The UOB One Account will be reducing its interest rates from May 2025, in line with “long-term interest rate environment expectations”. Account holders will see their maximum return on the first S$150,000 cut from the current 4% p.a. to 3.3% p.a..

However, as a carrot to the stick, UOB also announced a new promotion that offers a 6% rebate on income and property tax payments made via GIRO. While it’s capped at S$50 per month, it’s still an opportunity to save up to S$600 off your tax bill, and well worth considering.

Besides, it’s not an either/or situation. You can enjoy the best of both worlds by paying part of your tax bill via GIRO for the rebate, and part of it with CardUp or Citi PayAll etc. to earn miles.

UOB 6% rebate on income tax payments

From 1 April 2025 to 31 March 2026, customers who pay personal income tax or individual property tax via GIRO from a UOB One Account will earn a 6% rebate, subject to the following caps.

| MAB in UOB One | Monthly Cap (Equivalent tax bill based on 6% rebate) |

Total Cap |

| ≥S$30K and <S$75K | S$10 (S$167) |

S$120 |

| ≥S$75K and <S$150K | S$25 (S$417) |

S$300 |

| ≥S$150K | S$50 (S$833) |

S$600 |

| 🧒 Extra bonus for UOB CDA holders |

| If you have a UOB Child Development Account, your rebate is 6.5%, subject to the same caps show in the table above. |

To earn this rebate, customers will need to complete the following three steps:

- Register mobile number for PayNow on UOB TMRW

- Activate Money Lock on UOB TMRW (minimum S$1 lock amount)

- Apply for GIRO Monthly Tax Payment Plan through the IRAS portal, selecting a UOB One Account for deduction

No further actions are required if you’ve already performed the above three activities prior to 1 April 2025.

To illustrate, a customer who has a MAB of S$150,000 will receive a 6% rebate on each month’s GIRO deduction, capped at S$50 per month and S$600 for the entire promotion period.

Here’s the monthly GIRO amount that would trigger the cap for each MAB band:

- MAB of ≥S$30K and <S$75K: S$167 per month

- MAB of ≥S$75K and <S$150K: S$417 per month

- MAB of ≥S$150K: S$833 per month

When is the rebate credited?

Rebates will be credited by the end of the 2nd calendar month following the payment. For example, payments made in May 2025 will be rebated by 31 July 2025.

Terms and Conditions

The T&Cs of this promotion can be found here.

What if I want to earn miles on my taxes?

If you don’t care about miles, then it’s a simple matter of switching your IRAS GIRO arrangement to your UOB One Account, sitting back and watching the rebates come in each month.

But I’m guessing that most miles chasers see their taxes as an opportunity to buy additional miles through a bill payment facility like CardUp or Citi PayAll. The good news is that this is still possible, with a little more micromanagement (though nothing too onerous).

