| The following is a sponsored post by OCBC Bank. All opinions and analysis remain that of The Milelion. |

I write an awful lot about how to optimize spending through credit cards and other loyalty programs, but with all the financial uncertainty brought about by COVID-19, it might be prudent to switch gears a bit and talk about optimizing savings.

More specifically: how are you managing the money you’re not spending? How is it stored up for future needs- in a biscuit tin, in a bank account (not all that different, given the current interest rates), in insurance products, or in the market?

When examining the options, you may have come across a type of investment known as unit trusts. In this post, we’ll look at what these are, how they work, and the pros and cons of choosing them to grow your nest egg.

Read on till the end for a special offer for OCBC 360 customers too– it’s basically free money for those under 30.

What are unit trusts?

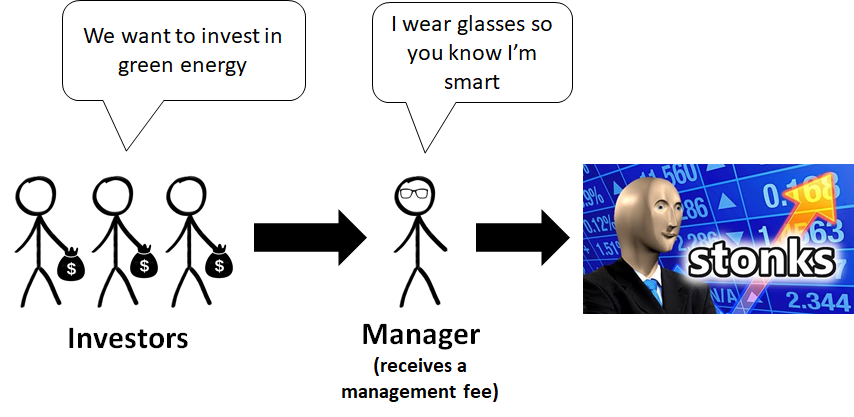

A unit trust is an arrangement where funds from various investors are pooled together and invested in a portfolio of assets, according to a given investment objective and approach.

For example, three friends may decide that they want to invest in green energy, but don’t have the expertise to pick which specific companies or instruments to buy. They can pool their funds into a unit trust arrangement, overseen by a manager who invests the money in accordance with a pre-agreed sector focus and risk tolerance. The manager monitors the portfolio’s performance on a day to day basis, and manages the holdings as needed.

Subsequently, the investments in the fund may pay dividends or coupons, or the manager may sell selected investments in the fund for capital gains. These distributions may be paid out to investors in proportion to their holdings (not all unit trusts declare distributions; growth-oriented funds focus on capital appreciation instead of regular distributions)

So as my badly-illustrated example shows, there are two types of potential returns from unit trust investments:

- Distributions (when the underlying investments pay out coupons or dividends)

- Capital appreciation (when the underlying investment grows in value due to market forces)

Of course, like any investment, there’s a risk that things may not go according to plan. The underlying investments may cease to pay dividends, or their value may decrease. This then decreases distributions, or your investment value declines due to market forces.

| ❓ Unit Trust vs Mutual Fund? |

| The terms “unit trust” and “mutual fund” are often used interchangeably, and although there’s technically a difference in their legal structure, they’re pretty much the same from the investor’s point of view. |

In Singapore, unit trusts are regulated by the MAS as collective investment schemes. While this does not guarantee the profitability or quality of the fund, it does mean that disclosures in prospectuses must be true and adequate, and fund managers must ensure their investments are sufficiently liquid and diversified.

Why would you invest in a Unit Trust?

| Advantages | Disadvantages |

|

|

Diversification

Unit trusts offer low cost diversification, because the fund invests in a diversified range of assets. When you buy a unit in a fund, it’s as if you’re buying a small proportion of each of its holdings.

Professional Management

Unit trusts are managed by professional fund managers who decide what to buy, when to buy it, what to sell and when to sell it. Ideally, this will be a group of people with the requisite resources, expertise and skills to manage the fund well.

Of course, professionals can get it wrong too, hence it doesn’t completely relieve you of all due diligence responsibility. You’ll want to read the fund’s reports, compare its historical performance to relevant indexes (while keeping in mind that past performance is no guarantee of future returns), and assess the extent to which management’s investment strategy makes sense to you.

Allows you to buy into themes or meet certain objectives

Suppose you strongly believe that Artificial Intelligence is going to have a huge impact on the future, and companies which specialize in this field are going to do very well.

However, you don’t have the time or inclination to do research into individual firms or to monitor their performance on a daily basis. Buying into a fund can enable you to achieve the same end- potentially profiting from the rise of the machines artificial intelligence companies.

There are a myriad of different funds available to retail investors, each with their own risk profile, objectives, geographical focus and themes.

You can find funds that only invest in certain geographies, or in certain classes of assets (e.g purely government bonds). If you believe in the China growth story, you could purchase the JPM China A-Share Opportunities A fund, which exclusively invests in this country. If you want to put your money behind disruptive companies like electric vehicles, internet-of-things manufacturers and big data, you could purchase the LionGlobal Disruptive Innovation fund.

Whatever your preference, you’re likely to find something that suits you.

What are the downsides of unit trusts?

Fees

Your fund manager isn’t managing your money because he likes you. He’s managing your money because he’s receiving remuneration for doing so. For most unit trusts, fees are usually payable regardless of how well or poorly the fund performs.

It’s inevitable that the fees paid will, over time, reduce the returns on your investment. Of course, this is less of an issue if your fund’s returns less fees are more than what you’d have achieved if you went it alone (remember: it’s not just about absolute returns; you’ll also need to somehow factor in the cost of your time and attention).

