Back in August 2023, DBS launched a new welcome offer of up to 25,600 miles for the DBS Altitude Card, together with some rather unpopular changes to its core value proposition- which I won’t belabour because I’ve written about them enough already.

|

| DBS Altitude Offers |

| DBS markets this as “up to 40,000 miles” because their working assumes that you pay the annual fee (10,000 miles) and spend the entire S$2,000 on foreign currency spend (4,400 miles @ 2.2 mpd). Adjust for that, and the “true bonus” is 25,600 miles, the figure I’m using in this post |

This welcome offer was originally set to lapse on 30 September 2023, but has now been extended till 30 November 2023. As before, there’s a separate offer for new-to-bank and existing customers.

What’s more, DBS has also launched a rather tasty 25 million miles giveaway, so spending on your DBS cards could pay off handsomely in the near future.

DBS Altitude Card sign-up offers

|

|

|

| DBS Altitude AMEX | DBS Altitude Visa | |

| New Customers | 25,600 bonus miles (+10,000 miles with AF payment) |

22,600 bonus miles (+10,000 miles with AF payment) |

| Existing Customers | 11,600 bonus miles (+10,000 miles with AF payment) |

N/A |

| ❓ New-to-bank | ||

|

DBS defines “new-to-bank” as customers who do not:

|

||

From now till 30 November 2023, applicants for the DBS Altitude Card can earn up to 25,600 bonus miles, depending on which version of the card they apply for, and whether they’re a new or existing DBS/POSB customer.

On top of this, an additional 10,000 miles will be awarded if they choose to pay the first year’s S$194.40 annual fee.

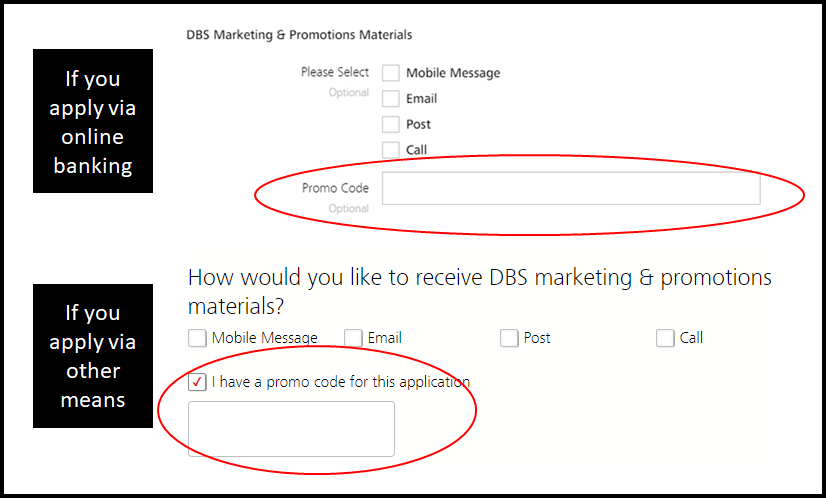

To enjoy these bonuses, customers must enter a certain promo code at the point of application (see below for details). Make sure to do this; no code, no bonus!

There’s nothing stopping you from signing up for both the Altitude AMEX and Altitude Visa cards. However, you will only enjoy the new-to-bank offer on the first card that’s approved, and therefore you should apply for the Visa fist, then the AMEX, should you go down this route.

DBS Altitude AMEX sign-up offer

New-to-bank customers

DBS Altitude AMEX DBS Altitude AMEXApply |

||

| Promo Code | ALTMEX | ALTMEXW |

| Bonus Miles | 25,600 | 25,600 |

| Base Miles From S$2,000 Spend (@ 1.3 mpd) | 2,600 | 2,600 |

| Miles From S$194.40 Annual Fee | 10,000 | Fee waived |

| Total Miles | 38,200 | 28,200 |

New-to-bank customers who apply for a DBS Altitude AMEX by 30 November 2023 (with approval by 14 December 2023) and spend S$2,000 within 30 days of approval will receive 25,600 bonus miles, on top of 2,600 base miles (assuming the entire S$2,000 is spent locally at 1.3 mpd).

If they pay the S$194.40 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTMEX, while those who want a first year fee waiver can apply with the promo code ALTMEXW.

The T&Cs of this offer can be found here.

Existing customers

DBS Altitude AMEX DBS Altitude AMEXApply |

||

| Promo Code | ALTMEXA | ALTMEXAW |

| Bonus Miles | 11,600 | 11,600 |

| Base Miles From S$2,000 Spend (@1.3 mpd) | 2,600 | 2,600 |

| Miles From S$194.40 Annual Fee | 10,000 | Fee waived |

| Total Miles | 24,200 | 14,200 |

Existing customers who apply for a DBS Altitude AMEX by 30 November 2023 (with approval by 14 December 2023) and spend S$2,000 within 30 days of approval will receive 11,600 bonus miles, on top of the 2,600 base miles (assuming the entire S$2,000 is spent locally at 1.3 mpd).

If they pay the S$194.40 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTMEXA, while those who want a first year fee waiver can apply with the promo code ALTMEXAW.

The T&Cs for this offer can be found here.

DBS Altitude Visa sign-up offer

New-to-bank customers

DBS Altitude Visa DBS Altitude VisaApply |

||

| Promo Code | ALTVIS | ALTVISW |

| Bonus Miles | 22,600 | 22,600 |

| Base Miles From S$2,000 Spend (@ 1.3 mpd) | 2,600 | 2,600 |

| Miles From S$194.40 Annual Fee | 10,000 | Fee waived |

| Total Miles | 35,200 | 25,200 |

New-to-bank customers who apply for a DBS Altitude Visa by 30 November 2023 (with approval by 14 December 2023) and spend S$2,000 within 30 days of approval will receive 22,600 bonus miles, on top of the 2,600 base miles (assuming the entire S$2,000 is spent locally at 1.3 mpd).

