DBS has extended its sign-up offer for the DBS Altitude Card, which is now valid for applications till 31 July 2023.

The details remain the same as before, with new cardholders earning up to 21,000 bonus miles and existing customers up to 10,000 bonus miles, with a minimum spend of S$2,000 within 30 days of approval.

|

| DBS Altitude Offers |

| DBS markets this as “up to 37,000 miles” because their working assumes that you pay the annual fee (+10,000 miles) and spend the entire S$2,000 on online airline and hotel bookings (+6,000 miles). My workings below have assumed the base case of local general spend @ 1.2 mpd. |

In addition to this, the bank is also teasing some changes to the card which will take effect from 1 August 2023.

Card benefit changes coming your way on 1 August 2023!

Thank you for supporting the DBS Altitude Card! We will be sharing more details about how you can continue to earn miles for your next trip with the revised card benefits. Watch this space closer to August.

As to what these changes are, your guess is as good as mine. A boost to the earn rates to keep pace with the OCBC 90°N Card and HSBC TravelOne Card, perhaps? Stay tuned!

DBS Altitude Card sign-up offers

From now till 31 July 2023, the DBS Altitude Cards are offering a sign-up bonus of up to 21,000 bonus miles, depending on which card you apply for and whether you’re a new or existing DBS/POSB customer.

|

|

|

| DBS Altitude AMEX | DBS Altitude Visa | |

| New Customers | 21,000 bonus miles | 15,000 bonus miles |

| Existing Customers | 10,000 bonus miles | N/A |

| ❓ New-to-bank |

|

DBS defines “new-to-bank” as customers who do not:

|

On top of the bonus miles, an additional 10,000 miles will be granted if you choose to pay the first year’s S$194.40 annual fee.

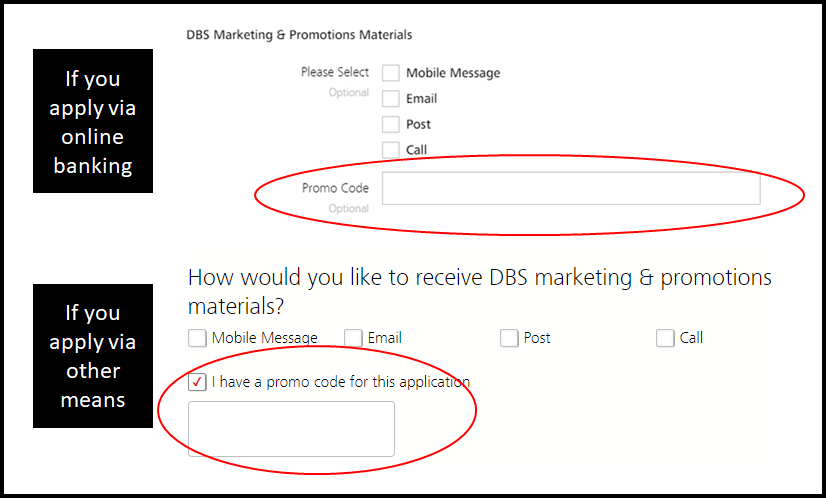

Regardless of which offer you pick, you’ll need to enter a certain promo code at the point of application (see below for details). Make sure to do this; no code, no bonuses!

There’s nothing stopping you from signing up for both the AMEX and Visa cards. However, you will only enjoy the new-to-bank bonus on the first card that’s approved.

DBS Altitude AMEX sign-up offer

New-to-bank customers

DBS Altitude AMEX DBS Altitude AMEXApply |

||

| Promo Code | ALTMEX | ALTMEXW |

| Bonus Miles | 21,000 | 21,000 |

| Base Miles From S$2,000 Spend (@ 1.2 mpd) | 2,400 | 2,400 |

| Miles From S$194.40 Annual Fee | 10,000 | Fee waived |

| Total Miles | 33,400 | 23,400 |

New-to-bank customers who apply for a DBS Altitude AMEX by 31 July 2023 (with approval by 14 August 2023) and spend S$2,000 within 30 days of approval will receive 21,000 bonus miles, on top of 2,400 base miles (assuming the entire S$2,000 is spent locally at 1.2 mpd).

If they pay the S$194.40 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTMEX, while those who want a first year fee waiver can apply with the promo code ALTMEXW.

The T&Cs of this offer can be found here.

Existing customers

DBS Altitude AMEX DBS Altitude AMEXApply |

||

| Promo Code | ALTMEXA | ALTMEXAW |

| Bonus Miles | 10,000 | 10,000 |

| Base Miles From S$2,000 Spend (@1.2 mpd) | 2,400 | 2,400 |

| Miles From S$194.40 Annual Fee | 10,000 | Fee waived |

| Total Miles | 22,400 | 12,400 |

Existing customers who apply for a DBS Altitude AMEX by 31 July 2023 (with approval by 14 August 2023) and spend S$2,000 within 30 days of approval will receive 10,000 bonus miles, on top of the 2,400 base miles (assuming the entire S$2,000 is spent locally at 1.2 mpd).