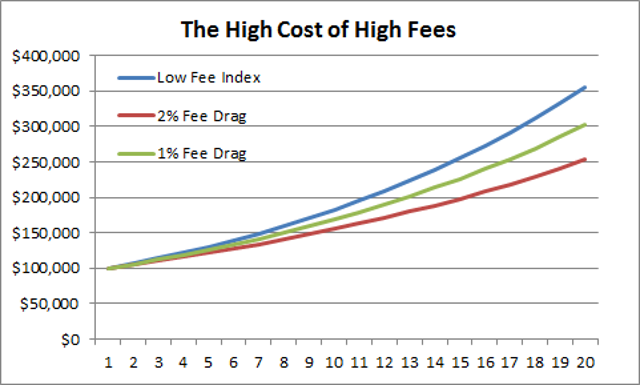

The concern with fees is what leads some to buy Exchange Traded Funds (ETFs) instead of unit trusts. For example, in Singapore it’s possible to buy shares in either the SPDR STI ETF or Nikko AM STI ETF, both of which seek to replicate the returns of the Straits Times Index.

These funds have expense ratios of just 0.3%, compared to the 0.5-2% you may pay on unit trusts. That difference may sound minuscule, but as the chart above shows, they really add up over time.

| ETF | Unit Trust | |

| Where to buy | Publicly- traded | Sold through private channels |

| Management | Passive | Active |

| One-time Fees | Cost of a trade | 0.88-5% |

| Recurring Fees | Very low (~0.05-0.4%) | Higher (0.5-2%) |

ETFs enable you to achieve diversification at a much lower cost, but they’re also not “actively managed”. That’s to say, their goal is not to beat the market; it’s to replicate the performance of a particular index. You may end up doing better than actively-managed funds; you may end up doing worse.

No guarantee of beating the market

Some writers at the Wall Street Journal (paywall) once threw darts at a stock list in a newspaper, and from those random hits, built a portfolio of investments. They then compared their performance with that of the speakers at the Sohn Investment Conference, a group of elite fund managers. The results? A 7.2% return for the darts, versus a negative return for the “professional picks”.

It just goes to show that putting your money with a fund manager isn’t a magic formula for beating the market. You need to carefully examine the sector you’re investing in, the credentials of the management team, and the broader market conditions before taking the plunge.

What to look out for in a unit trust

Before investing in any unit trust, you’ll want to carefully study the profile of management, the fund’s investment philosophy, and past performance (again: past performance is no guarantee of future returns).

Beyond that, you’ll also want to familiarize yourself with the following charges and fees.

One-time fees

As the name suggests, these are charged once and once only.

- Subscription fee/initial sales charge/ front-end load fee: These are paid when you buy into a fund. If you invest S$100 in a fund with a 5% subscription fee, only S$95 gets invested

- Redemption fee/ back-end load fee: These are paid when you sell a fund. If you redeem S$100 of units with a 5% redemption fee, only S$95 is returned to you. Funds which charge back-end fees typically do not charge front-end fees (and vice versa)

- Switching fee: Paid when you switch from one fund to another fund managed by the same manager

Recurring fees

These fees are charged on an ongoing basis, so long as you hold the units.

- Platform fee: A charge for buying funds through a platform, or a financial adviser who uses a fund platform (OCBC does not charge platform fees)

- Annual Management fee: Paid to the fund manager

The sum of the fees charged by the fund make up the total expense ratio. This is usually between 1.0 and 2.5% of the fund’s NAV, and should be disclosed in the factsheet and prospectus.

Special offer for OCBC Bank customers

Now that you know how unit trusts work, here’s a special offer for OCBC 360 Account holders under the age of 30 (as of 31 December 2020).

OCBC Bank and Lion Global Investors are giving away S$100 worth of units in in the LionGlobal All Seasons Fund- Growth to the first 5,000 customers who register their interest. This allows young investors to dip their toes in the water by experimenting with unit trusts, essentially free of charge.

Eligible customers must submit their interest through an online form, and credit their salary (of at least S$1,800 per month) to their OCBC 360 Account by 31 October 2020.

The first 5,000 eligible OCBC 360 account holders will receive S$100 worth of units each, credited to their unit trust account within 2 months after 31 October 2020.

This offer is only valid for Singapore citizens and PRs, who are non-US/EEA tax residents. Units cannot be redeemed within the first 6 months of crediting, and salary crediting must continue for at least 3 consecutive months.

For the full T&C, please refer to this link.

Conclusion

Unit trusts offer diversification and access to professional fund management, at the expense of fees. They can make sense for those who prefer to let someone else manage their money, but depending on your expertise and risk tolerance, better options (e.g ETFs) may exist too.

As with any investment decision, be sure to do your own due diligence and research before taking the plunge.

Even if one sees value in investing in UTs, no reason to buy from a bank like OCBC with its high sales charge. Imagine losing 5% of your investment from Day 1, Cheaper alternatives in the market.

it’s not 5% though, it’s 2%

2% is in comparison a lot, when near zero risk treasuries are at 0%

Conclusion – Do not buy unit trusts, buy the lowest cost index etf which the largest holding in the unit trust is from.

Unit trusts, like miles are the worst types of investments you can hold. Low cost ETFs are the way to go (eg the ones from Vanguard). You can purchase them without commission from most brokerages nowadays.

Agree on ETFs. Unfortunately, the majority of fund managers don’t beat the benchmark after factoring in all the fees and commissions charged.

Love the new-ish content! Would love to hear more of the milelion perspective on investments.