Citibank recently relaunched their rewards points program in Singapore to bring it in line with the rest of the world.

The revised rewards program is called ThankYou and features one of the largest rewards catalogs of any Singapore bank.

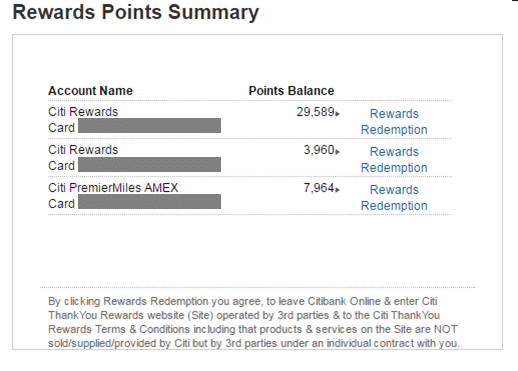

My biggest gripe with Citibank is that their system doesn’t pool your card rewards points by default. This means that if you have a Citibank Rewards Visa, a Citibank Rewards Mastercard and a Citibank Premiermiles card, you’ll end up having 3 separate points balances, as I do.

- You can only pool together Thank You points. Premiermiles cannot be grouped together with Thank You points when making a redemption. In other words, you can pool Citibank Rewards Visa and Citibank Prestige, for example, but you couldn’t pool Citibank Prestige and Citibank Premiermiles

- I’ve heard mixed reports of success in getting the CSO to agree to the pooling, so YMMV

I don’t think it’s technically very difficult to get the system to pool points into one balance (or, in the case of the Citibank Premiermiles card, changing the earning structure so the Premiermiles earns Thank You points, in the same way that all DBS cards (Altitude included) earn DBS points). Therefore the fact that the system is designed this way suggest a deliberate choice, which is very customer-unfriendly.

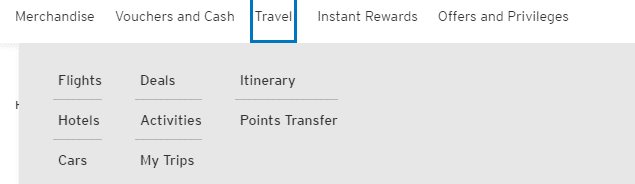

If you can live with that, Citibank offers you many, many options to spend your ThankYou points. You could redeem your points for

- Merchandise (like electronics, bags, home appliances)

- Vouchers and cash

- Travel (flights, hotels, car rentals)

- Airline and hotel points

- Instant rewards

Of course, just because you can doesn’t mean you should. It all boils down to what value you’re getting per point. The topic came to mind because a Citibank advert popped up in my Facebook feed advertising a special promotion for redeeming Citi ThankYou Rewards points. From now till 31 March 2017, you can use your Citibank points to redeem hotels or airline stays for 8% less.

I realise this has the potential to confuse people. It doesn’t mean you get a bonus when you transfer your Citibank points to Krisflyer, Asiamiles et al. It means you get 8% off when you use your Thank You points as currency for buying revenue tickets

Still confused? Read on.

What baseline value should you expect for your points?

A good starting point when we analyze the various redemption options that Citibank has on its ThankYou portal is to think about what value we’d get if we ignored all that noise and just redeemed our points for miles.

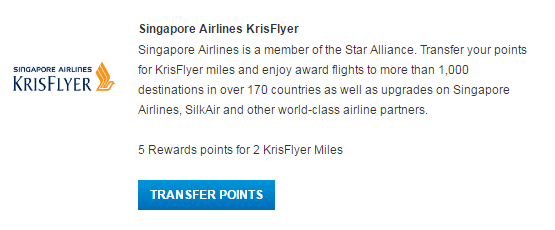

Citibank has the longest list of airline transfer partners of any bank in Singapore. Your points transfer at the rate of 5 points= 2 miles for

- Singapore Airlines

- Qatar

- Malaysia Airlines

- Thai Airways

- Qantas

- Cathay

- British Airways

- Delta

- Etihad

- Air France/KLM

- Garuda (hahahahahahahahaah)

Obviously, 1 Krisflyer mile <> 1 Delta Mile <> 1 Etihad Mile. So our valuation here will depend on what we convert our Citibank points to. Here I’m going to defer to Lucky’s valuation of miles and points. He doesn’t list all of the airlines that Citibank transfers to, but based on his chart Krisflyer miles are the highest value transfer option at 1.5 US cents (2.16 Singapore cents) per mile.

