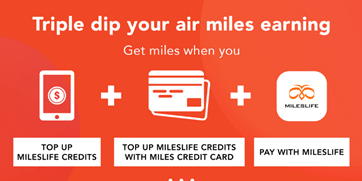

I saw today that Mileslife is launching a new system called Mileslife credits, which offers a chance to triple dip on Mileslife spend. Here’s how it works:

- You use your credit card to buy Mileslife credit. This earns you points on your credit card (first dip) for Mileslife spend, plus points from the Mileslife app for buying credit (second dip)

- You use your Mileslife credit to spend at restaurants, spas, etc, earning whatever rate those merchants are offering through Mileslife (third dip)

Example: I buy $1,000 worth of Mileslife credit, paying with my DBS Altitude card. I earn 1,200 miles from my card, and 1,500 miles from the Mileslife app. I then use that $1,000 credit at a restaurant offering 3 mpd for 3,000 miles. All in all, I have earned 5,700 miles for $1,000 of spend

Mileslife credit can be bought in denominations of $1,000, $2,500 or $6,000 only, in exchange for which you earn:

Now here’s the key question: are you willing to lock in $1,000, $2,500 or $6,000 with Mileslife? It’s quite obvious what’s going on here- Mileslife wants to incentivize you to lock in spend with the platform, for which it’s willing to give you a kickback in the form of bonus miles. You can get a refund for unused Mileslife credit, but it comes with a 15% admin fee (meaning this is definitely not a way to MS). Mileslife credit does not expire, and it’s non-transferable.

I could see Mileslife credit working for people in certain situations:

(1) You have a big office dinner coming up at a restaurant that accepts Mileslife and you’re able to pay for and expense this on your personal card

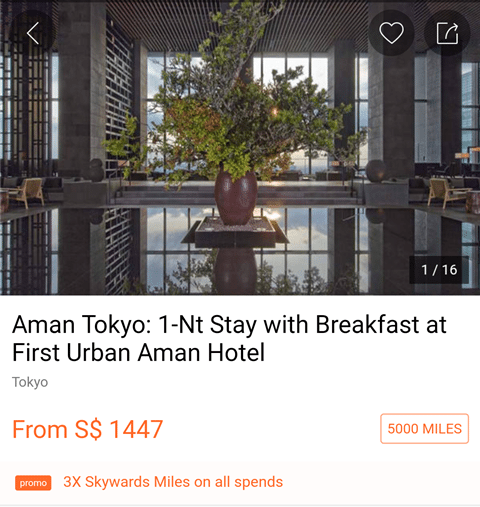

(2) You’re planning to book a hotel and have spotted one on Mileslife that offers attractive earn rates

Note that in both cases, you already have big ticket spending in mind, and this is simply a way of earning bonus miles on top of whatever you’d normally earn.

It’s understandable that most people would be hesitant on parking $1K of spend with the platform, so I don’t think I’d advise people to top up speculatively. If you are topping up, note that Mileslife is offering 2X the miles for the first 5,000 people who buy credit before 22 November. Credit posts to your account instantaneously in most cases.

Mileslife has recently changed the way their transactions are processed. The payment is now processed in Singapore so no cross border transaction fees are incurred. I also understand they have changed their MCC, but need to do some testing to see whether the new MCC earns 10X. UOB PPV is currently my best bet, but I’ll update this again when we have some confirmation.

If you’re new to Mileslife, you can sign up here and get 1,000 miles with your first spend of $49 or more.

I’m hoping DBS WWMC can be used for Mileslife purchases. Any luck in getting 4MPD now that the Amex Krisflyer 2x offer is over?

remember that dbs wwmc has explicitly excluded mileslife from points earning

Meaning not even the measly 0.4mpd but a bit fat NADA

Hi Aaron!

Does it mean the best card would be from DBS Altitude, Citi Premier Miles if there isn’t card specific promo like AMEX Krisflyer 2x? I’m struggling to see how we can use MilesLife if we have those 4x card specific spends already on food, online, shopping etc.

Just tested with PPV, seems like it isn’t earning 10x

Does Maybank Horizon signature visa allow earning of 3.2 for transaction on mileslife – For mileslife top up and mileslife dining?

I took a gamble and topped up using Citi Rewards Visa on 20 Sep, and can confirm 10X rewards points…