So I have a confession to make. All this while I’ve given little to no coverage to one of the best cards to use for overseas spend.

I’m not quite sure how it slipped past me, but now that I know about it you can be sure it’s going into my starting lineup of cards

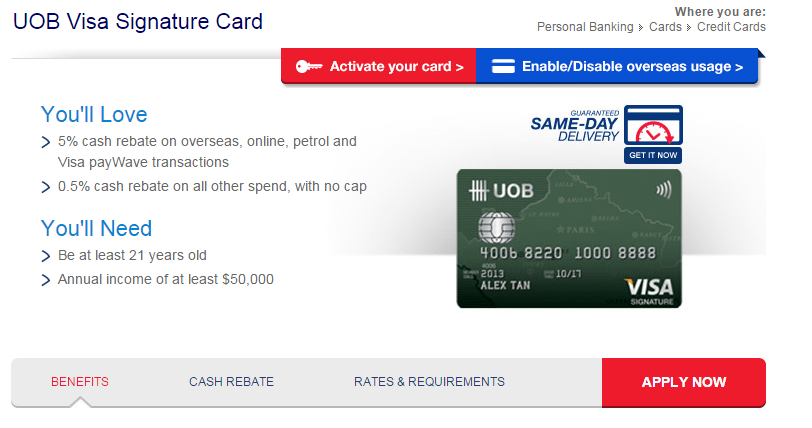

The UOB Visa Signature card has been around for a long, long time. It promises 4 miles per $1 of overseas spend, paywave, petrol or online spend, capped at the first $2,000 per month.

EDIT: There is a $1K minimum FOREX spend required per month to enjoy this bonus. Thanks to C on the comments

EDIT EDIT: The required spend is per statement period, not month. For me this is 15th to the 15th. This is quite an important distinction so do take note

In practice though, you’ll find yourself using this more for overseas spend than anything else, especially if you already have the DBS Woman’s Card to handle your online spending. Note also that UOB tends to be a lot stricter than DBS in their interpretation of what counts as “online” spend, so DBS Woman’s World card is my first choice for all things online.

As for paywave, transactions, note that you will not get UNI$ at merchants who give out UOB SMART$, eg Coldstorage, even if you pay through paywave. Here’s the list of paywave merchants, but you’ll need to cross reference it against this list of SMART$ merchants to figure out who you won’t be earning 4 miles from. It’s because of this complication that I don’t really bother to use the paywave feature.

Assuming you travel a lot for business, this is an easy 8,000 miles per month. Remember that UOB pools your UNI$ together, so you can combine this with your UOB PRVI Miles card and your UOB Preferred Platinum AMEX card.

The card actually offers the option to cash out your UNI$ as a rebate which gives an equivalent 5% rebate for foreign spend. Needless to say, this is a waste of your UNI$ because miles would be so much more valuable in this situation.

This really affects your overseas spending strategy more than anything. What I’d be doing is the following

First choice: UOB Visa Signature Card ($1=4 miles, first $2,000)

Second choice: DBS Altitude AMEX ($1=3 miles, assuming you’re within the first 6 months of getting the card)

Third choice: UOB PRVI Miles ($1=2.4 miles)

Note that I’m talking about on the ground overseas spend here, ie physically passing your card to someone to swipe. If you’re making online bookings from Singapore in foreign currency, eg flights and hotels, the dynamic changes. You’d want to maximise the 4.5 miles per $1 on your DBS Altitude AMEX or the 4 miles per $1 on your DBS Woman’s World Card.

I’ll update the Milelion credit card flowchart to reflect this as soon as I can.

There’s a min spending of SGD1,000 per month though

Yes, I should have mentioned that. Have updated it

That’s right. Need min 1k spend but it’s nonetheless very useful card if the spending pattern can fit. Need to be aware on the posting date to clock the requirement.

