[The following is a sponsored post by DBS. All opinions are those of The Milelion]

Deciding what method of payment to use when overseas is always a tricky question for me.

I could use my credit cards to earn rewards points, but then I’d be hit with overseas transaction fees. I could change money before I fly, but then I’d run the risk of carrying around a large stack of cash. I could withdraw money from ATMs as needed, but I’d incur ATM fees plus be vulnerable to card skimming.

That’s why I find the DBS Multi-Currency Account (MCA) to be such an interesting proposition.

The MCA was launched earlier this year, offering consumers the possibility of zero foreign currency transaction fees while enjoying the convenience of buying forex on-the-go. It currently supports 12 different foreign currencies: Australia Dollar, Canadian Dollar, Chinese Yuan (although you can’t use the debit card feature to pay in this currency) Euro, Hong Kong Dollar, Japanese Yen, New Zealand Dollar, Norwegian Kroner, Sterling Pound, Swedish Kroner, Thai Baht and US Dollar.

But how does the MCA compare with some of your traditional options for paying overseas?

Moneychangers

This will be the go-to solution for most people, and that’s just fine. If you get a good moneychanger, you’re looking at a ~1% spread at most. Of course, you first need to physically visit the moneychanger. For people who work around the Raffles Place area, that’s not really a problem. But for those who work in secluded industrial areas or ulu office complexes it’s not always so simple. And if you forget to change money beforehand, well, good luck with the airport’s exchange rates.

On top of all this there’s obviously the security risk of carrying around a big amount of cash. Then there’s also the question about how much to change- change too little and you might have to incur overseas ATM fees when you run out of cash (or worse, get bilked by overseas moneychangers). Change too much and you either have to make a return trip to the moneychanger on the way back (with the commensurate forex risk) or tie up some of your money till your next trip.

So while it’s definitely a good idea to change at least some cash before you head overseas, this shouldn’t be your only source of forex.

Credit Cards

Despite the fees involved, I’d happily use my card overseas to earn points…when I’m not paying. If you’re travelling for business and have a reimbursable expense account, by all means go for it.

But when I’m traveling on leisure I tend to be a lot more careful about when I use my credit cards, only using them when 10X earning opportunities arise (eg for overseas dining or shopping). Otherwise, I still prefer to transact in cash so as to avoid fees.

I’ve explained it before in this article, but to reiterate: when you pay with your credit card overseas you’re hit by three different kinds of fees- the currency spread (a double whammy if you’re charging in any currency other than USD, because transactions are converted into USD before they’re converted into SGD), the platform fee charged by Visa/Mastercard/AMEX and the bank’s foreign currency transaction fee.

[table id=3 /]

The other issue that annoys me about overseas card transactions is refunds. Suppose I buy something for US$100 on the first day of my trip and decide to return it on the last day. I’ll get refunded US$100, but when the refund works its way back to my card I may end up with less money still. Remember that your card uses a different buying and selling rate, so even if your transaction is refunded immediately you can still get hit. This was the case in the UK where an innkeeper mistakenly swiped my card for GBP54 instead of 45. She refunded the wrong amount literally the next minute, but when I saw my statement the refund amount was less than the original amount debited. I eventually got it sorted out with the bank but still…

Credit cards have a role to play in your overseas spending too, but only in certain circumstances (i.e 10X). Where personal travel is concerned, they shouldn’t be your primary means of spending.

ATM

If you don’t want to carry around large amounts of cash for security reasons, you could withdraw money as needed at an ATM. But the flat fee that banks charge for ATM withdrawals means that it’s financially inefficient to keep withdrawing money (not to mention that you need to be careful about the possibility of card skimming). Moreover, remember that you might end up paying both a bank fee and an ATM fee- I’ve seen this in a lot of places in the States where convenience stores have 3rd party ATMs unaffiliated with any particular bank.

I view ATMs as a source of emergency funds when I travel, nothing more.

DBS Multi-Currency Account

This brings us to the MCA. How it works is simple: you open an account and tag your DBS Visa debit card to it. You then transfer your SGD into any of the 12 currencies supported. When you shop overseas, pay with your DBS debit card and the corresponding foreign currency (except CNY, which isn’t supported) will be debited from your account, with no additional foreign transaction fees.

