[The following is a sponsored post by DBS. All opinions are those of The Milelion]

In my previous post I explained how the DBS MCA can be a more convenient and cost effective way of paying for overseas transactions. In this post, I’ll walk you through the opening, topping up and using of an MCA.

Opening your MCA

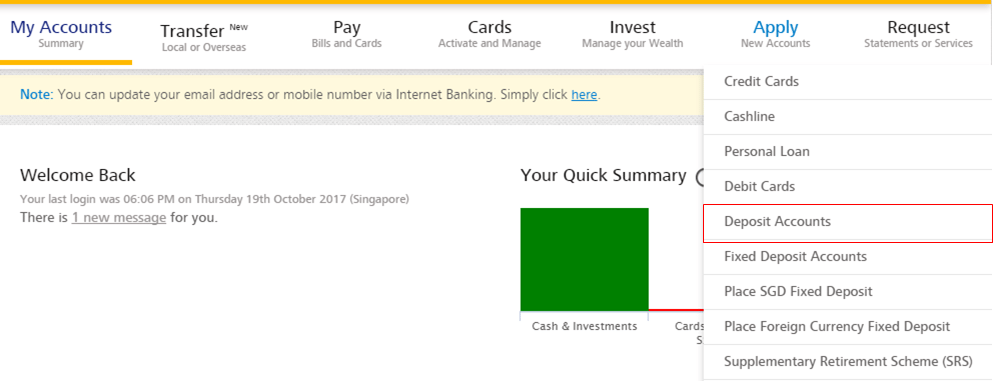

Opening the account is a breeze, assuming you’ve got your ibanking token handy. When you log into ibanking, look for the Apply tab on the top and click on “Deposit Accounts”.

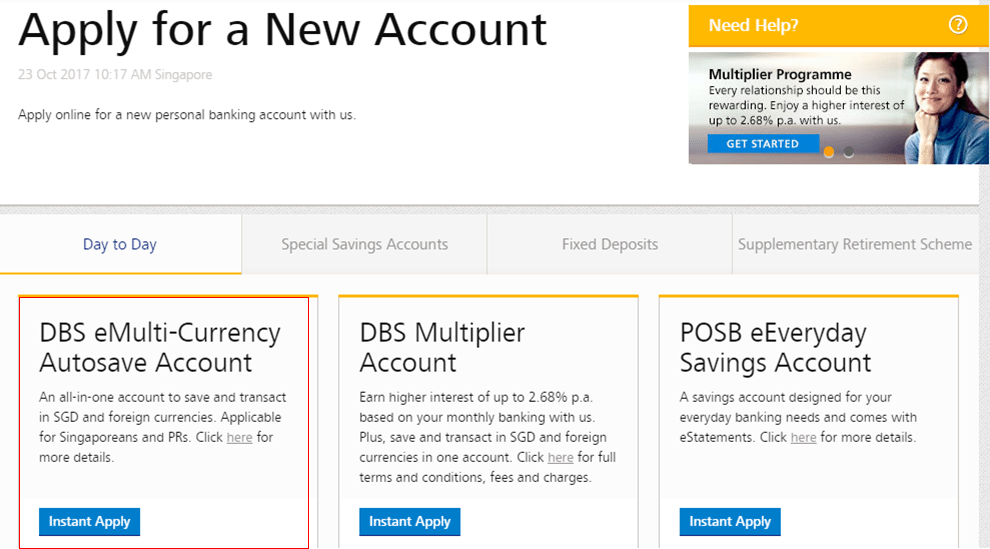

After entering your OTP, you’ll be brought to a new screen showing you a list of accounts you can open. Click on “DBS eMulti-Currency Autosave Account”. (OT: you might be interested to know that DBS is running a promotion offering $20 of free money plus a chance to win a GoPro Hero 5 for anyone who opens a new account online from now till 8 Jan 2018. This is for new and existing customers. Won’t go into full details but you can read them here)

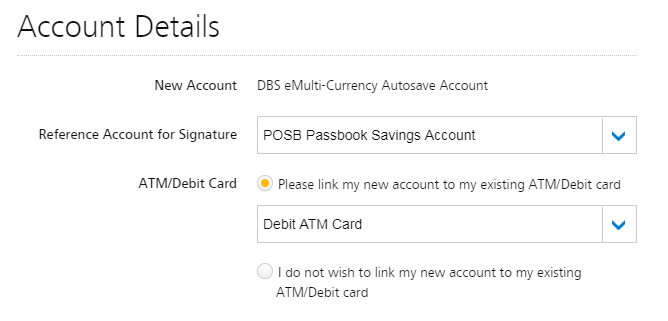

You’ll then be brought to a prompt screen that asks you to select the reference account for signature and which of your existing debit cards the newly-opened MCA should be linked to.

