One of the most attractive features of the KrisFlyer UOB Credit Card is its Accelerated Miles feature, which allows cardholders to earn an uncapped 3 mpd on dining, food delivery, online shopping and travel, and transport spend.

While it’s true you could earn 4-6 mpd on most of these categories with other credit cards, there’s always a cap involved. If you’re a particularly big spender, then an uncapped 3 mpd could be a very enticing opportunity indeed.

So how does the Accelerated Miles feature work, and are there any gotchas to be careful about?

What are Accelerated Miles?

|

||

| Earn Rate | Remarks | |

| Base Miles | 1.2 mpd | Earned on all SGD/FCY spend, no min. spend and no cap |

| Accelerated Miles | 1.8 mpd | Earned on selected SGD/FCY spend, min. spend S$800 on SIA Group, no cap |

| Total | 3 mpd | |

KrisFlyer UOB Credit Cardholders normally earn 6 KrisFlyer miles per S$5 (1.2 mpd) spent on all transactions, with no minimum spend and no cap.

Provided they meet a certain minimum spend threshold, they will be eligible to earn an extra 9 KrisFlyer miles per S$5 (1.8 mpd) on selected transactions for that membership year, with no cap.

This extra 1.8 mpd component is referred to as Accelerated Miles.

How do I qualify for Accelerated Miles?

To qualify for Accelerated Miles, KrisFlyer UOB Credit Cardholders must spend at least S$800 per membership year on SIA Group related transactions, defined as:

- Singapore Airlines

- Scoot

- KrisShop

For avoidance of doubt, this includes using your card to pay for taxes and surcharges on an award ticket (regardless of whether it’s operated by Singapore Airlines or one of its partners).

Kris+ and Pelago are not considered part of the SIA Group, although this could change in the near future.

What transactions can I earn Accelerated Miles on?

Assuming you meet the S$800 minimum spend threshold, you can earn Accelerated Miles on the following transactions, whether in SGD or FCY.

| Category | MCCs/ Transaction Description |

| Dining & Food Delivery | 5812, 5813, 5814 |

| Online Shopping | 4816, 5262, 5306, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5661, 5691, 5699, 5732, 5733, 5735, 5912, 5942, 5944-5949, 5999, 7278 (only for Shopee, Lazada and Qoo10) |

| Online Travel | Agoda, Airbnb, Booking.com, Expedia, Hotels.com, Kaligo, Traveloka, Trip.com, UOB Travel |

| Transport | BUS/MRT, 4121 |

| Bonuses apply to both SGD and FCY spending | |

The Accelerated Miles will be awarded on these transactions for the entire membership year, not just from the time the minimum spend was met.

When are Accelerated Miles credited?

Unlike base miles, Accelerated Miles are not credited when the transaction posts. Instead, they are credited two months after the end of the membership year.

Here’s an example of how it works for someone with a card membership year running from 1 June 2023 to 31 May 2024, and S$1,000 spend on Accelerated Miles categories per month.

| Month | Spend on Acc. Miles Categories | Base Miles (1.2 mpd) | Acc. Miles (1.8 mpd) |

| Jun 2023 | S$1,000 | 1,200 | – |

| Jul 2023 | S$1,000 | 1,200 | – |

| Aug 2023 | S$1,000 | 1,200 | – |

| Sep 2023 | S$1,000 | 1,200 | – |

| Sep 2023: Satisfies min. S$800 spend on SIA Group transactions* |

|||

| Oct 2023 | S$1,000 | 1,200 | – |

| Nov 2023 | S$1,000 | 1,200 | – |

| Dec 2023 | S$1,000 | 1,200 | – |

| Jan 2024 | S$1,000 | 1,200 | – |

| Feb 2024 | S$1,000 | 1,200 | – |

| Mar 2024 | S$1,000 | 1,200 | – |

| Apr 2024 | S$1,000 | 1,200 | – |

| May 2024 | S$1,000 | 1,200 | – |

| Jun 2024 | – | – | – |

| Jul 2024 | – | – | 21,600 |

| *I’ve shown this as Sep 2023, but it really doesn’t matter- so long as he meets this minimum spend by May 2024, he will be eligible for Accelerated Miles on transactions from 1 June 2023 to 31 May 2024 | |||

Each month, he earns 1,200 base miles (S$1,000 x 1.2 mpd). It’s only in July 2024 that the remaining 21,600 Accelerated Miles (S$1,000 x 1.8 mpd x 12) are credited.

Yes, you don’t need to tell me the irony, but Accelerated Miles are in fact delayed!

What are the implications of delayed crediting?

The delayed crediting mechanism gives rise to several important issues.

