KrisFlyer miles expire after 3 years unless you’re a PPS Club member, in which case they don’t expire.

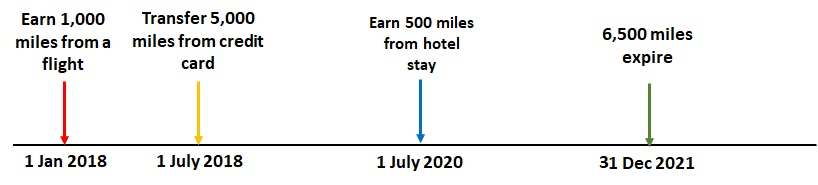

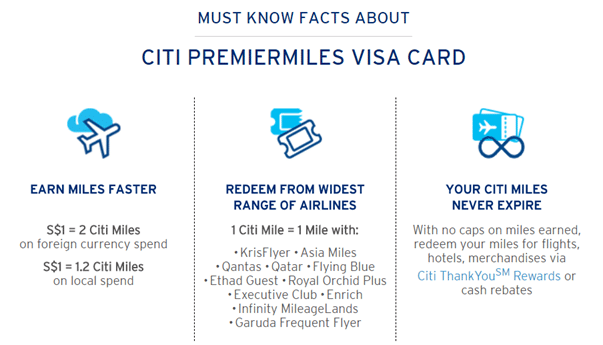

Although I’m not part of the PPS Club, I’ve personally never had a problem with expiring miles. That’s because I’m of the belief that you shouldn’t be holding on to miles for so long that expiry becomes an issue. What’s more, your real window is longer than 3 years, because you get the benefit of a few additional years (2 years for the UOB PRVI, no expiry for the DBS Altitude and Citibank Premiermiles) so long as your points reside on the bank’s side.

That said, I realise the 3 year policy can be an issue for people in certain circumstances, especially those saving up for an aspirational award who earn miles a slower rate under an auto-crediting arrangement. Moreover, I still think that KrisFlyer’s current mileage expiry policies don’t make sense, and here’s why.

What type of expiry policies are out there?

First, let’s lay out the three type of mileage expiry policies that FFPs can adopt:

(1) Time-based expiry

Under this system, miles expire after a pre-specified period of time following which they were earned, regardless of activity.

This is the policy that KrisFlyer currently adopts for basic, Elite Silver and Elite Gold members. Miles are valid for 3 years, and basic members can pay 1,200 miles or US$12 per 10,000 mile block to extend their validity for 6 months; Elite Silver and Gold members can pay the same fee for an additional 12 months.

(2) Activity-based expiry

Under this system, miles do not expire so long as the member has some sort of activity in their account at least once during a specified time period.

For example, miles in United MileagePlus remain valid so long as you have an earning or redemption activity at least once during an 18 month period. Any sort of activity resets the 18 month clock.

(3) No expiry

Under this system, miles do not expire, period. These policies are understandably uncommon, although Delta actively markets this as a key advantage of their SkyMiles program (who needs award charts, amirite?).

This is the policy that KrisFlyer adopts for PPS Club members. Ever since the changes made to the PPS Club back in May 2017, KrisFlyer miles do not expire for PPS Club members so long as they remain part of the PPS Club.

What’s wrong with a time-based expiry policy?

Airlines like time-based expiry policies because it enables them to reliably estimate their “breakage rate”, or the number of miles that expire without being redeemed. This all-important number affects the fair value of miles on the liability section of the balance sheet, and therefore other investor-relevant metrics like working capital.

The breakage rate also affects the rate at which airlines can recognise revenue arising from the sale of miles, a complex issue I won’t go into detail in this post (but am tempted to do in another). All things equal, a shorter expiry period increases the likelihood of breakage, reducing the fair value of the outstanding miles.

However, time-based policies aren’t great for numerous reasons. First of all, they penalize members who are saving up for an aspirational award. As David Feldman puts it in this excellent article:

And if they are dutifully earning miles throughout this period (for which your program is receiving revenue) — why on earth would you kick those members in the guts right when they are generating revenue for you?

