It’s fairly easy to find out how many miles you need for a particular redemption ticket- just refer to the award chart. Taxes and surcharges, however, are a bit trickier to price.

You could do a dummy award booking to see the taxes and surcharges, but the KrisFlyer website is buggy, error prone and above all, slow.

Besides, there will be times when you may want to book a partner award or a routing that the KrisFlyer website can’t support (e.g. mixed cabin, or using the stopover trick).

What do you do in those cases?

Using ITA Matrix to break down taxes and surcharges

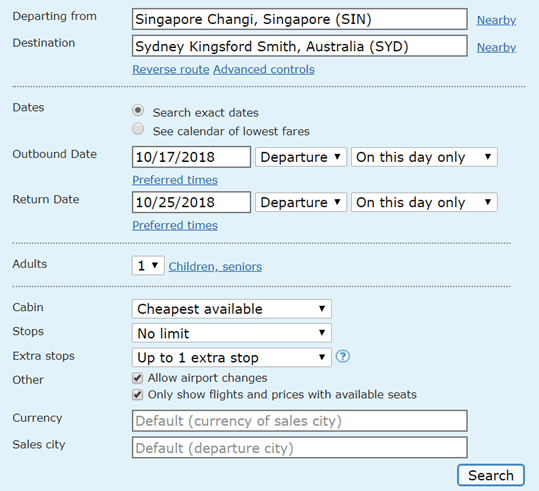

The ITA Matrix was not built with award searching in mind, but it’s still a travel hacker’s best friend as it allows you to check the applicable taxes and surcharges that will be levied on an award ticket.

The ITA Matrix is incredibly simple to use (plus, the page loads really, really fast). On the home screen, enter your departure and arrival destination and dates, just as you would on any OTA

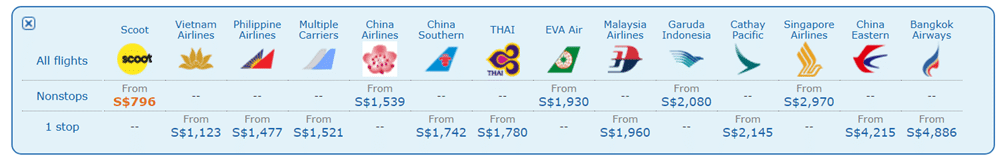

On the next screen, you’ll be shown a list of airlines to choose from. In this case we’re looking at the taxes on a Singapore airlines award ticket, so click on that.

That will cause the display below to filter out only Singapore Airlines operated flights.

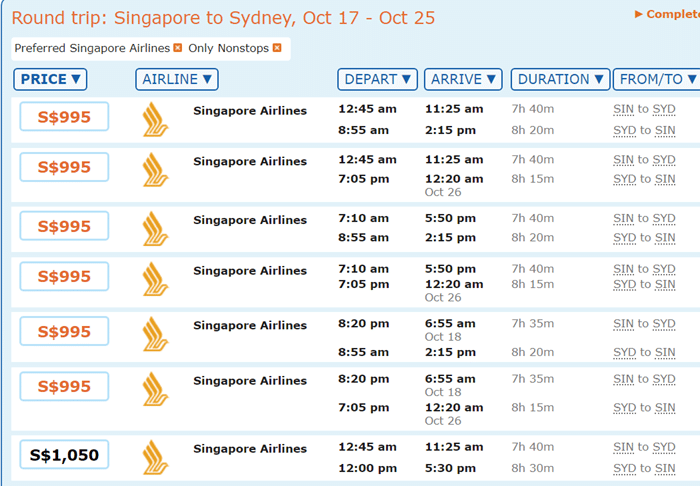

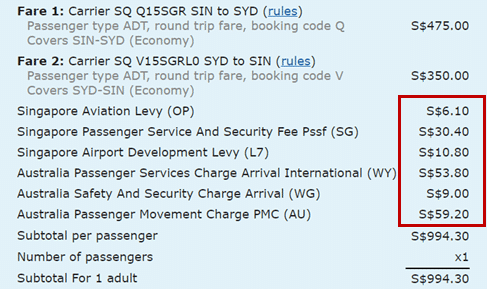

Click on the S$995 button, and you’ll be brought to the final screen where the cost is broken down. Everything that isn’t “Fare” is a tax or surcharge.