First, any pending Accelerated Miles will be forfeited if you cancel the card before they post. This effectively locks you into the card, which I’m quite certain is deliberate.

Second, because Accelerated Miles are credited as one lump sum, it will be very tricky to reconcile your points with transactions. I mean, it’s hard enough doing this on a month to month basis; imagine doing it for 12 months’ worth.

Third, you will be more exposed to devaluation risk. If SIA announces an award chart devaluation in, say, two months, other cardholders can rush out to convert their points and burn their miles before it happens. You can’t, because your Accelerated Miles are in limbo.

Fourth, your miles will all be of different vintages. The Base Miles will be credited each month, and start their 3-year expiry period immediately. The Accelerated Miles will follow two to 14 months later.

What happens in reality?

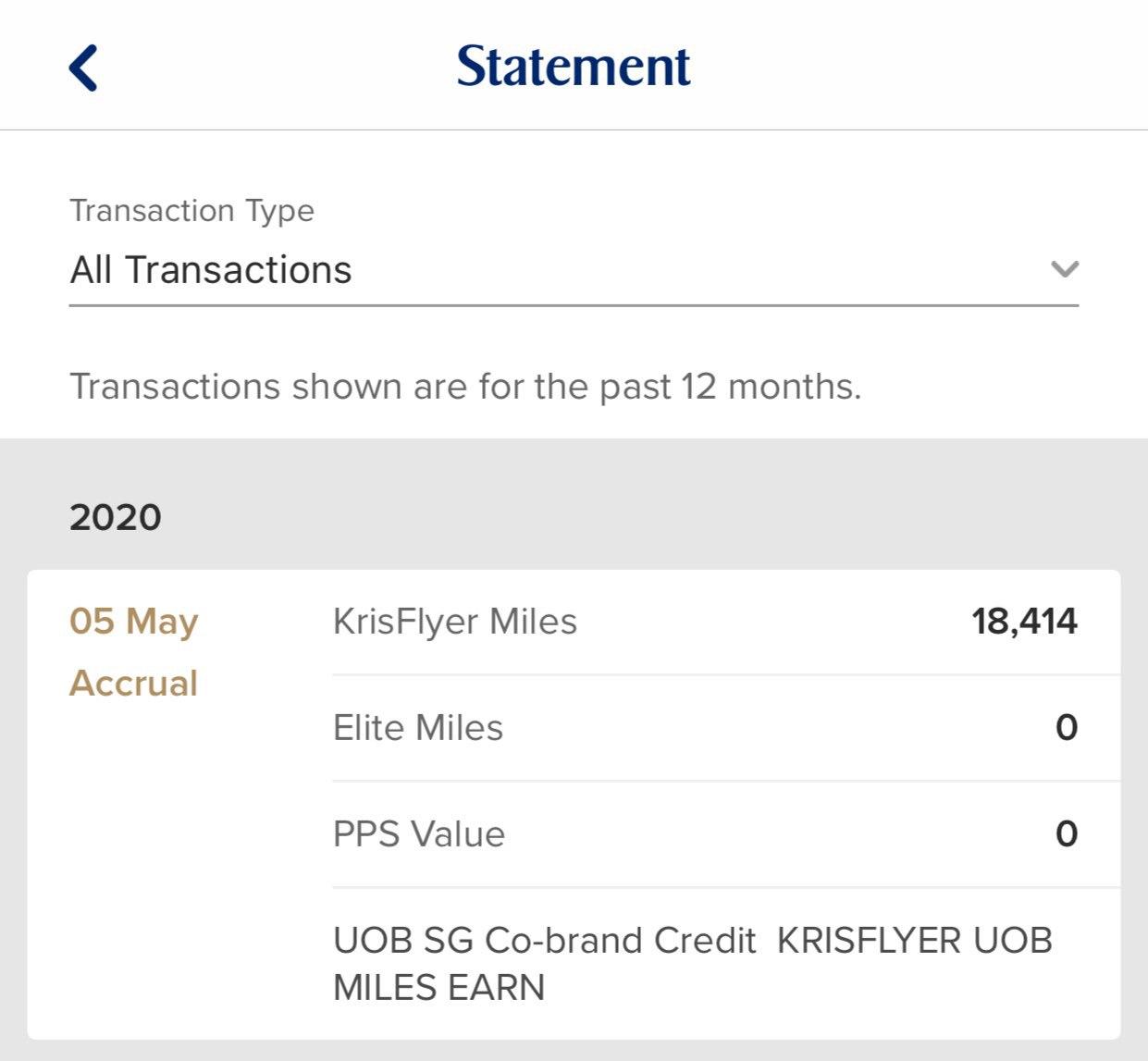

While the official position is that Accelerated Miles are only credited two months after the end of the membership year, in practice it seems like cardholders receive them one month before the card’s renewal date.

