A few months ago I wrote about the discovery that the UOB PRVI Miles Visa card was actually a Visa Infinite card in disguise. Although the card has no Visa tier written on it, run its BIN (bank identification number) through the online BIN checkers and you’ll see that it is indeed listed as a Visa Infinite.

The fact that it was a Visa Infinite meant you were able to register for Visa Infinite exclusive perks like the concierge service and the Hilton Honors fast track offer (which has since been extended to Visa Signature cards as well).

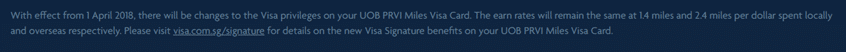

Well, a small note appeared at the bottom of the PRVI Miles webpage a few weeks ago:

In case that’s hard to read, it says:

With effect from 1 April 2018, there will be changes to the Visa privileges on your UOB PRVI Miles Visa Card. The earn rates will remain the same at 1.4 miles and 2.4 miles per dollar spent locally and overseas respectively. Please visit visa.com.sg/signature for details on the new Visa Signature benefits on your UOB PRVI Miles Visa Card.

My understanding is that existing issued UOB PRVI Miles Visa cards retain their Visa Infinite tiers, but subsequent issued cards (both new and renewal cards) will be Visa Signatures. Given that the Hilton fast track offer is now extended to Visa Signature cards, I don’t think the loss of Visa Infinite status is any big deal. More interesting is why UOB decided to do this, and I think we now know…

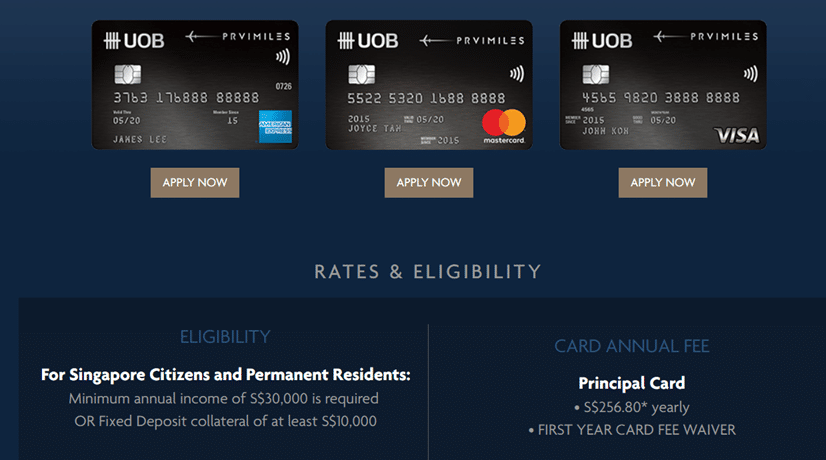

UOB PRVI Miles card income requirement is now $30,000

The income requirement needed to hold a PRVI Miles card is now $30K across the board, whether you get the AMEX, Mastercard or Visa version (previously the AMEX and Mastercard versions were at $50K and the Visa at $80K, and prior to that they were all at $80K).

That move makes sense, given that other competing cards like the DBS Altitude dropped their income requirement to $30K a long time ago. There was really no reason for UOB to have a higher income requirement for its PRVI products, apart from giving them a false sense of exclusivity.

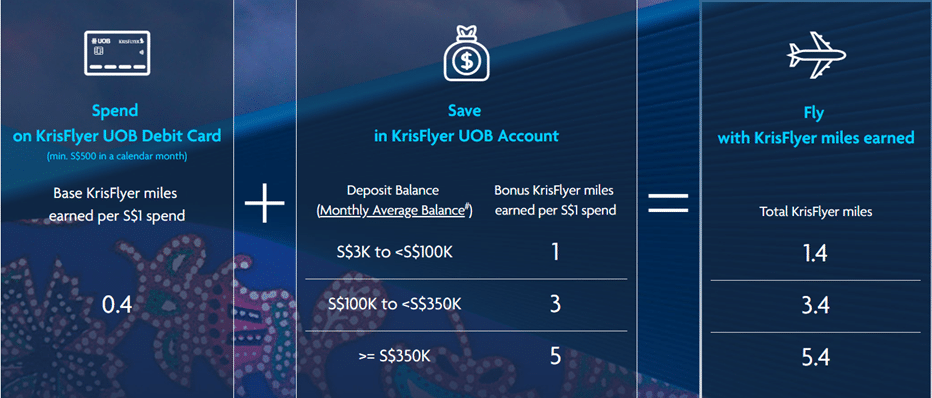

Implications for the Krisflyer UOB account

What’s also interesting is that the wording explicitly states you can get a PRVI Miles card with a $10K fixed deposit. This has always been possible, of course, but making it explicit means there’s even less of a reason to get a Krisflyer UOB account now.

If you put that same $10K in the Krisflyer UOB account, the bonus miles you could earn on the Krisflyer UOB debit card would be capped at 500 (5% of 10,000), which implies that your first $500 spend earns 1.4 mpd, and after that any subsequent spending earns 0.4 mpd. With the UOB PRVI Miles card, you earn 1.4 mpd/2.4 mpd in Singapore/overseas regardless of how much or how little you spend.

This might even be a good option for students who want to start earning miles for themselves and have parents who don’t mind parking $10K in a fixed deposit for them.