My thought process on how to value miles has evolved a lot over the past year- I definitely don’t think that Krisflyer miles are worth 4-5 cents anymore (and there’s a good slide on the presentation I made in December on why theoretical value <> actual value). My current valuation hovers between 2 and 3 cents. But anyway, if we take 2.16 cents as the “right” value, then 1 TY point= 0.4 miles = 0.86 cents

This is the value we should mentally anchor ourselves to when analysing the different options

[Note: for the purposes of this article, I’m going to be referring to Citibank’s pricing in terms of Thank You points. If you have a Premiermiles card, you will still see exactly the same portal and redemption options, but your pricing will appear in terms of Premermiles points instead of Thank You points. My calculations tells me that Citibank reliably uses the valuation of 1 Premiermile= 2.7 Thank You points]

Travel (0.42 cents per point)

This category confuses a lot of newbies because they confuse it with points transfer. It doesn’t help that Citibank puts Points Transfer as an option under travel either.

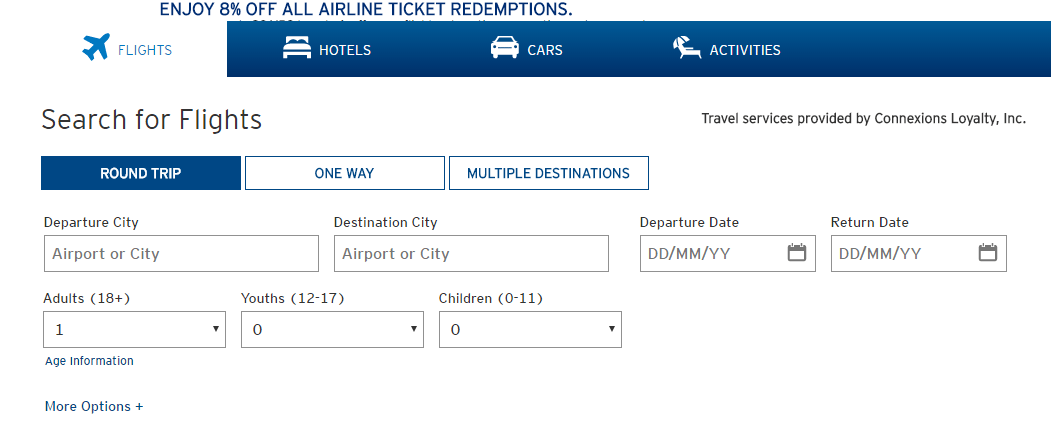

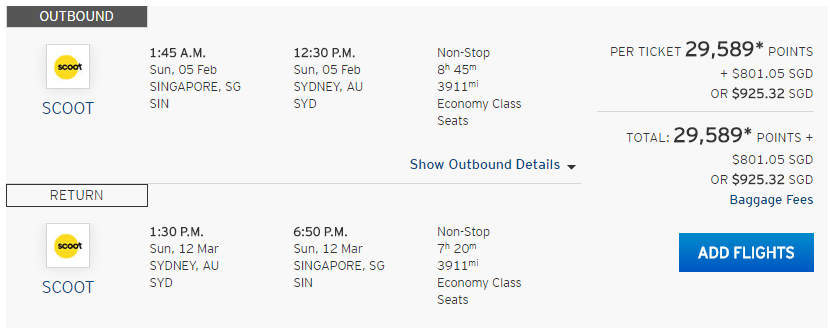

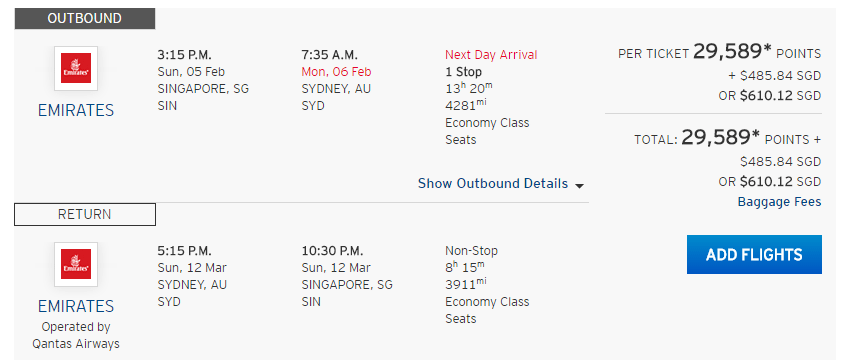

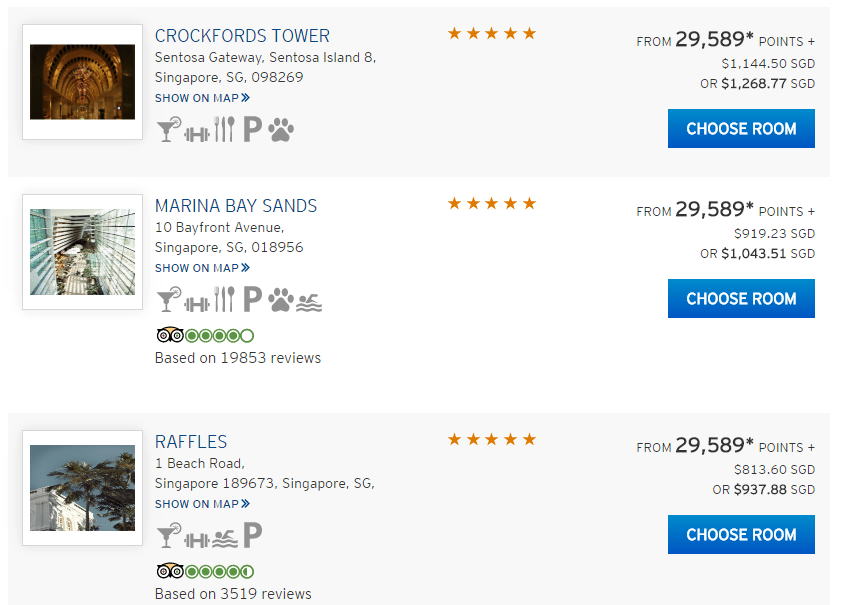

But redeeming your points for travel is not the same as redeeming your points for points transfers. What is going on is that Citibank partners with a 3rd party agency called Connexion Loyalty, which works pretty much like any other OTA (online travel agent- think Hotels.com, Expedia etc). Connexion Loyalty has a search engine that lets you look for flights, hotels or car rentals, in the same way you would using any traditional online booking engine.