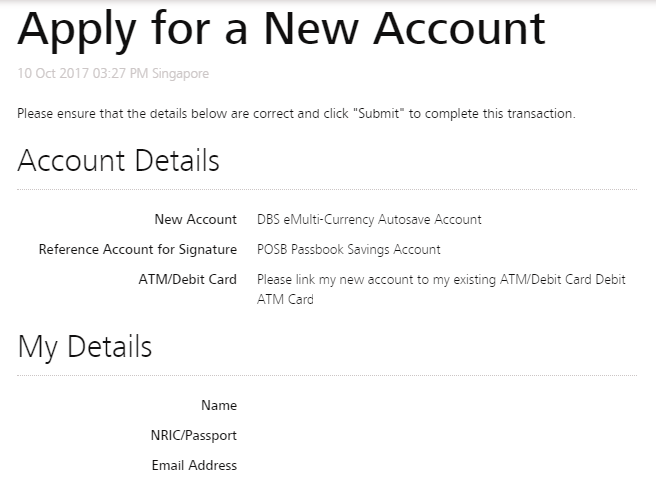

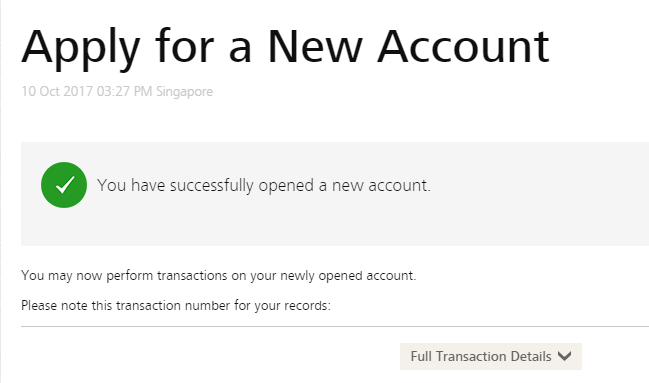

After that, verify your details are correct…

And that’s it. Your account is open and you’ll immediately be able to perform transactions on the new MCA.