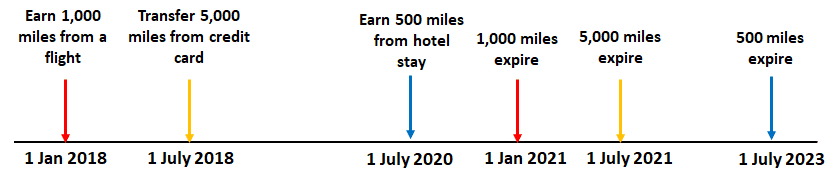

Second, time-based policies are confusing for consumers. Consider this scenario:

(1) I have 50,000 KrisFlyer miles that expire on 1 March 2018

(2) On 1 Jan 2018, I spend these 50,000 KrisFlyer miles to redeem an award ticket that departs on 1 October 2018

(3) On 1 May 2018 I decide I can’t travel and cancel my ticket. The customer service rep tells me I won’t get any miles back because they expired on 1 March 2018

From the customer’s point of view, this isn’t immediately intuitive. “What do you mean my miles expired? My ticket is still valid…” And yet the rep is technically correct. In one sense, your miles expire on a fixed date, but in another, you’re allowed to redeem those miles for a ticket that flies after the expiry date.

Third, time-based expiry policies penalize customers holding an airline cobrand card, which is kind of insane if you think about it. Someone with a KrisFlyer Ascend, for example, is earning miles that get directly credited into his or her KrisFlyer account. The 3 year timer starts ticking with every batch that get credited.

Contrast this with someone who earns points that don’t expire with a 3rd party credit card. This individual can choose when he or she wants the three year timer to start. If the cobrand cardholder is more valuable to the airline than the 3rd party cardholder, why is this individual on the losing end when it comes to expiry?

Fourth, breakage isn’t necessarily a good thing for airlines. If an airline is seeing high breakage rates on its miles, it means people are not getting the opportunity to spend them. In the short term, an airline may recognise more revenue from higher breakage, but over the medium to long term consumers will lose interest in acquiring such miles, meaning partner programs will buy fewer and ultimately the airline loses.

At the same time, however, I don’t think a no-expiry policy makes sense from the airline’s point of view. Remember that unredeemed miles hang around on the balance sheet as a liability and a drag on the overall financial position. Some of them may never get redeemed, even with a no-expiry policy, but that’s going to be a relatively small amount.

So if a time-based expiry policy doesn’t make sense for consumers (and arguably the airline), and a no expiry policy doesn’t make sense for the airline, what should KrisFlyer be doing?

What about an activity-based expiry system?

The problem with time-based and no-expiry policies is that they do not encourage the key metric of customer loyalty- engagement.

Think about it: the reason you have a loyalty program is to build touchpoints with your customers. I want to continually build out ways of interacting with them beyond just the airplane cabin. I want them to think about my airline when they go to the supermarket, or pump petrol, or book a hotel, or dine in a restaurant.

Activity-based expiry policies encourage just that. If KrisFlyer had an activity-based expiry system, I’d be more inclined to:

- Get and use a cobrand KrisFlyer AMEX, since the instant crediting effectively means my miles never expire so long as I use the card regularly

- Convert my Chope Dollars/Grab Points/Tap for More points/ other 3rd party loyalty program to KrisFlyer miles

- Dine more often with Mileslife and credit to KrisFlyer

- Use KrisFlyer Spree

- Credit miles from a Star Alliance partner to KrisFlyer

- Include my KrisFlyer number when booking a hotel reservation or rental car

All of these activities generate incremental revenue for KrisFlyer, insofar as they create more demand for miles.

More importantly, an activity-based expiry policy has the ability to engage the so-called marginal members. Time-based expiry policies actually aren’t an issue for the vast majority of us in the miles and points game, because we know how to manage our miles carefully. We’ll hold them on the bank side until we need to transfer, we’ll make plans to regularly burn whatever balances are in our Krisflyer account, and we generally won’t be in a situation where we have to accept inferior value (such as redeeming them on Krisshop) for our miles due to imminent expiry.

But we’re not the people that Krisflyer needs to build bridges with. Think about the marginal members on the fringes of the program. The occasional traveler with the odd flight here and there on Singapore Airlines. The guy who used a cobrand card for a while before switching to cashback. The lady who got a couple thousand free miles for signing up for a magazine subscription. Miles tend to be an afterthought to customers with this profile, and they each may have a small balance that ends up expiring or cashed out at a poor value.