The difference is that Connexion Loyalty takes those revenue prices and converts them into the bank’s proprietary currency (in this case Thank You points) based on some internal valuation metric. I’ve found that metric to be 0.42 cents per point.

You can use the booking engine to book air tickets, for example. I’ve checked the prices that the Connexion portal pulls and they’re at least on par with those I find on Kayak. That’s good, because it’d be a double whammy if they gave you a lower value on your points + charged you higher prices (ahem Krisshop’s pay with miles option ahem). But the valuation of 0.42 cents is only half of what you’d get if you converted your miles to a frequent flyer program. You could argue that when you redeem your miles with Citibank, you’re at least guaranteeing availability (because your points are used to buy revenue tickets), whereas if you transferred your points to an airline FFP you might not be able to find award space. That’s fair enough, but in my mind it certainly doesn’t warrant taking a 50% haircut on value.

You can book hotel rooms through the ThankYou portal as well, getting the same value as you would for flights. I didn’t check these values against what you’d find on 3rd party OTAs, so if you’re even considering this you owe it to yourself to find out if the same rooms are available elsewhere cheaper (or if any OTAs are running special credit card tip up promotions)

Remember that 8% discount I was talking about at the start of the article? Citibank is offering 8% off the number of miles needed to book hotels or flights through its ThankYou portal for the first 1,800 customers who enter the code SGAIR8 or HOTELS at checkout. That boosts your value per point to a whopping 0.45 cents. You’ll excuse me for not jumping on this.

