Whenever I tell someone about the miles game, the one thing I always take pains to emphasise is that whatever you do, do not carry a balance on your credit card.

It’s poison for your credit score, not to mention the interest and fees incurred will almost certainly outweigh any rewards earned. In that sense, it’s better to think of credit cards as debit cards with rewards, and not a means of spending more money than you have.

That’s why I was rather bemused by UOB’s latest campaign, which incentivises cardholders to, wait for it, carry a balance in return for miles.

UOB offering bonus miles for outstanding statement balances

From 5 August to 4 November 2024, UOB Visa Infinite, UOB Visa Infinite Metal Card, and UOB Privilege Banking Cardholders will earn an additional 0.5 UNI$ per S$1 (equivalent to 1 mpd) of outstanding balance on their card. This is capped at 5,000 UNI$ (10,000 miles) for the entire promo period.

The offer is targeted, and if you received an invitation to participate, registration must be done by sending the following SMS to 77862.

| 📱 SMS to 77862 |

| PMILES<space>Last 4 alphanumeric digits of NRIC/Passport<space>Date of birth in DDMMYY (Example: If your NRIC is S1234567A and date of birth is 31 July 1990, send “PMILES 567A 310790”) |

The following illustration is provided:

| Aug-24 | Sep-24 | Oct-24 | |

| Balance | S$9.5K | S$8.5K | S$6.5K |

| Payment for Balance | S$3K | S$3K | S$2.5K |

| Remaining Balance | S$6.5K | S$5.5K | S$4K |

| Additional UNI$ | 3,250 UNI$ | 2,750 UNI$ | 2,000 UNI$ |

| Total UNI$ Earned | 5,000 UNI$ (cap (and CBS) triggered) |

||

In this case, Roy the Revolver carries a S$6,500, S$5,500 and S$4,000 balance for August, September and October respectively. He earns an additional 1 mile for every S$1 outstanding, but also triggers the cap of 10,000 miles.

Oh, one more thing. Like any good UOB promotion, this has a cap. Only the first 270 cardmembers will get the reward, and I guess UOB must be getting so many questions about their “first X” promos that they’ve felt the need to stick this in the T&Cs too.

| Prior to 31 January 2025, UOB will not be able to advise on the status of a participant’s eligibility to receive the UNI$ or whether the qualification cap of this Promotion has been met |

When will bonus UNI$ be credited?

Bonus UNI$ will be awarded by 31 January 2025.

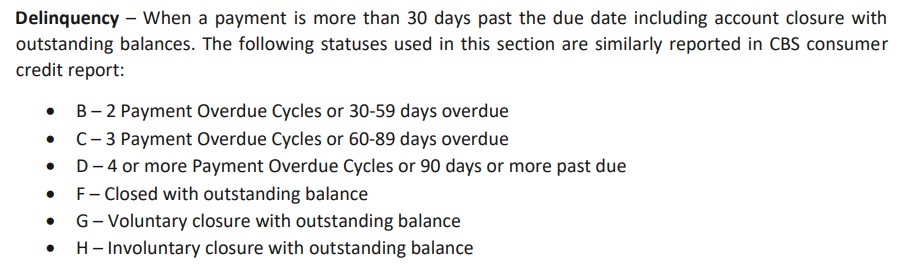

I find it somewhat funny that UOB also states that your account must not be “delinquent, voluntarily or involuntarily suspended, cancelled, closed or terminated” to receive the UNI$. Does carrying a balance count as delinquent, I wonder?

Terms & Conditions

The T&Cs for this offer can be found here.

Should you take advantage of this offer?

Well, let me put it this way.

Carrying an interest-bearing balance on your credit card is costly. You’ll be paying interest at 27.8% per annum, and as UOB concedes in its eDM, “the interest incurred may exceed the value of the UNI$ received.” Even if you had need of funds, getting a personal loan would be much, much cheaper.

But it goes beyond the explicit costs. Not paying your balance in full will hit your credit score, which in turn affects your ability to get approved for loans or other cards.

Keep in mind, there’s no guarantee you’ll even receive the reward, due to the first 270 cap!

Now just for laughs, what if you were to min-max this?

I suppose that in a best case scenario you would carry a S$10,000 balance for just one day. You’ll have to forgive me because I’m not very familiar with how interest on credit cards is calculated (because, um, I don’t carry a balance), but from what I gather, the 27.8% p.a. interest starts accruing from the date of transaction, not the date the statement balance was due.

UOB gives you 21 days to pay from the statement date, so hypothetically, if you were able to time your S$10,000 transaction to post on the very last day of the statement cycle, then make payment the day after it’s due, you’d pay about S$168 for 10,000 miles (and that’s before any additional late fees which may or may not be waived).

It’s not the worst price ever, but keep in mind that’s the absolute floor, based on the assumptions we’ve made regarding timing of the transaction. For most people, it’ll likely be much higher- and that’s to say nothing of the impact on your credit score, or the fact the reward isn’t even guaranteed!

Conclusion

|

|

UOB has launched a new promotion that offers an extra 1 mile per S$1 of outstanding card balance, capped at 10,000 miles. I should hope that this doesn’t encourage anyone to start carrying a balance, because even in a best case scenario, you’d be paying too much for the miles (not to mention the black mark on your credit score).

But hey, if you earn enough to qualify for a UOB Visa Infinite Metal Card or UOB Privilege Banking Card, you should be financially-savvy enough to know what you’re doing, right?

Right?

(HT: Pep)

🤡

Please report to the authority. Encouraging card holders to be delinquent with the objective selling miles is untoward of being a good corporate citizen.

This feels wrong.. Is it even legal for UOB to encourage not paying your credit card on time?

I think it’s usually 21 days after statement date for payment. So if u min max this it will be around $150 for 10,000 miles. Cardup is still cheaper if u have Uob infinite cards

oh yes you’re right it’s 21 days. so the price does drop to a more reasonable level, though you’d have to factor in the hit to your credit score and the fact you’d have to time everything just nice so that your $10k transaction posts the day your statement cycle ends.

and of course, the first 270 cap.

I’m afraid I don’t know anything about this in Singapore but in the US, paying only part of your CC is not delinquent in any way. You can carry for years on end – as long as you are paying more than the minimum due, you are not delinquent. You have simply an outstanding balance. Because only the minimum payment is truly ‘due’. Not paying a single dollar on the due date makes you delinquent. But carrying 10k forward every month – while incurring and paying off another 10k, too – is a perfectly fine use of your credit line.… Read more »

Do you not have to pay interest on the balance in the US?

I had to check if it’s 1 April. Can’t believe I’m seeing this- are they actually encouraging customers to take on credit card debt? And not just that, they’ve the audacity put a “first X” clause after their customers (1) suffer the 20% interest rate (2) put their credit scores at risk.

Who tf okayed this?

i assume they still need to pay the minimum rather than putting the bill aside, otherwise the penalty would be way more than the incentives

its not delinquency as long as minimum sum is paid. I am from the industry and we did something similar many years ago. Got hauled up by MAS and had to can the program.