One of the great trends we’ve seen in recent times is the democratization of lounge access. 10 years ago, airport lounges were the sole domain of the well-heeled premium cabin traveler. Now, even average joes can get lounge access with the right credit cards.

Of course, not all credit cards are made equal. Here is an overview of the lounge benefits offered by different credit cards.

[table id=7 /]

When selecting a credit card for its lounge access privileges, ask yourself

(1) What network of lounges does the credit card give access to?

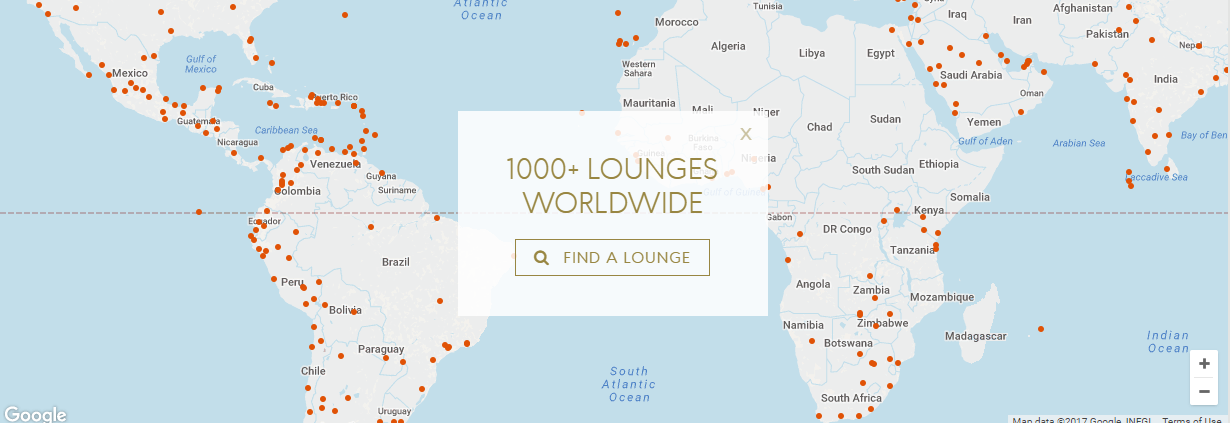

Priority Pass (PP) is by far the most common (and the largest) lounge access network across credit card providers. With more than 1,000 lounges worldwide, you’re almost certain to find a PP-affiliated facility wherever you’re heading.

As nice as it is to have lounge access in an airport like Singapore, it’s not strictly necessary. Lounge access is more urgent when you’re in a complete dive of an airport with no Wi-Fi, clean toilets, F&B concessions or even a place to sit. And trust me, such places exist. in those cases, it’s great to be able to whip out a PP and get access to a place of relative less misery.

But not all credit cards give Priority Passes. If you sign up for the Krisflyer Ascend, you’ll get 4x lounge vouchers that can be redeemed in Singapore or selected Plaza Premium Lounges worldwide. It’s a decent list, but it’s certainly not the 1000 range that PP is in. Similarly, the OCBC Voyage gives access to 70 Plaza Premium lounges worldwide. The quality of Plaza Premium lounges is more consistent than the Priority Pass network, but you lose out in terms of reach (note that a lot of Plaza Premium lounges can be accessed through the Priority Pass network anyway)

(2) How often can I go?

Unless you’re signing up for a top tier Visa Infinite card (min income ~$120K), you’re probably going to be getting a PP with 2-3 free visits a year. There’s nothing stopping you from signing up for multiple Priority Passes via different credit cards though, and your visits do stack.

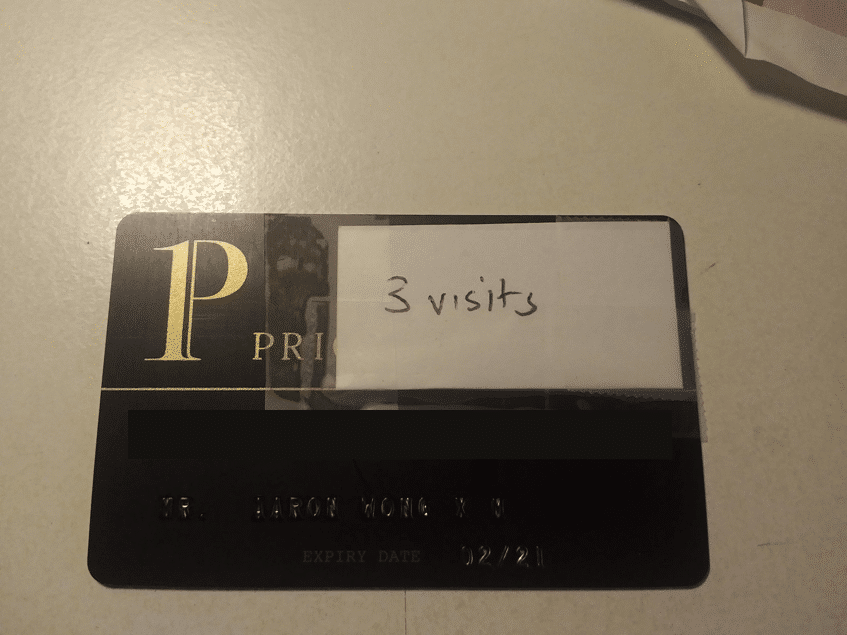

Anyway, if you’re a true miles geek, you will before long have multiple Priority Passes. They all look the same, and if you don’t track them you’re going to forget which ones still have free visits on them and which don’t.