You aren’t limited to just flights and hotels, of course. You could even buy tickets to activities to do at your destination. If spending 2,540 points on a 7D motion ride at Suntec City mall floats your boat, more power to you. Excuse me for finding this just a little bit cynical as I imagine Connexion earns some sort of commission on these sales while still charging you the regular walk up rates you’d pay at these attractions anyway. You’d be much better off buying the tickets yourself.

Vouchers and Cash (0.28-0.34 cents)

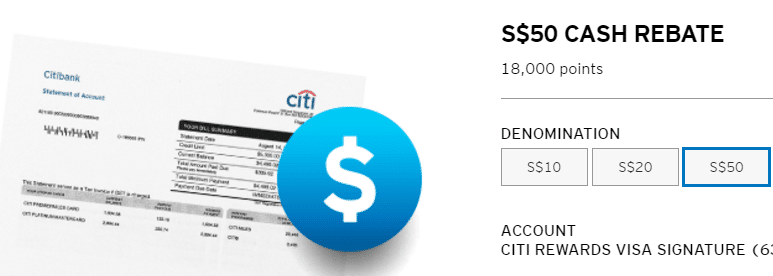

Your Citibank points can be used to redeem a cash rebate on your credit card statement in denominations of

- S$10 rebate- 3,600 points

- S$20 rebate- 7,200 points

- S$50 rebate- 18,000 points

There’s no scaling effect here. Your points are valued at 0.28 cents each no matter which denomination you choose. Why is this value even lower than travel? It’s probably due to the fact that Citibank wants to incentivize people to book travel through its portal. After all, when you book through them they earn some commission from the hotels and airlines. Getting a cash rebate, on the other hand, is a straight out of pocket cost for Citibank. So of course they’ll give you less value per point.

You can also redeem your points for a range of gift vouchers at 26 different merchants from Yoshinoya to entire malls like Wisma and United Square. The average value you get is 0.34 cents per point.

If you’re in a charitable mood you can make a S$10 donation to selected charities for 2,890 points, or 0.35 cents per point. Maybe the value’s a bit higher here because Citibank gets to write off your donation as a tax benefit on its own books? Either way, if you want to give to charity, there are much better ways of doing so.

Merchandise (0.2-0.4 cents per point)