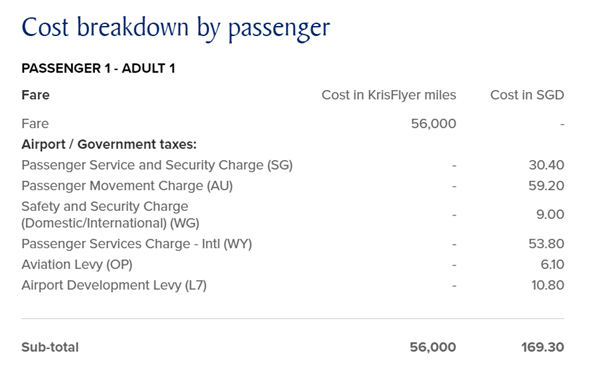

The figures in the red box add up to S$169.30, which exactly matches the the SQ site for a similar round trip economy award booking to SYD.

The ITA Matrix is equally useful for checking the surcharges on partner award tickets. As you know, Singapore Airlines no longer imposes fuel surcharges on either award or revenue tickets on its own metal, but will pass them on if partners charge them.

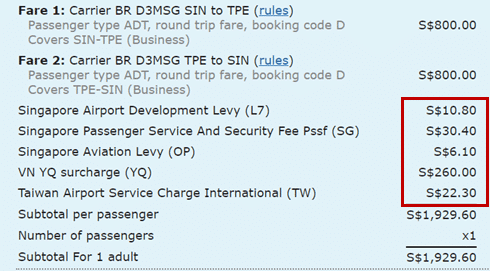

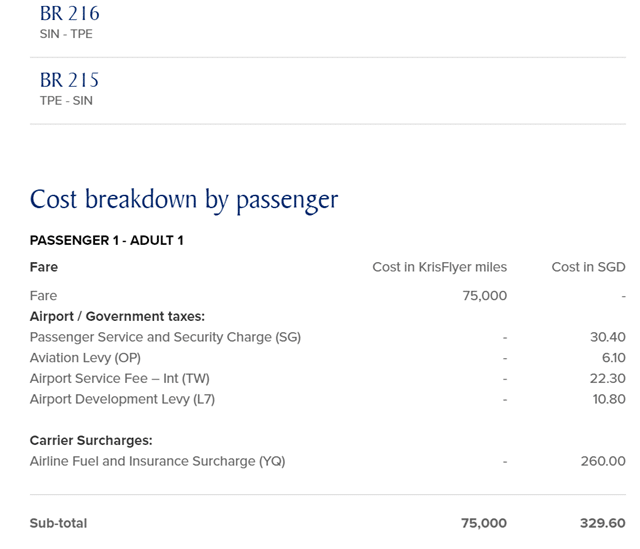

Let’s try looking for Singapore to Taipei on EVA Air. We follow the exact same process as before, but this time round we’ll click on the EVA Air option instead.

And there you have it- a total of S$329.60 in taxes and surcharges. Note the presence of the S$260 YQ, which (along with YR) is shorthand for fuel surcharges (or carrier-imposed surcharges in the case of YR). These really are junk fees, but they’re part and parcel of mileage redemptions.

Looking for the same flight on the SQ website yields a taxes and surcharges figure of S$329.60.

When will the ITA Matrix not provide the proper taxes and fees?

The ITA Matrix is certainly useful, but you should be aware that in some limited cases, the taxes on a revenue ticket may not always be the same as those on an award ticket.