In my mind there are three main benefits of this arrangement:

- First, the MCA eliminates the need to carry around large quantities of cash

- Second, there are no foreign transaction fees. When you buy a US$100 item, US$100 is debited from your USD account. When you return a US$100 item, US$100 is credited to your USD account

- Third, you have the convenience of buying foreign currency online, and this makes it easy to apply a DCA approach towards your overseas trip. Suppose you want to change S$1,000 worth of USD. You could choose to transfer S$200 every month for 5 months. When the SGD appreciates, you buy more foreign currency. When it depreciates, you buy less. You thus make yourself less vulnerable to sudden fluctuations. You could of course do this with a physical moneychanger, but this saves you the legwork

One important point- there are no foreign transaction fees when you use your MCA, but you still need to be careful not to fall afoul of DCC. If the merchant DCCs your transaction, you’ll be hit by conversion fees as the transaction goes through in SGD.

The chief drawback for miles chasers is that you won’t earn any rewards points with the debit card. That said, there is an ongoing promotion offering S$50 cashback when you spend the equivalent of S$1,500 on foreign currency transactions with your DBS debit card (till 31 Dec 2017, limit 10,000 customers, T&C here).

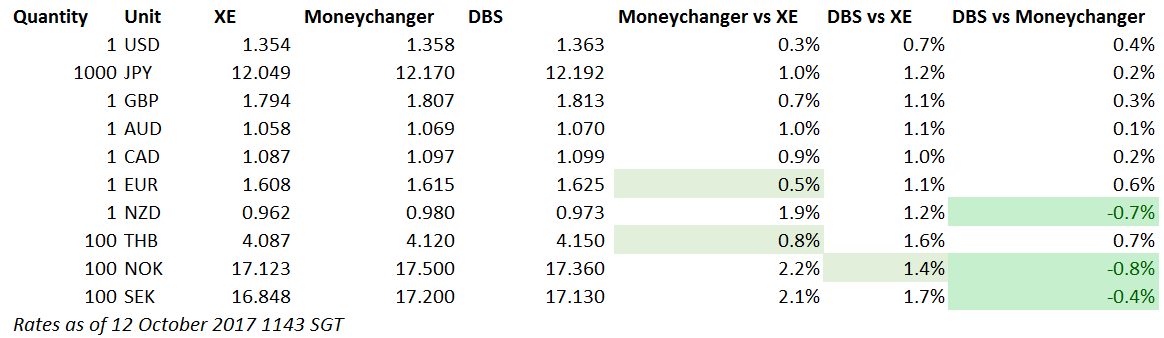

Comparing the rates

The key question is whether the MCA’s rates are competitive. I looked at the 12 currencies the MCA offers and was pleasantly surprised. Here’s how the rate for the MCA measures up versus the XE rate. I threw in the rate at a good moneychanger at Arcade for comparison.

You can see that the spread between the MCA and a moneychanger is marginal. In fact, there are some currencies (NZD, NOK, SEK) where the MCA offers better rates than a moneychanger. Otherwise, the difference is largely <0.5%. You could view that as the convenience fee for exchanging money on the go.

Conclusion

I think the DBS MCA can play a useful role in a foreign spending strategy. My approach would probably be to change a small amount of cash at a moneychanger for places that don’t take cards, bring a few credit cards that earn 10X bonuses overseas, and have my ATM card handy for emergency cash. However, the bulk of my general spending would go through my MCA-linked debit card.

If this sounds like the option for you, have a read of this post that walks you through how to use the DBS MCA.

| Terms and Conditions apply. SGD deposits are insured up to S$75k by SDIC |

sounds super easy and fair in terms of exchange rate. i’m tired of being hit with credit card fees for overseas spend and am going to look into this — thankfully it’s with DBS, which has the politest and most helpful staff in my opinion. thanks

Can the MCA linked debit card be used as ATM card for overseas withdrawal without being hit by overseas withdrawal fees?

that’s addressed here – https://www.dbs.com.sg/personal/deposits/savings-accounts/dbs-multi-currency-autosave/mca-visa-debit-faq.page

For overseas ATM cash withdrawals, DBS ATM fees will be waived for:

DBS Treasures / Treasures Private Client / Private Bank Visa Debit Cards

Withdrawals made using DBS cards at DBS ATMs overseas and Westpac Group ATMs

Otherwise, there will be fees applied

Which means uob/Citibank atm withdrawals are more reasonable. There’re no feeds involved for atm withdrawals from the same bank in other countries. Correct me if I’m wrong somewhere!

Question though – we’ll still be hit by the fee Visa charges for overseas usage, correct?

Nope. No additional fees. If something costs 100 usd, 100 usd is taken from your usd wallet

Some points:

1. Forex rate charged by DBS is still nowhere near as competitive as the moneychangers in Change Alley.

2. Transfer too much into the forex account means you will have to transfer it back to SGD and lose from the spread in the exchange rates.