Hi Aaron, Thanks for all the useful tips on the blog! I understand that the UOB Visa Signature gives 4 miles per $1 for overseas, online, petrol and Paywave transactions. While I understand that there are restrictive definitions on what constitutes qualifying online transactions, I don’t believe there are any restrictions on foreign currency transactions. Therefore, for e.g. if I buy air tickets from BA website and paid in GBP, it will not count as an online transaction but it will still qualify as an overseas transactions and I will still end up getting 4 miles per $1. Am I… Read more »

yes, you’re right about that. the only thing i’d urge caution about in your situation is the location of the payment processor. Are you buying from BA’s singapore website and getting pricing in GBP because you’re buying a one way, say from LHR to somewhere else? (My understanding is that BA.com would normally quote in SGD for its SG site). If you are buying through the Singapore website, notwithstanding the fact that it is pricing in GBP it may be processing through a payment processor in Singapore in which case you would not get 4 miles per $1. If you… Read more »

Thanks for the tip! It didn’t occur to me to consider the location of the payment processor as a factor. I guess in that case I will stick to DBS Woman’s WMC if $2k.

I just got this card and was reading the TNCs before heading overseas and noticed something to look out for. The $1K min spend is not per month, but per statement period, which would have caught me out.

“Cardmembers will earn UNI$10 for every S$5 spent on transactions in foreign currencies, including online transactions in foreign currencies, which is equivalent to 5% cash rebate, subject to a minimum foreign currencies spend of S$1,000 per statement period.”

http://www.uob.com.sg/personal/cards/credit/uob_visa_signature_card.html

yeah, that does trip up a lot of people. everyone’s statement period is the same right? for me it is 15th to 15th.

edit: just realised i’ve been saying “per month” in the article. good catch. have updated.

Hey Aaron… Now I am confused. So for uob visa signature it goes by statement month? Supposed statement date is 15th. Then the $1k spend must be clocked between the 15th day of two consecutive month? However for the DBS woman card which is by calendar month it does not matter? So if my statement date is 15th, then i spend $2k on 31 March and then $2k again on 1 April, even though both are in the same statement month, I still get 10times DBS points for both?

the statement month/calendar month confusion is understandable.

the statement month quirk is unique to UOB. for uob visa signature, your $1k must be clocked between the 15th of month x and the 14th of month x+1

for DBS it is calendar month. so your statement date is irrelevant. just spend $2k per calendar month.

Hi Aaron, your content is spectacular. Thank you so much for the information provided. Scenario: This card stays in my drawer and has $0 charged since day 1. Today I will take a trip to New York where I will proceed to charge USD$750 (equivalent to S$1,000) on a 1 night stay in a hotel. I will fly home the next day and put the card back into the drawer. Q: Will I get 4000 miles? ie. 4 miles for S$1? I want to use this as a dedicated holiday card, and it is easy to chalk up S$1,000 on… Read more »

hello hairy, thanks for the kind words. your analysis is correct. if you for whatever reason take 2 holidays in quick succession you should remember the statement period vs monthly distinction.

Great! It’ll be an awesome holiday card then with the UOB PP Amex for dining and Citi Rewards for shopping. Thanks!

The terms say ” minimum foreign currencies spend of S$1,000 per statement period”. So, if I make S$600 in foreign currency and S$400 in local SGD spend, will I be eligble for 10X or no? My guess from the terms, No. But reading above, it seems Yes.

you need to spend min $1k in forex currency, so no.

have edited to make it more clear

Also, just want to add more details with regards to the card. Even if you meet the min overseas spend of $1k, subsequent local spend on paywave and petrol will not qualify for 10 times points if local spend is not >$1k. So better to use this card strictly for overseas spend.

Hey Aaron,

Do you know if UNI$ will be credited to your account in the same month? or it will be retroactively credited in future?

I made 2k of overseas spend between 12-Nov to 11-Dec (my statement period is the 12th), but I received a paltry 680 uni dollars when I checked my statement today (this includes $300 dollars spend on my PRVI miles card)

Thanks!