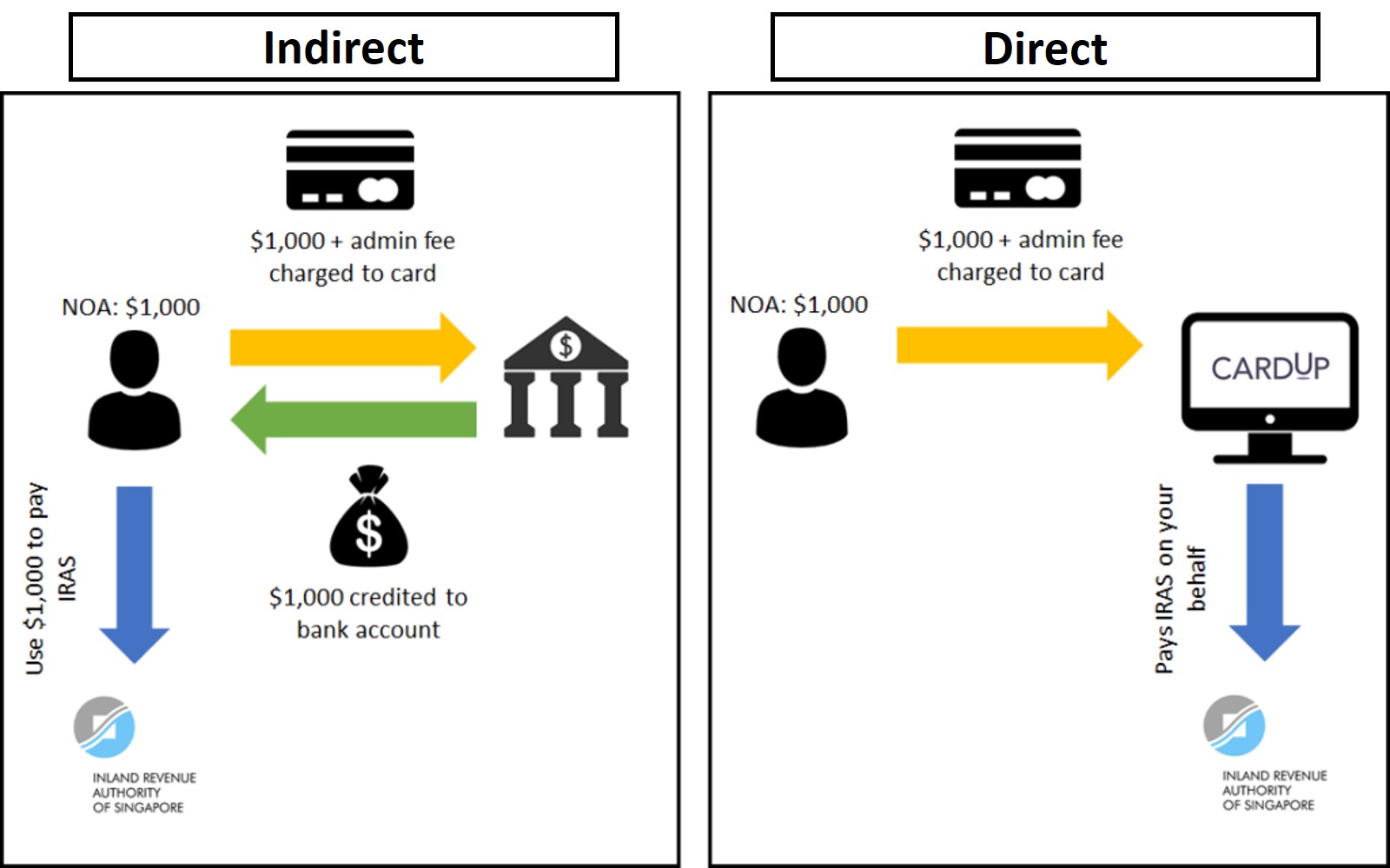

The first thing is to understand whether the payment facility you’re considering is indirect or direct.

| Indirect Payment Facilities | Direct Payment Facilities |

|

|

|

|

Both indirect and direct facilities work the same in the sense that your credit card is charged for the tax amount due plus an admin fee, earning miles in the process.

Where they differ is that:

- An indirect payment facility deposits the amount due into your designated bank account, in cash. You’re still responsible for paying IRAS

- A direct payment facility pays IRAS on your behalf

Indirect facility

If you’re using an indirect payment facility such as OCBC VOYAGE Payment Facility, StanChart Income Tax Payment Facility, or UOB Payment Facility, then there’s zero interaction with the UOB One 6% rebate promotion.

Indirect payment facilities do not make any payment to IRAS on your behalf, so your monthly GIRO deductions are unaffected.

Direct facility

If you’re using a direct payment facility such as CardUp, Citi PayAll or SC EasyBill, then it’s a little different.

Direct payment facilities make payment to IRAS on your behalf, which will affect the monthly GIRO deduction. But you’re perfectly at liberty to pay part of your taxes through a direct payment facility, and the rest through GIRO.

To illustrate, if your monthly income tax bill is S$2,000 per month, you could:

- Pay S$1,167 via CardUp each month

- Let the remaining S$833 be deducted from GIRO to earn a S$50 rebate (assuming your UOB One MAB is at least S$150K)

CardUp has ongoing promotions for one-off and recurring income tax payments, and you’re free to specify whatever amount you wish to pay each month, so long as you don’t overpay your tax bill.

It’s a similar concept for Citi PayAll or SC EasyBill— decide the split you want between miles and cashback, make manual payment for the miles portion through the direct payment facility, and let the balance be deducted via GIRO.

Now, here’s the crucial thing to remember. IRAS triggers GIRO deductions on the 6th of each month. To avoid a double deduction, I’d recommend making your manual payment at least two weeks in advance of this date.

For a detailed guide to earning credit card miles on your 2025 income taxes, refer to the post below.

2025 Edition: How to earn credit card miles on IRAS income tax

Conclusion

The UOB One Account is offering a 6% rebate on personal income tax and property tax payments made from now till 31 March 2026.

I would personally seek to max out this rebate before looking to earn miles on the remainder, as 6% beats the 1.2-1.6 mpd you can expect to earn on tax payments through bill payment facilities. The good news is that you can combine two forms of payment, so long as you don’t overpay your tax bill.

We changed the moment this was announced but the GIRO deduction still happen with the old account. So looks like you will get one month short if you are switching from other banks. You will get the full $600 only if your GIRO is already with UOB. Else for the switchers is $550.

Isn’t the first provisional giro deduction in May?

For 2025 starts in May. But UOB debate starts in April, so it is for the last payment of last year income tax.

That’s a good point that I missed! UOB.

if i just update the giro bank account from hsbc to uob, for may it is likely deduction will still be from hsbc. for the remaining 11 months, will the instalment amount be updated taking into account what has already been paid for may?

Can I GIRO pay my spouse’s tax income on my uob one account to earn 6% cashback?

curious about this too!

Is there a difference between signing up for GIRO on UOB TMRW app and IRAS portal ? Will both qualify for this rebate ?