If they pay the S$194.40 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTMEXA, while those who want a first year fee waiver can apply with the promo code ALTMEXAW.

The T&Cs for this offer can be found here.

DBS Altitude Visa sign-up offer

New-to-bank customers

DBS Altitude Visa DBS Altitude VisaApply |

||

| Promo Code | ALTVIS | ALTVISW |

| Bonus Miles | 15,000 | 15,000 |

| Base Miles From S$2,000 Spend (@ 1.2 mpd) | 2,400 | 2,400 |

| Miles From S$194.40 Annual Fee | 10,000 | Fee waived |

| Total Miles | 27,400 | 17,400 |

New-to-bank customers who apply for a DBS Altitude Visa by 31 July 2023 (with approval by 14 August 2023) and spend S$2,000 within 30 days of approval will receive 15,000 bonus miles, on top of the 2,400 base miles (assuming the entire S$2,000 is spent locally at 1.2 mpd).

If they pay the S$194.40 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTVIS, while those who want a first year fee waiver can apply with the promo code ALTVISW.

The T&Cs of this offer can be found here.

Existing customers

There is no offer for existing DBS customers who sign up for a DBS Altitude Visa card.

What counts as qualifying spend?

Cardholders are required to spend S$2,000 within 30 days of approval.

Qualifying spend consists of local and foreign retail sales and recurring bill payments, excluding the following:

| ⚠️ Excluded transactions |

|

For avoidance of doubt, CardUp transactions will only count towards the minimum spend if they are made in respect of rental payments (though all CardUp transactions are still eligible for base miles with DBS cards).

When will the bonus miles be credited?

Miles from the payment of the S$194.40 annual fee will be credited once the annual fee is charged.

Bonus miles will be credited within 90-120 days from the date of card approval, assuming the minimum spend requirement has been met.

What can you do with DBS Points?

DBS Points earned on the DBS Altitude do not expire, and can be converted to any of the following frequent flyer programmes with a S$27 admin fee.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

DBS also offers automatic conversions to KrisFlyer for a 12-month period with a S$43.20 annual fee.

In my opinion, it’s only worth transferring miles to KrisFlyer or Asia Miles. AirAsia BIG is more of a rebates program than a traditional frequent flyer scheme, and Qantas Frequent Flyer doesn’t have any real sweet spots for Singapore-based travellers (unless maybe you want to book a round-the-world trip, or domestic flights within Australia).

Are these offers worth it?

If you’re an existing DBS customer, definitely. It’s rare to see a sign-up offer for this group, so the opportunity to generate 10,000 bonus miles from S$2,000 of spend is very attractive indeed- that’s an average of 5 mpd!

If you’re a new DBS customer, you should be aware that DBS sometimes runs acquisition offers of S$300 cashback with a minimum spend of S$500, which may or may not be a better deal than 21,000 miles with a minimum spend of S$2,000, depending on how much you value a mile.

Overview: DBS Altitude Card

|

|||

| Apply (AMEX) | |||

| Apply (Visa) | |||

| Income Req. | S$30,000 p.a. | Points Validity | No Expiry |

| Annual Fee | S$194.40 (First Year Free) |

Min. Transfer |

5,000 DBS Points (10,000 miles) |

| Miles with Annual Fee |

10,000 | Transfer Partners |

|

| FCY Fee | 3% (AMEX) 3.25% (Visa) |

Transfer Fee | S$27 |

| Local Earn | 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 2 mpd | Lounge Access? | Yes (Visa) |

| Special Earn | 3 mpd on online flight and hotels, 6 mpd on Expedia, 10 mpd on Kaligo | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

DBS Altitude Cardholders earn:

- 1.2 mpd on SGD spend

- 2 mpd on foreign currency spend

- 3 mpd on online flight and hotel bookings (capped at S$5,000 per calendar month)

DBS Altitude Visa Cardholders enjoy a Priority Pass membership with two complimentary lounge visits.

For a full review of the DBS Altitude Card, refer to the article below.

Conclusion

DBS has extended its sign-up offers for the Altitude Card, with up to 21,000 bonus miles available to customers who apply by 31 July 2023.

This is a solid offer for existing customers (10,000 bonus miles), though new-to-bank customers may want to consider if they’d prefer to wait for one of DBS’s cashback offers to roll round again.

DBS is also teasing some changes to the Altitude Card from 1 August 2023. I’m hoping they’ll add some lounge benefits for Altitude AMEX Cardholders, as well as a boosted earn rate, but we’ll need to wait to see what they have in store.

Any bets on what changes we’ll see to the Altitude?