The minute you get a Priority Pass, get a sticker and paste it on the card, writing the number of free visits you have on that particular pass. Then cancel them out as you go along. Trust me, I wish I had done this because mine are a complete mess now.

(3) Can I bring a friend?

Of course. The question is whether you can bring one for free. OCBC Voyage and Citibank Prestige let you bring one guest for free, as many times as you want. Citibank PM and DBS Altitude let you split your two free visits between yourself and a guest.

As for the rest, you’re looking at paying US$27/S$38 once you exhaust your free visit quota. Some lounges may close one eye to bringing a small child, but YMMV.

(4) Are the lounges worth it?

The vast majority of Priority Pass lounges will be run by 3rd party contractors like Plaza Premium or the airport authority (although some airlines will also sell lounge access to Priority Pass). Therefore the quality is highly variable.

For example, some of the refurbished Plaza Premium lounges are really nice. Here’s Hong Kong, for example-

Or the Star Alliance lounge in Sao Paulo, also open to Priority Pass cardholders

In the good lounges, you’ll find clean showers, free alcohol, well maintained furniture and possibly other distractions like spa services (although if you access via Priority Pass it’s likely you’ll have to pay).

And on the other extreme you will have some very, very miserable lounges. Lounges so miserable I can’t be bothered to add photos of them (I can think of a couple I’ve visited in China and India though…). These will be nothing more than places to sit and wait to board, with some token soft drinks and a vague sense of exclusivity.

The best precaution against wasting your limited lounge visits on a crappy lounge is to simply ask at the front desk whether you can have a quick look inside before you decide. I’ve never had anyone say no to this before.

Another thing to note are that some lounges may impose time limits in theory, though I’ve never seen these actively enforced (since it’s simply logistically too difficult to track who came in when).

Not sure if it is worth adding in, or even relevant to this article, but the SCB Priority Banking Visa Infinite Card gives unlimited PP visits. No annual fee provided you qualify as a PB member. I’ve been maximising use to this to great effect by trying out almost all the PP lounges I come across.

Or you could get a maybank vi which waives the first year annual fee and enjoy unlimited lounge visits for a year…

Hi Aaron, can also add that HSBC VI allows unlimited visits for supplementary cardholder (but no guests).

And SCB Priority VI allows unlimited visits as well. Obviously that requires a certain minimum AUM.

Yep. 200k minimum AUM for SC Priority.

Good comments made, be sure to distinguish between the 2 SCB Visa Infinite cards: Normal VI and Priority VI.

Normal VI: 6 passes as aaron mentions, but can be split with guest as well i.e. cardholder + guest = 2 passes used.

Priority VI: unlimited passes only for cardholder.

thanks all. have updated to add these in.

It’s quite confusing when credit cards issue separate PP accounts/cards and you have to manage them separately… You can’t register just the one PP for your access.

that’s when you go low tech with sticker and marker

Couple of comments: 1. HSBC maintains their own lounges for Premier customers and I think they have it only at 4 places, one of the is IST, and second – HKG. Considering how crappy the place is in IST, I could not imagine anyone in clear mind going at that lounge if they have Star Alliance Gold and can go to the best lounge in the world – TK CIP lounge at IST. 2. In the list of crappy PP lounges please add one post-security at FRA. I went there for the purpose to take shower and first – it… Read more »

Good informative article Aaron. @invisible: where is the HSBC lounge at HKG? I’ve been to the one in IST but based on a casual search online couldn’t find where the one in HKG is located. A great lounge the PP gives access to is the Air China First Class lounge in Beijing. It’s open 24/7, offers tea tasting sessions and has private rooms available to sleep in (free of charge I think). It’s not up to the level of CX’s First Class lounge in HKG or anything but still a very nice lounge to access. Another very nice one you… Read more »

Honestly, I do not remember where it was at HKG because last time I was there in 2014. Might have closed since that.

Don’t waste PP visit at Bangalore’s Int’l Airport. The lounge’s only chilled drinks are mineral water and some juices in jug. Nothing else, no canned drinks.

This is incorrect. It offers free booze & food counter that makes eggs & dosas (Indian pancakes, for the uninformed), besides soups, salads, breads, pastries.

Agree. I really liked the live dosa station and thought the lounge was very nice. I visited it last a couple of years ago though.