Topping up your MCA

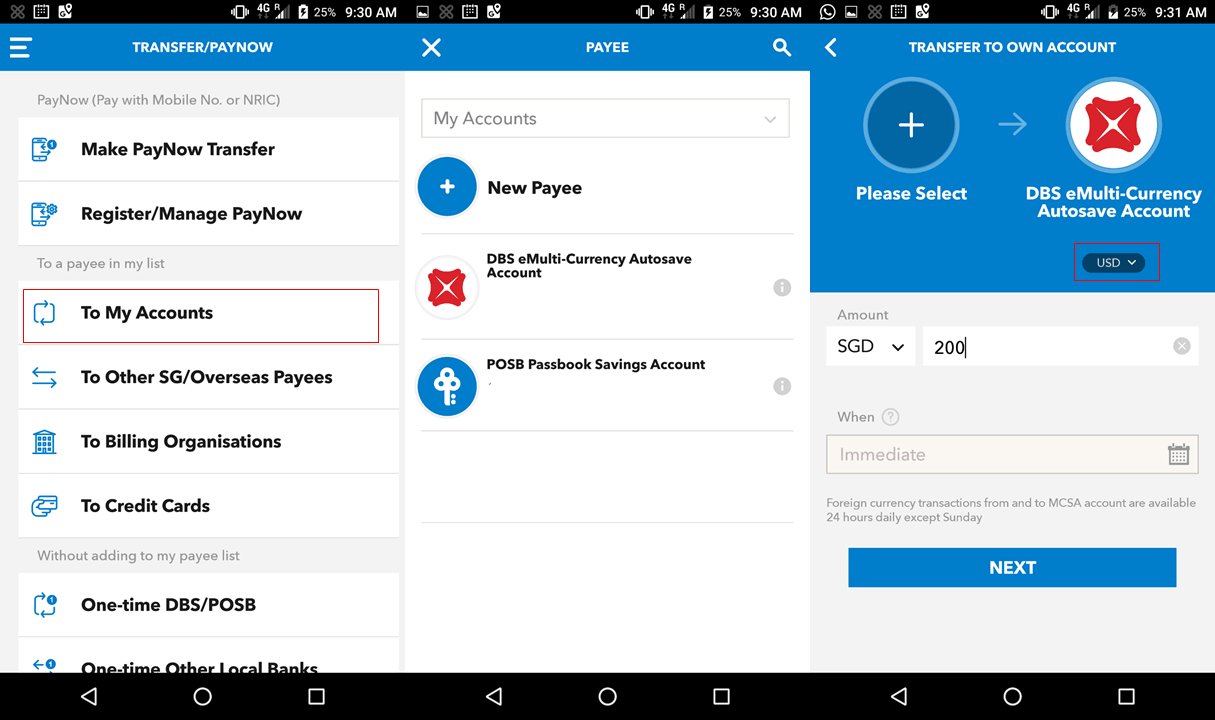

Moving SGD into any of the 12 currencies supported by the MCA is simple. You can do this via ibanking on your desktop, but I wanted to show you how it works on your phone so that you can do this on the go.

After you login to your account on the DBS app, select “Transfer/PayNow”, then “To My Accounts”. You’ll be prompted to select an account to transfer to. Pick your DBS eMulti-Currency Autosave Account. Here’s where you enter how much you want to transfer.

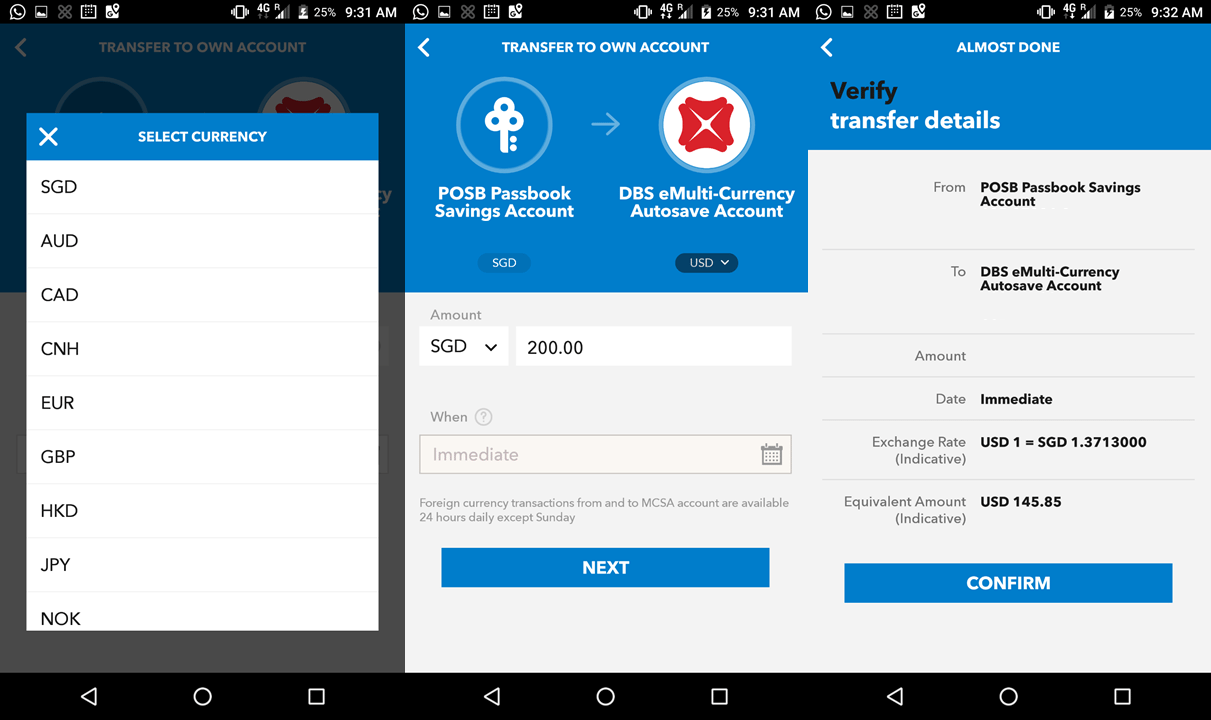

And also select the currency in your MCA you want to transfer to. You’ll also need to select which account you want to transfer from. Once you click “Next”, you’ll see a preview of your transaction indicating clearly how much forex you’ll receive for your SGD, as well as the exchange rate. These exchange rates, of course, match those you find on the DBS official website.