Hi Aaron,

A quick question on purchasing items online. Be it air tickets/hotels/agoda etc. Usually, assuming that the payment processor is in sg, the website will detect our IP to be from sg, and thus route payments to their sg processor.

Assuming I’m using a VPN, and thus changing my location to say London. Would I then be eligible for such overseas spend bonuses because my payment processor would definitely be from London.

Or would it be determined by “all countries, except the one that the card was issued”?

Just wondering

Thanks!

Here’s my (untested) thoughts. It comes down to which site you buy from. If you buy from Expedia SG site, your payment is likely to be processed in SG. If you buy from the Expedia UK site, however, it may be processed outside of SG.

Hey Aaron,

I’m gonna have to stay anonymous because it’s regarding a diamond ring that I’m intending to purchase from briangavin.com.

I am intending to pay for my ring in installments of the USD equivalent of 2000 SGD.

Because the merchant has agreed to break down my payment amount across several installments, i’m not sure if the transaction would be considered as “online spend”.

However, i’m pretty sure that the transaction will be in foreign (USD) currency.

IN this case, would you be able to advice if i’ll be eligible for 10x points / 4 mpd?

So there are two possibilities here- the first is that the merchant is taking down your card details, then each month will swipe 2k sgd offline wherever they are based. The second is that they will process online a transaction of 2k sgd each month. Either way seems OK in theory- both overseas physical transactions and online transactions in fcy which are not processed in sg will get 10x. But I’m always very paranoid about these things not working out. I’d try one month and monitor the points obsessively to see if the 10x posts properly. Remember that uob visa… Read more »

Just to give an update:

Just paid my first installment of USD 1400 (approx. SGD 2000) via paypal. Called UOB CSO and she confirmed that my transaction is eligible for 10X Uni$. Though i saw elsewhere on Milelion (https://milelion.com/2015/10/24/when-is-overseas-spend-not-overseas/) that paypal FCY is processed in Singapore.

Will give an update if the 10X Uni$ actually gets credited to my account 🙂

Edit:

Just to give an update:

Just paid my first installment of USD 1400 (approx. SGD 2000) via paypal. Called UOB CSO and she confirmed that my transaction is eligible for 10X Uni$. Though i saw elsewhere on Milelion (https://milelion.com/2015/10/24/when-is-overseas-spend-not-overseas/) that UOB does not award FCY spend when transaction is done through paypal..

Will give an update if the 10X Uni$ actually gets credited to my account ?

if every installment transaction on the card is US$2,000, then yes the VISA Signature will earn you that 10x. but do note that the spending is capped at S$2,000 per month (US$2k is about S$2.8k thereabouts) so you have some waste there.

Hey ratatouille, it’s gonn a be a USD 1400 transaction monthly, which equates to about SGD 2000

Hi milelion,

can i check with you if spend 1000 or more on paywave every month, it makes sense to use this card over the PPV?

Hi lalaisgone

I am also thinking in the same direction as you

Currently I am using this card for my petrol payment at SPC and the usual paywave payment

So you do get 4mpd if your paywave >1k?

And keeping the PPV for online spend!

yup, although remember it’s statement cycle not calendar month. but i guess this also depends whether or not you travel overseas often because if you do it’s a better idea to put forex spend for your 4 mpd

Does anyone know if the UOB VS’s 4mpd for Paywave transactions also apply to Apply Pay/Android Pay? the UOB PPV explicitly mentions contactless transactions (i.e. paywave & apple pay, etc.) does apple pay also process as a ‘paywave’ transaction or something else. by the way, the description of the bonus should be clearer. the $1k min forex spend is only applicable for foreign spend while $1k min local spend will also get u the bonus locally. it’s mentioned in the comments but not the article. just felt it should be clearer. i feel that it’s a bit neglected in this… Read more »