I think the SCB Normal VI title is not showing in the table. Otherwise, thank you for the compilation!

hi raymond, what do you mean not showing?

The SCB VI text was not showing in my Chrome and Firebox browser at all and shows up as a blank cell.

I looked at the HTML source and I found the problem – the SCB VI text with your affiliate link is an ad.doubleclick.net based link. Browsers like Chrome and Firefox have built-in adblockers that block these links and the text with the link by default these days – that is why it was not showing in my browsers.

interesting, i never knew this. thanks for pointing this out, i’ve just changed the link. does it work now?

Yup, it’s showing up perfectly now. By the way, great work on your site.

I have an Amex Platinum issued by Amex Australia (for those interested, 2x unlimited PP each with 1 guest free – the 2nd PP is for a designated supplementary) I have found as well that Amex Platinum guesting is a bit inconsistent: – no guests for delta – 1 guest for PP – typically 2 guests for amex lounge but depends on location I have found that lounge benefits for Amex Platinum extend to supplementary cards, except for PP, since entry is granted based on the card itself. Great for me since amex Aus issues free supplementary cards, not sure… Read more »

My other follow up comments in relation to non platinum stuff:

1. You left off diners club – 2 visits per year in Singapore, but overseas is less stingy if you can get a hold (e.g. unlimited for US Diners)

2. The 3hr limit has been enforced on me in the past by limiting your entry to the 3hrs prior to departure. At the time I had a US issued Diners with unlimited entry, so the agent just swiped me twice for 2 entries

The Diners card issued in Singapore only allows 1 free lounge visit per year.

diners club added, thank you.

Do you plan to add HSBC lounges I’ve mentioned?

thanks for the heads up- are you able to point me to a list? did some digging online and apparently there are some conflicting lists

http://www.airliners.net/forum/viewtopic.php?t=698801

Things are apparently complicated here…

First, I was thinking about HSBC’s _own_ lounges, which as I said and remembered was just 4 in the world, but seems they are gone and there is no information about these lounges anywhere in the HSBC site.

However, what is at HSBC UK website – stating that HSBC card gives FREE unlimited access at lounges under LoungeKey

https://www.hsbc.co.uk/1/2/credit-cards/hsbc-premier-world-elite-credit-card

Then you start reading at other places and it says that lounge might (or will) charge 15 pounds for access

https://www.expat.hsbc.com/1/2/hsbc-expat/products/cards/hsbc-premier-mastercard/details

On loungekey website no clarification either

https://www.loungekey.com/en/hsbcworldelite/faq

So I think until confirmed I would cross it out…

Uh I’ve got a dumb qn. Is there anyway (other than pasting stickers on the card) to track how many times I’ve used a card? Cos I’ve totally lost track and the lounge agent can’t tell.

PP website and app.

Pp cards issued by Citi cannot be tracked thru website or app.

A little known card, the ICBC UnionPay Platinum Credit Card, provides unlimited access to ICBC Lounges in mainland China for domestic flights.

http://singapore.icbc.com.cn/ICBC/%E6%B5%B7%E5%A4%96%E5%88%86%E8%A1%8C/%E6%96%B0%E5%8A%A0%E5%9D%A1%E7%BD%91%E7%AB%99/en/CommercialBankBusiness/CreditCards/CardsPrivileges/

Citibank PM card link not working?

apologies about that. it’s supposed to clickout to the premiermiles card but for some reason defaults to rewards all the time. let me try to get that fixed

You didn’t bother mention Citi Prestige ($250 travel credit, 4th night free), American Express Platinum ($200 travel and Uber credit, 5x points per dollar on airfare) and Chase Sapphire Reserve ($300 travel credit, 3x points on travel and dining), all of them came with unlimited Priority Pass for all cardholders and $100 Global Entry credit.

That’s because the ariticle is referring to cards issued in Singapore and the benefits offered here. Chase sapphire isn’t available in Singapore and Singapore issued Amex Platinum cards don’t have the travel benefits you mention. This entire blog is almost exclusively written froma Singapore context.

well…world domination can’t be too far away.

Has anyone successful used 2 of your pp cards for yourself and your travelling companion? The lounges used to allow this but recently can’t do so. Was wondering which lounge gives more leeway.

Hey Aaron.. wanna add one more card to the list if you have some time? BOC VI has 2 free visits for plaza premium lounges.

added, thank you!

SCB PVI Priority Pass benefit seems to have changed. No longer unlimited. 4 visits yearly with below 200k AUM, 24 visits above 200k AUM, unlimited for Private Banking clients https://av.sc.com/sg/content/docs/sg-pbvi-tnc-full.pdf

Hmm, interesting! On the one hand it’s sad to lose unlimited, but it seems like there’s no limit on number of guests that you can bring in – so you can bring in 4 ppl in one visit, for instance.

thank you for pointing this out let me analyze it and get something up