“Isn’t that good for the airline?” you ask. No, it’s not. In the short term perhaps, but the airline is missing out on the opportunity to bring these members into the fold. Suppose the lady with a couple thousand of expiring miles knew that she could extend them by simply signing up for a cobrand card, or giving her membership number when booking a rental car. I imagine she’d be inclined to do that. It’s the theory of loss aversion put into practice- if there is a simple way she can extend the expiry of her miles by another 18 months or so, why not?

Activity-based expiry policies make it more likely that these marginal members can make it to their very first award ticket. And that’s the key threshold that Krisflyer needs to get them to, because research has shown that that successfully attaining a reward increases customer loyalty and subsequent engagement. That’s just basic motivational theory- when customers realise “hey, this free ticket thing really works”, they’re more inclined to try harder in the future. Anecdotally, I’ve heard from quite a few people that the moment they were truly won over by miles and points was when they first sat down in 1A and received a glass of pre-departure champagne.

What’s the tradeoff?

If Krisflyer moved to an activity-based expiry system, the expiry period would certainly be shorter than 3 years. That’s a tradeoff I’m willing to accept, so long as the period is something reasonable like at least one activity every 18 months. That’s because the abundant ways of earning Krisflyer miles for those of us in Singapore means it’s easy to say active.

The equation would of course be different for you if you were a Krisflyer member in a country that didn’t have a lot of earning opportunities. But even then, it might encourage these members to do things like use Krisflyer Spree more often, or actively seek out channels that partner with Krisflyer like Kaligo or Rocketmiles to book hotels. That sort of behaviour is also good for Singapore Airlines.

Conclusion

Moving to an activity-based expiry policy would encourage Krisflyer members to stay active. It would also have the effect of drawing in marginal members. I can’t think of any real downside for those of us who carefully manage our miles and points, and in fact it might even be better for road warriors who earn big but don’t have the time to burn.

Or to put it another way- an activity-based expiry policy effectively means an active member’s miles never expire. Given the low threshold for “active”, this should benefit the vast majority of users.

What do you think? Does the 3 year expiry policy work well for you or would you prefer an activity based system?

Any solution to a child’s KF miles? I can’t redeem them as the system doesn’t allow me to book a flight as the child is below 12 yrs old.

ah, family pooling is a feature i wish KF would add too.here’s the relevant text- you can book if you’re traveling together with the child. the thing is your child would be redeeming miles for you as his/her redemption nominee, which is a bit messed up. A KrisFlyer or PPS Club member who is 12 years old or below cannot redeem his/her KrisFlyer miles for award tickets online, unless a redemption nominee who is 18 years old or above is travelling with him/her on the same flight. A KrisFlyer or PPS Club member who is between 12 and 17 years… Read more »

Activity based is good unless they treat redeeming flight as minimum qualifying activity

If I had a thousand thumbs I’d give this article a thousand thumbs up. KF’s expiry policy is one of the reasons I didn’t move to them, and away from United Mileage Plus, when I first moved to Singapore. I didn’t necessarily think my own miles would expire — I make pretty good use of them — but to me it said a lot about how the whole program is run, and I decided I’d be better off staying with MP. As a result, I feel no loyalty to SQ and will just as happily look to another Star Alliance… Read more »

activity-based would be great, but at this point i’ll just be grateful if they don’t follow delta and scrap the FF program altogether

This is precisely the reason why I never registered nor bothered with krysflyer. Choosing to invest in alaska and asia miles instead. So what if there are more options cos they end up expiring anyway especially in the context of constant threat of program devaluations etc.

The irony when asia miles also have a 3yr expiry…

err, Asiamiles point expiry shifts with account activity. Did you even read the article?!

This is extremely useful after finding a way to transfer a few hundred points to Asiamiles without any transfer charges. Also remember there are instances of credit card cancellation decisions and the points have to be converted.

What is a suitable arrangement for you (the fixed 3 yr clock) does not mean it fits everyone else’s.

asiamiles points expire after 3 years, regardless of activity

Even so, I prefer Asia Miles which I also maintain. Despite the grumbles about CX, they are more efficient than SQ and pretty well run. At least I don’t get the feeling I’m something the cat dragged in!