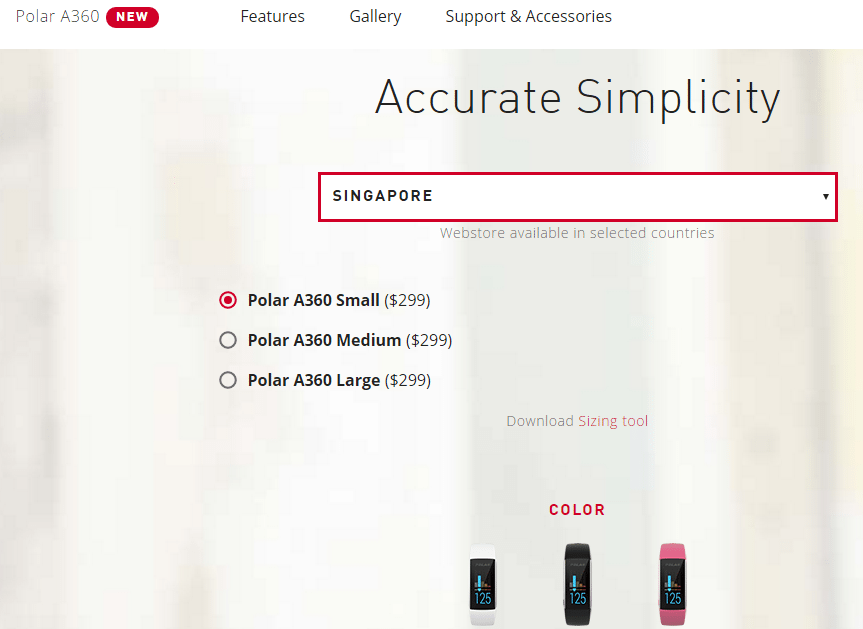

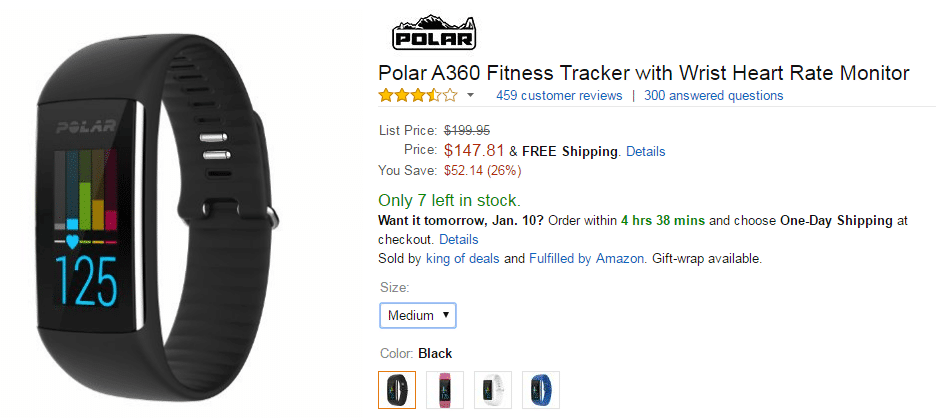

This is one of the trickiest categories to cover because the retail price of goods can differ dramatically depending on where you buy them from. In the example below, it’s easy to value the $50 North Face and $50 Ping Golf voucher, but what about the A360 Fitness Tracker?

If you buy the fitness tracker in Singapore, it will cost you S$299.

But you could get it on Amazon for US$145/S$208 (assuming you can get someone to mule it home for you…try Airfrov?)

I guess what I’m trying to say is it’s very hard for me to compute an exact value for how much you get when you redeem ThankYou points for merchandise (protip: don’t do it), because it depends what sort of retail options are open to you. Based on a completely unscientific sample of 10 data points I’ve got a value that ranges between 0.2 and 0.4 cents per point.

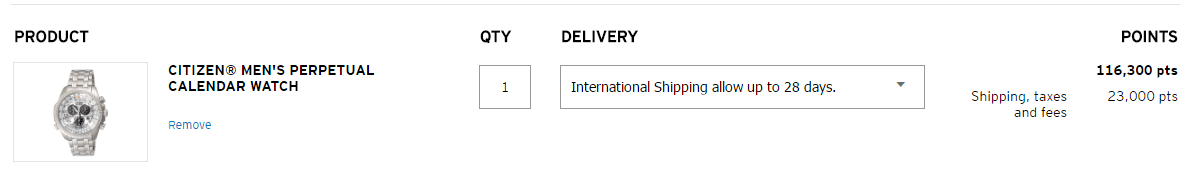

Keep in mind that not all merchandise options come with free shipping- several of them ship from overseas and Citibank expects you to cover the postage too, adding to the total cost. But hey, at lesat Citibank lets you pay for international shipping with your points too!

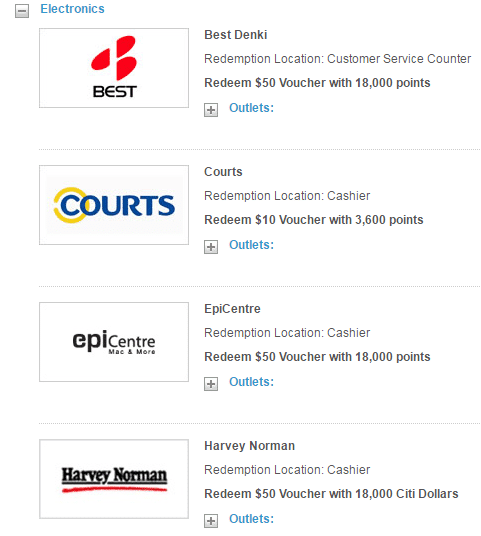

Instant Rewards (0.28 cents)

Citibank has the option of instant rewards at selected merchants, which are conceptually similar to cash rebates, with valuations to match. I don’t really understand why Citibank needs to offer these options given that it’s the same thing as using your Thank You points for a statement cash rebate at the end of the month.

