With a good proportion of Singapore’s workforce now working from home, food delivery services must surely have seen an uptick in business.

Sadly, GrabFood users may now have to start shelling out more. Yesterday afternoon, Grab sent out a push notification informing customers of its decision to add a minimum basket value and a S$0.20 platform fee to all orders.

The minimum basket value kicked in at 10 a.m this morning (13 March), while the platform fee will start from 27 March 2020.

How small is a small order?

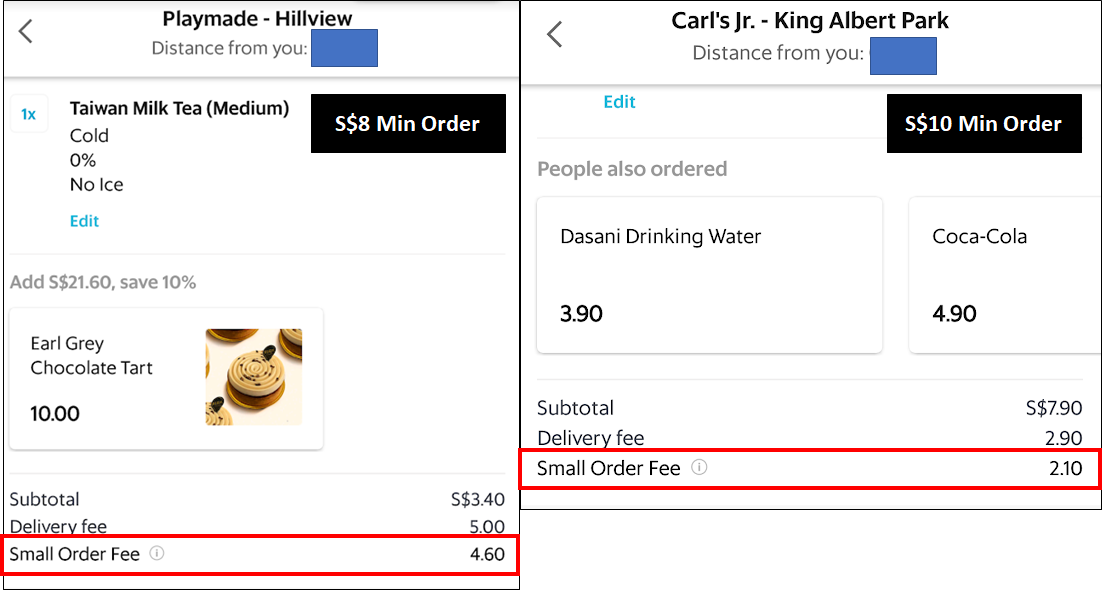

As per Grab, the minimum basket value starts from S$8, although in practice I’ve seen it go as high as S$10.

If you fall below the minimum basket value, your small order fee will be the difference between the current value and the minimum basket value.

In contrast, Deliveroo levies a small order fee too, but it’s capped at S$5. In other words, ordering just a single S$1 item would cost S$6 with Deliveroo, but as much as S$10 with Grab (both figures before delivery fees). foodpanda, to my knowledge, operates with a S$5 minimum order and a small order fee that tops up the difference.

|

|

|

|

| Minimum Value to Avoid Small order Fee | S$8-10 | S$12 | S$5 |

| Small Order Fee (Max) | S$10 | S$5 | S$5 |

| Platform Fee | S$0.20 (from 27 Mar) |

S$0.20 | None |

Conclusion

Those of you with GrabFood subscriptions would in any case need to spend at least S$10 to enjoy free delivery, so this change shouldn’t affect you. That said, it’s still an overall negative change for Grab customers, and one that was made with very little notice.

Although the platform fee is only 20 cents, I still don’t understand the general concept- you’d think this would be something that businesses already price into their fees. Grab is not alone in charging platform fees, of course (Deliveroo and gojek both have them), but it doesn’t follow that something is right just because it’s market practice (see credit card surcharges).

Even more reason to not use their shitter services now. I will completely stop giving them business once 4mpd possibilities are gone.

Platform fees are fixed and uniform regardless, so there is no difference whether it is priced in or not. Credit card surcharge is a completely different story all together because you can choose to avoid the surcharge by not using the credit card. Arguing for credit card surcharges to be priced in by the business is pathetically selfish, akin to asking non credit card users to subsidize our miles.

Surcharges are not charged by the issuer bank. They are charged by the acquirer bank, i.e. the merchant’s bank. This fee (MDR) is a cost of business to the merchant. In return the merchant gets benefits like getting more customers, reduced burden of cash handling, direct payment to account etc, all of which cannot be quantified. Therefore its disingenuous to call the customer selfish for asking for abolition of surcharge as the benefits accrue to the merchant and the customer ends up paying extra. For me if it can be avoided, i tend to take my business elsewhere to merchants… Read more »

Those are good points, but why should the non credit card users pay for it too? If half of the merchant’s customers pay by credit card, the other half is also paying for the bill but not getting the rewards. The merchant is already paying through the MDR, risk of fraud, high fixed deposit required by the bank, delayed receipt of payment, and very poor cashflow. The funds can sometimes take a week to reach the merchant if they are small. The winner is consumers like us who get the rewards and demand the merchant bear the cost, and of… Read more »

Feel like jacking up price of umbrella on heavy rainy day