Citibank has launched a new “holistic digital wealth proposition” called Citi Plus that includes the Citi Interest Booster, a hurdle account with interest of up to 2.8% p.a. (a figure you should take with a pinch of salt, as I’ll explain in a bit).

This complements its existing Citi Wealth First Account, though Interest Booster is clearly targeted more at millennials.

Now, I hardly consider myself the expert on CASA matters, but whenever I see something new and shiny, the first question I ask myself is: could a miles chaser use this?

Sadly, the answer is no.

Overview: Citi Interest Booster Account

|

| Citi Interest Booster |

| T&Cs |

The Citi Interest Booster account is now open for applications, and offers customers the following interest rates.

| 💰 Citi Interest Booster Account |

|

| Category | Rate |

| Spend Min. S$500 on Citi Cash Back+ Card or Citibank Debit Mastercard |

0.2% p.a. |

| Invest Perform 3x investment transactions in a month |

0.6% p.a. |

| Insure Purchase insurance policy with min. annual premium of S$5K |

0.6% p.a. |

| Mortgage Min. home loan of S$500K |

0.8% p.a. |

| Save Increase account balance by S$1.5K per month |

0.2% p.a. on incremental |

| Birthday Awarded in birthday month only |

0.1% p.a. |

| Base Interest Till 31 Dec 2023; 0.01% p.a. after |

0.3% p.a. |

| Total | Up to 2.8% p.a. |

| Bonus Interest Cap | S$50,000 |

Note the lack of a salary category, which is either low-hanging fruit or a major pain point depending on your mode of employment.

Straight off the bat, we can see that the interest rates aren’t anything to get excited about. The Citi Interest Booster is comprehensively outperformed by other alternatives on the market, both in terms of EIR and balance caps.

| 🏦 Singapore Hurdle Bank Accounts |

||

| Account | Max EIR* | Cap |

| OCBC 360 | 4.05% p.a. | S$100K |

| BOC SmartSaver | 3.0% p.a. | S$80K |

| DBS Multiplier | 3.0% p.a. | S$100K |

| Maybank Save Up | 3.0% p.a. | S$50K |

| Citi Interest Booster | <2.8% p.a. | S$50K |

| SC Bonus$aver | 2.38% p.a. | S$80K |

| UOB One | 2.15% p.a. | S$100K |

| CIMB FastSaver | 1.89% p.a. | S$75K |

| *When comparing accounts, be careful not to fall for marketing claims. For example, UOB One claims to offer “up to 3.6% p.a.”, but that’s only on balances from S$75-100K. Your first S$75K earns between 1.4-2.5% p.a., which brings down the EIR. |

||

You’ll notice I’ve put a “<“ sign under the EIR column for Citi Interest Booster. Even though Citi markets a rate of 2.8% p.a., it’s not actually possible to attain that for the entire year because:

- The Birthday interest of 0.1% p.a. is only awarded in the birthday month

- The Save interest of 0.2% p.a. only applies to the incremental balance in your account

I don’t have the mathematical prowess to calculate what that means for the EIR, but I’m pretty sure it means you won’t get 2.8% p.a.. You’ll be looking at something slightly above 2.5% p.a., assuming all the other categories are met.

Of course, it’s not sufficient to just compare headline figures. An EIR of 100% p.a. may be meaningless if the hurdles are insurmountable, and an EIR of 2% p.a. may be a sweet deal if it requires little to no effort.

With that in mind, let’s go through each of the hurdles, which Citi refers to as “missions”.

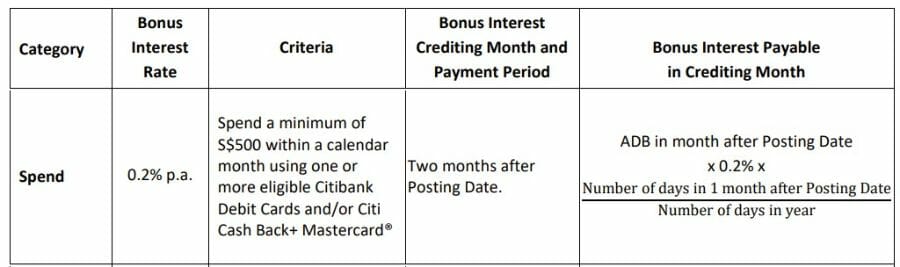

Spend: 0.2% p.a.