My take is: UOB PPV is the go to card for any contact-less payment for merchants giving UNI$. Its advantage is that there is no minimum spending required but capped at $2,000. UOB VS needs a minimum spend of $1,000 for 10X rewards. But there is one thing to note. If you accumulated a total of SG$1,500 for that statement period of which, $1,000 in local SG spending, and SG$500 from overseas spend (after FX conversion), only the SG$1,000 will earn 10X. The SG$500 for overseas spend will not, because the overseas spend is less than $1,000 of minimum spend.… Read more »

Exactly the response I have received from their CSO moments ago. You have to spend S$1000 overseas and S$1000 locally to enjoy the max 10X UNI$ from both sides.

I been looking for a miles card to replace my cashback credit card for petrol.

Doesn’t seemed to have a lot of choices for Shell petrol, as this card will issue SMART$ instead of UNI$.

Anyone else have any alternative for Petrol Miles credit card?

SPC petrol is causing a lot of vibration to my car engine, maybe not used to it.

So on my Visa Signature, let’s say I spent

a) $2000k overseas

b) $3000k locally with PayWave;

is there a cap on the 10x miles?

Does paying in USD for goods off Amazon USA get paid out at 4mpd?

yes.

If I don’t use this card for overseas spend, I can still get 10x for petrol and contactless as long as I hit $1k minimum spend per statement cycle?

Is there a cap?

Dumb question, but how do you tell what is your statement period?

call them and ask.

I know that the insurance premium won’t be count.

But if it is insurance payment for well-known insurance companies in other countries.

I actually bought it from my home country. This premium will be in FX.

Can we use this card to pay oversea insurance premium in order to enjoy 4 mpd?

not about transaction currency. about MCC. if the MCC is insurance, it won’t count.

Hi Aaron, I hope you can help me.. now that my Citi 8 mpd boat has sailed, I’ve got to sort out for my what-card-to-use-for-what-and-how.. I did try finding out for myself, so I’m not just ‘looking for a handout’ and yes I could call the bank, but we also know that what CSOs tell us, may not necessarily be accurate. So, if you do know for sure, or know how to find out for sure, I’d be grateful.. and if not, not sweat, I guess I’ll just have to try w the bank… ???? I read.. and reread this..… Read more »

You are reading the wrong T&Cs. Always search for the T&Cs link directly from the card page itself. This is the latest T&C.

https://www.uob.com.sg/web-resources/personal/pdf/personal/cards/credit-cards/travel-cards/uob-visa-signature-card/terms-and-conditions-governing-uob-visa-signature-card.pdf

That renders your $100 issue moot.

Thanks Ben.. and now, even more so, I’m glad I declared upfront that I’m a retard.. that gives me a licence to spill.. like a trainee waiter.. ?

Again.. many thanks.. still so much to learn.. no wonder I’m getting more headaches than ever before.. ??

The learning journey continues… and likely won’t end… So today I found out after reading again, UOB’s Ts & Cs, and apparently confirmed by agent at UOB, with regards to the following point.. “.. Contactless Transactions Cardmembers will earn UNI$10 for every S$5 spent on Contactless Transactions successfully carried out on and charged to the Card. “Contactless Transactions” refers collectively to: (i) Card Transactions that are performed using the Card via Visa payWave; and (ii) Card Transactions made via Apple Pay, Samsung Pay, Android Pay and UOB Mighty (or such other mobile payment services as UOB may from time to… Read more »

I’ve seen this ‘bit’ float around in different posts and seen different answers about it.. because I’ve spent the past couple of weeks doing my own ‘credit card housekeeping’ and hence definitely the reason my my name pops up so often and so much.. I’ve basically ‘gone back to school’ and maybe this has been already covered before and I’m just repeating something that’s already be sorted a long time ago, and if so, sorry.. but I did/do think it’s a very important small bit of a technicality.. so much so that (never bothered in the past and for sure… Read more »

i think you meant to say 15th to the 14th