After years of toying with the idea, DBS has finally made its debut in the $120K credit card segment with the launch of the DBS Vantage. This premium metal card will spearhead its efforts to capture the mass affluent segment, and give incumbents like the Citi Prestige and OCBC VOYAGE something to think about.

DBS Vantage DBS Vantage |

||

| Apply Here |

||

| Card T&Cs | ||

| Sign-Up Bonus T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$120,000 |

S$588.50 | 3.25% |

| Regular Earn | Bonus Earn | Miles with AF |

| 1.5 mpd (SGD) 2.2 mpd (FCY) |

4 mpd on dining & petrol (cap at S$2K per c. month) |

25,000 miles |

|

||

As part of the launch blitz, DBS is offering an 80,000 miles sign-up bonus on the DBS Vantage.

Let me state upfront that “80,000 miles” is a misnomer. Of this figure, 25,000 miles comes from paying the annual fee (thereby more akin to buying miles rather than earning them as a by-product of spending), and the actual bonus depends on whether you’re a new or existing customer:

- New: 55,000 miles

- Existing: 35,000 miles

That said, 80,000 miles is how the bonus is being marketed, so I’ll just use it as shorthand throughout this article.

While it’s not quite the 100,000 miles sign-up bonus we saw with the StanChart X Card, it’s still a great offer by all accounts. The only catch is the short timeframe to apply (by 27 June, unless you qualify for an extension to 8 July- see below), which is clearly a FOMO tactic- though frankly speaking, I’d much rather a short timeframe than a “first X” style offer.

In this post, I’ll walk you through everything you need to know about the DBS Vantage’s sign-up bonus, including qualifying spend, when to expect your miles, how to take home up to 108,400 miles in total, and what to do if you can’t see the DBS Vantage listed in your ibanking application portal.

| 💳 tl;dr: DBS Vantage sign-up bonus |

|

Recap: DBS Vantage sign-up bonus

Customers who apply for a DBS Vantage card by 27 June 2022 (with approval by 11 July 2022) and spend S$8,000 within 60 days of approval will receive the following:

| New | Existing | |

| Pay S$588.50 annual fee | 25,000 miles | 25,000 miles |

| Spend S$8,000 within 60 days | 55,000 miles | 35,000 miles |

| Total | 80,000 miles | 60,000 miles |

| Must apply with promo code VTMILES | ||

| ❓ “New” Definition | ||

| New cardmembers are defined as customers who are currently not holding on to any Principal DBS/POSB Credit Card and have not cancelled any Principal DBS/POSB Credit Card within the last 12 months. | ||

This bonus is on top of whatever base miles you normally earn with the DBS Vantage:

- 1.5 mpd on local spend

- 2.2 mpd on FCY spend

- 4 mpd on local or FCY dining or petrol spend (capped at S$2,000 per calendar month)

| 👍 Extension for Selected Customers |

|

DBS is offering an extension of the launch offer for customers who need to update their income records with the bank before applying. Such customers may apply by 8 July 2022 and get approval by 22 July 2022. See below for more details. |

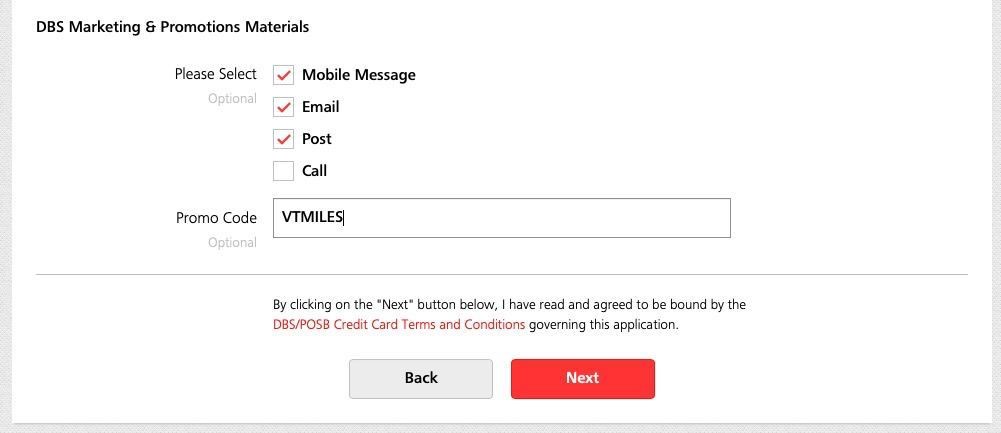

You must enter the promo code VTMILES when applying. No code, no bonus! The promo code field can be found towards the bottom of the application page, under the “DBS Marketing & Promotions Materials” section.

