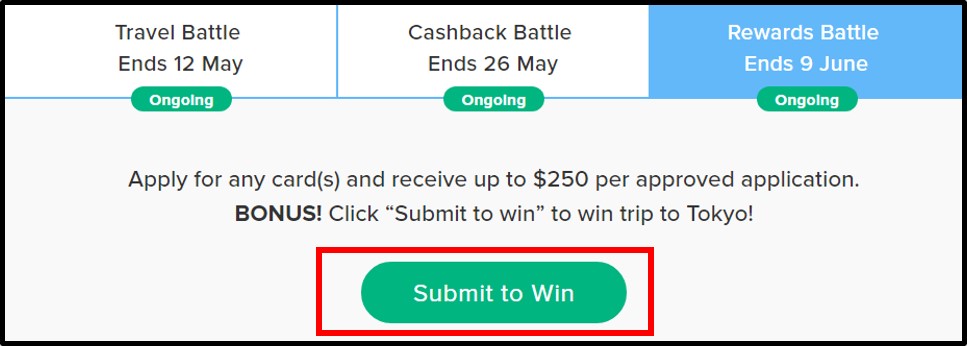

SingSaver is running a new campaign called Battle of the Cards, where you can get up to $150 bonus cash by picking the winners of three different card showdowns. There’s also three prizes of a trip to Tokyo up for grabs.

The Battle of the Miles Cards has already started, and the Battle of the Rewards Cards was scheduled to start on 27 May. However, SingSaver has decided to open the Rewards Cards battle early, so you can now start applying for your preferred cards.

|

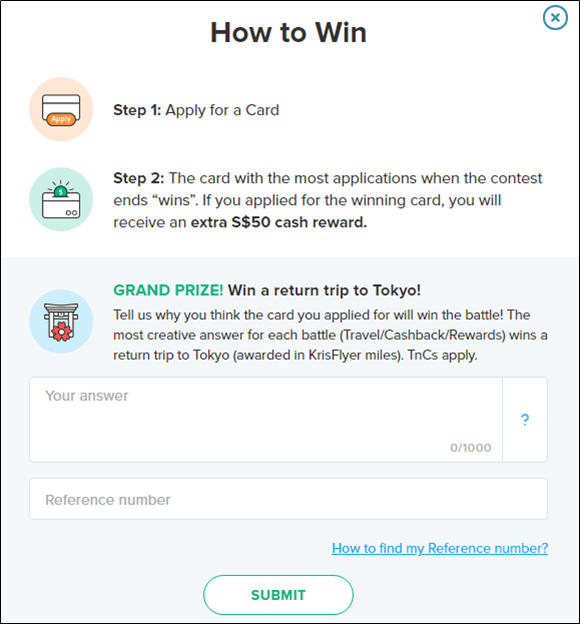

How Does Battle of the Cards work? Each battle features four different cards, and the card with the most applications wins. Successful applicants for the winning card will get a bonus $50 cash gift (regardless of whether they’re new-to-bank or existing), in addition to the usual SingSaver rewards. There’s a total of three battles, so you can get up to $150 bonus cash if you pick the right card for all three (of course, there’s nothing stopping you from being kiasu and applying for multiple cards during each battle). To win the trip to Tokyo, you need to apply for at least one eligible card and answer the question “why do you think the card you applied for will win?” at this page (click on the “submit to win” button)

Battle of the Cards T&C: Link | Battle of the Cards FAQ: Link |

Here’s my assessment of the Battle of the Rewards Cards.

Battle of the Rewards Cards (Ends 9 Jun)

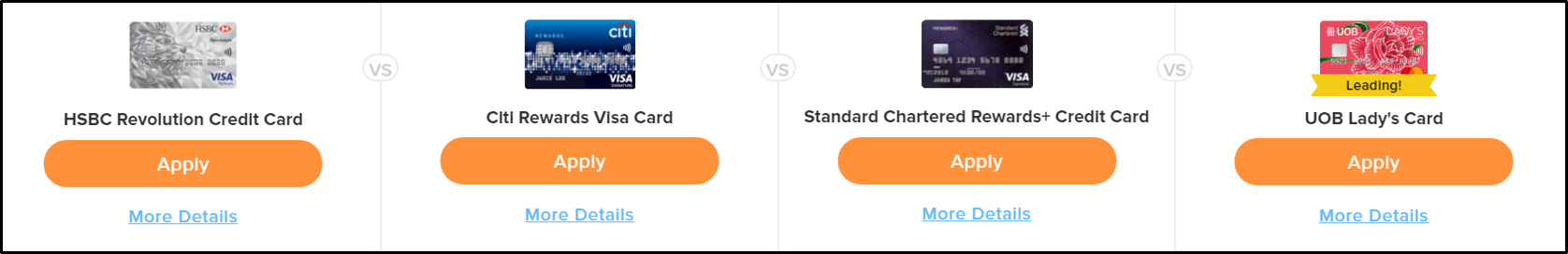

The four cards available for this battle are the HSBC Revolution, the Citi Rewards Visa, the SCB Rewards+ and the UOB Lady’s Card.