- S$10 voucher- 3,600 points

- S$20 voucher- 7,200 points

- S$50 voucher- 18,000 points

Seems like a repetition if you ask me. You basically go to the customer service counter and redeem an award with your points the same way you’d apply for a cash rebate on the Citibank ThankYou portal. I don’t get it.

Conclusion- so much choice, so little value

The ThankYou portal has so many different reward choices, but taking any option other than transferring your points to miles will yield inferior value. I supposed you could have saved a lot of time reading this article if you just remember the mantra that

Credit card rewards points should always be redeemed for airline miles

None of the alternate options even comes close to yielding 0.86 cents per point.

So do yourself a favor. If you want to buy a toaster, go to an appliance store. If you want to donate to charity, do so directly. If you want to buy attraction tickets, check the attraction’s own website and see if they offer direct purchase discounts. If you want to book a car, fiddle around with discount codes and get yourself the best rate. There’s no reason why you should be spending your hard earned points on any of Citibank’s inferior redemption options.

Bravo Aaron! Love this post!

You are the best Brother Aaron

#keeper

Hi, just a question. Comparing redeeming for miles vs for hotel points, do you see value in doing that for points? I saw that there is a current promo for redeeming Hilton points.

Whilst I am totally in agreement with you and I’m def in the advanced stages of mile hacking for my pleasure… not everyone has the TIME to do what we do… My parents need a kettle I’m not going to stop them from redeeming this illiquid currency into something they need… it has NO intrinsic value… its virtual so for them they “Should” redeem it for that kettle which they would have to fork out $20 to buy from a shop… Sometimes I think we incorrectly assume that a love of travel is a universal thing… I’m guilty of that… Read more »

That is all true but that doesn’t stop me from gently persuading (yelling) at my parents when they do it.

On a related note, I realised I’ve become one of those crazy miles evangelists – to be fair, people DO ask me first, but I can see their eyes glazing over when I launch into a thorough explanation of how I earn my miles.

@P boy do i know that look….

@Anon yes, I totally hear where you’re coming from. all things equal, more choices is better than fewer. But it’s a bit like seeing someone carbo load at the buffet when there’s king crab legs on offer

give them a supp card.

Just wondering, is it better to book tickets using Citibank portal or converting to frequent flyer miles then getting the ticket direct from the airline?

Hi there

I’m relatively new to the miles game. would like to ask, does that mean that even points for supplementary card will be separate from the principal card?

Thanks!

Supp card points earned will be added to the principal card holder pool.

Sorry for a little off-topic, but I’m wondering how I can check if Grab Pay charge is yielding the Cit points. I thought it was, but the reward page of Citibank online doesn’t show where the points are coming from, so I cannot really tell. The card yields 3.25 points for local spends, so charging $50 into Grab Pay should yield 162 (correct me if I’m wrong.) But I can’t find this number on the statement, so that means Grab Pay charge doesn’t yield any points?

Seems like a bit of a noob question, but since Qatar has the lowest cost per mile, is it most economical to transfer any ThankYou points to Qatar points? Thanks to your sage advice, I managed to match my SQ PPS status to the Qatar Platinum Tier – not sure if that confers any added benefits – any idea? A quick (and in the current circumstances, very optimistic) search on both SQ and Qatar shows me that business class on Qatar will cost me considerably less points – for example, SIN to LHR one way as follows: SQ – 92,000… Read more »

hi ben! yes, this particular article you commented on is a bit out of date, given what QR has done with its recent “revaluation” (read here: https://milelion.com/2020/11/25/qatar-airways-privilege-club-reverses-2018-devaluation-book-sweet-spot-awards-to-europe/) this means it’s now better to use QR to Europe, since there’s no YQ and the mileage requirements are lower. there is a stopover in Doha, but like you said, might be nice to break up the journey. between SQ J and QR J, I think it’s neck and neck. SQ J seats are nicer than QR J (unless you get the Qsuite, which I think is guaranteed ex-SIN, or at least it… Read more »