What counts as qualifying spend?

You will have 60 days from the date of card approval to clock at least S$8,000 of qualifying spend.

Qualifying spend includes both local and foreign retail sales and posted recurring bill payments, excluding the following:

| a. posted 0% Interest Instalment Payment Plan monthly transactions; b. posted My Preferred Payment Plan monthly transactions; c. interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS; d. payments to educational institutions; e. payments to financial institutions (including banks, online trading platforms and brokerages); f. payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); g. payments to hospitals; h. payments to insurance companies (sales, underwriting and premiums); i. payments to non-profit organisations; j. payments to utility bill companies; k. payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral service and legal services and attorneys); l. any top-ups or payment of funds to payment service providers, any prepaid accounts or purchase of prepaid cards/credits (including but not limited to EZ-Link, GrabPay, NETS FlashPay, Transit Link, Razer Pay, ShopeePay, Singtel Dash); m. any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers); n. any transactions related to crypto currencies; o. any transaction with transaction description “AMAZE*”; and p. any other transactions determined by DBS from time to time. |

For the avoidance of doubt, supplementary and principal cardholder spending will pool when calculating whether the minimum qualifying spend has been met.

| ⚠️ Update on CardUp |

|

After some back and forth between DBS and CardUp, I can confirm the following:

The thing is, MCC 7399 (Business Services Not Elsewhere Classified) is not mentioned as an exclusion category in the sign-up bonus T&Cs (60K offer | 80K offer). I can only surmise this is the operation of catchall clause that allows the exclusion of “any other transactions determined by DBS from time to time”. CardUp is in discussions with DBS to resolve the matter, but until further notice, CardUp transactions (except rent) will be excluded from sign-up bonus spending. |

Let me deal with the inevitable “does CardUp count?” question. The T&Cs for this sign-up bonus are an exact mirror of the regular DBS Rewards T&Cs, and CardUp transactions have always earned base points and counted towards sign-up bonuses on DBS cards.

Some will point to term (l) about “payment service providers”, but that exclusion has always been there, and has never been a barrier to earning DBS rewards points on CardUp transactions. There’s absolutely no reason to believe that has changed.

If you’re having a hard time hitting the sign up bonus, some “stored value facilities” which will still count towards qualifying spend are:

- NTUC or Cold Storage vouchers

- Amazon, Lazada or Qoo10 gift cards

- Chope gift cards or vouchers (this has the added advantage of coding as restaurant spend for 4 mpd!)

- Hotel points

When will the miles be credited?

The 25,000 miles for paying the S$588.50 annual fee will be awarded immediately (in the form of 12,500 DBS points) when the annual fee is charged. This happens at the time of card approval.

The 35,000/55,000 miles for the sign-up bonus will be credited within 120-150 days from the date of fulfilling the qualifying spend (in the form of 17,500/27,500 DBS points).

DBS Points earned on the DBS Vantage expire in 3 years, and can be converted to any of the following frequent flyer programmes with a S$26.75 admin fee.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

How to maximise your sign-up bonus

The thing about sign-up bonuses on most general spending cards that they usually entail some form of opportunity cost.

For example, if a 1.2 mpd card offers 10,000 bonus miles for spending S$3,000, the “real bonus” is much less, to the extent that the S$3,000 could have been spent on a 4 mpd card.

But the beauty of the DBS Vantage is that it’s offering 4 mpd on dining and petrol till 31 December 2022, capped at S$2,000 per calendar month (the cap is shared between dining and petrol). Therefore, you can minimise the opportunity cost by concentrating as much spend on these two categories as possible.