3. For those of us who collect miles, this is definitely not better when you can earn 4 mpd.

For sure point 3, which is why I’d still bring my 10x cards when I travel. But if it’s a general spending situation where I don’t get reimbursed, the math is less compelling. I’ve visited the moneychangers in change alley and I’ve found the rates to be comparable. i’d think of any spread as the convenience fee for not having to make the trip down

Hi Aaron, me interested in 10X cards when overseas, which one? pls share, thanks,

Here i’m talking about physical card present transactions: UOB PP Amex offers 10X on overseas F&B, citibank rewards offers 10X on overseas shopping, ocbc titanium rewards offers 10x on shopping

oh, and how could i forget uob visa signature. 10x on overseas spending, min $1k max $2k per statement period

Just a little note when using the MCA to draw money from ATM overseas. Your MCA account needs to be the primary account attached to the card (it’ll be better if it’s the ONLY account attached to the card). If it is not the primary account, the ATM might (will) withdraw from your primary account (which is likely an SGD account). The ATM will give no warning and usually u can’t see the account number when using the ATM so there is no way to verify which account the ATM is drawing from (i’ve had a bad experience with this… Read more »

Correct. I settled to have two accounts and two cards – one account – for local usage and its own card. Second account – almost no SGD inside and has its own card while refilled with the destination currency before travel.

However all this does not worth the hass because CIMB’s currency conversion rates are much better than DBS and if withdrawal is at VISA network – there will be no withdrawal fees either.

for cny, can we withdraw cash from foreign atms using the mca linked atm card? any charges involved?

same response as to IZ-

https://www.dbs.com.sg/personal/deposits/savings-accounts/dbs-multi-currency-autosave/mca-visa-debit-faq.page

For overseas ATM cash withdrawals, DBS ATM fees will be waived for:

DBS Treasures / Treasures Private Client / Private Bank Visa Debit Cards

Withdrawals made using DBS cards at DBS ATMs overseas and Westpac Group ATMs

There is a better card for general spend if your goal is to minimize transaction costs. The ICBC Global Travel Mastercard. There is the obligatory 2.5% markup (1% Mastercard + 1.5% Bank) but there is also a fuss free 3% cash rebate for foreign currency spend – no minimum or maximum. The 0.5% gain helps offset the Mastercard exchange rate spreads. Net net you’re pretty much at XE rates even after factoring in the fact that Mastercard (or is it the bank) converts the spend currency to USD before converting it again to SGD. Other weaknesses of MCA: – You… Read more »

the comments is starting to make this post looked skewed towards DBS multi currency account liao

Aaron makes it clear upfront the post is sponsored. The MCA is not a bad choice for many of the reasons laid out in the post. I had seriously considered it when it came out. But it has some glaring weaknesses compared to what’s out there in the market.

I’m not sponsored by ICBC. I’ll add another downside of the ICBC card to prove that: it is fugly!!!

There are definitely credit cards out there that can be useful for overseas purchases thanks to rebates on forex fees eg ICBC. But if you’ve resolved to forego earning miles and points anyway, then I don’t see much difference between using that versus using something like the MCA (ok, for ICBC you can argue that you actually earn back 0.5% because of the current promotion, however long it lasts). also, this wouldn’t be an option for a student or anyone who for whatever reason can’t get a credit card. FYI there is also the citibank debit mastercard that is functionally… Read more »

I don’t disagree with your last sentence. There is definitely a niche this product appeals to.

Tho to add in for citi, if you dont want ABBA, you can go for the citi maxigain.

ICBC card sounds interesting. wasn’t aware of it before but will go read up.

Even I didn’t know about this card. Interesting one. I was going through the T&As and it states that, “Cashback earned in that calendar month shall only be used to offset Singapore dollar transactions incurred in the following calendar month”. It also states that, “Cashback must be utilized within 12 months from the date it is credited into the Card account.” So basically if you go abroad and spend a bunch of money you’ll have to use this card locally as well to truly get your cash back, which means forgo some miles on local spend.

Yes, but you also get 1.5% rebate on local spend. So that’s foregoing 1.4 miles (on PRVI) or 1.2 miles (on Premiermiles or Altitude) for 1.5 cents. Not great, but unless you’re earning tons of rebate, not a big deal. Alternatively, your local spend can be on the few categories that generally don’t earn miles like transport card top-up or insurance.

Again, this card is for general spend, an alternative to MCA (I’d argue a better one). It is not a card for the 10x categories.