Join the Battle of the Rewards Cards here

HSBC Revolution

| SingSaver Gifts | New-to-Bank | Existing Customer |

| HSBC Revolution | $150 cashback (provided by HSBC) | $30 cashback (provided by HSBC) |

| Income Req | Annual Fee | Annual Fee Miles | FCY Transaction Fee |

| $30,000 | $150 (first 2 years waived) | N/A | 2.8% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 0.4 mpd | 0.4 mpd | 2.0 mpd- dining, entertainment and online, no cap | 37 months |

The HSBC Revolution earn 2.0 mpd on dining, entertainment and online spending. Dining and entertainment expenditure includes restaurants, cafes, fast food outlets, clubs and bars. Online spending includes pretty much anything you can think of- airlines, movies, hotels, taxi bookings, food orders, shopping and, interestingly enough, insurance premiums. Earning 2 mpd on insurance payments is as good as it gets in Singapore.

SingSaver is not offering any card-specific gift for the HSBC Revolution, although you’ll still win $50 cash if you apply for the card and it turns out to be the winner. HSBC is giving new-to-bank customers $150 cashback when they spend $800 within a month of card approval (existing customers get $30 cashback). You can read the terms and conditions of that offer here.

Apply for the HSBC Revolution here

Citi Rewards Visa

| SingSaver Gifts | New-to-Bank | Existing Customer |

| Citi Rewards Visa | $300 of Grab/Taka/NTUC vouchers | $30 of Grab/Taka/NTUC vouchers |

| Income Req | Annual Fee | Annual Fee Miles | FCY Transaction Fee |

| $30,000 | $192.60 (First Year Free) | None | 3% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 0.4 mpd | 0.4 mpd | 4.0 mpd- all online spending plus offline spending on bags, shoes and clothes, capped at $1K/month | 5 years |

The Citi Rewards Visa recently received a dramatic enhancement when the bank decided to award 10X points (4 mpd) on all online transactions, instead of the traditional “bags, shoes and clothes”.

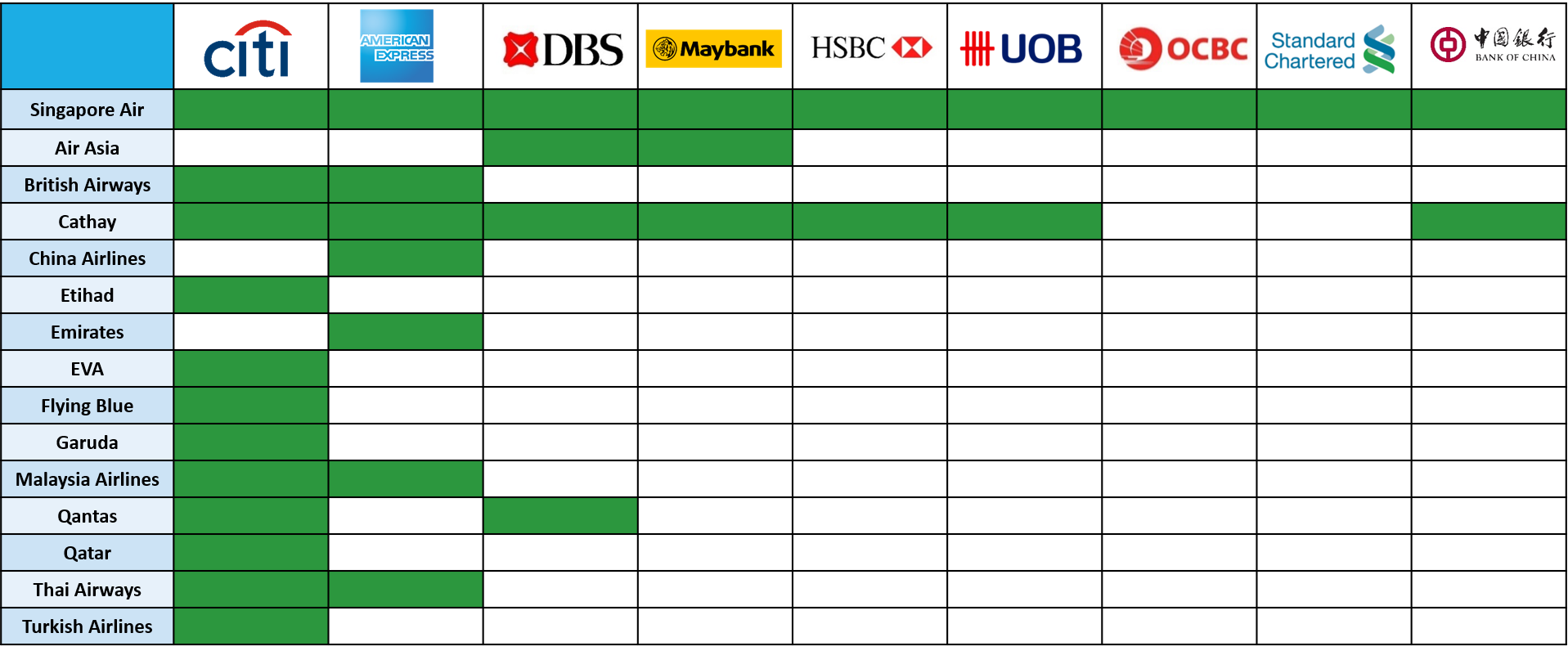

With the exception of travel and mobile wallet transactions, the Citi Rewards is now the go-to card for all things online- up to $1K of spend each month. Remember that Citi also has the widest variety of transfer partners among all the banks in Singapore, so your ThankYou points are especially valuable.