I don’t think the 3yr clock is a big deal. Those who know how to avoid dumping huge points in kf will do so anyway by warehousing on the banks side. Kf has a very wide range of credit card transfer partners across many countries that makes it easier to accumulate even if outside of singapore. When I was younger (without a credit card), and not in Singapore, 3 years gives more time to use the miles than an 18mth activity period since it wasn’t easy to credit miles to kf. And as you mentioned, putting an end date on… Read more »

i’m pretty sure you’re mistaken about KF qualification. i got KF elite gold first time with 50k miles instead of 75k

Oh that’s interesting. A few years ago a family member grumbled about having the elite miles reset to nil after achieving silver. After that I decided to chase status elsewhere (had partner *G for a few years but lost it now); family member persisted for a bit but saw the status light with another program

@Phill – Agree that the lounge hierarchy at Changi is pointless and petty. But having recently made gold, I can say there is quite a perceptible difference between gold and non-gold. Of course I am not so naive to think that sq would ever prioritise me for an upgrade. But there are other *a airlines….

@Aaron – 10,000 likes for this post. Was wondering if you managed to convey any of these points across during your recent sq hobnobbing evening?

@Chocolat I just found the lounge to be the biggest sign of sq’s disregard for golds The most silly thing I saw sq do to gold was to push them out of the business boarding line and into the economy line. In sq terms, gold priority boarding now means being called for boarding before other economy pax. But part of the reason a priority line was important for gold is to allow them to kick back in the lounge for that extra 10-15min and not have to deal with a snaking boarding line, esp for full A380s. Stupid change that… Read more »

Last flew sq a380 in jan and that was not my experience. Next sq a380 will be july so will keep a look out! Anyway the simplest way to avoid the queue is to be the last person to board the plane. (Within the allowed time of course) That is my usual strategy. No queue!

Yeah, I ignore the boarding line thing. Never been turned away from the Premium line with my B&W economy boarding pass and KF Gold.

I’ve flown quite a bit with EVA and have been upgraded PremY->J around 10% of the time with KF Gold.

0% from a much larger sample with SQ. I’m just happy if they give me a bulkhead seat…

Sorry realised there’s a Phil, changed my name @chocolat, been a couple years since I lost *G, but see Phil’s comments that most of them turn up in the biz lane regardless @Phil, I figured out after my first couple sq flight as a *G that all the golds just turned up at the business line anyway. My first sq flight as *G I followed the signs, it must’ve been just after they changed it but I was not pleased in the long Econ line. I just came back from the US, and sq made UA’s boarding process look world… Read more »

Oh UA’s is super convoluted!

I think there is room for a few Phils 🙂

I believe that the ‘uniquely Singapore mindset’ is part of corporate Singapore’s DNA. I have a sizeable amount of miles and redeemed them to go to HK on a two-to-go promo. Despite selecting our seats (aisles), my companion got her aisle seat (she has some status K-something Gold) and I got a middle seat with the bulkhead at my back and it was not a full flight. Returning on Tuesday it was the same story; this time I took a screenshot of the seat allocation. Sure enough when we checked in we got different seats! SQ disregards those with miles… Read more »

Sq doesn’t usually care about how many miles you have. To be fair most airlines are like this.

Sq kind of sometimes cares about how many elite miles you have. They really care how much PPS$ or whatever it’s called you have.

Quick question – how much miles do you all keep in your KF account at any point of time? Assume I have 200K miles with Citibank, should I transfer these miles to KF account to “park” there in case I would like to make redemptions?

I have over 200k in KF but I’m building towards 2 long haul redemptions.

In general keep them in your bank until you need them for maximum protection against devaluations.

It also gives you flexibility to redeem on other great carriers like EVA or Cathay.

Once transferred to Krisflyer, the krisflyer miles will expires in 3 years. The transfer usually just take a few days.

Aaron, can you have a whack at DBS and their 1 year expiry for points on most of their cards?

well, dbs points earned on the altitude don’t expire. the main issue for those of us chasing miles is the 1 year expiry with the dbs wwmc.

Still, 1 year expiry is generally very unreasonable. Means I need to pay a $25 annual fee to flip the miles over. Plus GST too right? The plus GST part is extra ludicrous.

I fully agree, that’s why, as a person based in Malaysia, my FFP is BAEC, because they don’t expire as long as you had some sort of activity within the past 36 months, which is really easy to achieve, either from credit card transfers, hotel partners, or alliance members.

[…] Other frequent flyer programs adopt activity-based expiry policies, where points can be extended indefinitely so long as you’ve got some accrual or redemption activity in your account within a particular period (check out my argument for why KrisFlyer should also switch to such a system here). […]