The post doesn’t provide the other requirements for maintaining the account. You need a pretty high ADB. Also since the DBS interest rate is pathetic; this might not work out so well.

you’re right- maintenance requirements can be found in this post: https://milelion.com/2017/11/07/getting-started-dbs-multi-currency-account/

MCA can hold SGD. and you’re going to need a savings account anyway where you’ll park a few months worth of salary at low interest.

Just to add, the DBS Multiplier account also functions as an MCA account, which might allay some concerns regarding low interest rates.

Sorry, but I personally feel that you’ve lost some credibility with this sponsored post. If my math is correct, even with Citi PremierMiles or DBS Altitude which only gives 2 miles per $1 spent overseas, you incur roughly 3 cents of transaction costs – that’d work out to 1.5 cents per mile, which according to your other posts is a more than acceptable price at which to buy miles. I appreciate that you’ve been somewhat balanced in presenting the pros and cons of MCA versus credit cards, but I really don’t see a convincing case for most miles chasers to… Read more »

Here’s the rub: I won’t hesitate to use my cards overseas where 10x opportunities exist because the fees are more than offset by the points earned. However, where only general spending 2mpd type rates exist, the proposition is much more marginal. When you take into account the currency spread imposed by Visa, your fees are closer to 4% than 3%. And that means you’re close to the 2 cents mark, which is just at the margin. (EDIT: As someone else pointed out, i’ve overestimated the costs of using your cards overseas because the basis for comparison should be your cheapest… Read more »

I disagree. I think you are overstating the cost of using a credit card for foreign currency charges. IMHO, the comparison with XE rates is irrelevant because the XE rate is one that is not available to retail customers, ie you cannot get currency at that rate, so even if on paper you are paying 4% more than that, the ‘cost’ of those miles is not 2c. The ‘cost’ is the difference between ‘credit card rate’ vs rate you can get forex at, which is either ‘moneychanger rate’ or ‘MCA rate’. I do travel a fair bit for work and… Read more »

the more i think about it, the more i agree. conceptually you’re completely right- the right rate to compare any option to is your lowest cost alternative, not the XE numbers which you wouldn’t as a consumer be able to access. So yes, the implication is that the cost of buying miles through this method decreases. for me personally, once i’ve maxed out my uob visa signature for the month and there are no other 10x opportunities i usually default to cash. where i see MCA fitting in for me is in place of those cash transactions. and again, this… Read more »

“but again, you can easily buy miles in singapore below the 2 cpm level through annual fees and things like the current cardup/prvi miles promotion, plus, it’s helpful to keep in mind the issues that arise with refunds and fx movements when you use your card” My point is that you are, in all likelihood, paying less than a cent per mile using a 2 mile/$ card for transactions in foreign currency, which is much less than any other form of ‘miles buying’. So as long as you are still buying miles, be it from paying annual fees, or taking… Read more »

Well, a lot of us don’t travel on business, and not everyone has enough recurring big ticket expenses like rental to buy miles via cardup. For me, besides buying miles outright from Lifemiles, AA, OCBC Voyage etc, overseas (personal) expenditure using credit cards is the next most important source of miles, at under SGD0.02 per mile.

By the way, did you consider that credit cards offer some protection that debit cards don’t? E.g. the MCA debit card is stolen, any money lost is gone forever, whereas for credit card there’s still some recourse.

But yes, to each his own.

“The other issue that annoys me about overseas card transactions is refunds. Suppose I buy something for US$100 on the first day of my trip and decide to return it on the last day. I’ll get refunded US$100, but when the refund works its way back to my card I may end up with less money still. Remember that your card uses a different buying and selling rate, so even if your transaction is refunded immediately you can still get hit. This was the case in the UK where an innkeeper mistakenly swiped my card for GBP54 instead of 45.… Read more »

i find the fx rates terrible from DBS

you get charged to deposit cash notes of foreign ccy i believe, so cannot go to the arcade then deposit at bank

i use a money transfer company like WorldFirst to buy my ccy. I would use WorldFirst to fund these MCAs.

all banks charge to deposit cash notes of foreign currency. It’s standard practice.

Once upon a time, DBS MCA was a low key account that did not charge fees for FCY deposit and withdrawal (at least not for USD). It was used mainly those “in the know” with frequent USD transactions. I think it was at the beginning of this year that they decided to “promote” the account and start charging fees. I remember someone in my office mentioning long lines to get USD cash out in DBS when they announced the change.

Could you share some of the disadvantages too? Thanks.

[…] transaction fees and don’t mind skipping the miles, you may want to consider getting a DBS Multi-currency Account, which allows you to top up a debit card with pre-purchased foreign currency. The newly launched […]