Customers who make a minimum spend of at least S$500 per calendar month on the Citi Cash Back+ Card or Citibank Debit Mastercard will earn a bonus 0.2% p.a..

The minimum spend does not include Citi’s usual rewards exclusions, such as education, government payments, prepaid top-ups, insurance premiums and charitable donations.

Unfortunately, spending on miles or points cards like the Citi PremierMiles Card or Citi Rewards Card will not qualify. That does seem to be the trend for most hurdle bank accounts these days.

| Account | Min. Spend | Eligible Cards |

| BOC SmartSaver | S$500 |

|

| CIMB FastSaver | S$300 |

|

| Citi Interest Booster | S$500 |

|

| DBS Multiplier | N/A |

|

| Maybank Save Up | S$500 |

|

| OCBC 360 | S$500 |

|

| SC Bonus$aver | S$500 |

|

| UOB One | S$500 |

|

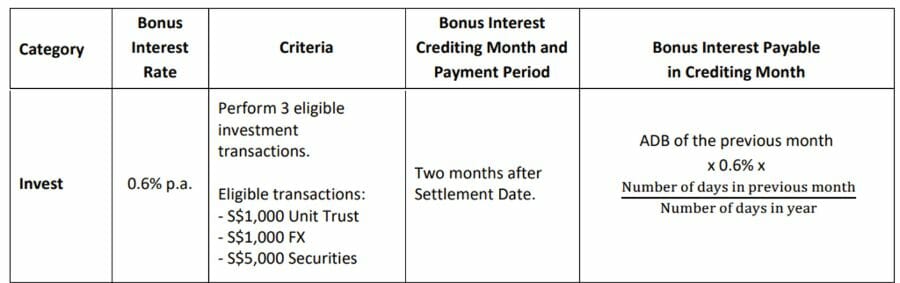

Invest: 0.6% p.a.

Customers who perform at least three qualifying investment transactions per calendar month will earn a bonus 0.6% p.a..

Qualifying transactions include:

- Min. S$1,000 unit trust purchase

- Excludes money market funds

- Excludes investments using CPF savings or SRS

- Min. S$1,000 forex conversion

- Includes currency conversions made between your own accounts (including joint accounts)

- Min. S$5,000 stocks purchase

- Buy orders for securities listed in the USA, Singapore and Hong Kong

Each of the above counts as one qualifying transaction, so you’d need to make 3x buy orders of at least S$5,000 worth of stocks, for example.

The invest category is normally the hardest to hit for a hurdle account, assuming you prefer to do your own investments and avoid the bank’s fee-laden products. But Citi, to its credit, has included forex conversion and stocks purchases as eligible categories. This makes it a relative outlier among banks; DBS Multiplier is the only other hurdle account to recognise equities transactions.

| Account | Eligible Products (Min. Invest) |

| BOC SmartSaver | N/A |

| CIMB FastSaver |

|

| Citi Interest Booster |

Must complete 3x activities |

| DBS Multiplier |

No minimum investment |

| Maybank Save Up |

|

| OCBC 360 |

|

| SC Bonus$aver |

|

| UOB One |

|

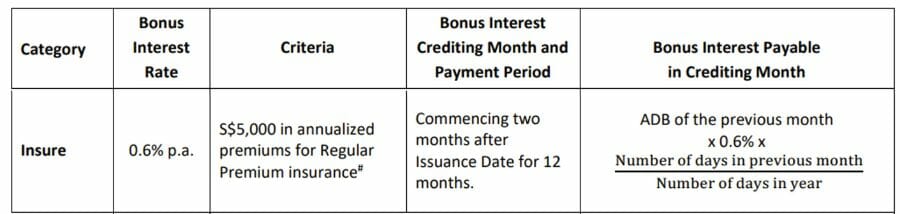

Insure: 0.6% p.a.

Customers who purchase a new regular premium insurance policy with a minimum annual premium of S$5,000 will earn a bonus of 0.6% p.a..

This excludes insurance policies purchased using CPF savings or SRS.

The bonus interest will apply for 12 months.