Flights to and from the USA

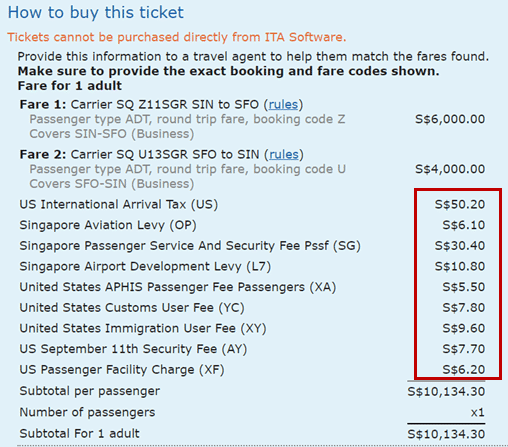

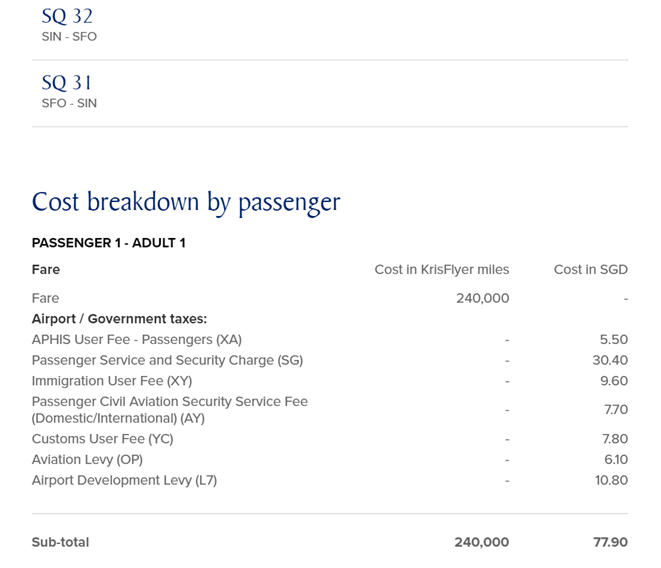

Look at this example of Singapore to San Francisco on SQ31/32

The figures in the red box add up to $134.30. However, when I try to price an award on the SQ website, here’s what I see:

$77.90 of taxes on an award ticket versus $134.30 for a revenue ticket. What’s causing the $56.40 difference?

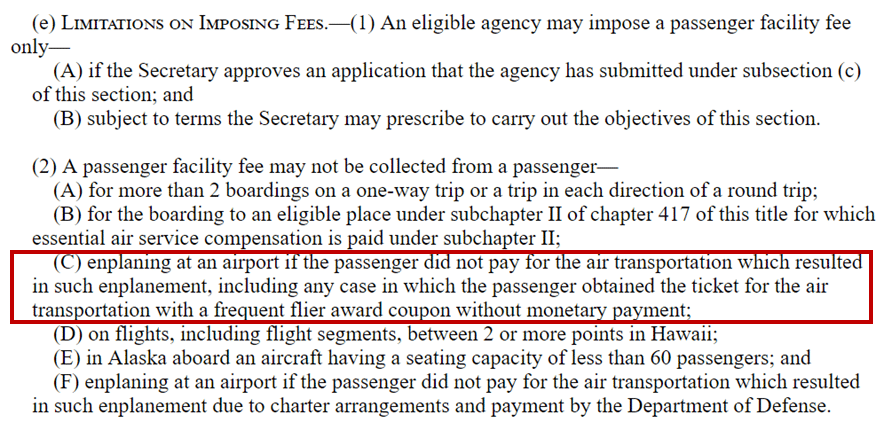

In this particular instance, it’s because the USA applies a different set of taxes and fees to “free” tickets (i.e. awards) as it does to revenue ones. Here is some remarkably boring government legislation for you to paw through concerning taxes and fees in the US:

See what it says? Award tickets do not attract Passenger Facility Fees (S$6.20 in this case). They also don’t attract the US International Arrivals/Departures Tax (S$25.10 each way, so $50.20 in this case), and that’s where our $56.40 differential comes from.

Flights from India

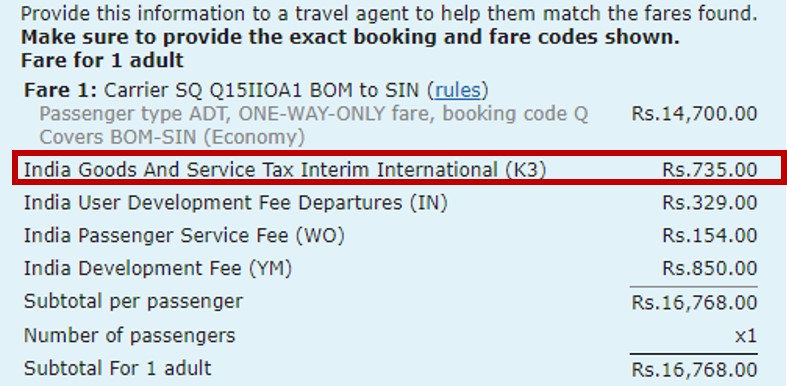

Indian Goods and Services Tax will be reflected on the ITA Matrix but will not be levied on award bookings, because no cash goes towards the fare component. Therefore, your taxes will be less than what the ITA Matrix suggests.