For example, I received a screenshot from a cardmember who received his card in June 2019. By the letter of the T&Cs, he should receive his bonus miles in August 2020, but instead they were credited in May 2020.

There are a few more reports of similar cases.

If you do receive your Accelerated Miles before the card renewal date, then yes, you can proceed to cancel the card if you wish for the upcoming membership year.

However, keep in mind that this “advance crediting” is not official UOB policy, and therefore you can’t hold UOB to it. It’s also not clear whether this happens for every cardmember, or whether some are just lucky. And even if they’ve done it in the past, there’s no guarantee it’ll happen again in the future.

Is it still worth earning Accelerated Miles?

So given the minimum spend and delayed crediting, is it worth the trouble earning Accelerated Miles?

It really boils down to how big a spender you are. If you don’t max out the 4-6 mpd caps on other cards, then there’s really no reason why you should be settling for 3 mpd, on a delayed timetable.

If you do, then I’d argue there’s definitely something of interest here- especially for those who buy luxury goods. Take a look at the qualifying transactions for Accelerated Miles, and you’ll notice the following inclusions:

- MCC 5944: Clock, Jewelry, Watch and Silverware Stores

- MCC 5948: Leather Goods and Luggage Stores

Those happen to be the MCCs for luxury merchants like Cartier and Louis Vuitton, and by pairing the KrisFlyer UOB Credit Card with Amaze, you could earn an uncapped 3 mpd on your purchases (since Amaze converts the transaction into an online one).

This is all the more crucial because there are few cards left in Singapore suited to handle big ticket spending, following the recent nerf to the OCBC Titanium Rewards and its annual 4 mpd cap of S$13,335.

Don’t confuse with miles from SIA Group!

The KrisFlyer UOB Credit Card also earns 15 KrisFlyer miles per S$5 spent (3 mpd) on SIA Group transactions.

Unlike Accelerated Miles, these are credited at the time the transaction posts, and have no minimum spend requirement.

Conclusion

|

| Apply |

The KrisFlyer UOB Credit Card’s Accelerated Miles feature is an excellent way for big spenders to rack up miles, since there’s no cap on the maximum bonus you can earn.

The main catch here is the delayed crediting, which can be up to 14 months in some cases. This makes it difficult to reconcile your bonus miles or react quickly to devaluation events, and while there are some reports that UOB may actually credit Accelerated Miles before the end of the membership year, you have no recourse if they follow the letter of the T&Cs and deposit it two months after.

Assuming none of these are deal breakers, then neither should the S$800 minimum SIA Group spend required to trigger the Accelerated Miles feature.

Yeah it really only is good for luxury goods

The card for Hermes.

Hi, to enjoy the benefit with scoot, it have to book through flyscoot.com/KrisFlyerUOB. Does it attract spike in ticket price ?

will there be accelerated miles for 5812, 5813, 5814 if i pair with Amaze + UOB KF ?

its a good 1 card strategy, i have recommended it to all my friends who are lazy to play the 6/4 MPD game

I think it is also worth mentioning that pairing this card with the Krisflyer UOB Account would earn you an additional 0.4mpd. AND bonus KrisFlyer miles up to 6mpd! Though the bonus miles depend on how much your Monthly Account Balance(MAB) is, as it is capped at 5% of your MAB. Some examples of yearly bonus miles from Krisflyer UOB Account: $500 monthly spend on UOB Krisflyer with $20,000 MAB = 12,400 bonus miles. (2.1mpd) $500 monthly spend on UOB Krisflyer with $50,000 MAB = 32,400 bonus miles. (5.4mpd) $1000 monthly spend on UOB Krisflyer with $20,000 MAB = 14,800… Read more »

with interest rates being as high as they are now, it’s a terrible deal. your cost per mile is way too high, and the 5% cap makes it even worse

hi! do you know if we need to pay the annual fee to get the accelerated miles? thank you!

not a requirement as such, but if in your subsequent year UOB refuses to waive and you refuse to pay, then you have to cancel the card and forfeit any pending miles.

okie thanks! but am I correct to say that if the miles are awarded one/two months after the membership year and they are not willing to waive the annual fee then you have to pay the annual fee to get those accelerated miles?

yup. ymmv. that’s your potential “hostage situation”

understood, thank you!

Would CardUp transactions by eligible for the 3% accelerated miles too?

If I use Atome to make payment in KrisShop, does it still count towards the $800 SIA Group spend?