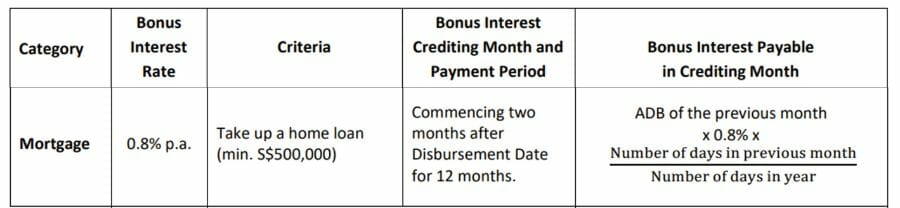

Mortgage: 0.8% p.a.

Customers who take up a minimum home loan of S$500,000 will earn a bonus of 0.8% p.a..

This excludes mortgage loans with interest offset features, and overdraft facilities.

The bonus interest will apply for 12 months.

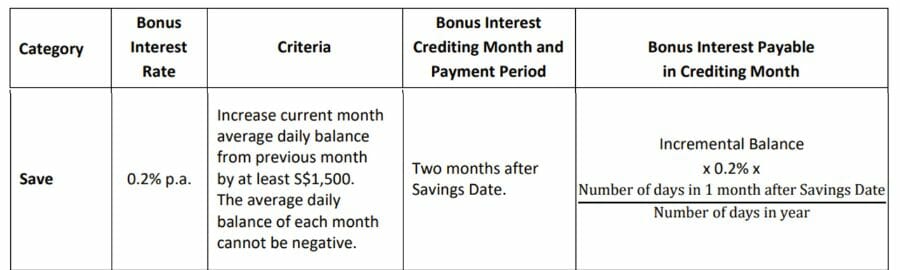

Save: 0.2% p.a.

Customers who increase their Citi Interest Booster account average daily balance by at least S$1,500 from the previous month will a bonus 0.2% p.a. on the incremental balance.

That’s worth repeating: unlike other hurdle accounts with a Save feature (e.g. OCBC 360) that award bonus interest on the entire balance, Citi awards bonus interest on the incremental balance only.

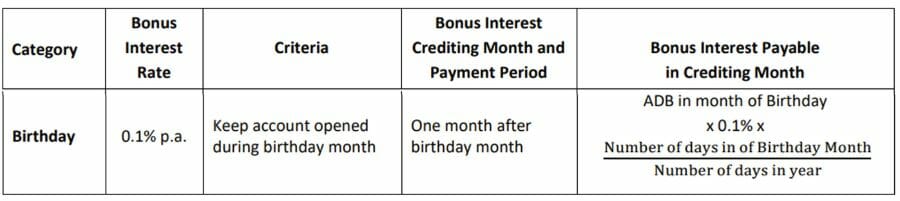

Birthday: 0.1% p.a.

Customers will earn a bonus 0.1% p.a. during their birthday month.

Joining bonus of S$686

| 🏦 Update: S$150 cash offer |

| SingSaver is offering an additional S$150 cash for every new account opened by 31 October 2022 and funded with at least S$15,000 for six months. You can apply via the link below to get this offer. T&Cs apply. |

| Apply Here |

To mark the launch of Citi Plus, Citibank is offering up to S$686 of welcome rewards for customers who do the following:

| Citi Plus Base Reward Criteria | ||

| Fund S$15K within 2 mo. from enrolment and maintain till the end of 6th mo. | S$130 | |

| Holds a valid primary/main card of an eligible Citi Credit Card within 2 mo. from enrolment | S$60 | |

| To qualify for Citi Cash Back+ Card Rewards | ||

| Apply for a Citi Cash Back+ Card as a new Citi cardholder and get 10% cashback on up to S$3K qualifying spend in the first 2 mo. | Up to S$300 cashback on Citi Cash Back+ Card |

|

| Earn 1.6% cashback and 0.4% bonus cashback on Citi Cash Back+ Card with min. S$500 spend per mo. for 12 mo. from enrolment (bonus cashback capped at S$2K spend mo.) | S$120 cashback on Citi Cash Back+ Card |

|

| To qualify for Citi Interest Booster Account “Spend” and “Birthday” Mission | ||

| Spend min. S$500/mo. on Citi Cash Back+ Card and/or Citi Plus Debit Mastercard for 12 mo. from enrolment, plus birthday bonus of 0.10% p.a. on S$15K in Citi Interest Booster Account | S$76 bonus interest | |

| Total Rewards | S$686 | |

Do note that the S$686 figure is somewhat inflated, because it includes the 1.6% base cashback for spending S$500 per month for 12 months on the Citi Cash Back+ Card (S$96), as well as the regular Spend and Birthday bonuses from the Citi Interest Booster Account (S$76).