New-to-bank customers get $300 of Grab/NTUC/Taka vouchers upon approval ($30 for existing).

Apply for the Citi Rewards Visa here

SCB Rewards+

| SingSaver Gifts | New-to-Bank | Existing Customer |

| SCB Rewards+ | $100 cash | $50 cash |

| Income Req | Annual Fee | Annual Fee Miles | FCY Transaction Fee |

| $30,000 | $192.60 (first 2 years free) | N/A | 3.5% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 0.29 mpd | 2.9 mpd, first $2.2K card anniversary year | 1.45 mpd- dining, first $5K/card anniversary year | 3 years |

The SCB Rewards+ card offers 1.45 and 2.9 mpd on dining and overseas spending respectively. This is subject to a combined cap of 20,000 rewards points per anniversary year, which means

- $5,000 of pure local dining spend OR

- $2,222 of pure foreign currency spend

Honestly speaking, there isn’t much reason to go for the SCB Rewards+, especially when you could earn 4 mpd on overseas spending and dining with cards like the UOB Visa Signature and UOB Lady’s Card respectively.

If you’re a new-to-bank customer, however, you might be interested in the $100 of cash that’s on offer (existing: $30). There’s also a bonus $20 if you apply through the instant approval feature and spend a minimum of $1 within 3 days of approval.

Apply for the SCB Rewards+ here

UOB Lady’s Card

| SingSaver Gifts | New-to-Bank | Existing Customer |

| UOB Lady’s Card | $50 cash | $50 cash |

| Income Req | Annual Fee | Annual Fee Miles | FCY Transaction Fee |

| $30,000 | $192.60 (first year free) | None | 2.8% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 0.4 mpd | 0.4 mpd | 4.0 mpd on one of seven bonus categories, capped at $1k/month | 2 years |

UOB rebooted their Lady’s card portfolio in March this year, and the cards now pack a real punch.

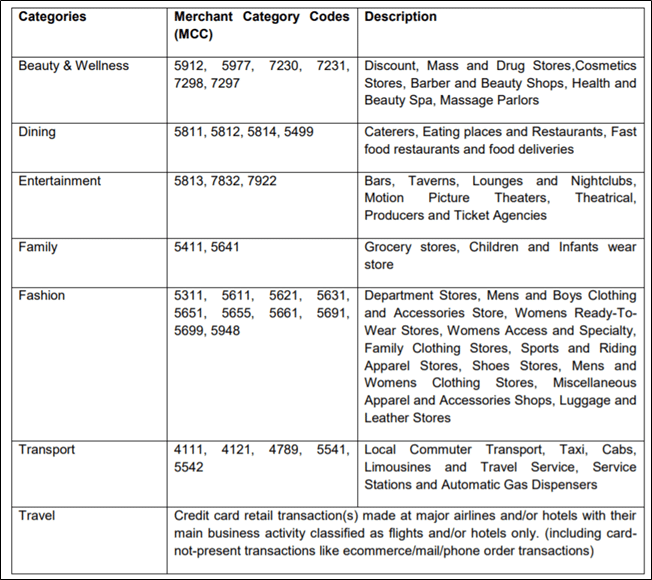

The UOB Lady’s card allows you to earn 10X points (4 mpd) in one of seven categories, capped at $1K each month:

- Beauty & Wellness

- Dining

- Entertainment

- Family

- Fashion

- Transport

- Travel

This category can be switched every quarter, which means the UOB Lady’s card can be different things to you at different times. Holding a wedding banquet? Switch to the Travel category this quarter to get 4 mpd on your banquet payments. Buying a beauty package? Switch to Beauty & Wellness.

The only drawback of this card is that it’s gender-exclusive: only women need apply. Of course, there’s nothing stopping you from getting your other half to apply, rack up the points and redeem a ticket for you.

New-to-bank and existing UOB cardholders receive $50 cash upon approval.

Apply for the UOB Lady’s card here

Conclusion

If you’re looking for a miles card, be sure to check out the Battle of the Travel Cards where the following four cards are on offer:

- Citi PremierMiles Visa

- UOB PRVI Miles

- AMEX KrisFlyer Ascend

- SCB Visa Infinite

Also, don’t forget to take part in the trip to Tokyo draw- simply answer the question “why do you think the card you applied for will win” at this page.