For example, in a best case scenario, you would get approved in June 2022 so that your 60-day qualifying spend period covers June, July and part of August. Then split your S$8,000 spending like so:

- June 2022: S$2,000 on dining/petrol

- July 2022: S$2,000 on dining/petrol

- August 2022: S$2,000 on dining/petrol + S$2,000 on general spend in FCY (or do it in June/July, it really doesn’t matter)

That would yield a total of 108,400 miles, split into:

- 25,000 miles from paying the S$588.50 annual fee

- 55,000 miles for meeting the S$8,000 minimum spend (assuming new customer)

- 24,000 miles from spending S$6,000 on dining/petrol

- 4,400 miles from spending S$2,000 in FCY

Of course, you need to weigh for yourself whether it’s worth paying the 3.25% FCY fee to clock overseas spending, but even if you did it all in SGD, your total haul as a new customer would be 107,000 miles– not all that different.

Why can’t I apply for a DBS Vantage?

Some existing DBS/POSB cardholders have reported that they don’t see the DBS Vantage as an option when applying via the card application page on DBS/POSB ibanking.

It’s so common a problem that DBS has set up a dedicated landing page to address it. tl;dr: DBS has set up its system in such a way that the DBS Vantage is only visible to those whose income records reflect income of at least S$120,000 per annum (don’t ask me why they did it this way, it seems like extra work).

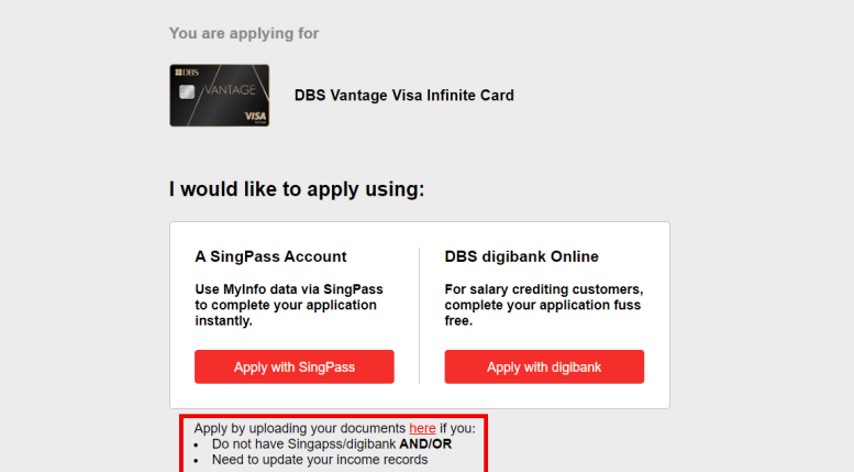

You will need to update your income records with DBS before you can apply for the DBS Vantage. DBS/POSB customers can visit this link to update their income, which will take five working days to process.

Won’t that cause you to miss the boat on the sign-up bonus? It might, so it’s good news that DBS has pledged to honour the 80,000 miles sign-up bonus for customers who:

- Submit income update applications between 23 June to 27 June 2022 (both dates inclusive)

- Submit application for DBS Vantage Card by 8 July 2022 with promo code VTMILES and have the Card approved by 22 July 2022; and

- Make a minimum spend of S$8,000 within 60 days from card approval date

This concession will be granted automatically; you do not need to contact DBS.

Another possible scenario is that you see the DBS Vantage in your ibanking, but get an error message “we are unable to proceed with your request as your annual income record does not meet the minimum requirement of S$120,000″ when you try to proceed.

This means that you’ll need to manually upload your income documents to continue your application, as shown below.

Conclusion

DBS Vantage DBS Vantage |

||

| Apply Here |

The DBS Vantage’s 80,000 miles sign-up bonus is valid for applications till 27 June 2022 (or 8 July 2022, if you qualify for the extension), so there isn’t a lot of time to mull things over.

For what it’s worth, I think that if you’ve been considering getting a $120K card, this represents the prefect opportunity to hop onboard since the value of the sign-up bonus can offset a big chunk of the first year’s annual fee (though the argument for switching from an existing $120K card may be more complex- something I hope to explore in an upcoming update of the $120K Credit Card Showdown).