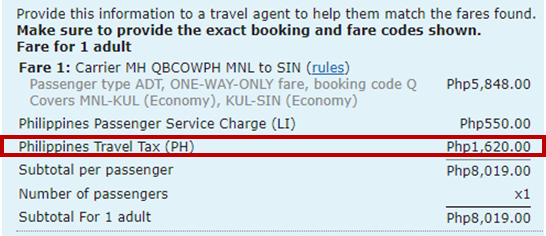

Flights from the Philippines

The ITA Matrix will show the Philippines Travel Tax, which is imposed on Philippine nationals traveling abroad. Here’s how the Philippines Embassy in the USA explains it:

“Philippine Nationals are expected to pay for the Philippine Travel Tax upon departure from the Philippines. It is usually paid at the airport upon departure or; oftentimes, already included in the cost of the ticket when purchased. US Nationals and Permanent Residents (Green Card Holders) are exempt from the Philippine Travel Tax. US Permanent Residents need to secure a Travel Tax Exemption Certificate from the Philippine Tourism Authority at the Department of Tourism Building at TM Kalaw Street, Ermita Manila. The Philippine Travel Tax is PHP1,620.00 (approximately $35.00). “

Anyway, it’s not a concern to Singaporeans, and means the actual taxes will be lower than what the ITA Matrix suggests.

Other things to note

Layovers add to cost

When your aircraft does a layover in one city before proceeding to another, that airport’s authorities add on additional fees to your ticket. For example, in the screenshot below we see that flying with SQ31 from SFO to SIN…

…results in a routing that has fewer taxes and surcharges than flying SQ1 from SFO-HKG-SIN

Cabins matter

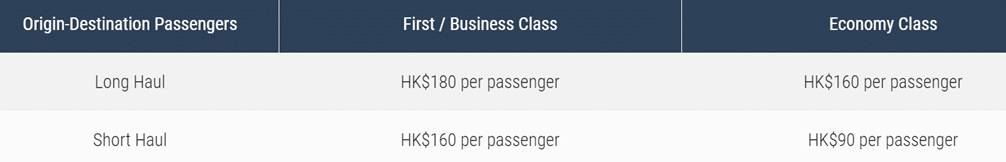

Don’t assume that fees will be the same for all passengers on a particular flight, regardless of cabin. In the case of the UK (Air Passenger Duty), France (Air Passenger Solidarity Tax) and Hong Kong (Hong Kong Airport Construction Fee), higher fees apply for First/Business Class passengers.

That said, if you’re comparing like-to-like, that is, a Business Class fare on the ITA matrix to a Business Class award on SQ’s site, your taxes and surcharges figure should still be correct.

Qantas flights

Qantas is a strange one- back in January 2015 they folded fuel surcharges into base fares for revenue tickets, but continued to impose them on award tickets. Therefore, the quotes that ITA Matrix throws up will understate the total taxes and surcharges. This only further re-emphasizes what a money grab fuel surcharges are.

Conclusion

Many people don’t bother to question the taxes and surcharges they get quoted by agents over the phone. In most cases this isn’t a problem because those are automatically calculated. However, there are some airlines which still do this manually, creating the possibility of human error. In any case it pays to be informed and have an idea of what the taxes and fees should be before making a booking.

Signing up for credit cards through any of the links in this article may generate a referral commission that supports the running of the site. Found this post useful? Subscribe to our Telegram Channel to get these posts pushed directly to your phone, or our newsletter (on the right of your screen) for the latest deals and hacks delivered to your inbox.

Interesting – thanks for sharing the link.

Just so I’m clear – for any miles reward redemption (say in this case, its for SQ), I have to pay the taxes and surcharges separately (and there is no way that miles can be used to waive them off)?

yes, you have to pay taxes and surcharges in cash

Sorry if this was answered before, are there any recommended cards (DBS Altitude, WWMC) for paying the tax and fuel surcharges for both offline phone redemption and online redemption on SQ website? Thanks.

“However, there are some airlines which still do this manually, creating the possibility of human error. ”

Could you give some examples of airlines that do this please? Kinda curious.

US airways used to do this for their dividend mile program. i believe some airlines like RAM still continue to do this manually