If they pay the S$194.40 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTVIS, while those who want a first year fee waiver can apply with the promo code ALTVISW.

The T&Cs of this offer can be found here.

Existing customers

There is no offer for existing DBS customers who sign up for a DBS Altitude Visa card.

What counts as qualifying spend?

Cardholders are required to spend S$2,000 within 30 days of approval.

Qualifying spend consists of local and foreign retail sales and recurring bill payments, excluding the following:

| ⚠️ Excluded transactions |

|

The DBS comms team has previously confirmed with me (as recently as August 2023) that CardUp transactions will only count towards the qualifying spend for sign-up bonuses if they are made in respect of rental payments.

However, since the T&Cs don’t make explicit mention of this fact (there’s just a blanket line saying CardUp is excluded), I’m going to check with them again and update this post when I hear back. Hopefully we can get that term stated in black and white.

| ⚠️ Update |

| DBS has confirmed with me that CardUp rental payments will count towards qualifying spend for welcome offers. They will amend the T&Cs to avoid confusion. |

Regardless of this clause, all CardUp transactions, regardless of type, are still eligible for base miles with DBS cards (i.e. 1.3 mpd).

When will the bonus miles be credited?

Miles from the payment of the S$194.40 annual fee will be credited once the annual fee is charged.

Bonus miles will be credited within 90-120 days from the date of card approval, assuming the minimum spend requirement has been met.

To illustrate, a cardholder who gets approved on 1 August 2023 and pays the S$194.40 annual fee for 10,000 extra miles:

- Will receive 10,000 miles when the annual fee posts in the first statement month

- Must meet the S$2,000 min. spend by 31 August 2023

- Will receive bonus miles by 29 November 2023

Is it worth it?

A bonus of 25,600 miles for new customers and 11,600 miles for existing customers is solid enough, especially since the latter are normally left out by banks.

However, you’ll need to factor in the opportunity cost of spending on a general spending card. Assuming you clock the S$2,000 minimum spend on local transactions @ 1.3 mpd, your opportunity cost (compared to spending on a 4 mpd card) will be 5,400 miles (S$2,000 x (4-1.3)).

What can you do with DBS Points?

DBS Points earned on the DBS Altitude do not expire, and can be converted to any of the following frequent flyer programmes with a S$27 admin fee.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

DBS also offers automatic conversions to KrisFlyer for a 12-month period with a S$43.20 annual fee.

In my opinion, it’s only worth transferring miles to KrisFlyer or Asia Miles. AirAsia BIG is more of a rebates program than a traditional frequent flyer scheme, and Qantas Frequent Flyer doesn’t have any real sweet spots for Singapore-based travellers (unless maybe you want to book a round-the-world trip, or domestic flights within Australia).

Overview: DBS Altitude Card

|

|||

| Apply (AMEX) | |||

| Apply (Visa) | |||

| Income Req. | S$30,000 p.a. | Points Validity | No Expiry |

| Annual Fee | S$194.40 (First Year Free) |

Min. Transfer |

5,000 DBS Points (10,000 miles) |

| Miles with Annual Fee |

10,000 | Transfer Partners |

|

| FCY Fee | 3% (AMEX) 3.25% (Visa) |

Transfer Fee | S$27 |

| Local Earn | 1.3 mpd | Points Pool? | Yes |

| FCY Earn | 2.2 mpd | Lounge Access? | Yes (Visa) |

| Special Earn | 6 mpd on Expedia, 10 mpd on Kaligo | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The DBS Altitude Card has an income requirement of S$30,000 and an annual fee of S$194.40, which can be waived in the first year (or paid to earn an extra 10,000 miles).

Cardholders earn:

- 1.3 mpd on SGD spend

- 2.2 mpd on foreign currency spend

DBS Altitude Visa Cardholders enjoy a Priority Pass membership with two complimentary lounge visits.

For a full review of the DBS Altitude Card, refer to the article below.

DBS 25 million miles giveaway

|

| DBS 25 Million Miles Giveaway |

Finally, don’t forget about the recently-launched 25 million miles giveaway for DBS cardholders.

From now till 31 January 2024, DBS customers who charge their overseas and travel spend to their cards can win one of 475 prizes, split into:

- 5x prizes of 150,000 DBS Points (300,000 miles)

- 470x prizes of 25,000 DBS Points (50,000 miles)

Both the DBS Altitude Cards are participating, together with all of DBS’s points-earning portfolio (e.g. Vantage, Woman’s Card).

Cardholders will automatically earn chances by spending on their DBS cards from 1 September 2023 to 31 January 2024:

| Spend | Chances |

| Every S$100 spent on Travel Spend |

1X |

| Every S$100 spent overseas | 10X |

For the full details, refer to the post below.

Conclusion

DBS has extended its welcome offer for the Altitude Card, with up to 25,600 bonus miles available to customers who apply by 30 November 2023 and spend S$2,000 within 30 days of approval. They can also opt to pay the S$194.40 annual fee for an extra 10,000 bonus miles, though I’m relatively more lukewarm about that.

What’s nice is that there’s an offer for existing customers too of 11,600 bonus miles, when most banks typically don’t offer this group anything.

Don’t forget that you can also clock chances towards DBS’s 25 million miles giveaway by spending on your cards, though outside of this sign-up bonus, I personally would focus more on the DBS Woman’s World Card.

Anyone receivee the miles yet ?