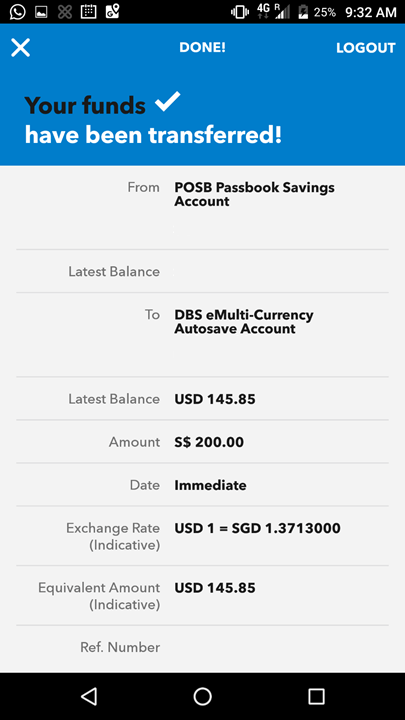

Click confirm and you’re done. The process is the same no matter what currency you want to move your SGD into.

Using your MCA

During the setup phase, you’d already have linked your debit card to your MCA. This means when you use your debit card for any foreign currency transactions, the corresponding amount will be debited from your foreign currency wallet.

If you do not have sufficient foreign currency funds to pay for a transaction, the entire amount will be debited from your SGD wallet in your MCA. If insufficient SGD funds are available in your MCA, your transaction will be declined.

Remember- when you use the Visa function on your debit card, you’re still vulnerable to DCC. So be very sure to tell the merchant that you want to be billed in local currency. If they go ahead and use DCC without your consent, file a complaint with the bank as soon as possible.

Conclusion

One last point to note about the MCA- there is a monthly fall below fee of S$7.50 if your daily average balance falls below S$3,000. This fee is waived if you’re aged 29 and below, or if this is your first account with DBS and is opened online. Given that the MCA can hold SGD as well, there’s no reason why you shouldn’t park some of your savings in the MCA to avoid the fee. You can use the MCA-linked debit card to withdraw SGD when you’re in Singapore, just like your regular ATM card.

So that’s the MCA for you- easy to setup and use, and definitely something worth exploring for your next trip.

However you don’t get miles/points on overseas transactions with foreign currency. Just wondering if the 2 miles for every $1 in foreign currency transaction is worth the bank charges and exchange difference changed by the credit card company. Have you analyzed this before?

fk your minimum balance dbs, people living in the struggle and you want us to park 3k in your bank? get real.

btw, dont buy fx online from dbs, if you are able to buy around 3k sgd of foreign ccy, its better to use a foreign currency payment/transfer company like WorldFirst, their rates are better.

Just being a bit pedantic here, but how can you say “In my previous post” as your opening when this article’s publish date is earlier than the one in the link?

I meant publish /time/, but you get what I mean.

Hi Aaron, is the MCA service only available to Sinagporeans/PRs or also available to foreigners residing in Singapore with a DBS account?

Thank you very much for this article! It surprised me to find such a convenient account that I can activate immediately online right from my existing DBS savings account. I realised one could potentially make profit from buying low and selling high foreign currencies using the multicurrency account. Just curious – does a Singaporean need to pay tax on such profits made in the multicurrency account?? I look forward to your comments! Thanks!

how do i transfer the fx balances back to sgd when I’m back from vacay? Any charges to convert back to SGD by DBS?

No, just the prevailing FX rate

Thanks A-Aron, 🙂 Great site you have here.

Here’s a different perspective, with painful hidden fees! :/ My experience with depositing AUD into this A/c (vs. transferring from SGD within DBS’s MCA),. If you’re depositing foreign currency (e.g. AUD) into a fresh AUD wallet like I just did, you’ll need to pay an a/c starting fee (% varies by country) and for me it was a painful 2.5% for AUD with DBS e-MultiCurrency account. Comparatively HSBC charges 1.5% for this (with Everyday Global Account) and I was going to put less in this a/c but decided the lower fee + waiver of withdrawal fee in AU (advance customer… Read more »