The “true bonus” is therefore closer to S$514, and it becomes significantly less if you’re already an existing Citi cardholder and don’t want to use cashback cards (in which case the Citi Interest Booster account is probably not for you in the first place).

This group is looking at S$190 at best, which sounds like a decent amount of free cash until you consider the opportunity cost of parking S$15,000 for six months at a very low EIR.

The T&C of this offer can be found here.

My thoughts on the Citi Interest Booster Account

While the Citi Interest Booster gets a few things right, if your profile is anything like mine, you won’t find much joy here.

- I don’t invest or insure with Citibank, nor would I consider doing so (when I trade equities, I prefer brokers with no minimum commission; when I buy insurance, I buy term life plans)

- My spending on Citibank credit cards is limited to the Citi PremierMiles and Citi Rewards

- My home loan is with another bank

This makes the Citi Interest Booster a complete non-starter for me, since I’ll be earning 0.3% p.a. base interest, plus 0.2% p.a. on any incremental I put into the account and 0.1% p.a. during my birthday month.

As it stands, the structure of the Citi Interest Booster is heavily weighted towards insurance, investments and mortgages- somewhat unsurprising, because this is where banks earn the most margins.

Assuming we take an EIR of 2.5% p.a. for the Citi Interest Booster (in reality it’ll be slightly higher thanks to the Birthday and Save bonus), then the contribution from Invest, Insure and Mortgage is ~80% of the total.

| Account | % of EIR from Invest, Insure or Mortgage |

| Citi Interest Booster | 80% |

| SC Bonus$aver | 76% |

| Maybank Save Up | 68% |

| OCBC 360 | 54% |

| BOC SmartSaver | 50% |

| CIMB FastSaver | 14% |

| DBS Multiplier | N/A |

| UOB One | N/A |

That’s hands-down the highest among its peer group, and the upshot is that the Citi Interest Booster account is not for passive individuals who just want to save and spend, or those who do their investments and insurance off-platform.

So what bank account options does that leave the miles chaser?

If you’re a woman, your best option would be the UOB One account. By spending at least S$500 on the UOB Lady’s Card and crediting a salary of at least S$1,600 via GIRO, you would earn 2.14% p.a. on the first S$100,000 in the account.

If you’re a man, it’s much harder:

- You could earn up to 1.1% p.a. on the first S$25,000 in the DBS Multiplier by crediting your salary and spending on your DBS Altitude/DBS Woman’s World Card, but your combined salary + card spending would need to exceed S$30,000 to hit that rate

- You could earn up to 0.95% p.a. on the first S$50,000 in the Maybank SaveUp by crediting your salary (min. S$2,000) and spending at least S$500 on the Maybank Horizon Visa Signature, but its 3.2 mpd earn rate is bested by other 4 mpd cards out there

- You could earn up to 1.44% p.a. on the first S$80,000 in the BOC SmartSaver by crediting your salary (min. S$6,000) and spending at least S$1,500 on the BOC Elite Miles Card, but that card’s been nerfed to oblivion, and do you really want to put yourself through the pain of dealing with BOC?

Given the drawbacks of each method, I’d much rather just plonk my short-term liquidity needs in a cash management account.

- Endowus Cash Smart: 1.7-3.3% p.a.

- Stashaway Simple: 2.1% p.a.

- Stashaway Simple Plus: 3.6-4.1% p.a.

- Syfe Cash+: 1.9% p.a.

It’s important to note the above rates are projections only (i.e. not guaranteed), and the amounts are not principal protected. Still, considering their liquidity and lack of hoops to jump through, I find them a much simpler solution.

Conclusion

Citi’s new hurdle account wants to court the millennial crowd, but if you’re a miles chaser, there’s very little of interest here. Even if you’re in the cashback camp, you won’t get a lot out of the Citi Interest Booster with just the Spend, Save and Birthday categories.

This is an account that virtually mandates Invest, Insure or Mortgage if you want to earn anything close to a decent return, and for me, there’s just no compelling reason to get involved- unless maybe your home loan and investments are already with Citi.

What do you make of the Citi Interest Booster account?