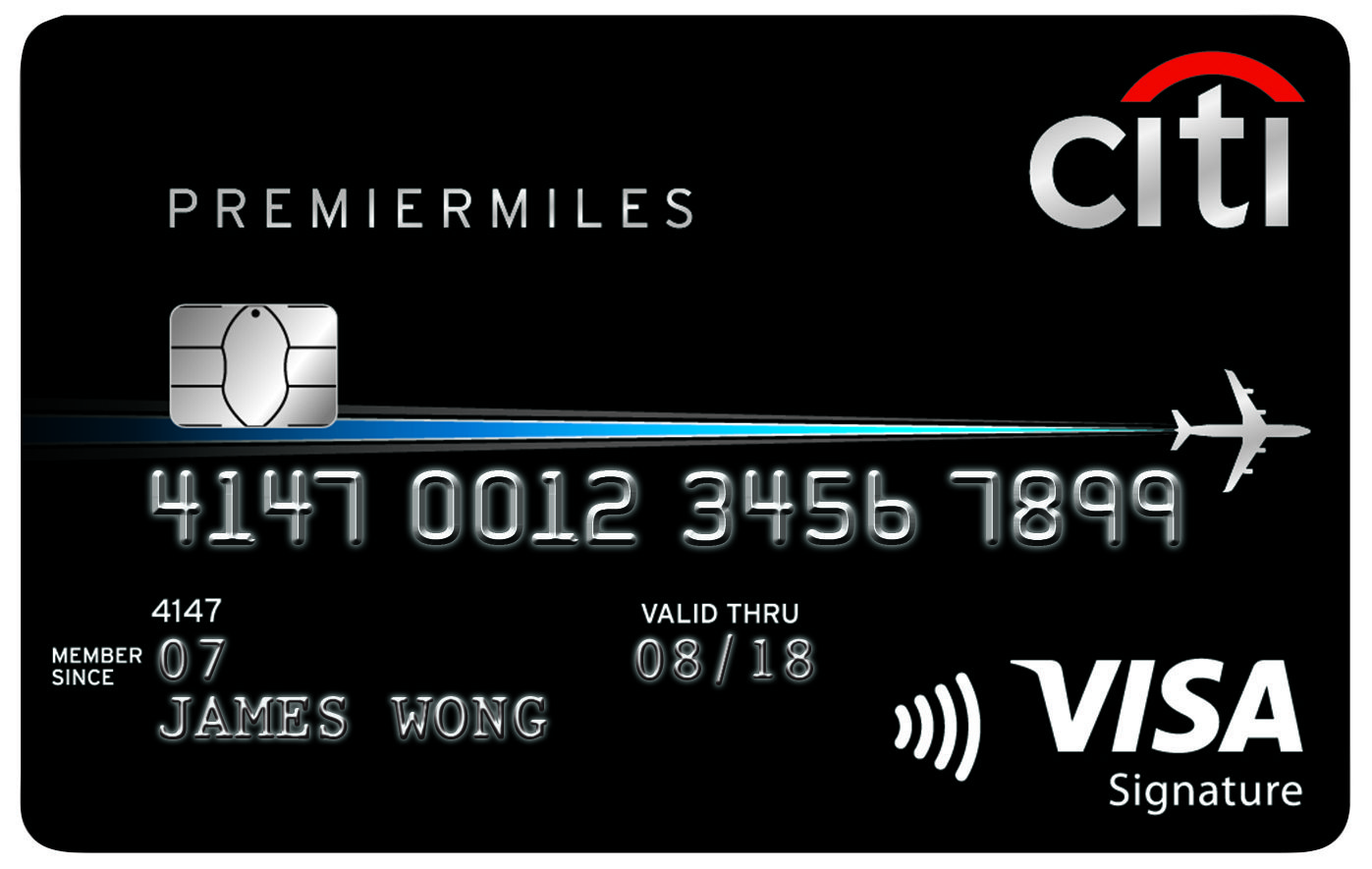

What impact will this have on Citibank Premiermiles?

With the UOB PRVI and the DBS Altitude now down to $30K, the odd man out is the Citibank Premiermiles card. The Visa version still requires a $50K annual income, and the AMEX $80K. It would make sense to me that the Citibank product managers reconsider the income threshold for their card, because apart from having a wider range of transfer partners there really is no compelling reason to go for the Premiermiles over other cards (plus, remember Citibank’s awful policy of having separate, non-poolable points currencies so your Citibank Rewards/Prestige card points can’t be combined).

Then again, Citibank has consciously positioned themselves as the “rich man’s bank” in Singapore by setting a minimum relationship balance of $15K, so maybe this is what they’re going for.

Conclusion

It’s great that the threshold to owning a miles card has steadily decreased over the years. When the Altitude and PRVI cards came out, they were both positioned at $80K. Over the years, those requirements were first waived unofficially, then officially brought down. Yes, we lost a few benefits along the way (the Altitude used to have airport transfer service for example) but on the whole it’s still great for people who are just starting off in their careers.

The UOB PRVI Miles isn’t all roses though- it’s got a hefty annual fee at $256.80 and unlike the DBS Altitude or Citibank Premiermiles card, does not give you miles when you pay the annual fee. If you can’t get it waived, you might not want to hold on to it. Also note that some people take exception to UOB’s rounding down policy, which means there’s some careful thought to be given to spending on small amounts.

If it interests anyone at all. The 2 cents per mile facility had been extended to end 2018.

Thank you for your email dated 19 March 2018 with regard to PRVI Miles payment facility.

We are pleased to inform that this facility is still available until 31 December 2018 for PRVI Miles cardholder.

Will UOB prvi mile, i.e. the uni$ earned, expire like normal uni$ in 2 yrs?

Is it better to apply the visa or master?

i’m indifferent. maybe the mastercard, if you want to use ABT

[…] Visa). That said, we know that income requirements for general spending miles cards are falling across the board so I’d be surprised if BOC went with a high requirement like $80,000 or […]